Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO letter

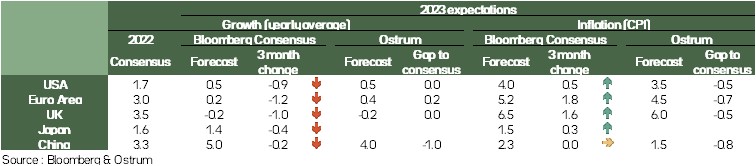

Two questions for 2023: recession and pivot

What recession? For the moment, published activity data are not collapsing even though all leading indicators promise much more difficult quarters. For the moment, the economy is showing surprising resilience in the face of all headwinds. A recession seems inevitable and the debate focuses on its intensity. There are two sides. Those who agree with us that the recession will remain within reasonable limits. In our case two quarters of contraction with a cumulative loss of the order of 0.5 ppt. The other side is much more pessimistic with a longer or deeper recession against a backdrop of energy crisis. This is a plausible scenario, even though it seems to us that it is premature and erroneous to make it the central scenario.

What pivot? The market played this summer, and again recently, with the famous “pivot”, the idea that central banks will slow down their rate rises. The Fed is now well above the neutral rates, the ECB should overtake them by two meetings and the question is what level of restraint is appropriate. Some countries are also showing signs of slowing down, such as Australia.

These two questions are closely linked: the strength of the labour market, one of the reasons for our more constructive view of the economic situation, leads us to believe that the said pivot will not intervene until the end of the year for the Fed and the ECB. Especially with inflation data that remain as stubborn as ever.

These two issues are absolutely central to the trajectory of risk assets. We remain cautious at year-end. The lack of visibility, the risk of a serious crisis this winter, should not allow risk premiums to deflate.

We introduce our views at the end of 2023. In this scenario with inflation not falling rapidly next year, central banks would remain very vigilant and rates would stabilize at high levels relative to what we had been accustomed to for a decade. After winter and central bank pivot has come to past, risk premiums are expected to return to levels more in line with their long-term average, so we have a much more constructive view of risk assets by the end of 2023.

Economic views

Three themes for the markets

-

Monetary policy

The Fed has passed its neutral rate, the ECB should follow shortly. The issue of the pivot, certainly premature, is therefore irrefutable. The other question is whether the central banks are going to back down next year if inflation goes down. Given the shock, it’s unlikely.

-

Inflation

Once again, inflation surprised by its level and resilience on both sides of the Atlantic. While inflation is expected to decline, the underlying trend remains too dynamic to be consistent with the Central Bank target. In Europe, the trend would be towards 3% by the end of next year, giving an average of more than 5% over the year as a whole.

-

Which recession?

Economic data continues to show some resilience, although a recession seems inevitable. The question then becomes the extent of this recession when markets have valuations consistent with an extremely pessimistic scenario. It is unlikely that we will have a clear answer to this question before the end of the year.

Key macroeconomic signposts : activity

- The overall economic cycle weakens further in September. Business surveys everywhere suggest a fragile profile of activity. World trade will slow and accentuate this phenomenon (right-hand graph)

- This point is observed on the graph on the left. The various indices tend towards 50 or below. Only the overall ISM index remains robust due to strong service dynamics as manufacturing slows down sharply just above the 50 separator. In US cycle analysis, manufacturing inflections are generally more relevant to anticipating a slowdown than the services index.

- In the United States, the major risk concerns the real estate dynamic. The recent rise in mortgage rates has resulted in a sharp decline in home resales (well correlated with household consumption via a wealth effect) and a drop in the price of real estate in July. Coupled with tightening monetary conditions, the likelihood of a recession increases around the end of the year.

- In China, whose composite index fell below the 50 threshold in the left-hand graph, growth revisions are rather bearish. The housing crisis is major and penalizes consumption since 70% of household wealth consists of real estate. This real estate risk will not disappear quickly even if the 0 covid policy should be lifted.

- In Europe, the risk is Germany, whose model is falling apart. It no longer benefits from Chinese impulses or cheap Russian gas. In addition, the energy transition must be reviewed because it was based mainly on this cheap gas. The risk of recession is very high with a rapid ripple effect on neighbouring countries.

Key macroeconomic signposts : inflation and budgetary policy

- In the US, the Fed focuses on wages to avoid inflation falling into the long term. It will not hesitate to tighten the tone even at the cost of a strong slowdown in activity or even of a recession.

- In the Eurozone, the risk of inflation persistence comes mainly from energy prices. On the left-hand graph, we see the predominance of the contribution of energy to explain the high inflation rate.

- This contribution no longer follows, unlike in the past, the price of oil. The price of black gold is approaching that of 2021 and its intrinsic contribution will decrease. On the other hand, the rise in the price of gas and electricity explains a contribution that remains strong over the long term.

- It can be seen from the middle graph that the price of oil expressed in euro has risen much less and much less fluctuated than that of gas (the price of electricity is based on the price of gas since it is set at the margin on the last power station which is started up to meet demand, it is generally a gas-fired station).

- The high gas price reflects the rationing effect into Russian gas since the summer of 2021. This movement has frankly increased after the invasion of Ukraine by Russia. The Europeans bought gas at very high prices in order to have the necessary energy.

- In 2023, this issue of gas supply will remain a major one because Europe does not have long-term contracts for its supply. This will keep prices high, probably volatile. It will weigh on purchasing power and penalize the cycle.

- One solution would be to increase electricity production in France to limit dependence on gas.

Priority to the fight against high inflation

- Fed: Higher rates, longer

After raising its rates for the third time in a row by 75 basis points in September, the Fed made it clear that it was going to continue its aggressive monetary tightening policy in order to fight against high inflation and contain inflation expectations. To this end, its rates will remain in restrictive territory for some time even at the risk of weighing heavily on growth. Its Fed funds expectations were thus revised sharply upwards to 4.4% at the end of 2022 (compared to 3.4% expected in June) and 4.6% at the end of 2023 (compared to 3.8%). - ECB: again +75bp in October?

The ECB is also determined to fight "far too high" inflation and contain inflation expectations. Thus, after having raised its rates by 75 bp in September and by 50 bp in July, it should raise them again by 75 bp in October. Discussions are underway to modify the conditions of the TLTROs. A decision could be taken at the October 27 meeting. Unlike June-July, the ECB did not need to use the flexibility of reinvestments under the PEPP in August and September. - The BoE intervenes urgently

The announcement of the "mini-budget" by the Liz Truss government, with vast unfunded tax cuts, created a real panic in the UK bond markets. This has seriously weakened pension funds and created a risk to financial stability. The BoE was thus forced to postpone for a month the reduction in the size of its balance sheet and to buy bonds urgently. These purchases are supposed to end on October 14 at the risk of creating greater chaos if the government does not review its copy at the same time.

Strategic views

Waiting for a new world

Synthetic market views: winter is coming

Until the end of this year, we will remain very cautious about risky assets, uncontrollable risks, especially geopolitical ones, create too little visibility. On the other hand, we believe that rates will continue to rise, albeit more slowly, and above all we play on the fact that the curves do not anticipate enough inflation.

We are setting a limited long position on emerging markets as valuation are supportive and outflows stabilized.

By the end of 2023, on the other hand, once the recessive risks have passed, even the partial normalization of risk premiums encourages us to take a much more constructive view of risky assets, notably credit and equities.

Allocation recommendations: the unknown before the upturn?

Valuations remain attractive, especially for parts of credit, especially in light of our limited recession scenario. At the end of the year, however, it is unlikely that there will be much visibility and that the situation will change significantly.

By the end of 2023, we are constructive on the HY which will be supported by technical factors. Similarly, on emerging markets, spreads especially on the riskiest names are very generous, so there are opportunities there too.

Asset classes

G4 rates

- The Fed is continuing its monetary tightening, which should bring rates to 4.5% by the end of the year. Employment growth and elevated inflation argue for higher rates but valuations close to 4% on 10-year notes justify a neutral stance.

- In the euro area, inflation still requires monetary tightening. The ECB is expected to raise its rate by 75 bp. Sentiment remains seller due to expansionary fiscal policies in the face of the energy crisis.

- The budgetary uncertainty maintains considerable volatility on the Gilt, which the BoE is trying to calm despite the need to fight inflation. We recommend a short Gilts position.

Other sovereigns

- Italy remains at the center of investor concerns given the political risks but the BTP spread has not yet reflected the specific risk. The spread narrowing linked to the European energy plan is unjustified and an underweight in Italian BTP remains warranted.

- The spreads on the core countries show stability and argue for a neutral position vis-à-vis the Bund.

- In the G10 universe, the RBA is slowing the pace of monetary tightening, but other central banks remain quite hawkish. Swedish and Swiss bonds have the greatest potential for rising yields.

Inflation

- Inflation (8.2% in September) is slowing gradually in the United States thanks to energy, but underlying inflation remains sustained (> 6%). Tight Fed policy suggests a neutral stance on US TIPS breakevens.

- In the euro area, inflation reached 10%. However, monetary tightening weighed on inflation expectations. Current breakeven inflation rates offer attractive entry points.

- In the UK, volatility is considerable after the mini-budget shock and despite the intervention of the BoE. The inflation outlook remains tilted to the upside and suggests maintaining a long bias on breakeven.

Credit

- The expected slowdown weighs on rating actions. Sentiment remains unfavorable to the asset class, with fund outflows and heavy protection buying arguing for caution. We expect credit spreads to widen further.

- Activity on the primary IG bond market remains constrained by market volatility. New bond issues are however absorbed by markets thanks to high premiums especially on non-financial bonds.

- Fundamentals are deteriorating on high yield, as investors cut their exposures. The limited supply compensates for fund outflows. However, current cheap valuations point to a reduction in spreads.

Stock market

- Taking advantage of inflation and the weakness of the euro, earnings expectations are showing strong resilience. We think the deterioration expected by investors is to be relatively small compared to previous recessions.

- Valuation multiples are low (10.5x at 12 months) and the median PE is back in line with long-term average. The expected dividend yield is elevated at 4.1% although it dipped below Euro IG spread.

- Markets are hesitant between monetary tightening, energy crisis and attractive valuations. However, by the end of 2023 we are more positive, with a Euro Stoxx 50 to 3,800.

Emerging

- The EMBIGD vs. Treasuries spread has widened due to the slowdown and Fed policy. We estimate the spread’s equilibrium value at 430 bps. We are targeting spread tightening towards 510 bps in the month to come.

- Outflows from emerging bond funds have resumed but issuance in the primary market remains very limited, as bond redemptions exceed new borrowing.

- High yield offers a historical yield premium against the IG. The countries most in difficulty (Argentina, Zambia, Costa Rica) have received support from international institutions.