Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to podcast (in French only)

(Listen to) Axel Botte’s podcast:

- Review of the week – Financial markets, activity in the U.S.;

- Theme – Budget and political crisis in France

Podcast slides (in French only)

Topic of the week: Back to School! The Four Highlights of the Summer

- The ongoing uncertainty related to the trade war remains significant, particularly concerning U.S. inflation prospects. The customs tariffs on industrial metals such as steel and aluminum have been raised to 50% and expanded to 400 derivative products. Europe faces the threat of additional tariffs targeting its digital sector regulations.

- The increasing threat to the Fed's independence is raising questions about its members' commitment to the dual mandate.

- The steepening of sovereign bond yield curves in major financial markets reflects the risk premium associated with rising fiscal and inflationary risks.

- In response to Trump, emerging markets are strengthening their economic and financial cooperation with China.

Trade War: Uncertainty Remains High

U.S. tariffs are at their highest level since the end of World War II !

D. Trump has raised average tariffs on foreign goods to the highest levels since the end of World War II, at 17.3%! So far, the tariff increases have not impacted consumer prices due to high stocks (purchases in anticipation of tariffs) and the absorption of tariffs by American companies. This trend could quickly reverse, as evidenced by the rebound in the Producer Price Index for July at 3.7% YoY, the highest level since March. Foreign companies may increase their prices due to tariffs, risking losing market share. Companies most exposed to the American market will be the most penalized.

Europe must use its regulations governing the digital sector as a bargaining tool.

Moreover, tariffs are high at a 50% rate for aluminum, steel, and copper. In August, the U.S. administration surprised by expanding the list of aluminum and steel imports subject to its 50% tariffs to 400 derivative products, including mobile cranes, baby strollers, motorcycle parts, fire extinguishers, and appliance parts. American copper imports are also subject to the same tariff rate, and the list of derivative products on the red metal could also expand. This decision risks causing distortions in American production chains, creating shortages that fuel inflationary pressures.

Another point concerns new threats of additional tariffs for countries "discriminating" against American tech companies. The European Union (EU) is particularly targeted due to its regulations on its digital sector. However, this is also a major asset in negotiations as the bilateral trade balance between the U.S. and the EU presents a surplus in services. During the trade agreement signed on July 25, Europeans withdrew all coercive measures targeting American products in exchange for a 15% tariff rate on most of their products. Will the EU relinquish its powerful negotiation leverage and allow D. Trump to succeed in his economic project where he was expected to fail?

Fed: Increasingly Threatened Independence

The U.S. 2-year inflation swap rate has reached 3%, marking its highest level since September 2022!

Tensions around the Fed's independence escalated when D. Trump attempted to remove Governor Lisa Cook with "immediate effect." If successful, this would mark a historic precedent, ending the independence of the 111-year-old monetary institution. D. Trump would then have 4 members of the Fed's Board of Governors aligning with his view to lower rates. This also raises questions about the members' adherence to the Fed's dual mandate, whose two objectives are employment and inflation.

The White House is also exploring ways to make the 12 regional Feds more influential, given that 5 of the 12 presidents vote on the FOMC. Every five years, the presidents of the 12 regional Feds are subject to Board approval. The next review is scheduled for the first quarter of 2026, and theoretically, a majority could strengthen some regional voters. J. Powell's term ends in May 2026.

Growing threats to the Federal Reserve's independence have fueled inflation fears, compounding concerns about the budget deficit. As a result, the U.S. 2-year inflation swap rate has reached 3%, a peak since September 2022, when U.S. inflation exceeded 8% and the Fed had raised interest rates to combat it.

Sovereign bond markets are beginning to sense trouble.

The steepening of sovereign yield curves reflects the risk premium associated with rising fiscal and inflationary risks.

Despite the global monetary easing cycle, long-term interest rates have continued to rise, leading to the steepening of sovereign bond yield curves in major monetary centers. This reflects the risk premium demanded by investors related to increasing fiscal and inflationary risks.

In Japan, the prospect of significant debt issuances and inflation fears have weighed on the long end of the yield curve. The 30-year Japanese interest rate has climbed to 3.2%, the highest since 1999. Japanese institutional investors who had habitually invested heavily in other bond markets, particularly Treasuries due to their 0% interest rates, should now prioritize their own government bonds.

The long-term interest rates in the UK have reached their highest level since 1998, as reflected by the 10-year rate at 4.75%, which is the highest compared to its peers, reflecting the persistence of inflation but also political risk.

In Europe, the French fiscal situation is unsurprisingly in the spotlight. The confidence vote requested by Prime Minister F. Bayrou on September 8 risks plunging France into a deep political crisis. The OAT/Bund spread widened to 82 basis points, reaching April highs, close to the peak of 88 basis points reached before the fall of the Barnier government in December 2024. The 30-year interest rate has reached 4.42%, a post-2011 high. The 10-year OAT/BTP spread has reached 6 basis points, reflecting French government borrowing costs exceeding those of Italy in capital markets. The government's priority is first to avoid a deeper political crisis, like another dissolution, to prevent exacerbating debt pressures, and secondly, to avoid a downgrade of the sovereign rating by credit rating agencies, of which Fitch (September 12) and S&P (November 28) have already assigned a negative outlook, threatening to lower the rating to A+ from the current AA-.

Emerging Markets Strengthen Economic and Financial Cooperation with China

D. Trump's aggressive policies have led many countries to strengthen their economic and financial cooperation with China. China is hit by U.S. tariffs of nearly 50% and is therefore seeking to diversify its trading partners and suppliers.

The growth of Chinese exports to Africa has outpaced that to other regions in 2025!

China has rapidly diversified its trading partners to compensate for the loss of market share in the American market. Chinese companies have targeted Africa. The growth of Chinese exports to the continent at 25% YoY, or $122 billion, has surpassed that to other regions in 2025. Nigeria, South Africa, and Egypt are the main destinations for its exports to the continent. Africa represents 6% of total Chinese exports, half the share of the United States, but this should quickly increase. African countries are encouraged to buy Chinese products as tariffs for several countries have been reduced to 0% to open the Chinese domestic market to them while responding to their significant infrastructure needs. It is also a way for China to offload its production overcapacities to the continent, such as solar panels, with imports soaring 60% YoY. Cooperation is also financial. Kenya is negotiating with Chinese authorities to convert its dollar-denominated debt to yuan and extend the repayment period, allowing it to reduce the $1 billion debt service it spends annually to repay China. Kenya has over $5 billion in debt with China, and exchanging the debt to yuan would halve interest payments and create fiscal flexibility.

India is cautiously seeking to strengthen its economic ties with China.

India, Washington's main ally against China, is cautiously seeking to strengthen ties with Beijing after the U.S. doubled its tariffs to 50% to punish it for importing Russian oil and military equipment. The Indian Prime Minister will visit Xi Jinping for the first time in seven years next week on the sidelines of the Shanghai Cooperation Organization summit. Trade exchanges between Central Asian countries and China amounted to $94 billion in 2024, significantly surpassing those with the European Union or Russia. The impact of tariffs on the Indian economy is considerable, with the U.S. being its largest export market at $86.5 billion per year, two-thirds of which are subject to new tariffs ranging from textiles to jewelry. India and China are expected to discuss the resumption of their cross-border trade after a five-year interruption due to a military standoff at their border.

Conclusion

The trade war and threats to Fed independence create an uncertain climate for financial markets, likely increasing volatility that was at annual lows. While the U.S. adopts a protectionist policy, emerging markets paradoxically strengthen their economic and financial cooperation, seeking alternatives and diversifying their exchanges, particularly with China. This dynamic could redefine global trade relations, while internal challenges, such as France's fiscal situation, add another layer of complexity to an already unstable economic landscape.

Zouhoure Bousbih

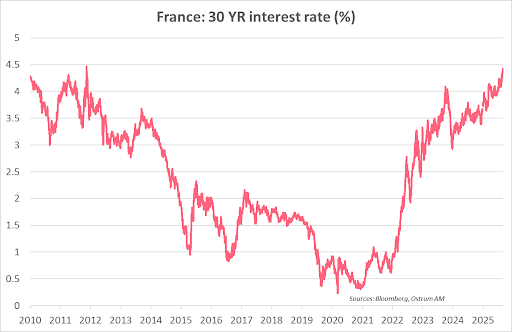

Chart of the week

Increased Tensions on French Debt

The French 30-year bond yield has reached nearly 4.5%, reflecting post-2011 levels, and indicating the risk premium demanded by investors due to rising fiscal risks.

The surprise decision by Prime Minister F. Bayrou to call for a confidence vote on September 8 has reignited fears of a deep political crisis and snap general elections.

France remains the only country in the Eurozone not to have undertaken fiscal consolidation. This rate increase reflects a French sovereign credit risk by investors who had long been complacent.

Figure of the week

6,500

The U.S. S&P 500 stock index has reached a new all-time high, surpassing 6,500 points.

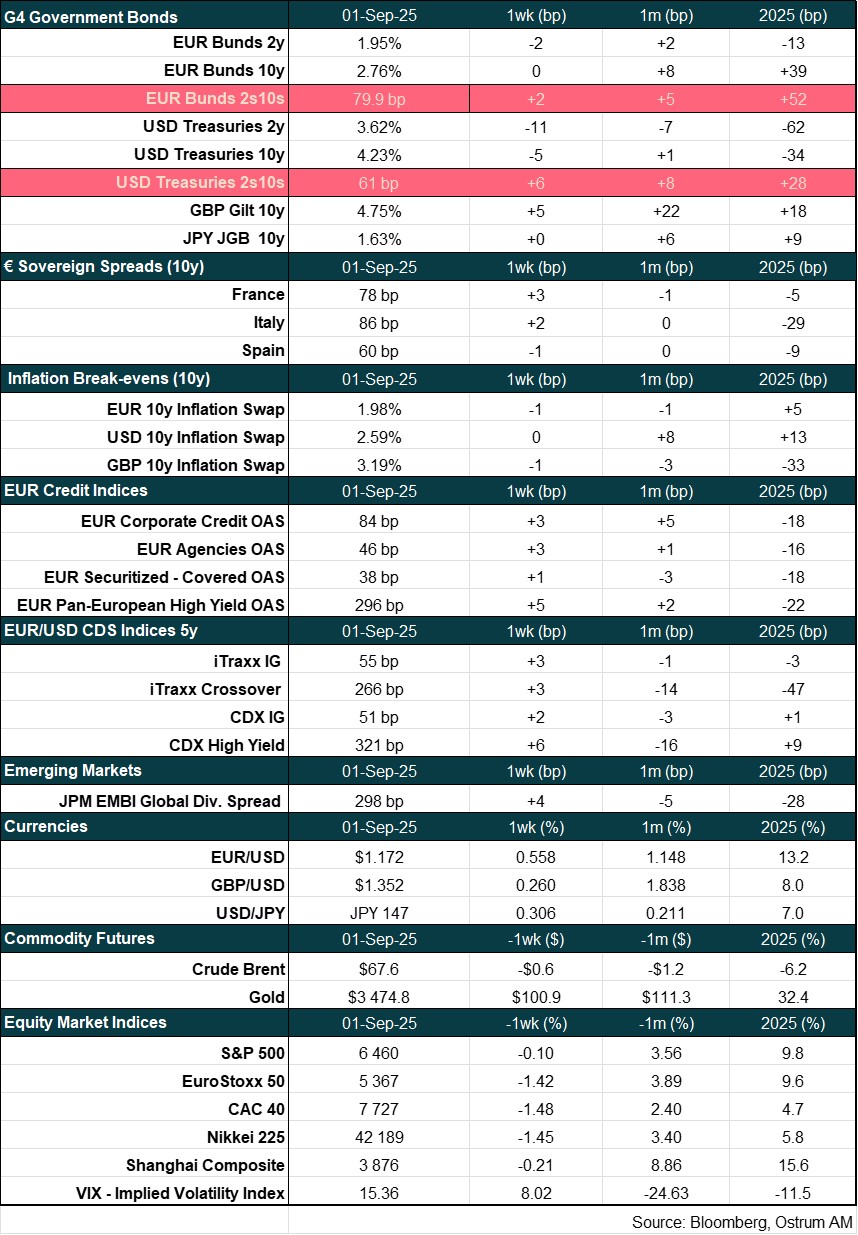

Main market indicators