Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum AM's views on the economy, strategy and markets.

The CIO letter

The Fed has finally cracked

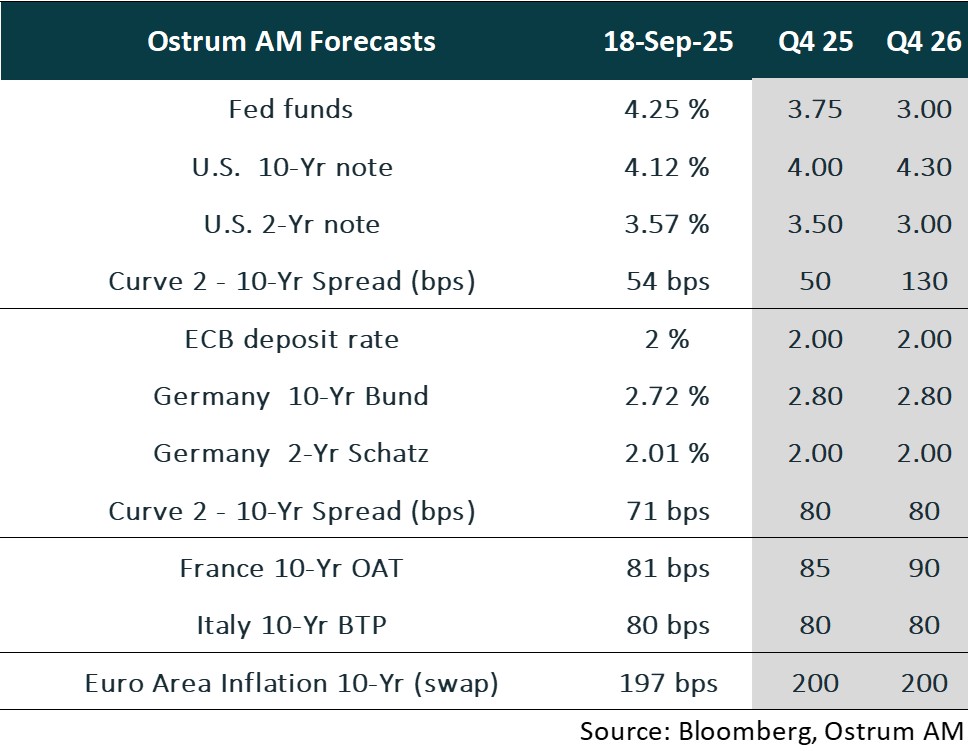

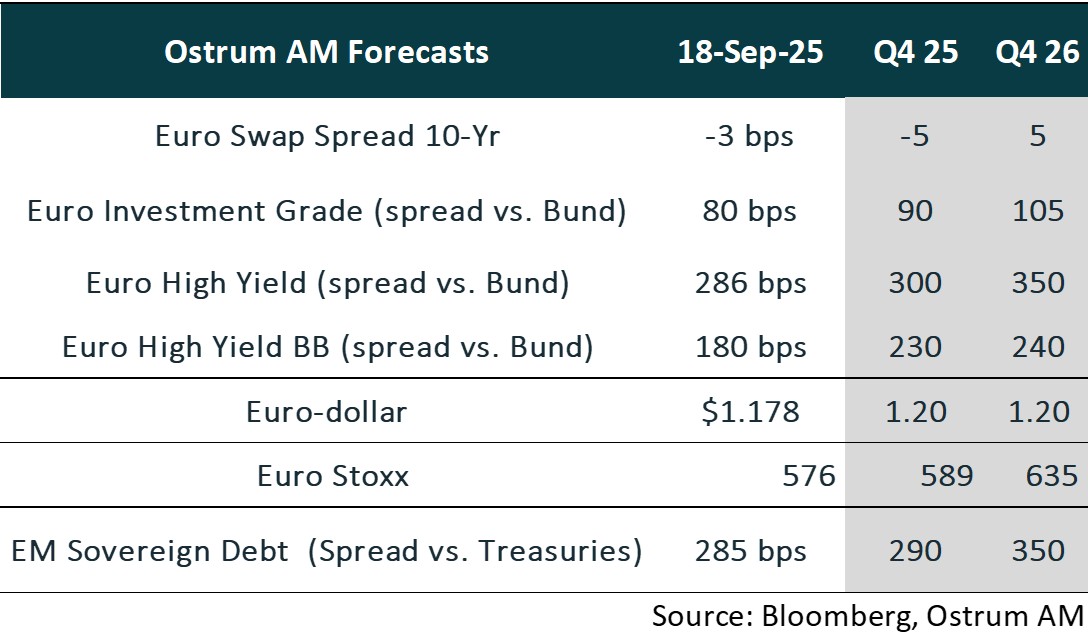

Price action in the markets depicts an environment of economic recovery with little risks of persistent inflation or financial volatility. These stellar performances contrast with a still troubled international context and the ongoing uncertainty surrounding U.S. economic policy. The resulting weakening of the U.S. labor market, which has reshaped Fed policy, paradoxically provides significant support to the markets. At the same time, questions regarding the independence of the monetary institution impose a risk premium on long-term real rates. This dual influence of sovereign credit risk (upward pressure on rates) and economic risk (downward pressure) makes the trajectory of the 10-year yield highly uncertain, but we lean towards a slightly bullish bias by the end of the year.

In the eurozone, economic growth will be stimulated by the rollout of public investments in Germany. The disinflation process is nearing its end, so the ECB is expected to maintain the status quo on rates through 2026. The French political crisis remains contained and does not require any intervention from the ECB at this stage. The OAT has already factored in the likely downgrades of France’s credit rating (S&P, Moody’s), given the difficulty in restoring public finances.

The dizzying rise in valuations of U.S. technology stocks is driving a broad upward movement across all risk assets, overshadowing geopolitical risks. The AI theme remains the engine of these excesses, amplified by the Fed's change in policy stance. The T-note is expected to hover about 4%, while the Bund will need to fully incorporate the status quo and fiscal stimulus (2.80%) by the end of the year. Pressure on OAT spreads has no consequences on other sovereigns. Credit is navigating this period without volatility, although the recent narrowing of spreads could mean the market is priced for perfection.

Economic Views

THREE THEMES FOR THE MARKETS

-

Growth

The U.S. economy is adjusting to Donald Trump's policy. The second half of the year is expected to be below potential due to a slowdown in employment and investment, excluding AI. Furthermore, there is a risk of government shutdown starting at the end of September. In the eurozone, a gradual recovery is expected to continue thanks to the implementation of German investment plans. In China, the weakening of data at the beginning of Q3 does not call into question the growth target for 2025. The reduction of excess capacity will nevertheless need to be compensated by increased demand support.

-

Inflation

U.S. inflation stands at 2.9% in August. Price increases are expected to remain around 3% during the 4th quarter. Tariffs and price inertia in services offset the disinflationary effect of rents. In the eurozone, inflation is close to the ECB's target of 2%, but service prices remain high due to the still strong wage dynamics (3.5-4%). Combating Chinese deflation is a priority objective for the government, alongside the anti-involution policy. Consumer prices fell by 0.4% in August.

-

Monetary policy

After the September cut, the Fed, under the influence of the Trump administration, is expected to bring its rate down to around 3% by 2026. Focus is placed on the employment situation, risking a potential inflationary overshoot. The ECB is likely to maintain the status quo at 2% until the end of 2026, but the disinflation process appears to be complete. Ms. Lagarde does not intend to respond to the cyclical decline in inflation. The PBoC continues its accommodative policy. The bias among other major global central banks remains toward easing.

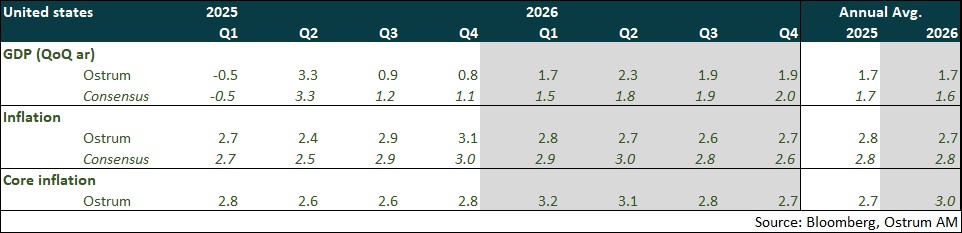

ECONOMY: UNITED STATES

Two years below potential, continued deterioration of the labor market, significant risk to the real estate sector.

- Demand: The confidence shock and the tariff burden will continue to weigh on household consumption and business investment in the second half of the year. The credit quality of households is deteriorating. These effects are expected to dissipate in 2026, with an increase in transfers to households. The trade balance is projected to deteriorate again starting in the second half of 2025. Housing investment is set to contract, posing a recession risk. Productive investment will primarily be driven by AI (data centers, software, and R&D).

- Labor Market: Hiring is slowing down. The unemployment rate is expected to rise to 4.5-5% by the end of the year and remain above 4.5% in 2026, despite weak labor force participation (due to constrained immigration). Job openings are trending downward, but labor shortages are likely to intensify.

- Fiscal Policy: The budget has passed. Budget cuts and tariff revenues have somewhat improved the deficit. The contribution of public demand to growth is negligible. In 2026, a new easing is expected in anticipation of the mid-term elections.

- Inflation: The decline in oil prices and the reduction in discretionary consumption are expected to limit the impact of tariffs. However, the price inertia in services (such as healthcare) will keep inflation above the target in 2026.

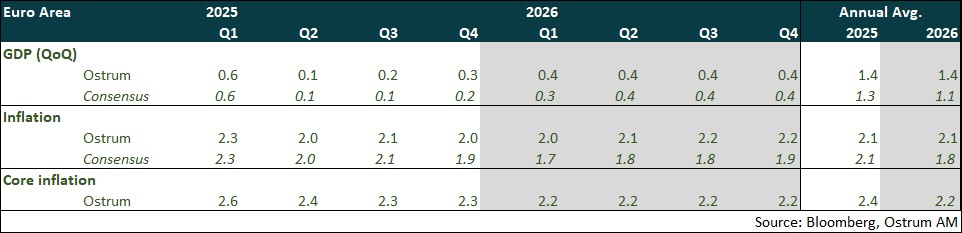

ECONOMY: EURO AREA

After a volatile first half of the year due to the increase in U.S. tariffs, growth is expected to gradually strengthen starting in the second half of the year with the launch of the German infrastructure plan, and then further enhance in 2026.

- Activity: The trade agreement with the United States prevents an escalation of tensions, but uncertainty remains regarding the future evolution of tariffs. Starting in the second half of 2025, growth is expected to strengthen with the gradual implementation of German plans, the impact of which will be more significant in 2026, along with the increase in military spending in the eurozone.

- Domestic demand: Households will continue to benefit from the impact of the monetary easing implemented by the ECB since June 2024 and from gains in purchasing power, although these will be more moderate. Public investment is expected to increase starting in the second half of the year, driven by Germany, and then accelerate in 2026. Additionally, peripheral countries are expected to benefit from the disbursements of the NextGenerationEU funds, the program for which concludes at the end of 2026.

- Fiscal policy: Germany has announced a budget plan that breaks completely from its longstanding fiscal prudence, including significant military and infrastructure spending. In France, the fall of the Bayrou government and the appointment of a fifth Prime Minister in two years increase uncertainty about the country's ability to reduce its budget deficit and stabilize its debt, leading rating agencies to downgrade France's credit rating to A+ (Fitch and likely S&P as well).

- Inflation: Inflation is expected to remain close to the ECB's target of 2%. Inflation in services is likely to moderate only gradually due to a slow adjustment of wages to inflation. There is a risk of an influx of highly competitive Asian products.

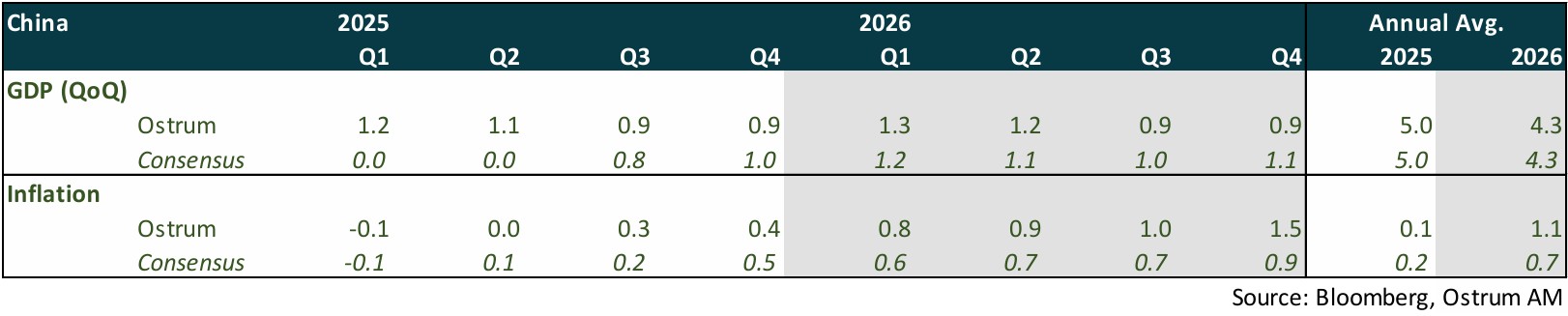

ECONOMY: CHINA

Growth was 5.3% in the first part of the year. The authorities are prepared to tolerate a moderation of activity related to the "anti-involution" campaign targeting excess production capacities. This marks a significant strategic shift.

- Activity slowed down in July, linked to the "anti-involution" campaign. Despite robust growth in the first half of the year, leading indicators for July show weaker activity dynamics across all sectors due to the "anti-involution" campaign targeting excess production capacities. In 2015, China also implemented the "supply-side structural reform" aimed at eliminating excess capacities in key sectors such as steel and coal. To mitigate the impact on activity, Beijing accompanied the reform with budgetary measures to facilitate reflation. The authorities are expected to strengthen their fiscal support to limit the impact on employment and growth and to achieve the growth target of 5%.

- Exports: Foreign trade is expected to provide less support to GDP growth due to reciprocal tariffs, despite exports remaining robust this summer.

- Demand: The growth of investment and retail sales is slowing down due to the "anti-involution" campaign. A consumption plan is set to be presented in September. A new urbanization plan will help absorb unsold housing stocks by migrant workers.

- Inflation: We believe that reflation should intensify next year, and we have revised our forecast for 2026 upwards to 1.1%.

- Monetary policy : Fiscal measures have taken over from monetary policy to support activity. However, we believe that the PBoC may lower its rates by the end of the year, as real rates remain high.

- We do not believe that the authorities will resort to devaluing the yuan as they did in 2015 to reverse deflation. Instead, they are prioritizing the stability of their currency to focus on the trade war.

Monetary Policy

Divergence between the Fed and the ECB

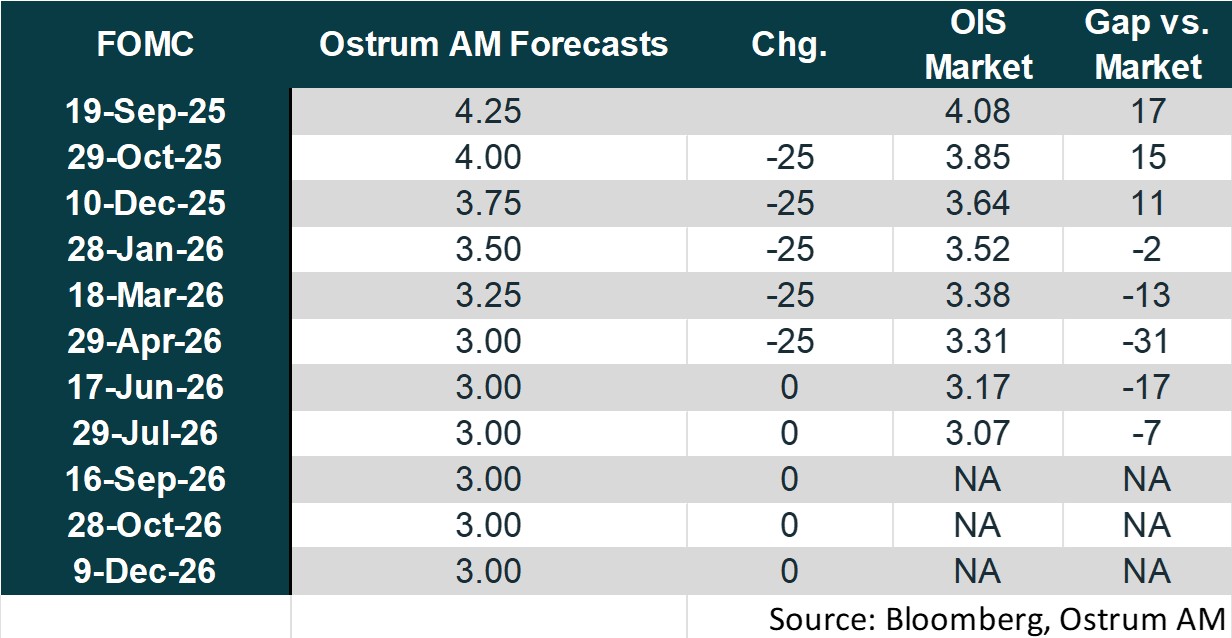

- The Fed is resuming its rate-cutting cycle

The Fed has decided to lower its rates by 25 basis points, bringing the federal funds rate to the range of [4.00 – 4.25%]. This marks the resumption of its rate-cutting cycle (-100 basis points between September and December 2024) after a 9-month period of maintaining the status quo. This decision was motivated by increased downside risks to employment, following data revealing a significant slowdown in job creation over the past three months. While inflation risks remain tilted to the upside, the impact of tariffs is considered to be temporary. Members of the monetary policy committee anticipate, on average, two more rate cuts by the end of the year (compared to just one during the June meeting), followed by further cuts in 2026 and 2027. We expect two more rate cuts by the end of the year and three additional cuts in 2026, aiming to return to the neutral rate, given the ongoing deterioration in the labor market and significant risks in the real estate market.

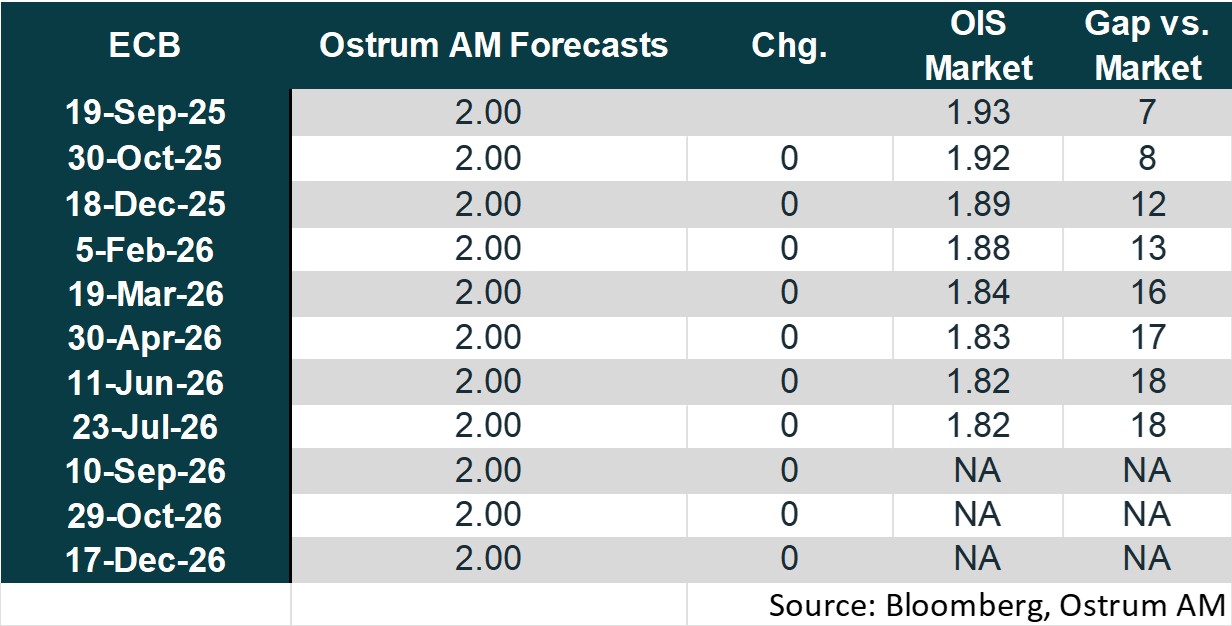

- Extended status quo of the ECB

After lowering its rates 8 times over the course of a year (-200 basis points between June 2024 and June 2025), the ECB has kept its rates unchanged for the second consecutive meeting on September 11. Christine Lagarde indicated that the disinflation process is complete and that the ECB is still in "a good position" due to resilient growth, a strong labor market, and inflation expected to remain close to the 2% target in the medium term. The risks to growth are considered more balanced following the trade agreement signed with the United States, although this agreement does not eliminate all uncertainties. The ECB will determine its rate policy meeting by meeting, based on incoming data. This suggests that rates will likely remain unchanged until the end of 2025 and into 2026. A final rate cut would only be considered in the event of a negative shock to growth.

Market views

- U.S. Rates: The Federal Reserve responded to the deterioration in employment starting in September; despite upside risks to inflation. Fiscal risks will continue to weigh on long-term yields.

- European Rates: The ECB will keep rates unchanged at 2% until 2026. The 10-year Bund forecasted at 2.80% reflects a more ambitious fiscal policy in Germany.

- Sovereign Spreads: OAT spread forecasts reflect both political and fiscal woes. BTP spreads should be more stable.

- Eurozone Inflation: Inflation expectations remain anchored around the 2% target.

- Euro Credit: Investment-grade credit spreads have tightened significantly. A modest widening from current rich levels appears likely.

- Euro High yield: Valuations in the high-yield sector are expected to normalize over the coming year. However, the default rate remains low and below the historical average.

- Exchange Rates: Distrust in the dollar has propelled the euro higher, with the single currency expected to approach $1.20 by the end of 2025.

- European Equities: Tariffs are likely to weigh on margins, but the positive sentiment factor is likely to propel valuation multiples higher.

- Emerging Debt: Emerging market spreads may remain close to current tight levels in the near term.