Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO Letter

2023, the revenge of fixed income?

2022 was an “annus horribilis” for markets. The vast majority of asset classes performed negatively: sovereign rates, credit and equities. Interest rate investments suffered particularly, with a Bund portfolio, for example, losing almost 20% at the worst time of the year. Unfortunately, this is a feature of significant inflation phases, with all asset classes tending to react in a synchronized manner and thus reduce any effort to diversify.

Will 2023 be a milder year?

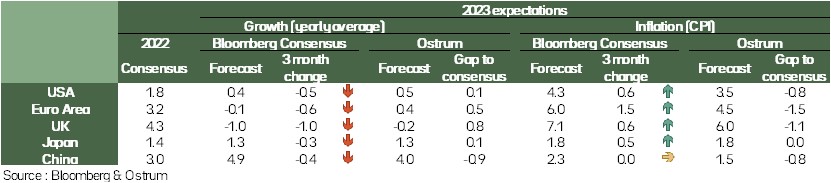

Our economic scenario is based on two main ideas. On the one hand, the recession which seems inevitable would be of a limited scale, with in particular very limited damage on the labour market. On the other hand, inflation should fall, this has already begun, but the inertia that is taking hold will not allow us to return to the 2% we want before the end of 2023. Central banks are therefore facing an activity that shows signs of resilience and inflation that remains too high.

As a result, monetary policy should remain restrictive throughout the year. A lot of the rate hikes are behind us, Fed and BCE should stop theirs in the coming months. But for how long? Our economic scenario, in particular the trajectory of inflation, calls for rates that remain high at least until the end of the year. The market is much less convinced.

Win/win?

In this scenario, with central banks no longer moving for several quarters, long rates should adjust. They would offer, finally!, a decent portage. Moreover, with the end of the rate hikes, the uncertainty on the future trajectory would disappear and with it volatility. A much more frightening cocktail for the investor where the two components of the return/risk couple would be more favorable.

Icing on the cake, we expect a moderate rise in the default rate. And so, credit spreads are tightening, even though they have already come a long way in the last quarter of 2022. However, this movement would add performance.

2023 could then be the year of revenge for rate products, after admittedly a year 2022 more than difficult.

Economic Views

Three themes for the markets

-

Monetary policy

The Fed and ECB have slowed their rate hikes. However, the upswing cycle is not yet over, with 50 bps remaining for the Fed and at least 100 bps for the ECB. From Q2 the two banks should stop and keep their rates unchanged until the end of the year. An environment of high and stable rates.

-

Inflation

The signs of falling inflation are multiplying on both sides of the Atlantic. The first question is the rate at which inflation is falling. It’s potentially high because of significant baseline effects. The second issue is the medium-term landing. It is unlikely to return to 2% in the near future.

-

Recession

The economic data is mixed. It validates the idea of a slowdown but would remain limited. Our view of a small recession on Q4 and Q1 remains the most likely scenario. The scenario of a much deeper recession seems less and less likely.

Key macroeconomic signposts : activity

- So far, economic activity in developed countries has been quite robust.

- The main reason is in Europe, a countercyclical fiscal policy that supported private demand despite the energy shock. This pooling of the shock has made it possible not to penalize too much the purchasing power of income.

- In the US, private demand continued to grow but at a moderate pace. YTD GDP began to shrink for 2 quarters before rebounding in late summer and early fall.

- Nevertheless, signals about the Eurozone cycle remain worrying, business leaders have a somewhat pessimistic perception of the coming months.

- This is consistent with the moderate pace of industrial raw materials. The peak at the beginning of the year has diminished.

- In the short term, there are two risks. The first is real estate. This sector has benefited from very favourable financial conditions, this is no longer the case and transactions are slowing down frankly.

- The second risk is China. The decision to lift the 0-covid policy was made because the cycle is mediocre and real estate is definitely changing. Lack of collective immunity and low vaccination rates will create a risk of high contamination. This could result in disruptions on Chinese production lines.

Key macroeconomic signposts : Inflation and budgetary policy

- Inflationary pressures are being reduced quite significantly. The price of oil is comparable to last year’s level, and the price of industrial raw materials is slightly below 2021.

- This point can be observed on the production prices which are negative in November in China over a year, which slow down sharply in the US to 8%. In the Eurozone, the profile has changed. Their variation has frankly slowed down in October.

- This translates into a significant shift in the contribution of energy to the US. This is not yet the case in the Eurozone because of the price of gas, which clouded a bit the issue in 2022.

- In the US, inflation slowed for the fifth consecutive month. Only the services component is now increasing. This reflects the effects of real estate and rising wages. Hence the Fed’s obsession to weigh on the pace of wages so as not to take the risk of seeing inflation enroll for the long term.

- In the Eurozone, wage dynamics are less dynamic this autumn, reflecting the absence of a price/wage loop. The slowdown in inflation mainly reflects the lesser contribution of energy, prices were already high a year ago and they are slowing down as shown by the price of oil.

- Nevertheless, the spread of the energy shock in the economy still forces the ECB to remain vigilant.

Strategic Views

Central banks are not done

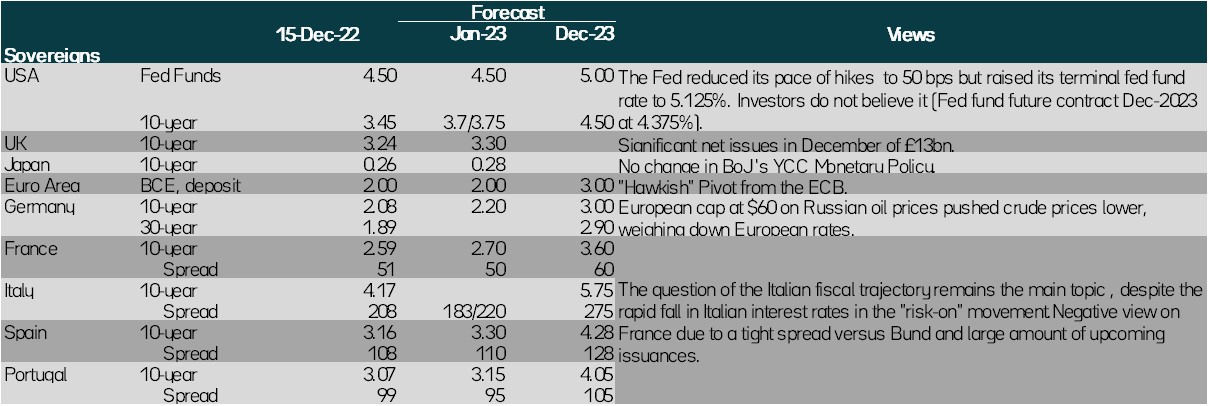

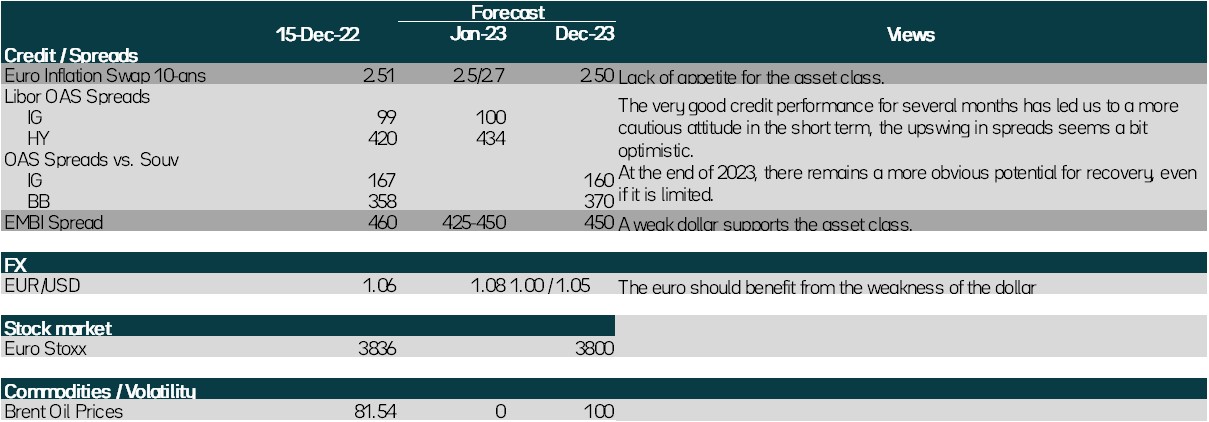

Synthetic market views: Central banks battling recent easing in financial conditions

Central banks are struggling to convince financial markets of the need to continue tightening monetary policy given the expected drop in inflation. However, inflation remains too high relative to targets. Yield curves are inverted despite quantitative tightening and government refinancing needs to come. The monetary authorities are facing an easing of financial conditions which seems counterproductive in the fight against inflation. The downward adjustment of the dollar went hand in hand with the rebound in risky assets.

Allocation recommendations: Recent rally in risky assets looks excessive

Credit and equity markets have erased the large valuation discounts that prevailed early on this autumn. These markets no longer show obvious undervaluation. The decline in risk aversion allowed the European IG corporate bond primary market to reopen just ahead of the seasonal lull in December. However, it will be necessary to absorb the ECB’s QT announcement and the competition from sovereign bond issuance at the start of next year. Bond yields should resume their rise at the start of the year. The inflationary risk is not well taken into account by markets. Equity markets have swiftly priced in the end of Covid-related restrictions in China and the resilience of economic activity in Europe. The winter slowdown may however weigh on risky assets.

Monetary Policy

Ever-Higher Rates and Longer in Restrictive Territory to Fight High Inflation

- Fed : “Stay the course until the job is done”

Given the magnitude of the rate hikes achieved and the lag with which monetary policy is transmitted to the real economy, the Fed slowed the pace of its hikes to 50 bps in December, after 4 consecutive hikes of 75 bps. The Fed will continue to raise rates to make monetary policy tight enough. The members of the FOMC have thus revised their forecasts for Fed funds to 5.1% in 2023 (compared to 4.6% in September). The balance sheet will also continue to decline significantly. We expect the Fed funds range to peak at [4.75% - 5%] in March. - ECB: Rate hikes of 50 basis points and QT from March

The ECB was very clear at the December meeting. If it slows the pace of the rate hike to 50 bps, this is by no means a "pivot", given the sharp upward revision to the inflation outlook (6.3% in 2023, 3.4% in 2024 and 2.3% in 2025). Rates will continue to increase significantly at a steady pace (50 bp explicitly quoted) in order to reach a sufficiently restrictive level. They will stay there long enough to allow inflation to return to around 2%. The reduction in the size of the balance sheet will take place from the beginning of March, gradually, via the non-reinvestment of part of the APP payments from maturing securities, at the rate of 15 billion euros per month. This rate will be reviewed quarterly. - Other central banks

After raising their rates very aggressively, the central banks are slowing down a little while indicating that they will continue to tighten given that inflation is still too high. The BoE thus raised its rates by 50 bp. The divisiveness is becoming more prominent with the looming recession, with 2 members voting for a status quo in December and one for 75 pb. China, meanwhile, is in no rush to ease monetary policy further.

Asset classes