Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

Economic Views

Three themes for the markets

-

Monetary policy

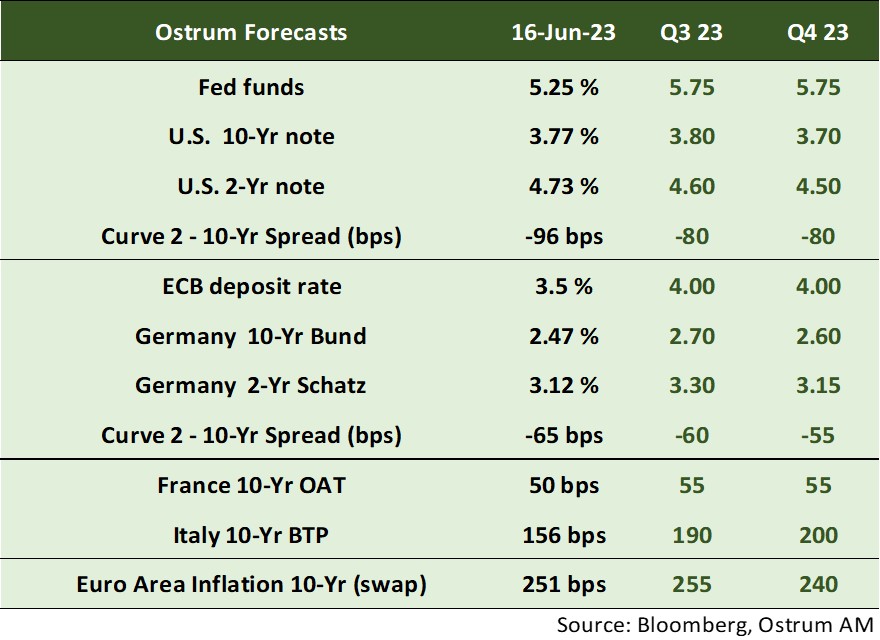

Central banks are reaffirming their restrictive bias. The Fed left rates unchanged at 5.25% in June. However, a rise in July seems certain after the publication of the FOMC’s dot plot showing an additional 50 bps of tightening this year. After the 25 bp hike in June, the ECB is expected to raise the deposit rate to 4% this summer. Monetary tightening also involves balance sheet amortization with TLTRO repayments (€607 billion between June and December) and the end of APP reinvestments from July (€148 billion in the second half).

-

Inflation

Inflation (4% in May) is moderating in the United States, due to lower energy and goods prices. Core inflation stood at 5.3% in May. Tensions in the labor market are contributing to a high level of inflation in services. In the euro zone, inflation stood at 6.1% with a slight dip in the underlying index (5.3%). Wage negotiations and employment limit the extent of disinflation. Inflation is zero in China, even negative on producer prices. The rebound in consumption is insufficient to recreate tensions.

-

Growth

In the United States, consumption remains dynamic, but the monetary tightening should lead to a slowdown in growth in the second half. The eurozone recorded a technical recession between Q4 and Q1. Growth should pick up from Q2. Disinflation and rising wages should allow consumption to improve. In China, the consumer-led recovery is proving disappointing at this stage, requiring additional economic support from the authorities.

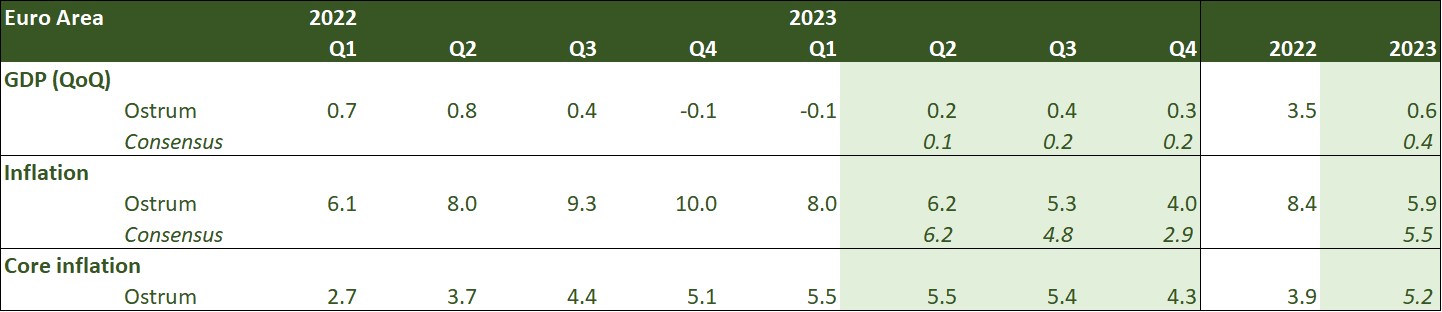

Key macroeconomic signposts : euro area

- The euro zone economy experienced a technical recession in Q4 2022 and Q1 2023. Domestic demand and more particularly household consumption was affected by the loss of purchasing power linked to high inflation. The situation is contrasted between countries.

- Germany is the most affected country due to its greater dependence on Russian energy before the war in Ukraine, the greater weight of the manufacturing sector in its economy and modest growth in world trade.

- In France, the recovery is very moderate. Growth is more sustained thanks to tourism.

- The S&P survey for the eurozone points to more robust activity, despite a slight slow in May. The divergence is widening between the buoyant service sector and the shrinking manufacturing sector.

- Consumption should firm up in the second half thanks to lower energy prices, wage increases and employment growth. The investment should catch up some of the backlog with the support of Next Generation EU.

- Growth will remain hampered (0.6%) by the net tightening of credit conditions caused by monetary tightening. Household and business lending is already slowing.

- Inflation will continue to decline due to a more negative contribution from energy prices. It should return to around 4% at the end of the year. Core inflation will remain elevated for some time, as negotiated wages keep rising and may only adjust with some lag to the sharp slowdown in inflation.

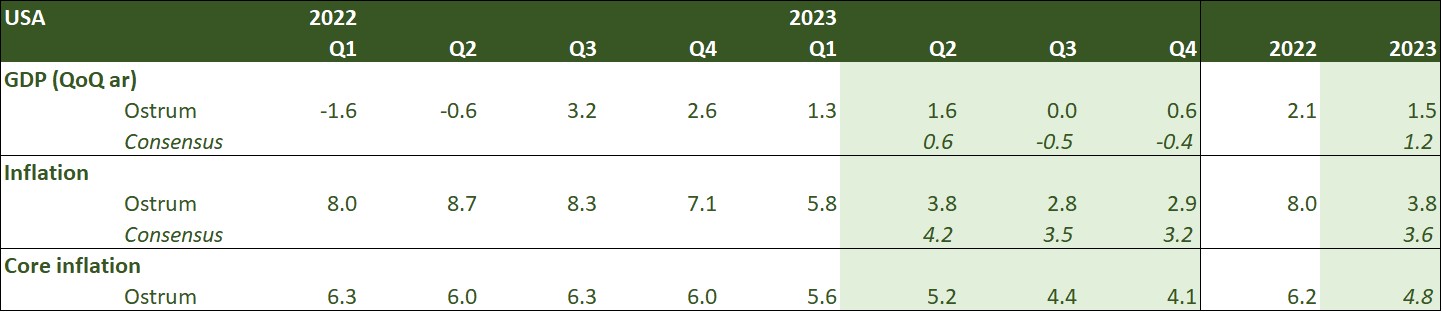

Key macroeconomic signposts : United States and China

- Growth is forecast at 1.5% in 2023.

- The second half will be more difficult with slightly positive growth. Consensus forecasts predict a recession.

- The modest rebound in 2Q 2023 to 1.6% comes from the resilience of consumption (+2%) and the end of destocking (which brings 0.6pp to 2Q growth).

- Productive investment should fall in the second half under the effect of the rise in interest rates (particularly structures). On the other hand, the stabilization of housing suggests a positive contribution of the item to GDP in the second half.

- Inflation is decreasing towards 3% with underlying inflation around 4% thanks to the delayed impact of the deceleration in rents (observed or imputed to owners).

- The trade deficit may widen in the second half.

- Consumption represents only 38.4% of GDP, whereas it represents nearly 70% in the United States. Expectations of a recovery in consumption modeled on the US or European situation are therefore exaggerated.

- China's post-Covid recovery is driven by consumption, while signals on manufacturing and real estate remain mixed.

- The Chinese authorities are taking their time before deciding on a possible stimulus. They are afraid of a sharp acceleration in inflation, like what we have seen in the United States and Europe, which could threaten the social stability of the country. The youth unemployment rate hit a historic high of 20.6% in May.

- Faced with weak economic indicators in May, the Chinese authorities reinforced monetary and budgetary measures in order to support domestic demand.

- China is one of the few countries that benefits from monetary and budgetary leeway.

- Inflation is low (0.2%), linked to low food prices (pork prices in particular) and should remain below the PBoC's 3% target.

- The weakening of the yuan is in line with the deterioration of the country's external position and helps to support exporters.

- Chinese growth should accelerate in the second half of the year, supported by new monetary and fiscal support.

Monetary Policy

Rate hikes needed due to more persistent underlying inflation than expected

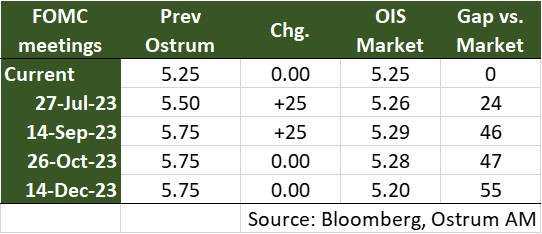

- Fed: After the Pause in June, the Fed expects two rate hikes

As expected, the Fed left its rates unchanged in June, at [5%; 5.25%], after having raised them by a total of 500bp since March 2022. Jerome Powell's more hawkish than expected press conference, on the other hand, came as a surprise. Members of the Fed have revised their outlook for growth and inflation upwards compared to March and anticipate a lower unemployment rate. As a result, they are now forecasting an average of two rate hikes in 2023 to bring the Fed funds rate to 5.6%. A first increase should occur in July before followed by a second hike in September.

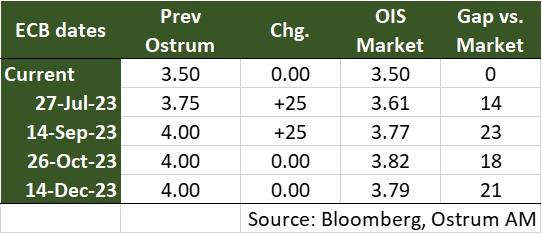

- The ECB preannounces a rate hike in July and leaves the door open for another

The ECB raised its rates by 25bp as expected, bringing the deposit rate to 3.50%. It confirmed the end of reinvestments under the APP from July. It surprised markets by significantly raising its core inflation forecast for 2023 (5.1% against 4.6% expected in March) and 2024 (3% against 2.5%). Christine Lagarde expressed concern about rising unit labor costs and wages. In this context, it pre-announced a rate hike in July and left the door open for another hike. Rates will remain high to allow inflation to return to around 2%.

- BoC and RBA hike rates, BOJ opts for status quo

The Bank of Canada resumed monetary firming by raising rates by 25 bp, putting an end to the status quo that began in January. In Australia, the RBA proceeded with two 25bp hikes in May and June, taking note of the risk of persistent inflation. The Bank of Japan, on the other hand, is maintaining its accommodative policy.

Strategic Views

A new round of monetary tightening

The main views: the second phase of monetary tightening

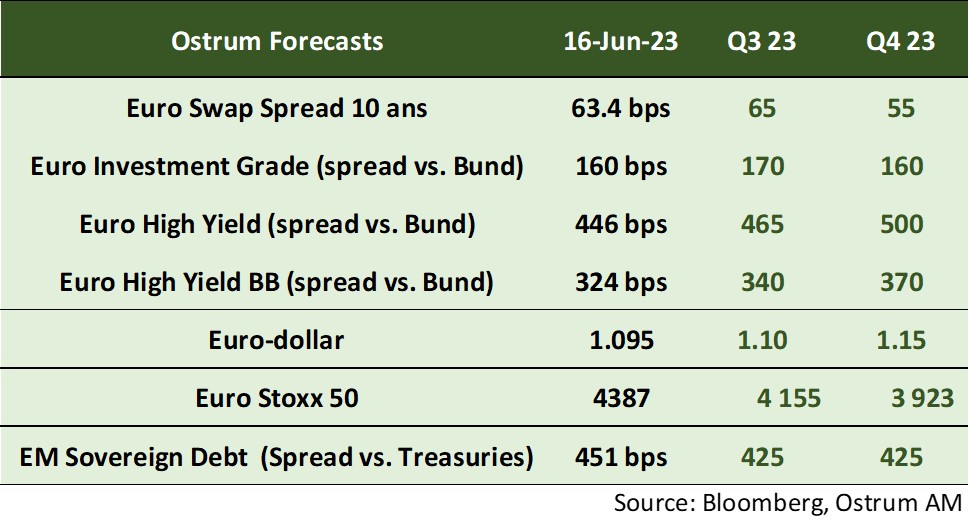

For the past few weeks, most central banks have toughened up their tone, including the monetary authorities which seemed to have adopted a status quo on rates (RBA, BoC). The Fed, despite a bizarre pause in June, will keep real rates high to weigh on inflation expectations. The ECB is considering a further tightening with rate hikes and balance sheet contraction. Financial markets will have to put up with less favorable liquidity conditions as US growth dips below potential in the second half.

Markets: yield curve inversion continues

The transmission of the interest rate policy to long maturities seems key at this stage. The curves should remain very inverted, which would limit the impact of the expected tightening on 10-year rates, as breakeven inflation rates level out in the euro area. The Bundand the T-note should change little between now and the end of the year. This stability in long rates will benefit credit and, to a lesser extent, high yield where valuations have tightened recently. The continued adjustment of the dollar gives rise to optimism on emerging market debt. On the other hand, European equities will face the rise of the euro and a probable reduction in margins in the second half.

Market views

Asset classes

- US rates: despite expectations for two additional hikes, yield curve inversion should deepen whilst keeping 10-year yields around current levels. The T-note yield will remain well below its peak of 4.2% in October 2022. Inflation is expected to slow as growth falls below potential in H2. The 2-year yield prices in monetary relief in 2024.

- European rates: the ECB raised its main interest rates in June. An increase in July is warranted. The hawkish bias of the ECB justifies our forecast on the German 2-year yield for Q3. Beyond that, rates should consolidate somewhat.

- Sovereign spreads: valuations seem excessive given the fiscal outlook in Italy and to a lesser degree in France.

- Euro area inflation: the fall in energy prices and monetary tightening should weigh on breakeven inflation by the end of the year.

- Euro credit: the IG market remains solid. By contrast, HY risk premia are likely to widen given rich valuations.

- Currencies: the Euro should benefit from ECB monetary tightening and the improvement in the terms of trade.

- Equities: consolidation and decline at the end of the end reflecting a more uncertain outlook for margins.

- Emerging debt: without a global recession, spreads should tighten further.