Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: United States, Euro area, and China: What is the economic outlook for the Second Half of the Year?

- The U.S. economy is facing the shock from tariffs and the uncertainty stemming from Donald Trump's policies. The state of public finances is also concerning;

- The U.S. labor market is expected to slow, and we are watching with concern the deterioration in consumer credit quality. U.S. growth is projected to be below potential in 2025;

- In the eurozone, the better-than-expected growth in the first quarter is expected to be followed by a slowdown due to the high uncertainty related to the trade tensions generated by the Trump administration;

- Business leaders and households are expected to adopt a more cautious behavior, which will weigh on domestic demand;

- The impact of high U.S. tariffs on the Chinese economy has been limited due to support policies implemented at the end of last year and the diversion of its exports to ASEAN countries. China is therefore expected to achieve its growth target of 5%. However, private consumption remains weak and should be a priority in the new five-year plan starting in March 2026.

Market review: Tariffs: The Weapon Dulls with Overuse

- U.S. courts are opposing Donald Trump's tariffs;

- United States: growth revised to -0.2% in Q1 amid slower consumption;

- Significant easing of long-term rates in Japan, leading to a flattening of global yield curves;

- Favorable environment for risk assets.

(Listen to) Axel Botte’s podcast:

- Review of the week – Trump continues to make headlines despite legal challenges;

- Theme – US, Eurozone and China scenarios.

Chart of the week

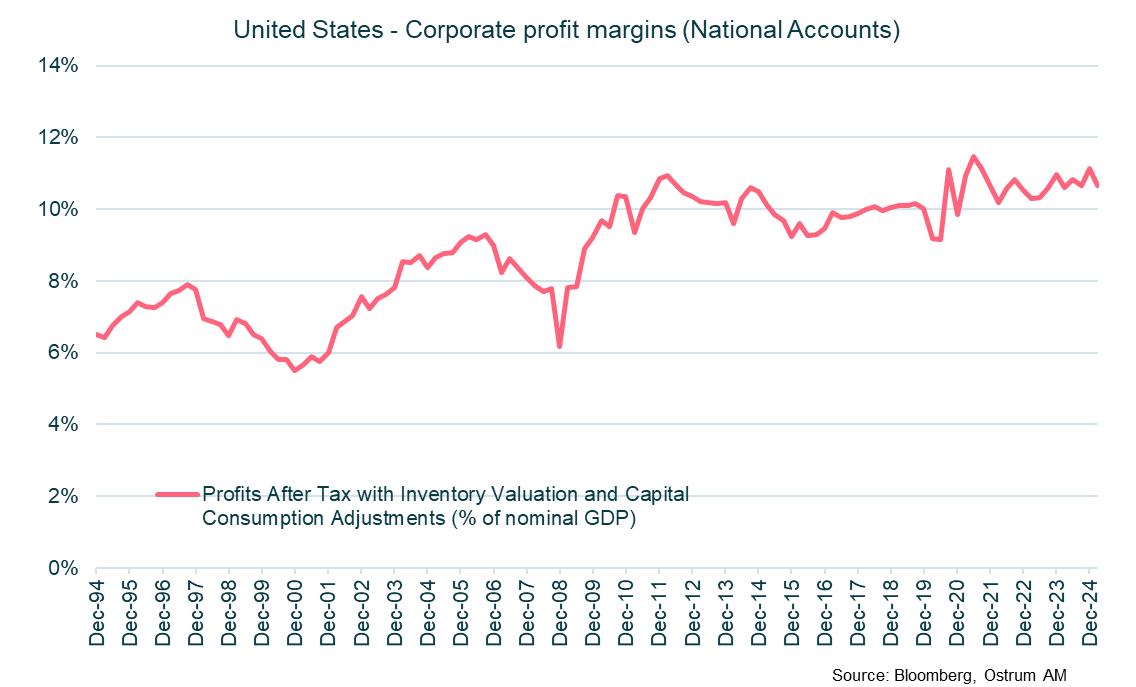

Corporate margins have been at historically elevated levels for some time now. Corporate pricing power has risen in the wake of Covid as lockdowns and government handouts spurred revenge consumer spending. IT margins rose in keeping with the development of cloud computing, remote work and lately AI.

On national accounts data, corporate profit margins on an after-tax basis stood at 10.6% of nominal GDP in the first quarter of 2025. Now, tariffs could eat profit margins to a degree, in most exposed sectors such as retail and automotive.

Figure of the week

18

Confidence among Europeans in the EU is at its highest level in 18 years, with record trust in the euro: 74% within the EU and 83% within the eurozone, according to the latest Eurobarometer.

MyStratWeekly : Market views and strategy

MyStratWeekly – June 3rd 2025