Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to podcast (in French only)

(Listen to) Axel Botte’s and Aline Goupil-Raguénès' podcast :

- Review of the week – Financial markets, U.S. growth and the risk of a shutdown;

- Theme – Draghi Report, one year later

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Draghi Report, one year later

- One year ago, Mario Draghi sounded the alarm and urged European leaders to act collectively and swiftly to revitalize European industrial policy and increase its productivity;

- One year later, he bitterly observes that the progress made is insufficient, as the challenges facing the EU have become greater: a significant increase in U.S. tariffs, intensified competition with China, and a sharp rise in military spending;

- Mario Draghi highlights the latest estimates from the ECB: the EU's additional investment needs to address the energy, digital, and defense transitions have significantly increased, reaching an average of €1,200 billion per year between 2025 and 2031, compared to the €800 billion anticipated a year ago;

- He reiterates his call for joint debt issuance to finance certain common goods that can enhance productivity, such as breakthrough innovations, large-scale technologies, R&D in defense, or energy networks. The common debt to finance common goods is also advocated by the ECB;

- Mario Draghi accuses European leaders of "complacency" and warns that "inaction threatens not just our competitiveness but our sovereignty itself."

Draghi Report: "Europe faces an existential challenge."

Persistently Slow Growth in the EU Due to Low Productivity

In his renowned report on competitiveness, Mario Draghi noted that the EU suffers from persistently slow growth due to low productivity. This situation has been exacerbated by diminished external support for growth, including the emergence of trade tensions, the necessity for Europeans to quickly forgo inexpensive Russian energy, and the changing framework that has prevailed since the end of World War II, namely political stability under U.S. hegemony.

Need to Act Swiftly in Three Key Areas

Mario Draghi warned that "Europe faces an existential challenge" and must act swiftly in three key areas. The most important is to close the innovation gap with the United States and China, particularly in advanced technologies. The second is to combine the decarbonization of the economy with competitiveness within a common plan. Lastly, the third area is to strengthen security and reduce dependencies.

The challenges facing the EU have become more significant.

Significant Increase in U.S. Tariffs

One year later, Mario Draghi observes that the EU is in an even more difficult situation. The United States has significantly increased its tariffs on its trading partners, with the average effective tariff rate in the U.S. being the highest since 1935 (17.4% according to The Budget Lab). This impacts global trade and the European Union's exports, particularly those with high added value.

Increased Competition with China

These higher U.S. tariffs also contribute to increased competition between China and the European Union, which was already strong, both in third markets and within the EU itself due to the reorientation of trade flows. As a result, China's trade surplus with the EU has increased by almost 20% since December 2024.

The EU's Strong Dependencies Reduce Its Capacity for Action

The EU's dependencies on certain countries limit its capacity to respond effectively. The trade agreement with the United States has been "largely dictated by American conditions" due to Europe's reliance on U.S. defense. Furthermore, the EU's strong dependence on Chinese critical materials reduces its ability to "prevent Chinese overcapacities from flooding Europe or to counter its support for Russia."

Slow response from the EU.

Europe has begun to react, but not quickly enough.

Diversification of Trade Agreements

Signing of a Cooperation Agreement with Mercosur and a Free Trade Agreement with Indonesia

To reduce its exposure to the United States in terms of trade (the U.S. is the top destination for European exports), the EU is diversifying its trade agreements. After the cooperation agreement with Mercosur, it has recently signed a free trade agreement with Indonesia. The increase in U.S. tariffs has accelerated these negotiations.

The European Commission has also launched strategic projects concerning critical materials, and defense spending is expected to rise significantly in the coming years. The downside is that financing needs, which were already very high, have considerably increased, while budgetary maneuvering room to fund them is limited.

Launch of the "Compass for Competitiveness" Plan

The EU has translated the recommendations of the Draghi report into concrete policies.

The European Commission has placed competitiveness at the heart of its agenda through the "Compass for Competitiveness," which translates the recommendations of the Draghi report into concrete policies. While progress has been made since last year, the pace is too slow compared to that of the United States and China. Mario Draghi observes: " On the AI frontier, the US produced 40 large foundation models last year, China 15 and the EU just 3. Among SMEs, AI adoption is still low — ranging from 13-21 %. And in the most strategic field—AI built on European intellectual property to anchor our core industries — progress is minimal."

Regulation

"Regulation is where the Union can act fastest and most decisively."

The EU must also accelerate the pace of its reforms in terms of regulation. " Europe has long styled itself as a regulatory power—it must now prove it can adapt to a fast-changing technological landscape." Mario Draghi specifically calls for the EU to undertake a much deeper review of the regulations concerning personal data processing (GDPR) in order to simplify and harmonize them. According to available research, this regulation " has raised the cost of data by about 20 % for EU firms compared with US peers", which hampers the development of AI.

Price of Natural Gas Still Four Times Higher than in the United States

Need to Reduce the Energy Price Gap with the United States

Energy prices remain excessively high. The price of natural gas in the EU is nearly four times higher than in the United States, and the price of industrial electricity is almost twice as high. Mario Draghi warns that if this price gap is not reduced, "the transition to a technology-driven economy will be slowed down." He notes that the demand for electricity from data centers in Europe is expected to increase by 70% by 2030. According to the International Energy Agency, if no action is taken, "one in five projects planned globally could be delayed due to bottlenecks in the network. Only countries that align their energy strategy with their digital policy will fully benefit from the race in AI."

Significant Increase in the EU's Investment Needs in One Year

Significant Increase in Military Spending

Following the NATO summit on June 24 and 25, allies committed to increasing defense spending to 5% of GDP by 2035, including 1.5% for related investments in infrastructure and resilience (such as cybersecurity). This compares to the previoustarget of 2% of GDP.

This translates into a significant rise in the EU's investment needs. Mario Draghi cites the latest estimates from the ECB in this regard. The central bank has significantly raised its estimates for the additional investment needs of the EU to address the energy, digital, and defense transitions. These needs are estimated at €1,200 billion per year on average between 2025 and 2031, compared to €800 billion anticipated a year ago.

According to the ECB, investment needs are estimated at €1,200 billion per year between 2025 and 2031, compared to €800 billion last year.

Since defense investments are primarily made by the government, the share to be financed by the public sector is higher: €510 billion per year, of which €320 billion is for defense. The share to be financed by the public sector thus represents 43% of total investments, compared to 24% estimated last year. Taking into account a margin of 20% around these estimates, the additional contribution from the public sector would therefore be between 2.7% and 4% of the EU's GDP per year.

The share to be financed by the public sector is higher: 43%, compared to 24% last year, amounting to €510 billion per year.

Need for Common Financing

The ECB reviews ways to finance these colossal investments based on three scenarios.

The current leeway at the national and EU levels is insufficient.

The Status Quo: This involves using the current leeway at the national and EU levels. It includes the available budgetary capacities in certain Member States as well as the tools provided by the EU. These tools comprise extending the budget adjustment period from 4 to 7 years, activating the national escape clause to finance military expenditures (up to €800 billion could be mobilized), and utilizing available funds under the SAFE program (€150 billion in EU loans), the Recovery and Resilience Facility, or other European funds. According to the ECB, even if these resources were fully utilized, there would still be a shortfall of at least €106 billion per year out of the €510 billion to be financed by the public sector, representing 21% of the financing needs.

The leeway for further reprioritizing national budgets is limited.

Reprioritization of National Budgets: This involves improving the efficiency of public spending, eliminating ineffective subsidies, and potentially implementing a special defense tax. However, the leeway for further improving the reprioritization of national budgets is limited due to the high levels of debt in some countries and the implementation of budget consolidation measures by those countries. Moreover, starting in 2029, budget balances will be further affected by the additional fiscal consolidation measures required at the end of the activation period of the national safeguard clause. Additionally, structural factors, such as an aging population and increasing demands on healthcare and social protection systems, will further burden public finances.

A More Cohesive Europe: For the ECB, "a more cohesive Europe is not just an option, but a necessary condition for effectively financing the three transitions."

For the ECB, "a more cohesive Europe is not just an option, but a necessary condition for effectively financing the three transitions."

This requires the implementation of the Union of Savings and Investment. Europe has private savings of 15% of GDP compared to only 4.5% in the United States. Allocating these savings more efficiently for the financing of major productive investments would reduce the share to be financed by the public sector and increase the competitiveness of the EU.

Increase Productivity Gains by Following the Recommendations of the Draghi Report: The report suggests that a 2% increase in total factor productivity over a decade could cover one-third of the fiscal spending needed to finance strategic investments.

Reform the EU Budget in the Next Multiannual Financial Framework (2028-2034): Allocate a significantly larger share to strategic spending and increase the size of the budget by reforming the EU's own resources.

Strengthen Joint Procurement: Military production in the EU is highly fragmented, with a significant national bias (around two-thirds on average). Improving joint procurement among EU countries or within "coalitions of the willing" would help reduce costs and stimulate innovation.

Joint Debt Issuance for European Public Goods

The ECB and Mario Draghi advocate for the establishment of common financing for strategic investments to be undertaken by the EU.

In its article, the ECB states that by building on the model of instruments established such as the Recovery and Resilience Facility, joint debt issuance would help reduce the borrowing costs for certain countries to finance EU public goods. It would also enhance the liquidity and depth of the European bond market, establishing it as a true benchmark safe asset. This would strengthen the euro's status as a global currency, thereby consolidating financial stability and increasing investor confidence, ultimately reducing borrowing costs.

For Mario Draghi, the next step will be a common debt to finance common goods. " Joint issuance would not magically expand fiscal space. But it would allow Europe to finance larger projects in areas that lift productivity—breakthrough innovation, scale technologies, defence R&D or energy grids— where fragmented national spending can no longer deliver."

Conclusion

One year ago, Mario Draghi sounded the alarm and urged European leaders to act collectively and swiftly to revitalize European industrial policy and increase productivity. One year later, he bitterly observes that progress has been insufficient, while the challenges facing the EU have become greater: a significant increase in U.S. tariffs, even stronger competition with China, and a marked rise in military spending. He calls on European leaders to radically change course and accelerate the process by adopting "exceptional measures" to address "exceptional circumstances." Europe has previously demonstrated its ability to take decisive action when on the brink, as seen with the creation of Next Generation EU, which paved the way for massive common funding to help all economies cope with the consequences of the COVID-19 crisis. Now, more than ever, genuine political will is essential.

Aline Goupil-Raguénès

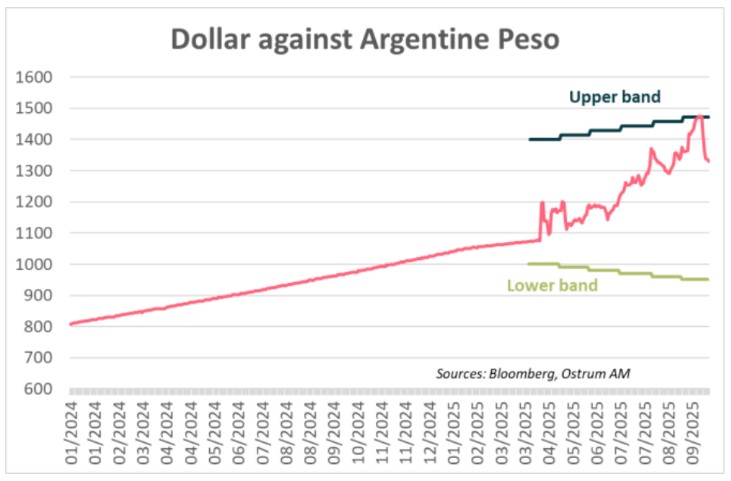

Chart of the week

The significant defeat of Milei's party in the local elections in Buenos Aires, on September 7, raised concerns about the sustainability of his economic agenda and heavily impacted the Argentine peso.

As a result, the currency reached the upper limit of the fluctuation band established last April, prompting the central bank to intervene by selling over $1 billion in just three days to defend its currency.

Tensions eased last week as the United States and Argentina discussed the establishment of a $20 billion swap line. U.S. Treasury Secretary Scott Bessent also stated that the U.S. was prepared to buy Argentine bonds in dollars. This aims to stabilize the markets and support Milei until the mid-term elections on October 26.

Figure of the week

10

China has committed to reducing its greenhouse gas emissions by up to 10% by 2035, which may seem modest but contrasts with Donald Trump's statements that climate change is "the greatest con job ever perpetrated on the world."

Market review : The Fed cuts rates

- United States: Q2 growth revised to 3.8% driven by the development of AI;

- New wave of tariffs on pharmaceuticals, including restrictions on semiconductor imports;

- Rates: The U.S. 2-year note reacts to growth and the rebound in oil prices;

- Currencies: The dollar is recovering, while the yen weakens towards 150.

A Glimmer of Economic Improvement in the United States?

The revision of U.S. GDP has prompted some profit-taking in equities, as markets may have overpriced the potential for Fed rate cuts.

The U.S. economy appears to be primarily driven by the rapid development of artificial intelligence. The upward revisions to second-quarter GDP growth, raised from 3.3% to 3.8%, highlight a staggering increase in software spending (+26.6%, following +18.8% from January to March, on an annualized basis) and a rebound in research and development to +8.4%. Information technology equipment surged by 11.7% in total, with computer purchases skyrocketing by 61.7%, following a doubling in the first quarter. However, consumption of services has also been revised upward, resulting in household spending ultimately increasing by 2.5% for the quarter, with continued improvement noted in July and August. In contrast, the remainder of the economy appears lackluster. The energy- intensive nature of AI is reflected in rising electricity prices, which are exerting a significant crowding-out effect on other sectors. Meanwhile, oil prices have rebounded by $3 over the week. Donald Trump's economic policies have taken a restrictive turn with the announcement of an annual $100,000 tax on H-1B work visas and further tariff increases on pharmaceuticals, trucks, and other imports. In Europe, preliminary September PMI readings indicate a slowdown in activity in France but a less unfavorable situation in Germany, with an improvement in services.

Financial markets are digesting the Fed's change in tone at Jackson Hole, which is expected to culminate in a rate cut in mid-September. Risk assets remain generally well-positioned, although Trump’s renewed tariff threats have prompted some profit-taking. U.S. small- cap stocks have dipped by 2%, while leading technology stocks are factoring in the risk of semiconductor import restrictions and ongoing visa controversies. European markets are slightly up, supported by financials, oil, and cyclical stocks, while healthcare shares lag behind. The rebound of the dollar has pushed the euro below $1.17, providing support for Eurozone equities.

In the bond markets, the T-note briefly reached 4.20%, and the latest data have revived some upward pressure. However, 10–30-yearspreads are tightening across most markets, including the Gilt, which is facing increased government financing needs. The German 10- year bond hovers around 2.75%. Net state borrowing will be less penalizing in the coming weeks, but the level of German debt may induce unfavorable reallocations for the OAT. DBRS may soon upgrade Italy's credit rating to A, which would afford BTPs more favorable treatment at the ECB's window. A reduction in discounts should enhance the use of BTPs as collateral in repo markets. Nevertheless, sovereign spreads are rising, reflecting a rebalancing after the announcement of German primary issuance. The BTP trades at 83 basis points over Bunds, 1 basis point wider than the OAT. Two-year inflation breakevens (+6 bps in the Eurozone) are responding to the rebound in crude prices, exacerbated by the euro's decline. The greenback is also appreciating against the yen, which approaches 150 yen per dollar following weaker Japanese inflation data (services PPI, Tokyo CPI). Stability prevails in the credit markets, with spreads against swaps remaining steady around 70 basis points. The asset class continues to attract strong demand, including in the high yield sector, despite high valuations.

Axel Botte

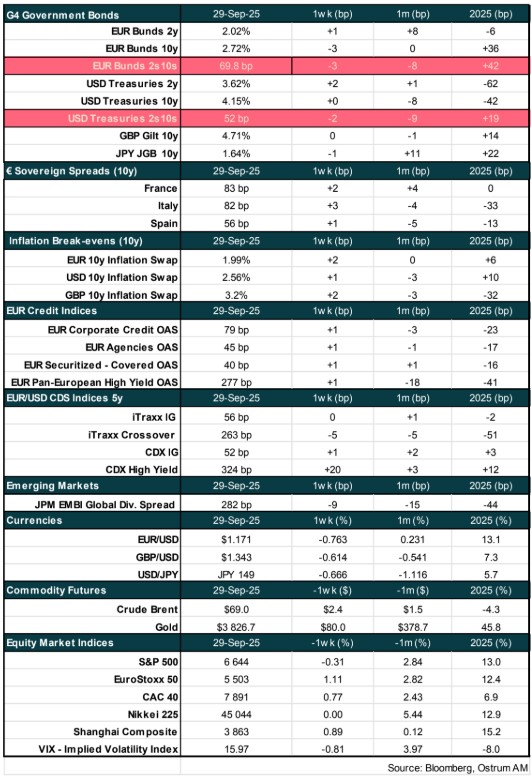

Main market indicators