Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to podcast (in French only)

(Listen to) Axel Botte’s podcast :

- Review of the week – Financial markets, U.S. labor market and inflation in the Eurozone;

- Theme – The challenges of the developing USD stablecoin market.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The challenges of the developing USD stablecoin market

- A stablecoin is a type of cryptocurrency designed to maintain a stable value to traditional fiat. There are significant speed and cost advantages to using stablecoins;

- But challenges exist. Stablecoin issuance must be backed by reserves, which needs to be properly regulated. Sovereignty risks may exist as USD-linked stablecoins can be issued outside of the U.S. jurisdiction;

- The growth in the stablecoin market could represent net additional demand for Treasury securities, and exert downward pressure on T-bill yields;

- The BIS indicates estimates that $3.5 billion of stablecoin inflows may lead to lower T-bill yields by 2 to 2.5 bps. Hence, a $2-4 trillion stablecoin market could substantially influence the transmission of Federal Reserve monetary policy;

- Besides stablecoins, tokenized MMFs are developing fast. Unlike stablecoins, they are yielding instruments that can also be used as collateral.

What is a stablecoin?

Stablecoins tied to the dollar have a market value of around $250 billion

In recent years, stablecoins have emerged as a significant innovation in the cryptocurrency market, serving as a bridge between traditional finance and digital assets. A stablecoin is a type of cryptocurrency designed to maintain a stable value by pegging it to a reserve asset, typically a fiat currency like the US dollar or euro. This peg helps mitigate the volatility that cryptocurrencies like Bitcoin and Ether often experience, making stablecoins more suitable for everyday transactions and as a store of value.

Stablecoins are primarily traded on cryptocurrency exchanges such as Binance, Coinbase, and Kraken, which facilitate crypto-to-crypto transactions without reverting to traditional fiat currencies. Popular stablecoins like USDT (Tether) and USDC (USD Coin) constitute a significant portion of trading volume on these platforms. The USDT token is tied to the US dollar with a market value of $172 billion. It is by far the largest, with Circle’s No. 2-ranked USDC stablecoin worth about $74 billion (source: Bloomberg). The use of stablecoins enables smoother transactions, allowing users to engage directly within the cryptocurrency ecosystem, drastically reducing transaction processing times from days to mere minutes, and lowering transaction costs. Stablecoin users engage in transactions without needing to convert back to fiat currencies, which can introduce delays and additional fees involved in traditional banking transactions. As a result, stablecoins significantly enhance the speed and affordability of transactions within the digital asset space (source: J.P. Morgan).

Are there any challenges with the use of stablecoins?

Sovereignty and risks of fragmentation can arise as stablecoin grows.

The U.S. does not have an external ‘sovereignty’ challenge like the euro area since payment services (the Visa-Mastercard duopoly, applications like ApplePay, and dollar-backed stablecoins) are predominantly located in the U.S. But there is also an internal challenge that is less visible. One can choose to receive a payment in cash or via bank transfer. In both cases, "central" money (issued by the central bank) is transferred: directly through the banknote, or indirectly via interbank transfer; The money received in my account (commercial bank money) can be converted into cash (central bank money) at a rate of 1-to-1. Deposit insurance applies and banks can borrow from the central bank to meet liquidity needs.

Distributed ledger technology now enables lower-cost payments, including cross-border transactions. However, the link to central bank money is severed: the 1-to-1 exchange is not guaranteed by design. Thus, there is a risk of monetary fragmentation.

As is well known to Central Bankers, trust in money is critical to economies. A dollar must have the same value in whatever form it is held and be exchangeable within and between these various forms. The terms of exchange of stablecoins must be known, consistent and enduring. They must be the same for all holders and independent on the terms of business of exchanges. As presently set up, not all stablecoins satisfy this condition. BoE Governor Andrew Bailey adds that since risk free assets do not protect against operational risks, for instance a successful cyber-attack, trust in stablecoins requires an insurance scheme (as with bank deposits), and a statutory resolution arrangement that ensures their holders are preferred creditors in any insolvency process.

Through banks, deposits support lending. And a fraction of bank deposits is held as reserves with the central banks. Commercial bank money is thus not 100%-backed by risk-free assets as loans to household and companies are not risk-free. With stablecoins however, money and credit provision can be separated.

Why should this increase the demand for Treasuries?

Stablecoin issuers must hold T-bill as reserves

Stablecoin issuers such as Tether and Circle hold substantial amounts of U.S. Treasury bills as part of their reserve assets, with Tether reportedly being one of the largest buyers of Treasuries. As stablecoins continue to circulate, the need to maintain adequate reserves bolsters demand for these government securities. Supervision of stablecoin issuers will be critical. Tether had been notably absent from the US prior to Trump’s second term, after clashing with regulators. In 2021, the company paid a $41 million fine to settle allegations it had misrepresented its reserves.

Stablecoin growth should raise demand for T-bills

The rise of stablecoins may create an implicit obligation for global users to engage with the U.S. dollar, particularly in regions with limited access to traditional banking systems. This reinforces the dollar's dominance in international trade and financial transactions. Looking forward, the market for stablecoins is projected to experience significant growth. Estimates from various financial institutions suggest that the total issuance of stablecoins could reach about $3.7 trillion by 2030, while Standard Chartered anticipates a figure of around $2 trillion by 2028. TBAC estimates suggest that this growth could lead to an additional $900 billion in T-bill purchases linked to the expansion of stablecoins.

Challenges for Federal Reserve Monetary Policy

The development of USD-linked coins may affect the transmission of Fed policy

The development of stablecoins poses potential challenges for the Federal Reserve's monetary policy. As stablecoins grow in use and their market dynamics evolve, they may exert downward pressure on short-term Treasury yields. This scenario can affect the effectiveness of the Fed's policy rates in influencing broader economic conditions. Moreover, the shift of assets into stablecoins may complicate the control of the overall money supply, as a significant portion of liquidity moves outside the traditional banking system, potentially leading to unaccounted increases in monetary aggregates.

BIS study: quantifying the impact of stablecoins on T-bills

Stablecoins may distort bill valuations

The BIS paper discusses the emerging influence of stablecoins on Treasury markets, particularly focusing on their impact on short-term yields and potential implications for monetary policy and financial stability. The study highlights several key findings:

- Magnitude of Impact: The analysis indicates that a 2-standard deviation inflow of stablecoins, quantified at $3.5 billion, can lead to a yield impact of approximately -2 to -2.5 bps in the Treasury market. An expanding stablecoin market to $2-4 trillion could substantially influence the transmission of Federal Reserve monetary policy.

- Mechanisms of Influence: The paper outlines three primary channels through which stablecoin flows can affect Treasury pricing:

- Direct Demand: Stablecoin purchases can decrease the supply of Treasury bills available in the market, as funds that could have been used to buy T-bills are redirected to stablecoins.

- Indirect Demand Relief: The influx of stablecoins can alleviate dealer balance sheet pressures, impacting asset prices by reducing the burden on dealers who traditionally absorb Treasury supply.

- Signaling Effects: Large inflows of stablecoins may signal shifts in institutional risk appetite, which in turn can affect how investors price Treasury securities.

- Policy Implications: The increasing presence of stablecoins in Treasury markets necessitates regulatory scrutiny, especially regarding reserve transparency. For instance, the data transparency of stablecoin USDC enhances market predictability, contrasting with the opacity of USDT (for instance, maturity disclosure of USDT reserves is incomplete). Regulatory frameworks that standardize reporting could mitigate systemic risks linked to concentrated ownership in Treasury securities.

- Financial Stability Risks: As stablecoins become prominent investors in Treasury markets, their inherent vulnerabilities—such as liquidity, interest rate, and credit risks—could pose financial stability challenges. If a major stablecoin experiences redemption stress, it could trigger fire sales of Treasury securities, particularly affecting longer-term T-bills.

There is a need for regulatory attention and further research into their implications for monetary policy and financial stability. Considering the evolving relationship between cryptocurrency and traditional finance, the BIS calls for exploration of potential cross-border effects and interactions with other financial instruments during liquidity crises.

Are tokenized MMFs a superior alternative to stablecoins?

The rapid growth in tokenized MMFs has catalyzed an alternative narrative. Tokenized MMFs are a yielding instrument whilst stablecoins, which cannot pay interest under the Genius Act. On-chain investors can use stablecoins or tokenized MMFs. Stablecoins can be redeemed at a fixed price of $1. Depending on the fund protocol, holders of tokenized MMFs may also redeem at $1. But there are differences. Tokenized MMFs enable efficient management of short-term liquidity and instant collateral transfers (freeing tied-up capital and reducing intraday exposure fees). Issuers of tokenized MMFs are regulated asset managers as opposed to private companies (including the above-mentioned Tether and Circle). Tokenized MMF transfers can occur instantaneously on blockchains (most of them are issued on public blockchains) and are typically mediated by smart contract rules.

The endgame, years from now and assuming widespread adoption, could be that tokenized MMFs become a medium of payment. Quasi-money becoming money has never been closer.

Conclusion

Stablecoins represent a significant innovation to make payments faster and less costly and foster the use of the U.S. dollar at a time when de-dollarization could be threatening the position of the dollar. The development of stablecoins from a market value of $250 billion to trillions within the next decade carry risks. Financial stability can be threatened by stablecoin outflows. External sovereign risks would arise if stablecoins are issued outside of the fiat currency’s jurisdiction as it may undermine the transmission of monetary policy.

Axel Botte

Chart of the week

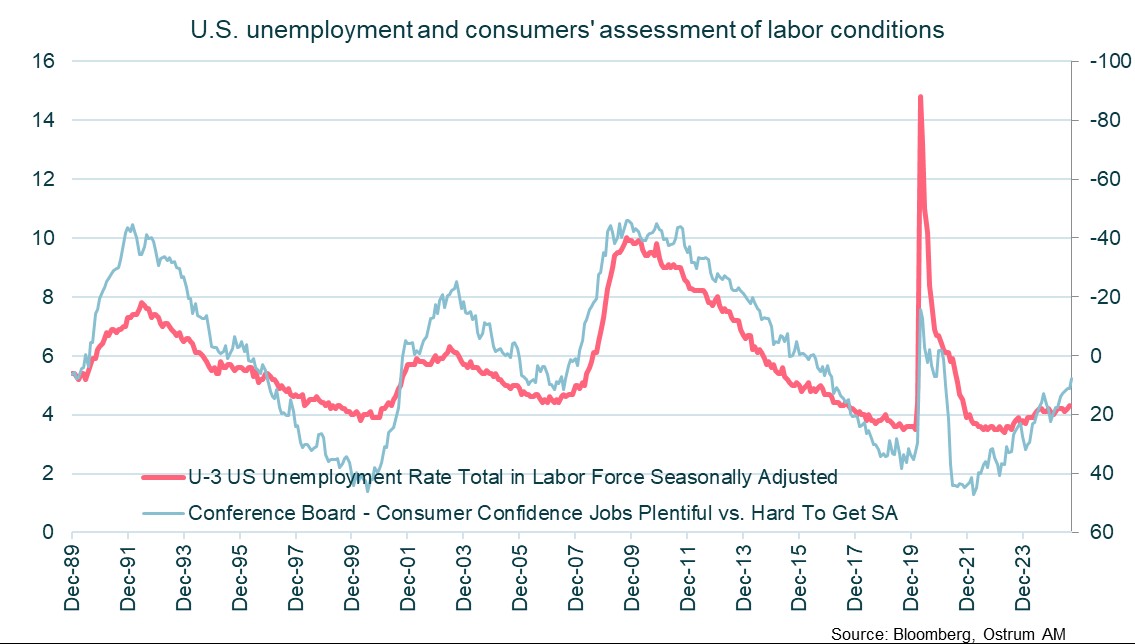

Given the shutdown in the United States, the release of employment statistics will be delayed. Naturally, market attention has shifted towards surveys of businesses and households.

The Conference Board’s confidence survey is a key measure of households' perception of employment trends.

The gap between its components of 'plentiful jobs' and 'jobs hard to find' tends to identify cyclical turning points in the unemployment rate. This measure has been on a downward trend since March 2022, while remaining distant from recession levels.

Figure of the week

125

Brazil aims to launch the Tropical Forest Forever Facility at November's COP30 climate summit to raise as much as $125 billion to protect tropical forests.

Market review:

- U.S. government shutdown begins as Trump threatens thousands of federal government job cuts;

- U.S. job market: ADP signals job losses in September, August data revised down;

- Equity markets shrug off shutdown; posted weekly gains;

- Bond yields down last week.

Markets Resilient Amidst Turbulence?

Financial markets appear buoyant, seemingly ignoring the government shutdown and the deteriorating political situation in the United States, even as employment trends remain unfavorable.

The government shutdown commenced on October 1 in the U.S., delaying the release of public statistics and shifting market focus to private sector surveys. The ADP reported a net loss of 32k jobs in September, following a downward revision for August to -3,000 (from an initial reading of +54k). The JOLTS survey indicates 7.2 million job openings, but the hiring rate continues to adjust. The Challenger survey conveys a similar message: recruitment plans are at their lowest.

The situation could worsen if Donald Trump follows through on his threat to lay off hundreds of thousands of federal employees from agencies affected by this forced closure. Reopening is contingent on passing a budget, even a temporary one, but Democrats are demanding assurances regarding funding for Obamacare, and the GOP lacks the necessary 60 votes to advance a bill in the Senate.

In the Eurozone, PMI surveys (composite at 51.2) point to moderate growth, despite the bleak economic outlook in France. Inflation stands at 2.2%, with only falling energy prices preventing a rebound in core inflation (2.3%). Notably, the ECB's wage projections have been revised upward to 1.9% for June 2026, indicating that inflation risks may be greater than central bankers currently estimate.

Despite political gridlock and a weakened U.S. economy, financial markets are performing well. Major stock indices have gained 1% to 2% over the past week, with the Nasdaq once again outperforming. Europe has fared even better, with increases nearing 3% driven by rebounds in healthcare and cyclical sectors. The agreement between Pfizer and the White House suggests a favorable resolution regarding pharmaceutical tariffs. Bond yields are trending downward, with the 10-year T-note briefly dipping below 4.10%. The lackluster employment indicators are leading to a flattening of the yield curve. Conversely, inflation keeps the Schatz above 2%, resulting in a reduction of the 2-10 year spread as the Bund approaches 2.70%. The easing of Bund yields comes as Germany faces a 21% increase in net financing needs next year (€204 billion according to Citi). France plans to borrow 8% less than in 2025, so that the unexpected fall of PM Lecornu has had a moderate impact at Monday’s open. Italy, is now projecting a 3% deficit for 2025, and will see its financing needs plunge by 24% next year. However, Italy’s debt agency's prefinancing strategy, which involves borrowing an additional €10 billion more than initially expected this year, prevents a short-term tightening of the spread (82 bps). UK Gilts benefit from global trends, but the key determinant will be the autumn budget at the end of November. In the meantime, the BoE faces a challenging decision regarding interest rates as inflation remains significantly above its target. Credit markets remain expensive but stable. The average spread on investment-grade credit is at 70 bps over swaps. The lack of dispersion in spreads indicates a risk-seeking buying environment. Flow data also confirm strong interest from end investors in this asset class. In the high-yield segment, the bond market was somewhat heavier last week with spreads widening by approximately 7 bps. Nevertheless, the iTraxx Crossover is trading around 255 bps, a level that still covers the historical average default risk.

Axel Botte

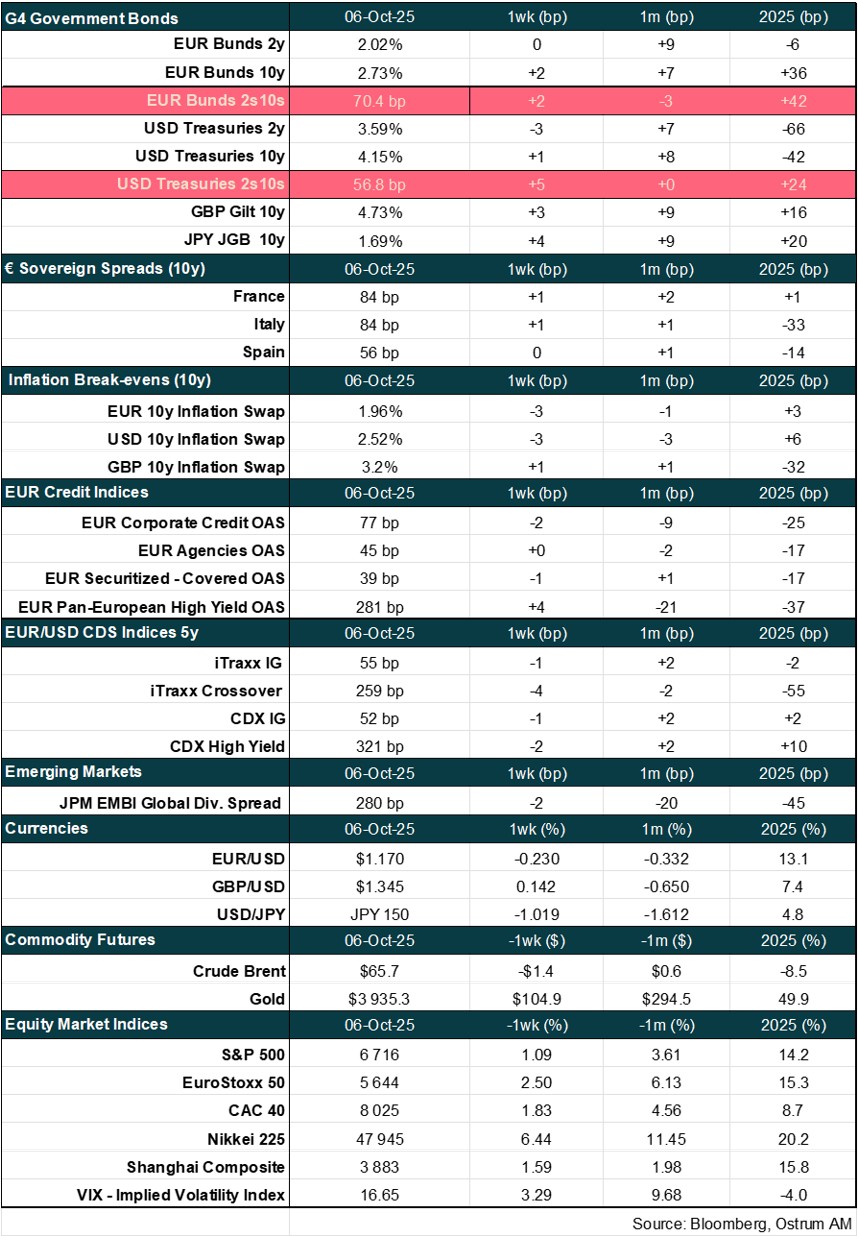

Main market indicators