Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO letter

What kind of recession?

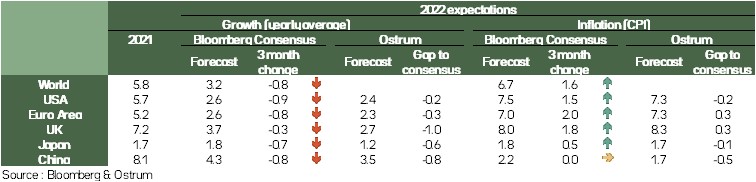

The inflation-growth pivot. We wrote two months ago that the market was going to pivot from an obsession with inflation to fears about growth. Here we are. The survey figures finally send unambiguous signs of slowing down, and the curve has adjusted considerably since mid-June in particular by anticipating much less aggressive monetary policies as the data deteriorated.

While inflation, and its resilience, is no longer a real debate, growth patterns in the second half of the year are much more discussed. The divergence of forecasters is strong, a sign of a growing lack of visibility and a source of volatility in the markets. INSEE, for example, believes that budget transfers will support consumption and thus help avoid a recession. At the opposite, very pessimistic scenarios exist under the hypothesis, in particular, of a monetary tightening too strong that would break growth.

S2: mirror image of S1? Our scenario is a median one, with a strong slowdown but a recession that remains ”technical”. In this case, the central banks would step aside from their desire to raise rates and return to a more dual mandate. With a few months of lagging behind in the markets, the obsession with inflation would therefore be marred by fears about growth. In this case, the peak of sovereign rates for this year would be behind us.

The speed of the slowdown is also a key factor for risky assets. Paradoxically, our “technical recession” is more of a positive scenario for risky assets, which suffered a lot in the first half of the year. Valuations that are consistent with a very degraded economic scenario: if the slowdown is measured and monetary tightening slows down, this could therefore be an upward draw.

The second half of the year would be, in part, a mirror image of the first half, with rates continuing to rise and more positive risk assets.

Of course, all this implies that the world economy should not absorb another crisis: if for example Russia stopped its deliveries of gas, world growth, and especially European growth would be much more affected

Economic views

Three themes for the markets

-

Growth

The data is clearly deteriorating, leaving little doubt about a future slowdown. This is anything but a surprise. On the other hand, the extent of the slowdown is debated and should condition both the trajectory of monetary policies and that of risky assets.

-

Monetary policy

If central banks raise rates frantically, two elements should eventually alter this trajectory. On the one hand, inflation should ease, if only for basic effects, and growth should suffer. It is unlikely that there will be an inflection point before the end of the summer.

-

Inflation

Still the same story about inflation with figures that remain very high. The index of surprise if it remains very high, nevertheless shows signs of reflux. Inflation is spreading over many sectors. More problematic, a wage/price loop is being established on both sides of the Atlantic.

Economy

Rising recession risk and rising inflation

Deterioration of business surveys

Business surveys deteriorated in July. The composite index of the PMI-Markit survey has even receded below 50 in the Eurozone, Germany and the United States, signaling a contraction in activity. The point of concern lies in the most advanced components such as new orders that are contracting more while stocks have increased significantly, especially in the Eurozone. In Germany, the IFO index fell sharply in July, particularly expectations, due to the greater risk of a shutdown of Russian gas supplies. Consumer confidence reached new all-time lows in the Eurozone and the United States (University of Michigan index) in particular. The risk is a decrease in consumption linked to the loss of purchasing power due to inflation. In China, the catch-up effect in June due to reduced health restrictions will not continue, especially as the government adopts new local lockdowns.

Risk of persistent inflation

Inflation continued to accelerate in June to reach an all-time high in the Eurozone (8.6%) and a new high in the United States for 40 years (9.1%). The sharp rise in prices is spreading to a greater number of sectors, as evidenced by the year-on-year increase in the underlying price indices in the Eurozone and the United States, well above the 2% target followed by central banks. This is the result of the sharp rise in energy and food prices, a catch-up in post-COVID demand and more sustained wage growth in all countries and particularly in the United States. In the coming months, inflation is expected to remain high, partly due to the continued strong contribution of energy and food prices.

Budgetary policy

Governments facing rising energy prices

- US: Biden weakened

As the mid-term elections approach, Joe Biden is weakened by the loss of purchasing power suffered by households as a result of the sharp acceleration of inflation. The sharp rise in the price of gasoline on record highs (close to $5 per gallon at the end of July) only weakens him further. This motivated an official trip to the Middle East and more specifically to Saudi Arabia, where relations had deteriorated since the Khashoggi affair, to try to convince it to increase its oil production. Joe Biden got no guarantees.

- Return of political risk in Italy

Following the breakup of the national unity coalition, Mario Draghi resigned as President of the Council and early parliamentary elections will be held on 25 September. This increase in political risk comes at a time when Italy is facing an increased risk of recession, an energy crisis amplified by its heavy dependence on Russian energy and the normalization of ECB policy (increase in interest rates and cessation of asset purchases, especially in Italy). Investors fear that the new government will not continue the key reforms begun by Mario Draghi to bring growth on a higher trajectory and benefit from the new tranches of funds of NextGenerationEU. The Italian spread thus risks to deteriorate much more and thus test the new ECB instrument (TPI).

- Emerging countries: Pay debt or feed yourself

The share of emerging countries in the EMBIG index in “distress”, that is with a spread of more than 1,000 bps, is 30%, the highest since 2009. Energy and food importing countries with high dollar debts are particularly vulnerable.

Monetary policy

Central banks focus on fighting high inflation

- Very tight Fed

The Fed raised its rates for the second time in a row by 75 basis points, on July 27, to bring the range of changes in Fed funds to [2.25% - 2.50%]. Its top priority is to fight "far too high" inflation and to this end it is rapidly tightening its monetary policy so that it becomes restrictive. The Fed has indicated that it will continue to hike rates and reduce the size of its balance sheet. Jerome Powell reported that in September another big rate hike might be needed but that would depend on the data. At some point, "it will likely become appropriate to slow down the pace of rate hikes."

- BCE: + 50 bp further in September? TPI tested?

The ECB raised its rates by 50 bps on 21 July after pre-announcing a 25 bps increase at the June meeting. It thus puts an end a little earlier than expected to the negative rate policy implemented since 2013 (the deposit rate is at 0%) and which was clearly no longer appropriate due to the risk of persistent inflation. It will continue its rate hikes at the next meetings but no longer gives any advance indication of the evolution of key rates. It could raise them again by 50 bps in September to anchor long-term inflation expectations of households and businesses. This higher-than-expected increase virtually erased the rate hikes anticipated by the markets in 2023.

The ECB has announced a new Transmission Protection Instrument (TPI). It will be activated to ”fight against unjustified and disorderly dynamics” of interest rates preventing the transmission of monetary policy to all the countries of the Eurozone. Of unlimited size, it will be activated for countries meeting certain criteria including budgetary sustainability.

Strategic views

Carry and risk

Synthetic market views: selectivity

Spread assets show a much more attractive level of return for the investor. The level of carry is much higher and leads to positioning on certain asset classes, HY credit, some HY part of the EMBIG or inflation for example.

On the other hand, visibility has been reduced with fears about growth, the trajectory of which is becoming more uncertain. To this must be added a market whose liquidity is extremely low and which is therefore recommended to over-adjust to the slightest news. Porting strategies must therefore be implemented selectively.

Allocation recommendations: an inconsistent market

Risk premiums have not distorted homogeneously in all markets. This results in differentiated allocations on asset classes that better compensate for the risk embarked. The European HY credit seems to us to offer particularly attractive valuations. Some EMBIG sub-funds also. On the other hand, the introduction of the TPI should avoid too much spread widening of European peripherals.

In the short term, the lack of liquidity on the markets, and therefore the risk of erratic movements, does not encourage consumption of the entire risk budget. The positive return on money market, at last, is also a game changer.

Asset classes

G4 rates

- The Fed raised rates by 75 bps to 2.5% in July and is considering further monetary tightening. The Fed seems ready to accept a recession to limit inflation, which contributes to inverting the curve by weighing on long rates. Duration neutrality prevails.

- The ECB raised rates by 50 bp in July but struggled to convince the market of continued tightening. The Bund is also benefiting from Italian political risk and sluggish growth. We are neutral on Bunds.

- The BoE is expected to raise rates by 50 bps in August in the face of higher prices. Conversely, the BoJ is maintaining its accommodative monetary policy by buying considerable amounts to cap the 10-year at 0.25%.

Other sovereigns

- The TPI or new anti-crisis tool seems insufficient to contain the pressure on Italian spreads in particular. It is worth keeping a bearish bias on peripheral bonds, especially in Italy. BTP spreads could break the 240 threshold.

- The spreads on the core countries show some stability which advocates for a neutral position vis-à-vis the Bund.

- The strong rally in key markets (UST, Bund) weighed on most G10 curves and ended the upward trend in rates. Several curves are strongly inverted as in Canada or Sweden. Neutrality is justified.

Inflation

- Inflation (9.1% in June) remains too high in the United States. The decline in oil prices and monetary tightening are however pushing breakeven inflation rates towards low levels.

- In the euro area, inflation rose to 8.6% in June. The ECB conditions the extent of rate hikes on inflation. Valuations leads us to a positive view on European breakevens.

- In the UK, inflation is expected to exceed 10% in the short term. Real rates will go up. The view is more constructive on Japanese inflation, due to the weakness of the yen.

Credit

- The credit market no doubt offers attractive valuations, but the caution of investors, justified by the risk of recession, argues for a neutral stance.

- The primary market is functioning but requires ever-higher issue premiums (the highest since March 2020). Risk aversion is still dominating over attractive valuations.

- Sentiment is improving on high yield, thanks to reduced selling pressure. Liquidity is poor in both directions, causing large intraday moves.

Stock market

- Growth is slowing, the recession would threaten profitability. Corporate speeches are more cautious. EPS growth is highly concentrated in a few sectors.

- Multiples have corrected (11.8x on 12 months’ horizon) and are below their long-term average. The expected dividend yield is 3.7%. High margins will be under pressure but balance sheets are healthy.

- The volumes are significant, but investor capitulation may not be complete ; fund outflows are slowing. We forecast a Euro Stoxx 50 at 3,650 by the end of the year.

Emerging

- The EMBIGD spread increased last month around 550 bp against Treasuries. Attractive valuations do not compensate for risk aversion. This argues for a neutral position on the spread which should evolve between 500 and 570.

- Emerging fund outflows continue, fueling spread widening despite a stalled primary market. Liquidity remains mediocre.

- Countries in difficulty are supported by the IMF and the WB, so the credit metrics are holding up. We favor a compression EM HY – EM IG.