Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to podcast (in French only)

(Listen to) Axel Botte’s and Zouhoure Bousbih’s podcast :

- Review of the week – Financial markets, Central banks;

- Theme – Anti-involution: Towards a Structural Transformation of the Chinese Economy!

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Anti-involution: Towards a Structural Transformation of the Chinese Economy!

- In response to intensifying deflationary pressures and tariff escalation, Xi Jinping has declared war on involution: the intense and unproductive competition;

- China is thus addressing a major structural issue on economy: production overcapacity;

- Unlike the 2015 reform, production overcapacity is concentrated in the private sector, which plays a crucial role in the Chinese economy;

- Most are closely linked to the electric vehicle industry, leading authorities to adopt a different approach focused on redirecting investments towards innovative areas, leading to consolidation;

- This is not just a short-term stimulus but a major structural change in the Chinese economy, allowing to find a balance between growth, sustainability, and innovation.

Why is China implementing an anti-involution policy now?

Intensified Deflationary Pressures on the Chinese Economy.

The budgetary support measures introduced at the end of 2024 have failed to sustain the rebound in economic activity, particularly the domestic demand. The inflation rate stood at -0.4% for August, indicating extremely low consumption levels. The youth unemployment rate reached 18.9%, marking its highest point since 2023, which reflects the economic slowdown, especially in the private sector that accounts for 80% of jobs. The real estate sector is also under renewed pressure, as evidenced by the decline in new property prices and residential sales.

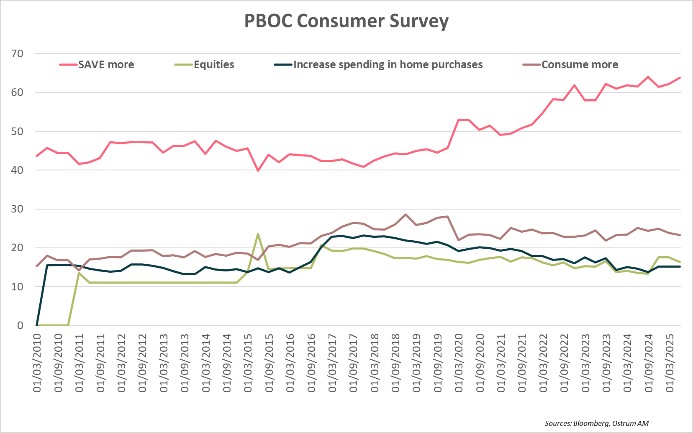

The lack of visibility in the labor market, along with the ongoing real estate crisis, has led Chinese households to save rather than spend, as highlighted by the second-quarter consumer survey from the People's Bank of China (PBOC), shown in the graph alongside.

Deflationary pressures have thus intensified in the second half of the year, amidst a backdrop of escalating tariffs with the United States. It was therefore urgent to act swiftly, this time targeting a major structural issue in the Chinese economy: production overcapacity.

What is the rationale behind the anti-involution policy?

Involution describes intense and unproductive competition that leads to lower prices and profits.

The concept is to combat involution, a term used to describe intense and unproductive competition leading to diminishing returns. Chinese authorities believe that reducing competition to increase corporate profits could also serve as a means to boost inflation rates.

The sectors targeted by the anti-involution policy are those involving advanced and emerging technologies, showcasing China's technological prowess on a global scale. These include electric vehicles, batteries, photovoltaic panels, and steel, in which China leads global production chains. The growth in these sectors has surpassed demand, resulting in overproduction, falling prices, and pressure on profit margins.

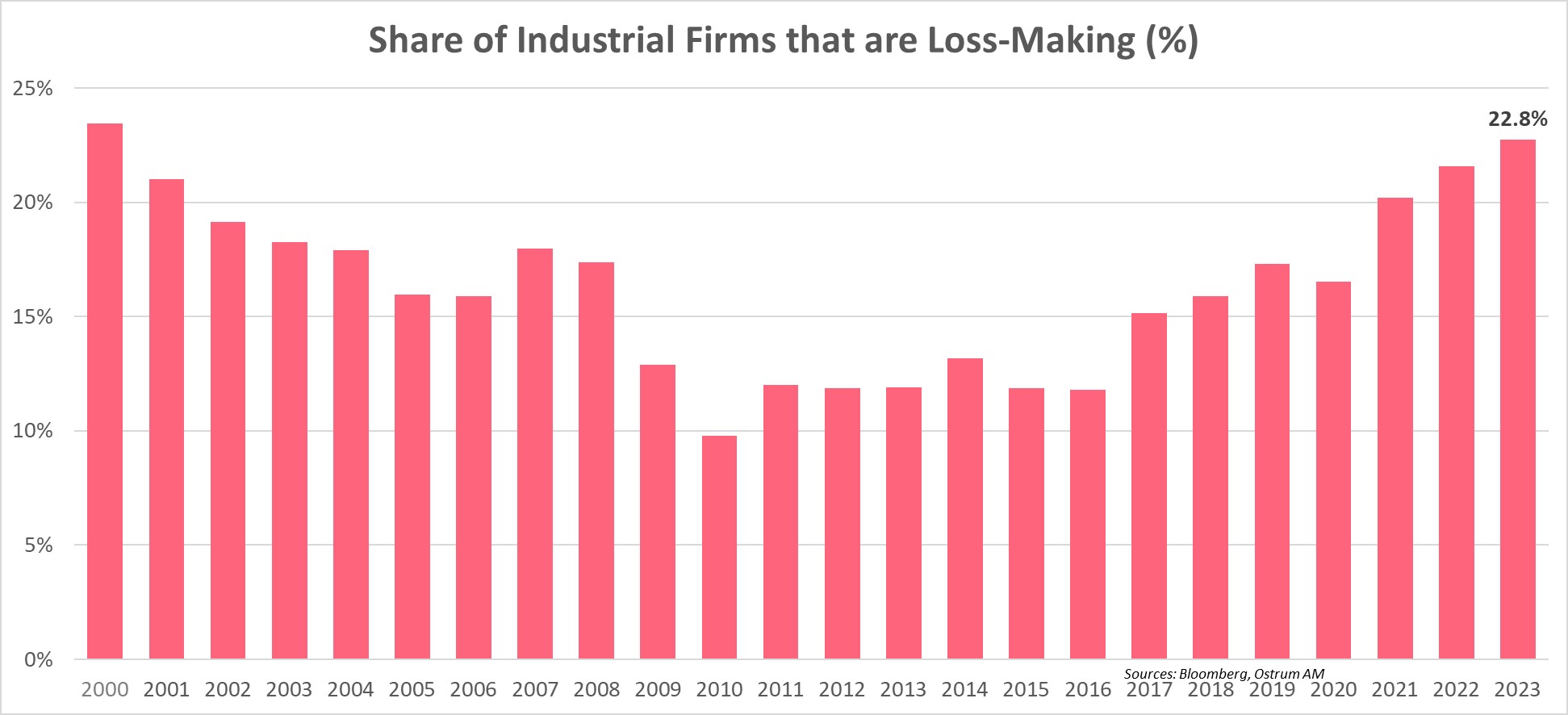

The accompanying chart shows that nearly 23% of Chinese industrial companies are experiencing losses, the highest level since 2001!

23% of Chinese industrial companies are losse-making, the highest level since 2001!

The Chinese government is concerned because involution is destructive to its economy. If Chinese companies do not increase their profits, they will not be able to invest in the future, particularly by creating jobs and maintaining their technological edge.

Moreover, the contraction of profit margins in industrial companies increases the risk to the financial stability of the country, as they do not earn enough to repay loans taken from banks.

What are the differences between the anti-involution policy and the 2015 supply-side reform?

This is not the first attempt by the Chinese government, which had already launched the "supply-side structural reform" at the end of 2015, a campaign aimed at tackling overproduction concentrated in state-owned enterprises (SOEs).

Unlike in 2015, production overcapacities are concentrated in the private sector, which plays a crucial role in the Chinese economy.

Currently, overcapacity is concentrated in private companies, which play a crucial role in the Chinese economy, representing 60% of GDP and 80% of the country's jobs.

Moreover, unlike in 2015, the residential real estate crisis that began in 2021-2022 remains unresolved. Residential property prices continue to decline, but demand remains weak. Chinese households prefer to save their money rather than purchase property in an environment of high economic uncertainty, partly due to the trade war with the United States.

Finally, public debt has increased (100% of GDP) to stimulate the economy, which limits fiscal maneuverability.

Will China succeed in reducing its overcapacity, and how long will it take?

Xi Jinping declared war on production overcapacity during the meeting of the Central Commission for Financial and Economic Affairs, a central decision-making body, indicating a real change for the Chinese economy.

In 2015, it took approximately 2 to 3 years to reduce the production overcapacity within SOEs.

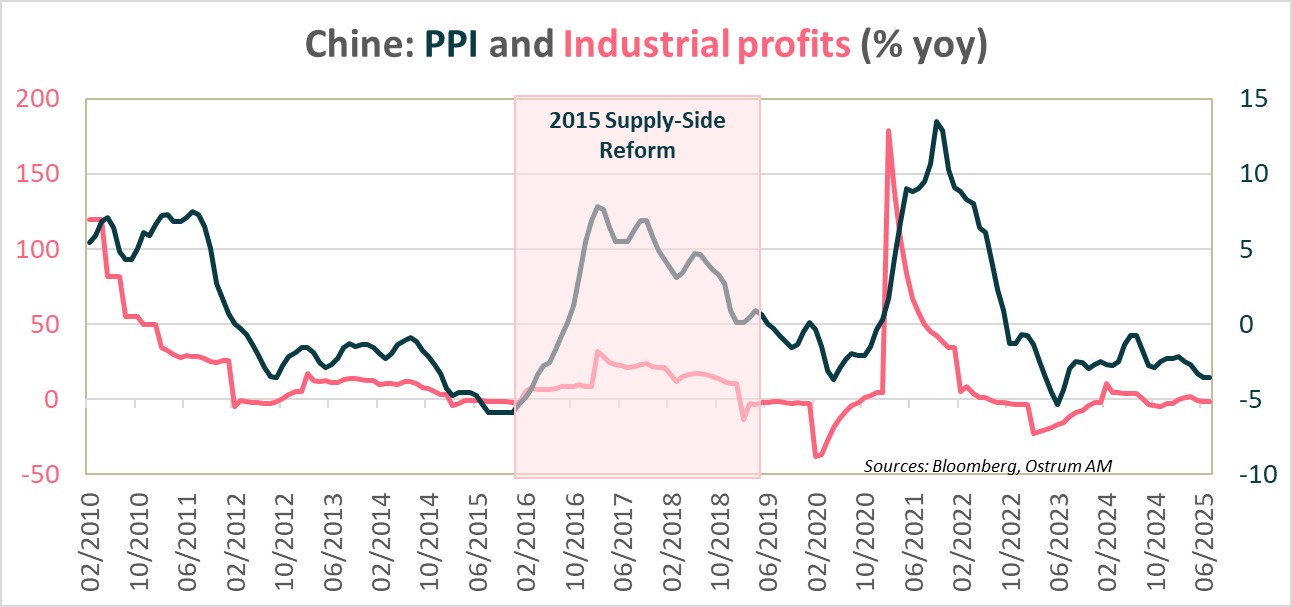

In 2015, the drastic reduction in production capacity in the steel and coal sectors alleviated competitive pressure, leading to a rapid increase in prices, as shown by the chart alongside. The price increase of these two essential raw materials for many industries had a significant ripple effect on overall prices. Thus, inflation measured by producer prices, stuck in negative territory for 54 consecutive months, turned positive. In 2015, it took between 2 to 3 years to reduce overcapacity in state-owned enterprises and normalize supply chains.

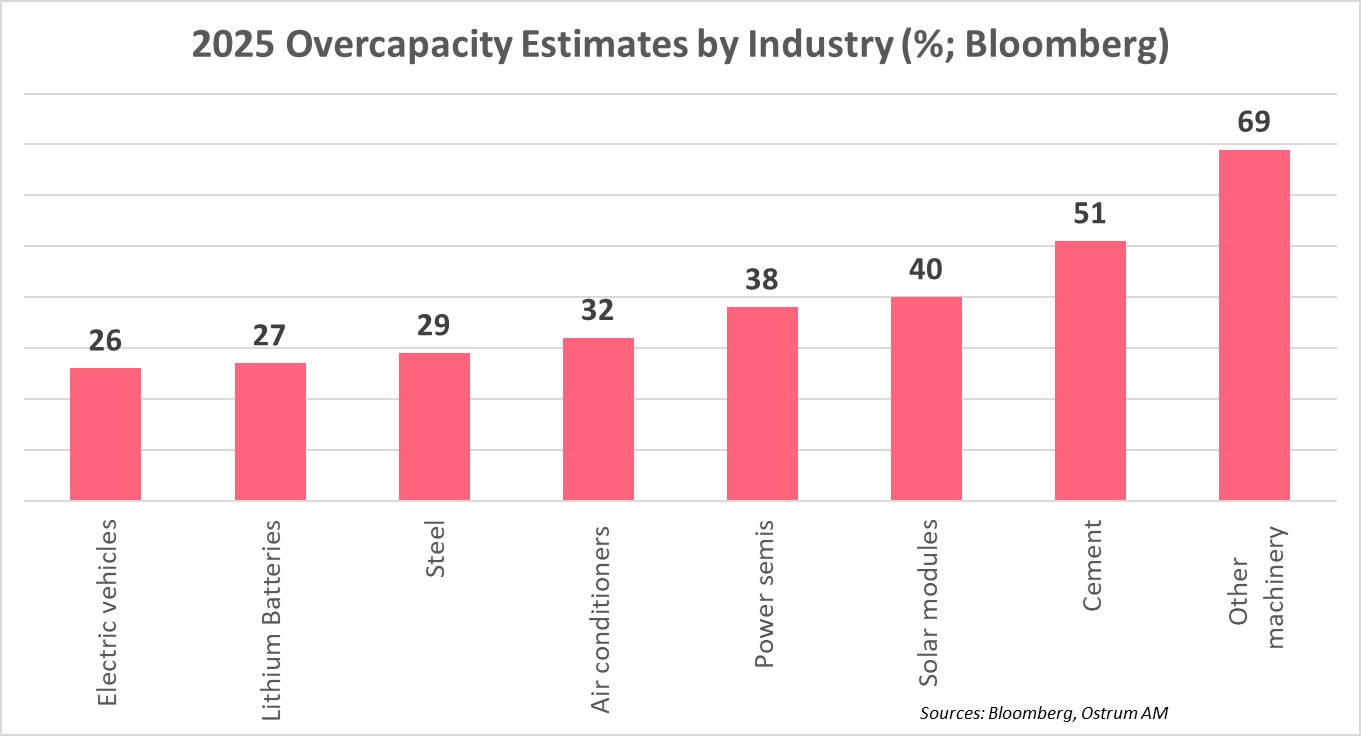

A similar evolution can be expected as overcapacity affects few industries, according to the chart below based on Bloomberg estimates. Overcapacity is high in the following industries: other machinery (69%), cement (51%), and solar modules (40%).

In 2025, overcapacity particularly affects machinery (69%), cement (51%), and solar modules (40%).

It is noteworthy that most of these industries are closely linked to the electric vehicle sector.

Chinese authorities have opted for a different approach. The goal is to eliminate low-quality capacities while maintaining the sector's growth momentum. This involves a reorientation of investments towards other areas, such as vehicle intelligence and autonomous driving technology. The new safety standards regulation, which will come into effect in 2026, should also facilitate consolidation in the sector.

What are the impacts on Chinese growth?

Anti-involution is not merely a short-term stimulus; it is a major structural change for the Chinese economy.

The anti-involution policy is not merely a short-term stimulus but a structural transformation of the Chinese economy, balancing growth, sustainability, and innovation. However, it poses risks to short-term growth. The economic indicators for July and August have already indicated the impact of such a policy on activity. Thus, like 2015, the Chinese authorities are accompanying this reform with measures to support domestic demand, such as the consumption plan and the new urbanization plan. High real interest rates due to low or negative inflation provide room for monetary policy maneuvering.

The new urbanization plan will help stabilize the real estate market and stimulate consumption. Indeed, despite an urbanization rate of 67%, migrant workers (rural) do not have equal access to real estate and public services.

In August 2015, China also implemented a slight devaluation of the yuan against the dollar to enhance the competitiveness of its exports, which led to significant capital outflows, threatening its financial stability. The PBOC should prioritize currency stability, particularly against the dollar, to remain focused on the trade war.

Conclusion

Deflationary pressures have intensified in the second half of the year, reflecting a slowdown in activity, especially in the private sector, which plays a crucial role in the Chinese economy. In response to the urgency, Xi Jinping has shifted toward anti-involution, addressing a major structural issue in the Chinese economy: production overcapacity. Unlike the 2015 reform, overcapacity is concentrated in the private sector. This affects few industries, but most are closely linked to the electric vehicle sector. The authorities have adopted a different strategy for their industrial flagship, emphasizing a reorientation of investments towards more innovative and sustainable domains. This reform is also accompanied by measures to support domestic demand: a consumption plan and a new urbanization plan aimed at migrant workers to boost consumption. The anti-involution policy is a major structural change for the Chinese economy, allowing for a balance between growth, sustainability, and innovation.

Zouhoure Bousbih

Chart of the week

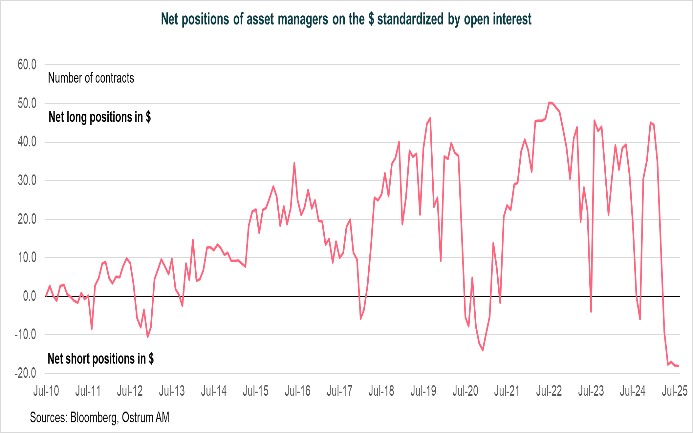

Foreign investors are rushing to protect their American financial assets from fluctuations in the greenback.

Thus, the flows of currency-hedged ETFs on American financial assets have surpassed those that are unhedged.

Another way to illustrate this is the chart above showing a record amount of net short positions on the dollar at $2,500,000 since 2010!

The cost of futures contracts has decreased along with lower short-term rates, making protection cheaper even as the incentive to buy increases. Investors now differentiate between the performance potential of American financial assets and the dollar, which is influenced by the White House's policy.

Figure of the week

100

It will take the BOJ more than 100 years to sell its stock of ETFs.

Market review : The Fed cuts rates

- Fed: 25 basis point rate cut, with two additional cuts expected in October and December;

- BoE: status quo on rates and reduction of the pace of QT to £70 billion over 12 months;

- T-note rises above 4.10%;

- Stocks continue to rise, amidst stable spreads.

The Fed cuts rates

The Fed lowers rates while revising growth and inflation projections upward. The resilience of risk assets rekindles the trend toward steepening after three weeks of flattening. The OAT offers the widest sovereign spread in the Eurozone.

Last week, central banks dominated the news. The Federal Reserve reduced its rate by 25 basis points as expected, even as it raised growth and inflation forecasts for 2026. The Fed's optimism fuels the rally in risk assets (stocks, high yield) while reviving the trend toward steepening yield curves. The dollar has seen a slight increase.

Recent U.S. data show an improvement in consumer spending. However, survey results are mixed, with the Empire Manufacturing Index declining before a notable rebound in the Philadelphia Fed index. In this context, the Fed proceeded with a 25 bp rate cut, as anticipated. Stephen Miran, Trump’s voice on the FOMC, immediately voted for a 50 bp cut, projecting Fed funds at 3% by the end of 2025. Waller and Bowman, who dissented in July, voted for the 25 bp cut. Miran is therefore isolated and lacks real influence over the FOMC's decisions. According to Jerome Powell, a 50 bp cut was not even discussed. The surprise came from the upward revision of growth and inflation projections for 2026. No FOMC member expects an unemployment rate exceeding 4.5% next year. Despite a solid consensus on the macroeconomic situation, the rate projections among FOMC participants range from 2.75% to 4% starting in 2026. Meanwhile, the BoE's status quo (7 votes against 2 for a 25 bp cut) is accompanied by a reduction in the pace of QT to £70 billion over 12 months starting in October 2025. In Japan, the BoJ hints at a potential rate hike as early as October. Kazuo Ueda has committed to gradually reducing its holdings of Japanese equity ETFs at a modest pace of $4.2 billion per year.

Risk assets continue to advance. Valuations are not hindering the tightening of the high yield market or the upward pressure on stocks. Implied volatilities remain low, hovering around 15% for the VIX ahead of Friday's quarterly expirations. Favorable rotation signals towards small-cap American stocks (Russell 2000) have emerged over the past month, but American technology remains the primary driver of gains. The Euro Stoxx is up 1% for the week. The Nikkei reacted negatively to the BoJ's announcement of ETF sales, yet its weekly performance remains positive (+1.5%). In the bond markets, the T-note rebounded to 4% before returning to around 4.12% following the Philadelphia Fed release. This movement revives the yield curve steepening trend, justified by risks to fiscal outlook. In the Eurozone, the revision of the German federal government's issuance program (+€15 billion in Q4 2025) contributed to the rebound in Bund yields (2.75%). The Gilt (4.70%) is facing pressure from deteriorating public finances in August, despite reduced QT from the BoE. The autumn budget will be crucial for long-term British rates. The French OAT is the most undervalued among Eurozone sovereign debt. The 10-year French spread is above 80 bps, compared to 55 basis points on Spanish Bonos. The 10-year inflation breakevens are remarkably stable. In the credit markets, spreads remain low around 70 basis points over swaps, despite a slight decline in inflows to credit funds. The iTraxx Crossover has tightened below 250 basis points, pulling high yield bond spreads down with it.

Axel Botte

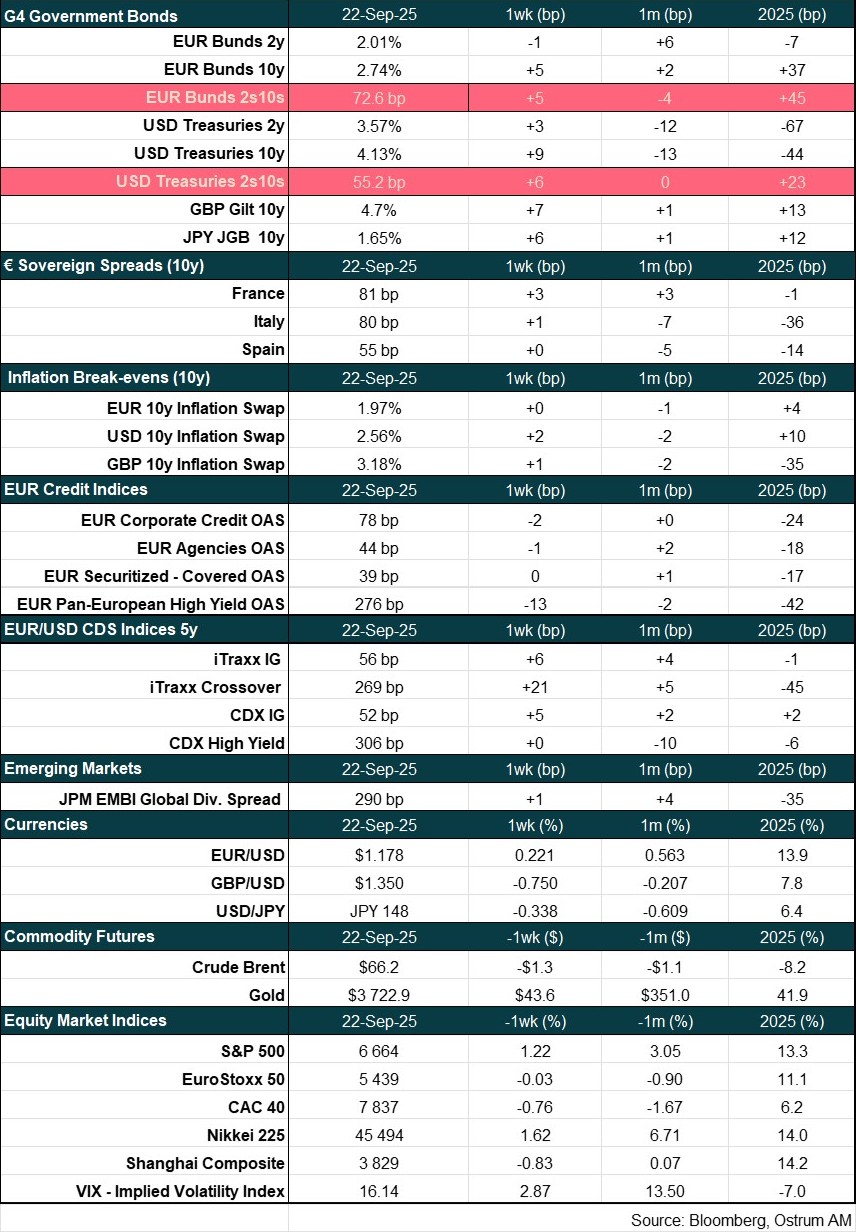

Main market indicators