Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO letter

- When the Fed is back on the warpath

The market typology has fundamentally changed since the beginning of the year. While the increase in rates in 2021 was almost exclusively linked to the recovery in inflation expectations, the evolution since the beginning of the year shows a small decrease in these expectations, and thus the increase in rates, on both sides of the Atlantic, is exclusively due to real rates. This is the direct effect of much more aggressive central bank rhetoric, especially the FOMC minutes that mentioned a possible reduction in the Fed’s balance sheet. This is one more, important step: as long as the Fed reduced its QE, it is merely reducing its stimulus, conversely, talking about reducing the balance sheet means explicitly considering a restrictive policy. The markets have taken note.

We expected a more complicated market environment this year, particularly for risky assets. The first days of the year came to validate these fears.

If we take a step back from these recent developments, two questions arise. The first is how fast the tightening will be. If, in recent months, the central banks, the Fed and the ECB in particular, have only speeded up the standardization process, it would be wrong to simply prolong this trend. For sure, the inflation figures are stubborn and remain high which creates growing fears of second-round effects. But growth is also showing signs of slowing down and could curb the temptation to tighten monetary policy.

The second issue is the reaction of risky assets, which have already suffered since the beginning of the year. Markets have been strongly supported over the past two years by unusually favorable monetary conditions. With central banks stepping back, more volatility seems inevitable, a correction is plausible.

In this case central banks could be caught between a rock and a hard place: economic fundamentals that require monetary tightening, markets that do not support and drop. Cornelian choice for these same central banks, and an environment difficult to navigate for investors.

Economic views

Three themes for the markets

-

Monetary policy

If the trend is clear, a global monetary tightening, there are still two sources of risk. On the one hand the speed of this tightening while the Fed in particular seems much more proactive. On the other hand, the ability of markets, particularly risky assets, to absorb this shock.

-

Inflation

The subject remains, once again, central. The sequential evolution of price indexes remains very dynamic. Second-tier effects take hold. This affects the dynamics of the central banks, and therefore the credit conditions. It also creates a strong distortion in the margins for certain companies.

-

Growth

Concerns are mounting, between a protracted Covid crisis, bottlenecks that persist, and an energy crisis in Europe, the trend is for deceptions on growth. The policy mix, which has been extremely favorable over the past two years, is also evolving towards a much less favorable position.

Key macroeconomic signposts

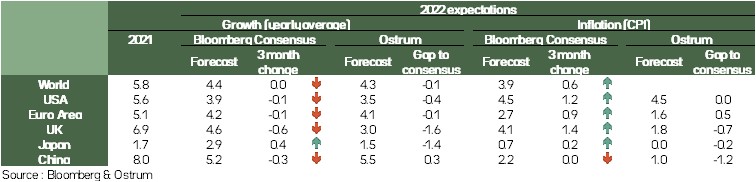

- The catch-up dynamic was strong across the developed countries in 2021. Economic policies have not been the same everywhere, but they have made it possible to quickly restart growth thus eliminating the large-scale shock observed in 2020. This economic policy has enabled a rapid return to employment.

- For the year ahead, there are common risks, the health risk with the Omicron wave, and dissociated risks as large geographical areas are subject to different situations.

- The health risk that could affect the pace of activity in the first quarter and thus weigh on the annual growth figure.

- The American economic situation was penalized by a rapidly growing incidence rate, a fiscal policy that Biden could not manage to pass, mid-term elections that would be unfavorable to him, a labor market that is slow to normalize and a monetary policy that is strengthening faster than expected.

- The Chinese economy whose real estate dimension will be a brake for growth and thus on world trade.

- In the Eurozone, the objective must be to make growth more autonomous and more self-centered in order to be less dependent on the rest of the world. This translates in the short term into binding health measures, the necessary good understanding between Emmanuel Macron and Olaf Scholz while the first will certainly run again in the French presidency. It also assumes that Mario Draghi remains Prime Minister so that his recovery plan remains current while avoiding Italy’s return to instability.

- In France, the government remains on the possibility of adjusting the "whatever it costs" to the evolution of the health situation.

The catch-up dynamic was strong across the developed countries in 2021.

Key macroeconomic signposts

- Inflation continues at the turn of 2022. Its origin is the demand shock caused by the recovery in China, the lifting of health uncertainty and the large-scale recovery in the USA. This shock occurred while company inventories were reduced. This imbalance has caused upward pressure on activity and prices, causing unprecedented tensions on the machinery of production and the price of world trade. These tensions are gradually being resolved. Companies are rebuilding their production capacity. This is the temporary dimension of inflation. It should hit its peak during the first semester.

- In China, inflation has been very low since the average inflation rate for 2021 was 0.9% against 4.7% in the US and 2.6% in the Eurozone. This translates, in the Middle Kingdom, an insufficient internal demand.

- This divergence is important because the US Federal Reserve wants to harden its tone to avoid losing its credibility and to avoid the risk of inflation becoming permanent. This is the sense of the acceleration of the measures that were contained in the minutes of the mid-December meeting and published in early January.

- The Central Bank of China (PBoC) has only one option which is to become more accommodating in order to strengthen domestic demand.

- The ECB is rather neutral in the current situation. It adjusts the amount of asset purchases but does not want to take the risk of indicating that it could become more rigorous in a finite time.

- The divergence between the Fed and the PBoC will be the key to the economy with a risk of depreciation of the renminbi while the US economy lacks resources to boost its economy.

Budgetary policy

The stimulus is largely a thing of the past

- « Build back better » still in the waiting room

After ratifying his $1 trillion infrastructure plan, Biden, whose popularity is declining, is still hoping to reach an agreement on the social and ecological aspects of his Build Back Better program ($1.750 billion). However, the Republicans were reluctant and Biden struggled to find a majority. If a reversal is still possible in Washington, the Biden plan seems increasingly compromised. - EU: Additional measures for 2022

The suspension of the Fiscal Compact rules was extended to 2022 to allow countries to take action to restore sustainable growth following the Covid-19 crisis shock. At the same time, reductions in Covid-related measures, as well as the economic recovery, are allowing deficits to shrink rapidly (e.g. Italy on the chart opposite). Even if we remain far from the balance.

Nevertheless, there is a risk in the implementation of the European recovery plan. Beyond the reforms to be implemented, European countries have so far spent only part of the aid paid by the European Union previously. In the event of delays in the disbursement of EU funds, the outlook for growth, deficit and public debt would be deteriorated. - Public green investments

In view of the need to significantly increase investment for the energy transition, discussions are underway on the possibility of granting them special treatment as part of the improvement of the Stability Pact.

Monetary policy

Acceleration

1. Fed considering to be restrictive

The Fed announced an acceleration of tapering at its December FOMC, with EQ expected to end in March, much earlier than expected. The dot chart also signals the desire to implement three rate hikes over 2022, again much more than was expected a few months ago. Additional surprise during the publication of the minutes in early January: she would consider a reduction in her balance sheet. This is another important step, a reduction in the balance sheet would put the Fed into a restrictive policy. This is a major change.

2. ECB in automatic pilot

The ECB’s QE reduction debate is no longer necessary as the full schedule for the year was announced at the December meeting. There is still a debate that is gradually gaining momentum on a potential rate hike. Extremely unlikely in 2022, this assumption becomes plausible for next year. In this case, the short part of the yield curve would begin to adjust upward, giving degrees of freedom to the long rates.

Inflationary pressures related to the energy transition also seem to be worrying some members of the ECB. The debate on a potential increase is expected to raise this year.

3. A global move

The Fed and ECB are part of a global movement: the number of rate hikes in the world continued to increase during 2021. We are therefore witnessing an overall acceleration of the exit with a few notable exceptions, especially the PBoC.

Strategic views

Rate hikes

Synthetic market views: a different dynamicCentral banks were talking about limiting their support, they are now a step further and are talking about restrictive policies. The immediate impact has been to increase yields while inflation expectations wane, so real rates have gone up again. This resulted in a risk asset correction and a general volatility rebound. While the market is still consistent with an exit from the Covid crisis, a normalization of the economy, and a stabilization of inflation, this central scenario is increasingly questionable. In equity markets in particular, high-duration securities (the most interest-rate-sensitive) have suffered very sharply, which is new; and the index correction underestimates the violence of sectoral rotations.

Allocation recommendations: the trend is your friend

The short-term situation is somewhat paradoxical, with an upward trend in rates that continues and that we support by taking positions short duration. At the same time, we remain positive about risky assets, and constructive about their potential mid-term upside. On equities, maintaining margins in the inflationary context is the key issue. As for credit, valuations remain a barrier to performance on both IG and high yield. Spreads on EM debt remain stable despite the directionality of Treasury.

A risk asset correction and a general volatility rebound.

Strategic views – asset classes

G4 rates

- The FOMC appears to be accelerating the pace of the withdrawal of the monetary stimulus. The bearish sentiment in the market, as well as inflation, encourages a short position of Treasuries.

- In the euro area, the ECB will gradually reduce its purchases in 2022. January syndications and 5% inflation suggest maintaining a seller bias.

- The BoE increased repo for the first time in December (+15bp). The global trend in inflation rates and risks in the UK justifies underexposure. Neutrality prevails over JGBs.

Other sovereigns

- Italian spreads hover around 135 bps. A 10-year spread tension is not to be excluded before the presidential election at the end of the month. However, we are opting for neutrality.

- The political risk exists with the elections in Portugal in January, we underweight the Portuguese loans. Greek debt syndications and QE reduction weigh on this spread.

- Under-exposure to NZD and NOK rates should be maintained due to the restrictive stance of monetary policies. The Riksbank could follow. In Canada and Australia, neutrality prevails.

Inflation

- Inflation (7% in December) is very strong in the United States. The Fed’s monetary tightening is expected to raise real rates, but not reduce breakeven.

- In the eurozone, inflation reached 5% in December. The energy crisis and the euro call for an increase in short-term inflation expectations. The rise in real rates will have a greater impact on long-term downturns.

- In the United Kingdom, real rates are expected to rebound as a result of the upcoming tightening. High inflation persists.

Credit

- Despite strong fundamentals, IG spreads remain unattractive, while the flow balance becomes less favourable with the future reduction in ECB interventions.

- There is little room for further compression of spreads, so spreads are likely to spread over the next month.

- Sentiment is improving on high yield, thanks to favorable fundamentals. The compression trend against IG ends. Valuations are somewhat tense historically.

Stock market

- The economic growth expected for 2022, with an operational leverage that remains important, could generate an increase in EPS of the order of 8%.

- Inflationary pressures (logistics, commodities, recruitment) weigh on costs and threaten profitability. The sectoral impact is very heterogeneous.

- For the coming month we are very cautious: demanding valuations, raising yields and a more difficult environment could constitute a very difficult environment.

Emerging

- Emerging USD spreads are expected to move within a target range of 360-385bps. We remain neutral on the EMBI spread, despite attractive valuations on high yield.

- While Chinese real estate risk weighs on sentiment, the discount on emerging high yield is significant compared to other comparable assets (US high yield).

- Flows to emerging funds have stabilized, but primary market activity is less favourable in January.