Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO letter

- A schizophrenic marke

Central banks are torn between growth that is increasingly showing signs of slowing down and inflation that continues to surprise on the upside. As a result, the future trajectory of monetary policy has become much more difficult to read. The respective decisions of the Bank of Canada and the Bank of England, two surprises but in opposite directions, are symptomatic of this growing uncertainty. The lack of visibility has created high volatility on fixed-income markets: revaluation of key interest rate expectations in developed countries, inflation trajectories and, at the end of the day, implied volatility that returns to levels we haven’t seen since March last year and the Covid crisis.

Conversely, the equity markets, on the wake of a season of positive results, remained very calm and continued to progress swiftly. In sharp contrast to the instability of the yield curve.

This schizophrenia is unusual and has never been permanent. Unfortunately, history shows that in general the stress on the fixed-income markets ends up contaminating the equity markets. This is all the more so since the expectations of the curve show that the cycle of rate hikes will remain very limited but will be sufficient for inflation, at least in the United States and the European Area, to return nicely to the objective of the central banks. All this, despite a normalization of the economy, with real rates that remain largely negative as at the worst time of the crisis. This is certainly a possible scenario, but one that is very much wishful thinking.

So, there’s a high risk of the curve recalibrating to a different scenario. Volatility is not going to go away. And this should create investment opportunities.

Economic views

Three themes for the markets

-

Monetary policy

In mid-December, three major central banks will have to take important decisions. The Fed with the rhythm of its tapering, the ECB with the program that will replace the PEPP and the Bank of England with an increase in rates. The visibility on central banks has greatly decreased, it is a major source of stress for the curve.

-

Inflation

Once again global inflation surprises remain high. The debate has now shifted to the job market and the price-wage loop. However, the current level of prices is sufficient to create considerable rate uncertainty and to create significant margin distortions for companies.

-

Growth

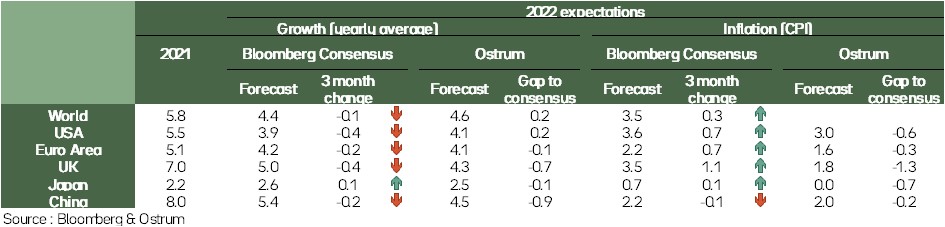

Bottlenecks remain an important issue and should not be resolved quickly. Tensions on the labor market also create constraints on supply. As a result, economic surprises are negative, and forecasters are downgrading their expectations.

Key macroeconomic signposts

- Economic activity is strong in developed countries. The indices for the whole economy of the Markit surveys always give good signals. In the Euro zone, data from the third quarter accentuated the catching-up momentum in the Euro zone. This resulted in an increase in the growth outlook for 2021 and 2022.

The immediate uncertainty is the health risk observed in Germany, the Netherlands, Belgium or Austria with a very clear increase in the incidence rate. Possibilities of reconfiguration are discussed and become effective as in Austria.

- In the USA, after the strong recovery in the spring due to premiums paid to households by the Biden administration, the situation stabilized during the summer. Signals are up over the last quarter as evidenced by higher retail sales. This improvement is also due to the reduction in health risk, which increased significantly during the summer.

- The questions come from China where growth risks are higher after concerns in the real estate market and therefore on the capacity of already heavily indebted local governments to support growth (there are very close links between local governments and real estate). Growth is expected to be weaker in trend. It is already perceived that the situation is changing through China’s contribution to German exports. Very strong in the first semester, it is now null.

- The main reason for shortages, bottlenecks in ports and rising commodity prices is the American recovery and the exceptional demand on goods while companies around the world had no stocks. Demand came too quickly and too strongly, creating pressure on recruitment and prices.

- The price of oil remains high compared to 2020 but ultimately not so much as compared to 2019. The concern here is the concern about market behaviour and expectations. There is a great deal of catch-up in energy price developments. Nevertheless, the one-year variation greatly penalizes purchasing power. This acts as a means of regulating demand.

The most annoying point in the price field is that of agricultural raw materials. Prices are at historically high levels including cereals and oil.

- This somewhat penalizes consumers in developed countries but it is mainly consumers in emerging countries who are strongly penalized because the weight of food in price indices is very high (40% on average) In the past, at such price levels, so-called hunger riots had been observed. The rise in political instability in some emerging countries is not independent of that.

- In developed countries the rate of inflation accelerated again in October. Energy accounts for between one-third and just over half of inflation. That’s significant and does not encourage central banks to intervene.

- The point to emphasize is that the euro area and the US do not have the same underlying inflation rate profile. Limited in the Euro zone, this rate is very strong across the Atlantic. This reflects the effects of the recovery with excess demand and also the impact of the rise in the price of real estate on the "Rent" component of the price index. This last dimension will be the most persistent.

Budgetary policy

Fiscal policies remain targeted

- « Build back better » in suspens

After the ratification of Biden’s $1.2 trillion infrastructure plan. Biden, whose popularity is declining, now hopes to reach an agreement on the social and ecological component of his “Build Back Better” program. However, the American president will continue to face political struggles. The Republicans are reluctant to vote in favor of an increase in the debt ceiling , in order not to endorse Biden’s plan. J. Yellen estimates that the government can keep running until December 15th without a deal. He will also have to convince recalcitrant in his own camp.

- EU ; additional measures for 2022

The suspension of the Fiscal Pact rules was extended to 2022 to allow countries to take action and restore sustainable growth after the Covid-19 crisis shock. Strong growth and the gradual reduction of exceptional measures to deal with the crisis will result in a decrease in budget deficits that will remain nevertheless above 3% in 2022. Some governments, such as Italy, have announced additional fiscal measures for 2022. In Portugal, political uncertainty risks are delaying the adoption of reforms and the planned increases in investment as part of the recovery and resilience plan. The European Union could then delay the payment of funds.

- Public green investments

In view of the need to significantly increase investment for the energy transition, discussions are underway on the possibility of granting them special treatment as part of the improvement of the Stability Pact.

Monetary policy

Who will be the next Fed's chairman ?

- ECB closes the door to rate the hikes in 2002

At its last meeting, the ECB did not change the direction of its monetary policy. Christine Lagarde did not reveal any details about the new program that will replace the PEPP, she confirmed the announcement will be made on December 16th. The ECB regards any rate hikes in the euro area in 2022 as “counterproductive”. The tightening of monetary policy to curb inflation (4.1% in October) could dampen the economic recovery of the area.

- “Tapering”, without surprise

Unsurprisingly, the Fed announced the start of its “Tapering”. Its purchases of financial assets will be reduced by $15 billion each month until June 2022. The Fed reiterated that it had no urgency to raise Fed fund rates. The main question will be the Presidency of the Fed. Joe Biden had indicated that he would take his decision before Thanksgiving. The choice is particularly challenging because of internal political struggles, the ecological and social reforms in particular creates divides within the Democrats camp. The Senate, with a Republican majority, will have to confirm or not the presidential nomination.

- Surprises come from the BOE and BOC

Surprises this month came from the Central Bank of England (BOE) and the Central Bank of Canada (BOC). The BOE kept its rates unchanged, going against its own rhetoric, probably reflecting its concern about Brexit. The BOC, on the contrary, abruptly stopped its QE program.

Strategic views

Inflation is the central investment theme

Synthetic market views: questions on the “forward guidance

The inflation thematic remains unavoidable on financial markets. However, the largest Central Banks (Fed, ECB, RBA, etc.) seem reluctant to act quickly despite market pressure. The BoE’s flip-flop, finally opting for a status quo in November, resulted in an unwelcome episode of interest rate volatility. This uncertainty is affecting swap spreads and some sovereign bond markets. Conversely, equity volatility (VIX at 16%) remains subdued and stock indices are up strongly in November. The potential impact of inflation on margins entail risks for stock markets but the earnings releases remained solid in Q3.

In addition to rising prices, the migration, energy and even the epidemic rebound in Eastern Europe are risks worth monitoring.

Allocation recommendations: trim the risky positions

The rise in long-term sovereign yields is expected to gather pace again, particularly in the United States. The accommodative monetary stance keeps pushing inflation breakeven wider. The next ECB decision as well as the elections in Portugal and Italy in January could revive the pressure on peripheral spreads. On equities, maintaining margins in the higher inflation context will become the key issue. As for credit, valuations remain a brake on performance on both IG and high yield. Spreads on EM debt remain stable despite higher volatility on T-notes.

Asset Classes

G4 rates

- FOMC announced tapering in November, $15 Bn a month. The expected pace of rate increases in 2022 is a source of volatility. The yield on T-notes is expected to rise with more volatility.

- In the euro area, inflation surprises upwards but the ECB tempers expectations of tightening. The December meeting may call for a reduction in risk, which is currently weighing on 10-year Bund yields.

- The BoE maintained an incomprehensible status quo in November despite elevated inflation. An rate hike in December is likely, the Gilt should respond to tightening. No change in Japan.

Other sovereigns

- The ECB has slightly trimmed bond purchases and Italian spreads are under pressure before the December meeting. The likely reduction in purchases after March justifies limiting exposures to peripherals.

- The political risk comes back with the elections in Portugal in January, the end of the mandate of President Mattarella in Italy and then the French elections. This argues for caution in these markets.

- The guidance of the RBA is called into question as the BoC, the Norges Bank or the RBNZ have begun their hawkish turn to combat inflation. Rates in developed countries are expected to rise.

Inflation

- Rising inflation surprises (6.2% in October) are accumulating in the United States, which fosters demand for inflation protection and hence contributes to wider breakeven.

- In the euro area, inflation exceeded 4% in October. The persistence of tensions, the energy crisis and the fall of the euro call for a continuation of the rise in inflation expectations.

- In the United Kingdom, bottlenecks, wages and energy are pushing breakevens to their highest since 2008. This trend should continue.

Credit

- Spreads have continued to tighten vs swaps by 6 bps and widen at 91 bps vs Bund. Valuations remain unattractive and sentiment has deteriorated with the expansion of swap spreads.

- Bond issuance is proving to be a little more difficult to absorb, with a slight improvement in new issue premiums. However, the ECB will remain active, despite a recalibration of QE expected in December.

- Valuations have improved in high yield, thanks to the recent expansion of spreads. Nevertheless, primary market activity is getting close to indigestion. The BB segment is to be preferred.

Stock market

- The economic growth expected for next year, coupled with an operational leverage that remains large, could generate a growth of the EPS of the order of 10%.

- Inflationary pressures affect costs and could erode profits. The sectoral impact is very heterogeneous.

- At the end of the year, with the reporting season behind us, caution is warranted. Macro news will dominate, the market’s momentum could then abate.

Emerging

- Emerging USD spreads remain in a target range lowered this month to 340-365bps. We remain neutral on the EMBI spread.

- While Chinese real estate risk weighs on sentiment, the discount on emerging high yield is significant compared to other comparable assets (US high yield).

- Flows to emerging funds have stabilized, the primary will decrease from mid-November.