Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The cio letter

Trump or the return to uncertainty

The victory of Donald Trump, with a majority in both the House and the Senate, reshuffles the political landscape. The US fiscal policy is set to ease, while tariffs on all trading partners are expected to rise, particularly China. In addition to trade issues, Europe must contend with uncertainties surrounding US military commitments in Ukraine. In China, Beijing has unveiled a plan to restructure the off-balance-sheet debt of local governments, amounting to 10 trillion CNY. This debt exchange is seen as a transparency effort and a means to reduce the interest burden on regions. Despite a slowdown in employment during the summer, U.S. growth has remained robust. The Eurozone is experiencing a slight uptick, with a growth rate of 0.4% in 3Q 2024. Chinese economic activity continues to be driven by foreign demand, particularly from the US. Inflation is easing due to a moderation in energy prices.

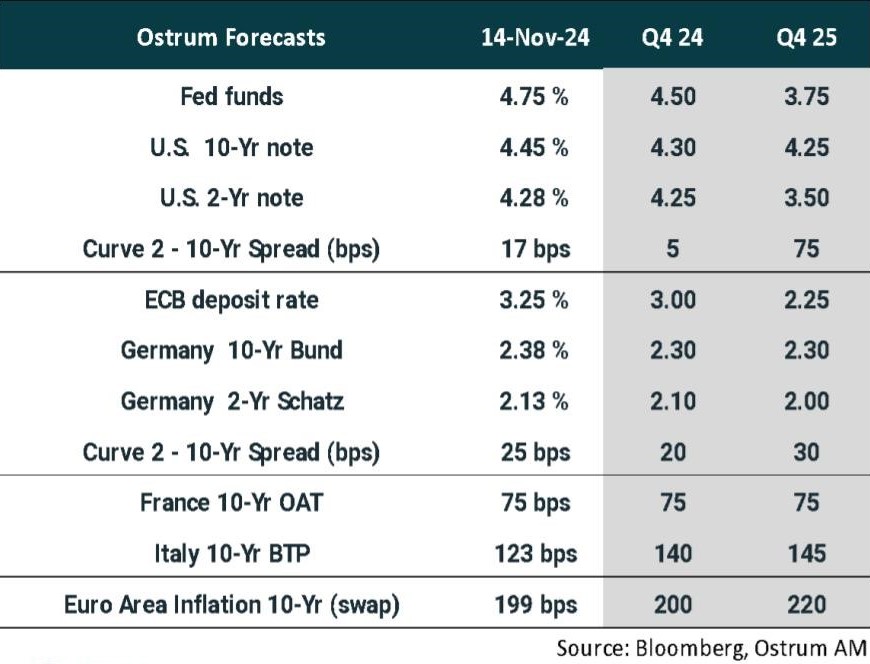

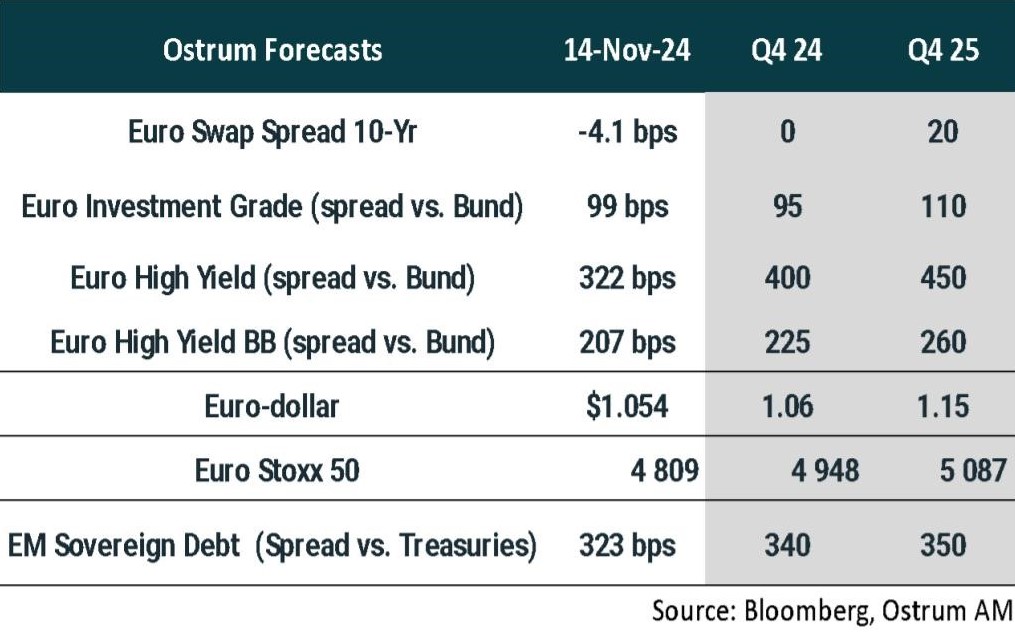

Under political pressure, the Federal Reserve will take its time to assess Donald Trump’s policies. Initially, the Fed is expected to lower rates to 4% as early as March. The neutral rate estimate is likely to be revised upwards, which will limit the Fed's future actions. The ECB will closely monitor the impact of tariffs on economic activity and is projected to cut its rates to 2.25% by 2025. The accommodative policy stance and a weaker euro will partially offset the contraction of its balance sheet.

In this context, bond yields may stabilize around 4.30% for the T-note and 2.30% for the Bund. Sovereign and credit spreads remain largely unaffected by the high volatility of interest rates. While high-yield bonds remain expensive, there are no significant catalysts prompting a widening of spreads. The outperformance of U.S. equities should continue, whereas disappointing earnings reports in Europe limit the upside.

Economic Views

THREE THEMES FOR THE MARKETS

-

Monetary policy

The Fed has reduced its rate by 25 basis points, considering that the risks to employment and inflation are now balanced. The inflationary risk from tariff policies has not yet been taken into account. The ECB will continue its monetary easing in December with another 25 basis point cut. The depreciation of the euro reflects the tariff risk and the ECB will not oppose it. The BoE is navigating cautiously between internal price pressures and a more uncertain international environment.

-

Inflation

Global inflation is slowing down, but the United States' trade policy will reshuffle the cards. In the United States, inflation was up at 2.6% in October, although core CPI inflation remains unchanged at 3.3%. In the eurozone, inflation stands at 2%, with service inflation close to 4%. Inflation in the UK is near the target, with a slow moderation in service inflation. In contrast, inflation in China remains nearly zero.

-

Growth

In the United States, growth proved solid at 2.8% in the third quarter, although labor market signals are mixed. The eurozone economy surprised positively between July and September (+0.4%), with surveys remaining mediocre in October. In China, fiscal and monetary measures are expected to support a recovery in activity.

ECONOMY: UNITED STATES

- U.S. growth reached 2.8% between July and September, driven by robust household consumption and a positive trajectory in equipment investment, excluding inventories. Public spending, particularly in defense, has seen significant increases. However, the external balance deteriorated by the end of the quarter. Conversely, while real estate investment has contracted, the housing supply remains insufficient, leading to continued increases in home prices.

- The federal deficit has surpassed 6% of GDP. The Congressional Budget Office (CBO) projected similar deficits over the next decade, with the potential for further deterioration under Trump’s administration. It is anticipated that Trump will extend the tax cuts enacted during his first term and reduce corporate taxes, while his tariff policy is expected to become more stringent.

- The risks of a financial crisis appear to be mitigated. Nevertheless, credit quality is declining, particularly in credit cards and commercial real estate, yet banks continue to lend, especially as short-term interest rates decrease.

- Inflation is gradually subsiding, with service prices (excluding housing) showing signs of deceleration. Housing costs remain the primary driver of inflationary pressures.

ECONOMY: EURO AREA

- Growth came in better than expected in the third quarter. Domestic demand, particularly household consumption, was partly responsible for this improvement.

- Growth remained very robust in Spain, while it turned out to be sluggish in Italy. France benefited from the impact of the Olympics, which is expected to correct in Q4, and Germany ultimately recorded growth of 0.2% for the quarter (after a revision to -0.3% in Q2, compared to -0.1%).

- Surveys conducted among business leaders reveal a lack of momentum in activity in October. The manufacturing sector is particularly affected by a significant deterioration in the business climate in the automotive sector, while activity is progressing moderately in services.

- In 2025, growth is expected to strengthen with a gradual recovery in household consumption, supported by the increase in their real income.

- In addition, the impact of the ECB's monetary policy easing will contribute to this. The latest ECB survey on bank lending is very encouraging in this regard. It reveals a strong rebound in household demand for loans for real estate purchases.

- On the other hand, fiscal policy will be a drag on growth. France and Italy are among the countries under excessive deficit procedures. The French government aims to reduce the deficit by €60 billion by 2025 and may face a motion of censure.

- The election of Donald Trump poses a risk to growth and inflation in the eurozone, given the potential increases in tariffs that the new administration might impose on imports from the EU.

ECONOMY: CHINA

- Economic momentum is improving as the year comes to a close, thanks to the stimulus announced at the end of September. Authorities are expected to strengthen their support in order to insulate the Chinese economy from the tariffs imposed by Donald Trump.

- However, since most of the announced measures will materialize in Chinese growth next year, this is not likely to prompt them to make hasty decisions.

- We had already revised our growth forecast upwards to 5% for 2025, taking into account the strengthening of the stimulus in the event of Donald Trump's reelection.

- GDP growth in Q3 rebounded to 0.9% seasonally adjusted compared to 0.5% in Q2, marking a growth of 4.8% since the beginning of the year, close to the growth target.

- The PMI surveys for October indicate an improvement in economic momentum, which bodes well for Q4 GDP.

- The PBOC is expected to continue lowering its rates to mitigate the risk of financial instability related to the high debt levels of local governments and to support the real economy.

- The debt exchange program between financing vehicles and local governments is expected to convert this implicit debt into long-term debt on their balance sheets. Local governments are likely to increase their issuances, but at borrowing costs similar to those of sovereign debt. This will help alleviate budgetary pressure on local governments and encourage them to adopt greater fiscal discipline.

Monetary Policy

Easing of monetary policy

- THE FED ON AUTOPILOT

After lowering its rates by 50 basis points in September, the Fed reduced them by 25 basis points on November 7, bringing the Fed funds rate range to [4.50% - 4.75%]. The central bank is making its monetary policy less restrictive due to significant progress made on inflation, compared to the peak in June 2022, amidst a slowdown in the labor market. With inflation concerns eased, the Fed is focusing on its second mandate: achieving maximum employment to avoid a sharp slowdown in this area. Additionally, the central bank continues to reduce the size of its balance sheet, albeit at a more moderate pace since June. We anticipate a 25 basis point rate cut in December, followed by three more cuts at each meeting to bring the Fed funds rate down to the range of [3.50% - 3.75%] by May. The Fed is likely to end its balance sheet reduction before March 2025. The central bank will need to firmly resist any attempts by Donald Trump to challenge its independence in order to maintain its credibility. - CONTINUATION OF GRADUAL RATE CUTS BY THE ECB

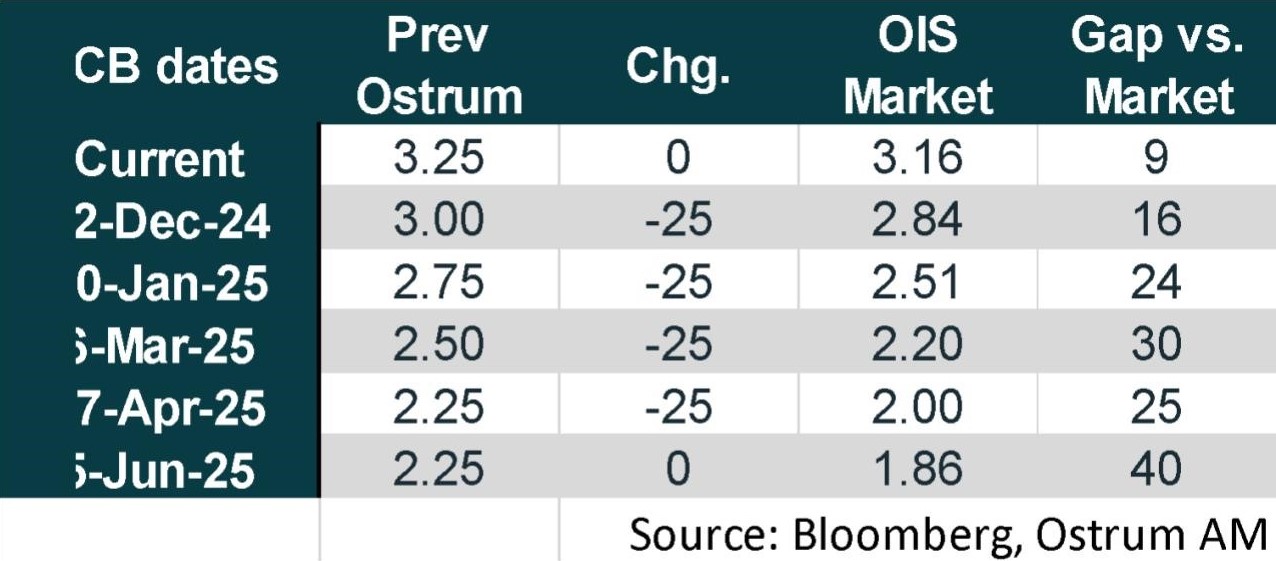

On October 17, the ECB decided to implement its third interest rate cut of 25 basis points since June. The deposit rate has been lowered to 3.25%. The ECB is more confident in achieving its medium-term inflation target of 2% given the rapid disinflation that has occurred since the peak of 10.6% reached in October 2022. Additionally, the ECB continues to reduce the size of its balance sheet through repayments of TLTROs (the last one in December), the cessation of reinvestments of maturities under the APP, and partial reinvestments of maturities from the PEPP (at an average pace of €7.5 billion per month), aiming to conclude this by the end of 2024. We anticipate a 25 basis point rate cut in December, followed by three more in the upcoming meetings, bringing the deposit rate down to 2.25% by April. Without moderation in the pace of quantitative tightening (QT), the ECB's balance sheet would shrink by at least €850 billion over two years.

Market views

Asset classes

- U.S. Rates: The Federal Reserve is now reducing its rates at a pace of 25 basis points. The yield on the 10-year Treasury is expected to stabilize around 4.30% before experiencing a slight moderation in 2025.

- European Rates: The Bund is anticipated to follow the Treasury note, reaching approximately 2.30% by the end of the year. The steepening of the yield curve is expected to resume next year.

- Sovereign Spreads: Budgetary uncertainties are keeping spreads at elevated levels.

- Eurozone Inflation: Breakeven inflation rates remain broadly stable, in line with the European Central Bank's target; however, a widening of these breakevens is likely in 2025 amid a context of yield curve steepening.

- Euro Credit: Investment grade (IG) spreads remain largely unaffected by interest rate volatility, while high-yield bonds continue to be considered expensive.

- Foreign Exchange: The European Central Bank (ECB) is expected to respond to tariff threats by lowering interest rates.

- Equities: The Euro Stoxx 50 is projected to experience a slight rebound by the end of the year, although it is likely to underperform compared to the U.S. market.

- Emerging Market Debt: Spreads have tightened significantly, leading to potential profit-taking in the short term. Further tightening is anticipated in 2025.