Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

Economic Views

Three themes for the markets

-

Monetary policy

The principle of separation of central bank objectives continues to prevail. Systemic risk seems to have been contained in the United States, so that the inflation target remains predominant in the conduct of US monetary policy. The Fed thus made a final hike of 25 bps before an extended status quo at 5.25%. The ECB will still have to raise its deposit rate twice to 3.75%. Monetary tightening also involves a reduction in the balance sheet with TLTRO repayments and the end of APP reinvestments from July.

-

Inflation

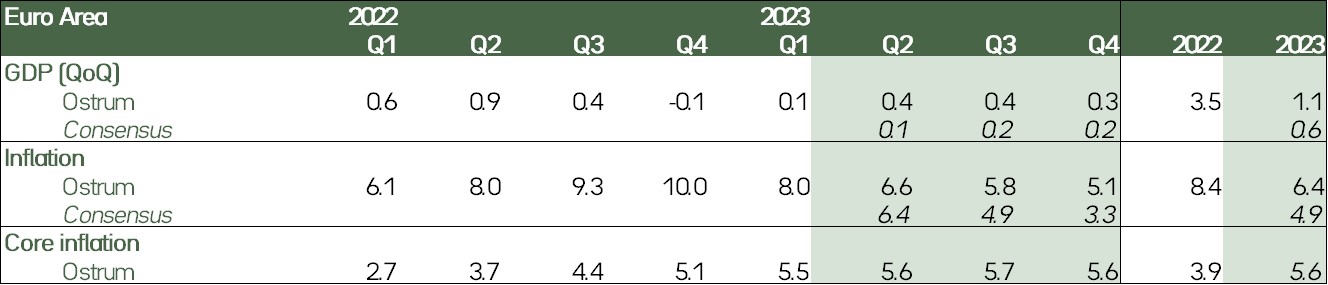

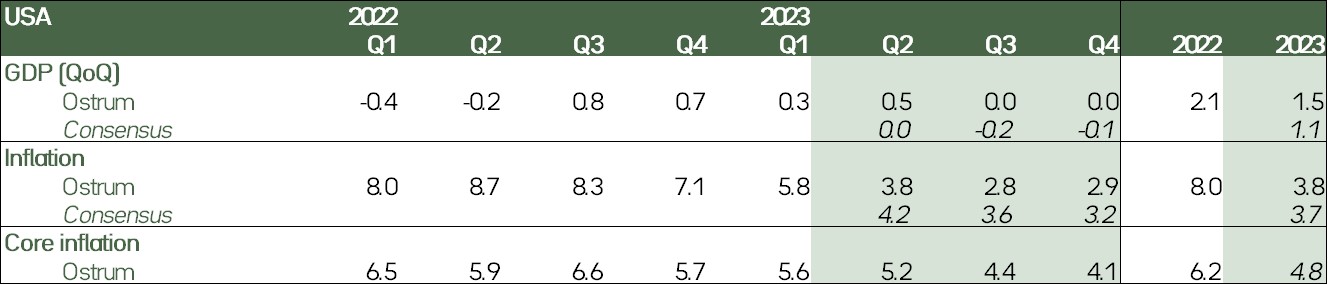

As expected, inflation is moderating in the United States, due to the drop in the price of energy and imported goods. Core inflation, however, remains stable. Wage pressures fuel inflation in services. This strong price inertia, also observed in the euro area, means underlying inflation will remain high at the end of the year, close to 5% in the euro area. The reopening of China is taking place without price pressures.

-

Growth

The euro area escaped recession, thanks to government support measures and the sharp drop in gas prices. Growth in Q1 stands at +0.1% so that an acceleration is expected in Q2. The rise in wages should allow consumption to pick up. In the United States, consumption is robust, but the monetary tightening should weigh on US activity which may skirt recession in the second half of the year.

Key macroeconomic signposts : euro area

- The euro area escaped recession. Activity finally contracted by 0.1% in 4Q before gathering some pace at the start of the year at a reduced rate: 0.1%.

- The extension of government measures to protect households and businesses from rising energy prices was partly responsible for this, as well as the fall in the price of natural gas. Consumption remained low.

- The surveys available to us in April point to firmer growth. The composite PMI index hits an 11-month high.

- This is linked to the dynamism of services, benefiting in particular from the higher demand in the tourism sector. On the other hand, activity contracted more sharply in the manufacturing sector due to less buoyant world trade.

- Spain and Italy appear to be the most dynamic due to the importance of the tourism sector in their growth.

- The relative decline in inflation and rising wages, as well as public support, should improve the dynamics of real incomes. Consumption will increase over the year. Similarly, the accumulated investment backlog should be addressed.

- As a result, we have a GDP trajectory that remains mediocre, but reaccelerates a little in the middle of the year.

- Inflation is expected to decline rapidly until the summer, mainly due to base effects on the energy component. But the underlying part remains very stable and should not fall below 5% by the end of the year.

Key macroeconomic signposts : United States

- The euro area escaped recession. Activity finally contracted by 0.1% in 4Q before gathering some pace at the start of the year at a reduced rate: 0.1%.

- The extension of government measures to protect households and businesses from rising energy prices was partly responsible for this, as well as the fall in the price of natural gas. Consumption remained low.

- The surveys available to us in April point to firmer growth. The composite PMI index hits an 11-month high.

- This is linked to the dynamism of services, benefiting in particular from the higher demand in the tourism sector. On the other hand, activity contracted more sharply in the manufacturing sector due to less buoyant world trade.

- Spain and Italy appear to be the most dynamic due to the importance of the tourism sector in their growth.

- The relative decline in inflation and rising wages, as well as public support, should improve the dynamics of real incomes. Consumption will increase over the year. Similarly, the accumulated investment backlog should be addressed.

- As a result, we have a GDP trajectory that remains mediocre, but reaccelerates a little in the middle of the year.

- Inflation is expected to decline rapidly until the summer, mainly due to base effects on the energy component. But the underlying part remains very stable and should not fall below 5% by the end of the year.

Monetary Policy

Divergence between the Fed and the ECB

- The Fed leaves the door open for a pause in June

While J. Powell had signaled on March 7 that the Fed was ready to accelerate the pace of its rate hikes to deal with stronger than expected inflation, banking stress, linked to the bankruptcy of SVB and Signature Bank a few days later, came to limit its extent. The Fed raised rates by 25 bps on March 22, after taking sweeping measures to avoid contagion to the entire banking system. The Fed's communication became more evasive: "some additional tightening may be appropriate." The risk is a greater tightening of credit conditions likely to weigh on demand and therefore inflation. We therefore anticipate a single rate hike in May: +25 bps and a status quo until the end of 2023. - ECB: "Inflation should remain too high, for too long"

The ECB raised its rates by 25 bp as expected, bringing the deposit rate to 3.25%. The latest ECB survey of commercial banks was key in explaining the 25 bp rise, not 50 bp, as in April. Christine Lagarde insisted on the fact that the slowdown in the rise in rates was in no way a pause and that the central bank should continue to raise them in order to bring them back into sufficiently restrictive territory. The ECB also announced the end of reinvestments of APP maturities as of July 1. We anticipate two rate hikes by the ECB of 25 bp in June and July to bring the deposit rate to 3.75%. - BoE and RBA hike RATEs

The BoE also hiked its rate by 25 bp (7 votes, vs. 2 for a pause), to 4.5%, and signaled that it would not reach its inflation target of 2% before early 2025. The Reserve Bank of Australia surprised markets by raising its rates by 25 bp in June, to 3.85%, after having paused in April.

Strategic Views

The return of the issue of debt sustainability?

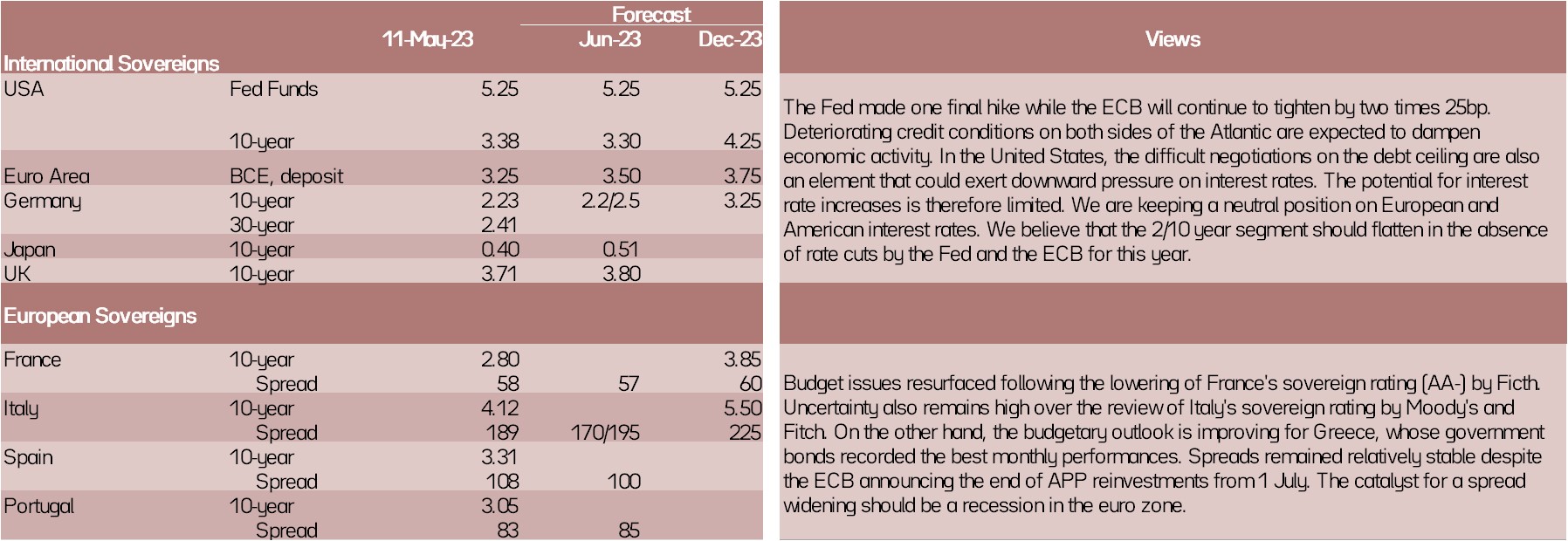

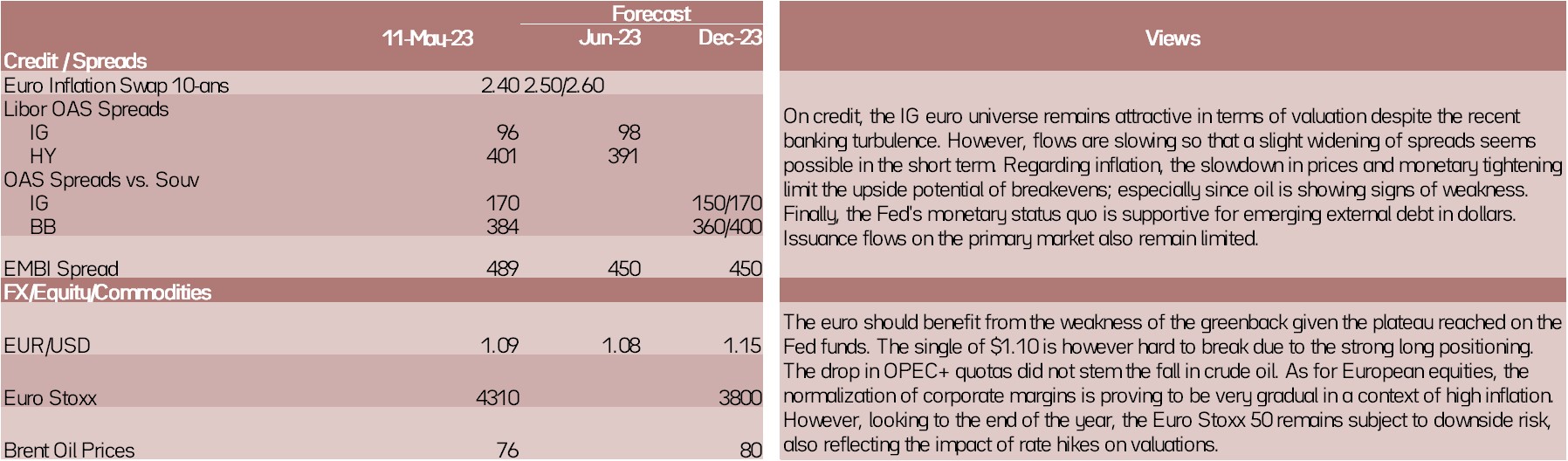

Synthetic market views: the effect of rate hikes spreads through the economy

The monetary tightening cycle is beginning to have a tangible impact on the economy. The Fed is entering a period of rate stability while the ECB still must adjust its policy. In addition to the banking difficulties in the United States, the downgrading of France's sovereign rating by Fitch to AA- or the difficult negotiations on the raising of the American debt ceiling are illustrations of this. US yields appear to have peaked in October 2022, coinciding with those of the dollar and inflation. Credit conditions are tightening in Europe and the United States, rekindling fears of recession.

Allocation recommendations: “Pause” does not mean “pivot”

Public debt issues militate for neutrality on sovereign spreads and European credit, whose valuation levels and fundamentals remain attractive. The default rate on the high yield remains close to zero, but a recovery of the failures is expected. Equity markets remain attractive due to the absence of a sharp downward revision in corporate earnings, equities remain on a favorable trend in the short term. The second semester could prove more difficult. The downward trend in the dollar is expected to persist and particularly benefit emerging external debt.

Market views

Asset classes