Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s & Zouhoure Bousbih's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Taiwan Dollar: The Time Bomb of a New Type of Financial Crisis

- Like a butterfly, panic spread through Taiwanese business circles, prompting them to massively sell dollars, leading to a sudden appreciation of the Taiwan dollar;

- Although the causes remain unclear, it has highlighted the colossal amount of foreign financial assets accumulated by Taiwan, totaling $1 trillion, which is 200% of its GDP!

- Life insurance companies hold more than $700 billion, primarily in U.S. bonds (Treasuries and investment-grade corporate bonds);

- Their hedging needs are met by the Central Bank of China, which provides them with dollars from its substantial foreign exchange reserves through currency swaps;

- Over the years, life insurance companies became lax, accumulating risks: $200 billion in foreign bonds are uncovered, representing 25% of Taiwan's GDP;

- Their solvency relied on a fragile balance, particularly the belief that the Central Bank of China would never allow the Taiwan dollar to appreciate;

- Life insurers have recorded significant potential losses, which may worsen if U.S. interest rates continue to rise and the greenback weakens.

Market review: Back to square One

- The Geneva agreement with China amplifies the powerful market rebound, but uncertainties remain;

- United States: activity likely at an inflection point;

- Markets will have to cope with the resurgence of U.S. budgetary risk, as Moody’s cuts rating to Aa1;

- Sovereign and credit spreads supported by the search for yield.

(Listen to) Axel Botte’s & Zouhoure Bousbih's podcast:

- Review of the week – Big Beautiful Bill, a BBB budget and the loss of the AAA;

- Theme – Taiwan Dollar: The Time Bomb of a New Type of Financial Crisis.

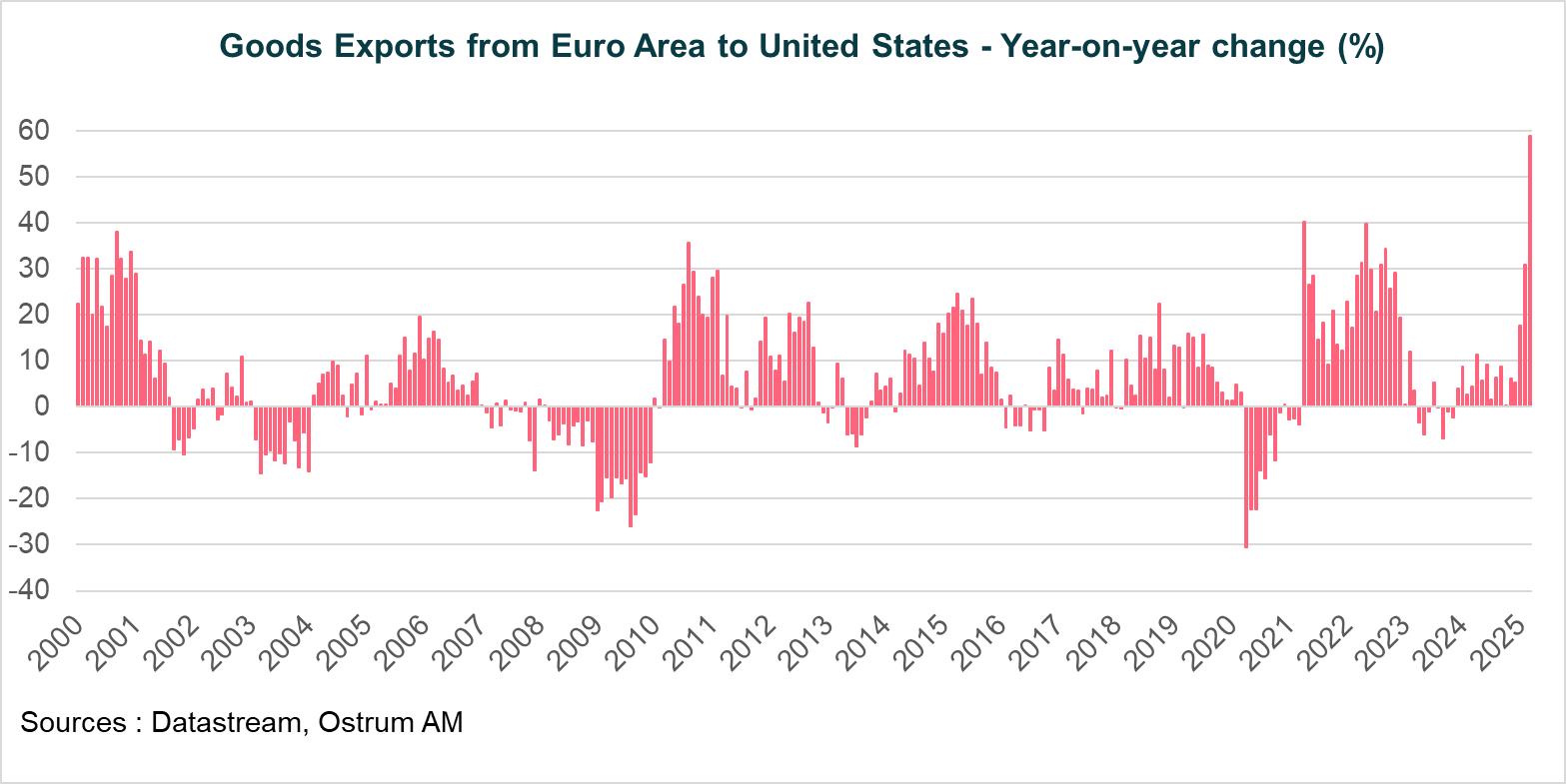

Chart of the week

Strong rebound in Eurozone exports to the United States in March (60% YoY growth), reflecting stockpiling activities in anticipation of new U.S. tariffs.

Detailed by country, the increase is more pronounced for Ireland, suggesting strong American demand for European pharmaceutical products

Figure of the week

-1.6

The decrease in margins for the month of April was 1.6% in wholesale machinery and vehicles, which significantly contributed to the 0.5% drop in producer prices in the United States

MyStratWeekly : Market views and strategy

MyStratWeekly – May 20th 2025