Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO letter

- A more uncertain future

Since early November last year, following the election of Biden and the announcement of vaccines, the markets have remained bullish with the vast majority of risky assets rewarded by the market. We noted that, since this summer, the signs of nervousness were multiplying even if the markets remained well oriented. The trend has increased recently with rapidly rising rates, fears about growth and inflation, and strong sectoral rotations in equity markets.

For the remaining of the year, we retain once again a positive view about market developments as fundamentals are still robust and central banks continue to be very supportive. We only use a portion of our risk budget in our allocation as market prices make it difficult to envisage a rapid rebound. In contrast, a major correction is unlikely, and we see no reason to further reduce investors’ risk budget.

On the other hand, the visibility over next year is much lower and the risks accumulate. Rather than stagflation we face an excess of demand that creates bottlenecks and makes us believe that we could face at the same time an economic overheating since production cannot keep up with this frantic pace, and inflationary pressures that seem to be building up. A typical pattern at the end of a cycle where the role of central banks is to withdraw monetary support. All this gives a much more complicated market environment

We remain constructive on the potential of markets next year, but the risk return arbitrage will certainly be much less favorable.

Economic views

Three themes for the markets

-

2022

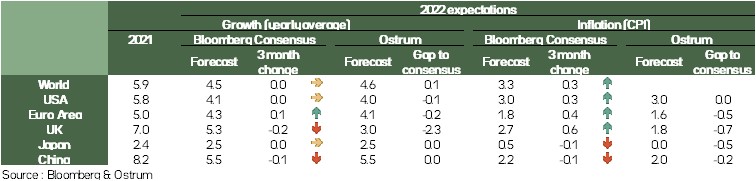

We have extended our medium-term views to the end of 2022. In this publication we dedicate a page to these forecasts and views. Next year is likely to be much more complicated with less favorable growth, potentially persistent inflation and less and less accommodating central banks.

-

Inflation

Inflation surprises remain very high globally, but the debate has now shifted to the labor market and the potential of an emerging wage/price loop. Tensions on the labor market, coupled with significant wage pressures, should continue to fuel the debate.

-

Growth

Growth remains strong but the peak has indisputably been passed. The signs of bottlenecks are increasing, signs of overheating activity. The news could be disappointing in the future. The economic surprises are negative, which is less favorable for the markets.

Key macroeconomic signposts

- Growth remains robust in developed countries. The recovery of pre-crisis activity will take place before the end of 2021 in most of these countries. The adjustment is much faster than anticipated a few months ago.

Maintaining proactive economic policies and health policies have supported activity and reduced risk perception.

And while health remains a concern, it no longer seems to be a source of macroeconomic disruption.

- However, the catching-up momentum has passed and the spectacular growth figures recorded in 2021 and 2022 due to strong gains at the end of the year will not be renewed in 2023. There will then be a return to growth figures comparable to those seen before the crisis. Since 1970, in the major developed countries, GDP, after a recession, does not return to the trend observed in the previous cycle, and the growth rate is always lower than that of the previous cycle. Recessions have a permanent cost. The crisis was special but all crises are and the sources that could boost productivity and change the pace of GDP are still to be found.

- The risk is greater on emerging countries. Political institutions have not been able to support activity and reduce risk as in developed countries and the management of the health crisis remains dependent on vaccine transfers. More recently, the rise in world food prices has resulted in a large levy on household purchasing power, since food accounts for an average of 40% of expenditure. The divergence with developed countries is marked and probably lasting due to the changing nature of globalization.

- The situation in China appears more fragile due to the political influence on the economy and the real estate crisis that will penalize the wealth of households. In addition,

The Silk Roads initiative implemented by Xi Jinping in 2013 is now competing with US and European initiatives.

- China, which had had a leading role, especially in emerging countries (Africa, Brazil, in particular) could lose some of its influence if its internal growth is weaker forcing it to repatriate resources to its own economy.

- The immediate issue is inflation. It has been very high in the US since April, well above the Fed target of 2% (5.4% in Sep). In the euro area, the inflation rate (3.4% in Sept), is above the ECB’s target. The increase in energy prices explains between 1/3 (US) and half (ZE) of the inflation observed. In Europe, the underlying component is below the 2% target. Inflation appears temporary, resulting from the necessary adjustments after a dramatic crisis. The likelihood of persistent inflation with widespread wage increases, a necessary condition for a persistent inflation, appears to be reduced. The inflation rate will fall below the ECB target in 2022.

- In the USA, the inflationary shock, in addition to energy, is due to excess demand after the Biden premiums. This effect is fading, and inflation is expected to return to an area closer to the Fed’s targets in 2022. If there are wage pressures, they will not be persistent because the economy is slowing down due to the Biden’s slowdown and its inability to pass new plans that would allow the economy to at least temporarily stall above its natural tendency. Nevertheless, the housing component is still increasing, it is an important weight in the price index and its appearance is partly conditioned by the profile of real estate prices which are oriented upwards.

Budgetary policy

Fiscal policies become more targeted

- Uncertainties related to the debt ceiling

Janet Yellen had warned of the absolute need for an early agreement in Congress to raise the debt ceiling to avoid a technical default by the United States as of October 18. This ceiling was eventually raised, but temporarily, until December 3, offering only a short respite. This will come at the same time as the deadline for adopting a new federal budget. Republicans do not want to participate in the decision to raise the debt ceiling so as not to endorse President Biden's massive physical and social infras-tructure plans. These are still not voted by Congress.

- 1st installments from Next Generation EU

The European Commission is continuing its pre-financing as part of its recovery plan: Next Generation EU. To date, 17 countries have received a total amount of 52.3 billion euros including 24.9 billion for Italy and 9 billion for Spain. It should be noted that the recovery and resilience plans of Poland and Hungary have not yet been approved due to the issue of respect for the rule of law. The European Commission also carried out its 1st Next Generation EU green bond issue, the largest ever: 12 billion euros in 15-year bonds. The deal was in high demand, being over 11 times oversubscribed. The EC plans to issue a total of 250 billion green bonds by 2026, making it by far the largest green bond issuer in the world

- Public green investments

Given the need to significantly increase investments for the energy transition, discussions are underway on the possibility of giving them special treatment in the context of improving the European Union Stability Pact.

Monetary policy

Fed's imminent tapering

- Discussions on the future of PEPP

At the September 13 meeting, the ECB decided to proceed with a slight recalibration of its Pandemic Emergency Purchasing Program (PEPP) by deciding to slightly reduce the pace during the last quarter compared to the previous 2. Over the last 4 weeks, its cumulative purchases have been 66.5 billion euros, against 77.7 billion on July 4 last. It has set an appointment for December 16 to discuss the future of the PEPP, which must end late in March of 2022 at the earliest. Discussions would focus on a new, more targeted program.

- Announcement of a tapering in November

At the September 22 meeting, the Fed prepared the markets a bit further for the upcoming announcement of "tapering" (slowing down its asset purchases). It said a moderation in the pace of its asset purchases may soon be warranted if progress in meeting its inflation and employment targets continues as planned. The Fed foreshadows the announcement of a tapering at the end of the meeting on November 2-3. The latter could start before the end of the year and end in mid-2022, according to Jerome Powell, if the economy develops as expected. Forecasts from various FOMC members also revealed that 9 out of 18 members now anticipate one or two key rate hikes in 2022. The Fed is thus preparing to gradually normalize its monetary policy in line with the recovery in activity.

- Tightening in some countries

While some emerging countries have decided to raise their key rates through fears about their financial stability, some developed countries (South Korea, Norway) have also increased their rates following the sharp upturn in activity.

Strategic views

Reality’s come back

Synthetic market views: “Winter is coming”

September was marked by a sharp rebound in long-term interest rates. The Fed’s and BoE’s “hawkish” shift has led to an adjustment in sovereign rates but also a much faster anticipation of the Fed funds’ upward trajectory. The majority of equity markets were affected after seven months of growth. The market became much more defensive and cautious, as sector rotations were significant, sectors linked to the rise in long-term rates in particular were penalized. Investors have decided to take their profits, after the records of the last few months. Finally, the recent surge in energy prices has revived the inflation debate.

September was marked by a sharp rebound in long-term interest rates.

Allocation recommendations: persistent

We believe that the rise in long-term sovereign yields should continue in the wake of the Fed’s “tapering” and an increase in the inflation outlook. On the equity markets, we remain discriminating while waiting for the new season of results that should bring more visibility. On the credit market, we believe that the ECB’s purchases should calm the tensions on the IG and the HY, we prefer the BB segment. We are neutral on emerging debt because of the increase in risk aversion which also penalizes the sentiment on the asset class.

Asset Classes

G4 rates

- At the September FOMC, the Fed signaled QE tapering will start likely before year-end. In addition, the lifting of uncertainty should push yields higher toward 1.75%.

-

In the euro area, inflation and growth should be conducive of higher yields. The Bund also remains subject to global bond trends, leading to a risk of steepening.

-

The BoE may hike rates in the near term, and 10-year Gilts are pricing in higher inflation. The 10s30s spread has room to flatten. Elections in Japan have moved bond markets but neutrality still prevails on JGBs.

Other sovereigns

- The ECB has announced a slowdown in the PEPP, but actual purchases have barely slowed down. The level of sovereign spreads justifies a constructive position on long maturities in Italy and Spain. However, the consensus is still bullish.

- Valuations nevertheless argue for selective cutbacks in sovereign debt holdings, particularly in France on maturities within 5 years and in Portugal.

- The RBA remains the most dovish bank amid a more restrictive global context. Elsewhere, the tighter policy bias prevails and suggests selling Canadian, New Zealand and Scandinavian debt.

Inflation

-

Upside surprises on inflation (5.4% in September) continue in the US, which should add fuel to the widening trend in breakevens.

-

In the euro zone, inflation stood at 3.4% in September. The persistence of inflationary pressures and the gas crisis favor a further widening of breakeven inflation rates in Europe.

-

In the UK, supply bottlenecks, wage pressures and energy are pushing breakevens to their highest levels since 2008. This trend is expected to continue.

Credit

- Euro area IG spreads widened slightly to 87bp vs. Bund. Valuations remain unattractive, and sentiment has deteriorated with the Evergrande crisis.

- Bond issuance is proving to be a little more difficult to absorb, with a slight increase in the new issue premiums. However, the ECB will remain very present despite the recalibration of QE expected for December.

- Sentiment is improving on high yield, thanks to the recent widening of spreads. However, the primary market (historic issuance in 2021) is sometimes close to indigestion. The BB segment is best place to be.

Stock market

- Equity markets experienced a correction in September. Earnings season will be important for markets as rising inflation threatens current high profit margins.

- The hawkish turn in monetary policy sparked sharp sector rotations favorable to banks and the “value” segment. The stagflation theme nevertheless would greatly benefits technology and other “secular” growth stocks.

- In October, there was a recovery in the large-cap quality stocks. The mid-cap segment is however underperforming.

Emerging

- Emerging USD spreads are approaching the upper bound of our target range between 350 and 370. We are neutral on the EMBI spread.

- Whilst Chinese real estate risk weighs on sentiment, bond issuance from IG countries remain well absorbed. Yet, a few large high yield transactions could weigh on the end of the year.

- The flows into emerging bond funds have reversed in recent weeks. The appetite for the asset class has been diminishing.

Strategic views – at end 2022

2022 Views

In this publication, we introduce our new end-of-year views, moving to the end of 2002 instead of the end of 2021.

Raising rates

In a supportive economic context, the slow global wave of monetary tightening that was initiated this year would also continue. The Fed would finish its tapering around the middle of the year; however we do not expect rates to rise before 2023, with Fed funds at the end of the cycle of increase that would not exceed 2.00%. The ECB on its side will maintain EQ next year and discussions on rate increases are very unlikely over the next two years.

German and US rates would then continue to slide upwards, even if our scenario is progressive and therefore far from a bond crack. It is accompanied by a flattening of the curve, especially in the United States, typical in a mature cycle.

Resilient peripheral spreads

The rise of the Bund should be accompanied by a widening of peripheral spreads. This movement would remain modest for three reasons: the economy is doing well, the European recovery programme, which is de facto a timid mutualization of debt, and the support of the ECB.

We must nevertheless monitor the politics: in France with the presidential elections and a risk of cohabitation, in Italy with the replacement of the president in February and the elections in Q2 2023 which could provoke turmoil by the end of 2022.

The credit holds

The ECB’s action coupled with positive fundamentals should limit the widening of the spreads.

Equities: a rather promising year

We anticipate growth in Euro Stoxx 50 next year, driven by the end of earnings normalization (close to 15% according to our models) but with valuations that would become more reasonable (and contribute negatively to the performance by around 8%).

Our target for growth is therefore 8-10% dividend included in 2022. This is an objective of 4,300 on the Euro Stoxx 50 but with an increased selectivity of the sectors and a more prominent stock picking attitude.