Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

Economic Views

Three themes for the markets

-

Monetary policy

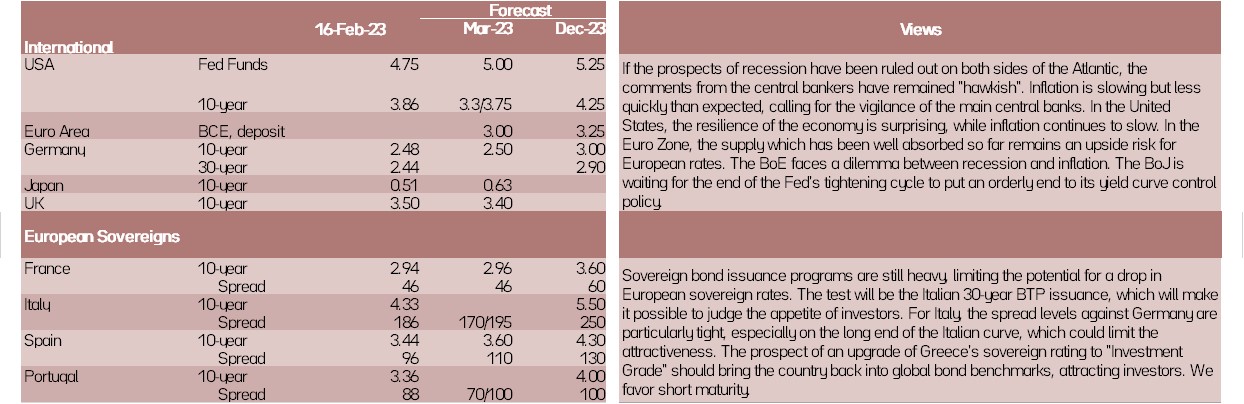

Central Banks (Fed, ECB) remain on course for monetary tightening. Terminal rates could be rounded to the upside. The main question, however, is still the duration of the restrictive monetary policy.

-

Inflation

Inflation is slowing down in both the United States and Europe. However, core inflation remains elevated. In the Eurozone, measures to cap energy prices spurs disinflation at the risk of perpetuating underlying pressures. A “transitory” disinflation is a significant risk.

-

Growth

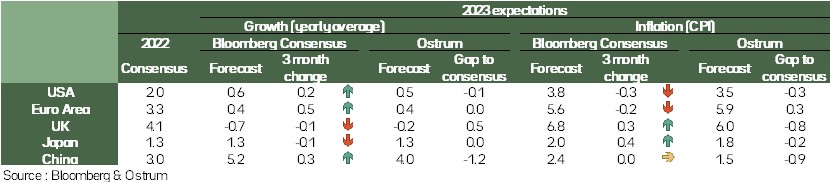

Economic data point to a soft patch through the winter However, a deep recession scenario has been avoided. Labour markets remain well oriented, most notably in North America.

Key macroeconomic signposts : activity

- Following the December alert, particularly in the USA, business surveys are looking more positive in January.

- The ISM index that synthesizes the manufacturing and service sectors has returned well above the 50 threshold. This is a characteristic of the American indicators in January, they all rebound strongly, effectively removing the risks of recession that could arise at the end of last year.

- To illustrate this point, job creation was very high in January 23, reversing the rather downward trend observed previously. It is for this kind of contingencies that the Fed does not want to take the risk of easing its monetary policy too quickly.

- In China, the synthetic index is back above 50. This was expected after the 0-covid policy was relaxed. In detail the rebound is not spectacular in the industry, it is more so in services. The momentum impact on the rest of the world will be modest in the short term.

- In the Eurozone, the index erases its passage into negative territory. This reflects the low price of energy around the end of 2022. What will be critical in 2023 will be business investment that has been somewhat undermined by monetary tightening and the employment dynamics that support household behavior.

Key macroeconomic signposts : inflation and budgetary policy

- Inflation will mechanically slow down in developed countries.

- The decline in the contribution of energy prices will continue because tensions were strong in the spring of 2022 after Russia’s invasion of Ukraine.

- This withdrawal is nevertheless in trompe l'oeil. The underlying inflation rates are not falling as fast and that’s where the central banks are dipping in.

- In the US, the wage rate is beginning to slow, which is a favorable factor as it limits the risk of inflation persistence. However, the Fed will continue to tighten the tone so as not to take the risk of being taken back by a hazard like the sharp rise in jobs in January. It cannot take the risk of withdrawing and will wait before lowering its reference interest rate.

- In Europe, the spread of the energy shock across the entire economy is very noticeable in the pace of the historically high underlying inflation rate. The ECB will continue to tighten the tone, but faced with a shock of this type the risk is to increase the risk of recession, companies have no choice but to raise their prices.

- The good news is the resumption of electricity production in France. This will limit pressure on gas prices, reducing the risk of a renewed energy shock.

Strategic Views

Too fast, too furious?

Synthetic market views: higher and higher

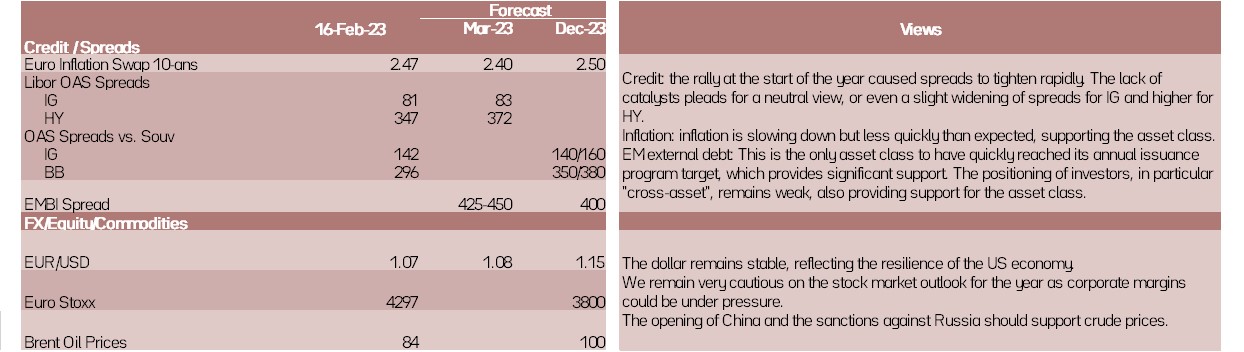

The good performance of the economy, albeit with very poor growth, continues to support a wave of optimism in the markets. The inflection point on inflation is interpreted as an indicator of monetary policies in the stabilization phase. Finally, it seems that many investors are still exposed to risky assets and are trying to regain exposure.

The result is a “risk on” environment that lasts and brings valuations to tight, but not unreasonable levels. The market therefore hesitates between technical arguments (flows) that push us to anticipate a trend that goes on, and more fundamental arguments that lead us to think that the market is becoming complacent.

Allocation recommendations: a question of risk/reward

In the short term the fall in inflation headline could support rates, even if we remain doubtful about the ability to quickly return to 2%. An increase at the end of the year is likely .

We are becoming more cautious about risky assets. While the trend is likely to continue, the upside potential for markets is very limited. On the other hand, in case of bad news, the correction could be quick. Risk/reward therefore does not encourage you to take strong positions. For example, we have a neutral to cautious view on credit or sovereign spreads.

Monetary Policy

Rates higher for longer

- Fed : “The disinflation process is only at the beginning ”

Given the extent of the monetary tightening since last March, the Fed slowed down its rate hikes to 25 basis points on 1 February, bringing the Fed Fund range to [4.5% – 4.75%]. At the end of the meeting, Powell said the Fed was still looking at two rate hikes, but the strong job creation and retail sales that have been published since then could provide an incentive for further increases. We anticipate 2 rate hikes of 25 bps in March and May, with risk on the upside. - ECB: “We stay in course until the job is done”

The ECB raised its rates by 50 basis points on 2 February to raise the deposit rate to 2.50%. The Bank also announced plans to increase by another 50 bps in March and assess the future course of its monetary policy. The aim will therefore be in March, in the light of the ECB’s new forecasts, to determine the rate of increase in key interest rates to be adopted in May (50 or 25 bps), in order to bring monetary policy back into sufficiently restrictive territory and maintain it there for some time. We anticipate a 50 bps increase in March and a 25 bps increase in May prior to an extended status quo. The risk for the ECB is to have to raise its rates again at the end of the year. - Kazuo UEDA to head The Bank of Japan

Economist and former BoJ member Ueda will head the BoJ in April, succeeding Kuroda. He will have the difficult task of normalizing monetary policy after 10 years of extremely accommodative policy. If gradual adjustments should be made for controlling the yield curve, the abandonment of the negative rate policy will only occur when inflation is expected to be sustained on the 2% target. Spring “shunto” wage negotiations will be a key element to watch.

Asset classes