Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum AM's views on the economy, strategy and markets.

The cio letter

Early signs of de-escalation

Financial markets are reacting more strongly to signals of improvement than to underlying economic substance. Investor sentiment has improved considerably following the announcement of a 90-day tariff pause and trade agreements with China and the United Kingdom. While many questions remain outstanding, particularly concerning tariffs applicable to pharmaceuticals and semiconductors, the atmosphere is palpably more relaxed, and economic uncertainty appears to have diminished somewhat. The tariff shock, for now, does not seem to be translating into a generalized acceleration in prices. The rebound in U.S. growth is anticipated to occur in the third quarter. In the Eurozone, encouraging first-quarter results reinforce our scenario of resilient economic activity.

Within this context, the Fed, under attack from Donald Trump, will not act preemptively but will closely monitor developments in the labor market and financial stability. The episode of tension in the Treasury market could repeat itself, given persistent fiscal risks. The ECB, on the other hand, will continue easing with two further cuts in June and July, or even more if the economic situation requires it. The Bund has regained its status as a safe haven relative to the T-Note. The German 10-year yield will fluctuate around 2.50%. Italian spreads have further potential for tightening, with the recent rating upgrade acknowledging budget consolidation efforts. The decline in risky assets from the beginning of April has been partially erased. Flows are recovering, such that IG credit has stabilized under 100 basis points against swaps, a new equilibrium that reflects persistent uncertainty. High yield remains more richly valued and vulnerable. On equities, the strong first-quarter earnings season is now giving way to a period of reduced visibility, with profit margins under pressure in the second half of the year.

Economic Views

THREE THEMES FOR THE MARKETS

-

Monetary policy

The Fed will closely monitor employment trends, as the price shock is not expected to fuel sustained inflation. The ECB is expected to cut rates by 25 basis points in both June and July, and could lower them further in the event of a more pronounced growth slowdown. In China, the PBOC is continuing its easing policy by reducing the required reserve ratio and interest rates.

-

Inflation

The increase in tariffs is not yet visible in US inflation figures (2.4% in April). The impact of these duties appears mitigated by household spending shifts and a slowdown in discretionary service consumption. In the Eurozone, inflation remained stable at 2.2% in April, with the core rate (excluding energy and food) at 2.7%. Inflation may decrease further in the short term due to weaker demand, lower oil prices, and the appreciating euro. Deflation persists in China, with inflation at -0.1% in March.

-

Growth

The US economy contracted in Q1 despite solid final demand ahead of tariff implementation. Activity is expected to experience near-zero growth in Q2 before a second-half rebound, albeit below potential. In the Eurozone, growth was stronger than expected in Q1 (+0.3%). This improvement is expected to moderate given the forthcoming contraction in global trade. China experienced a robust first quarter and is taking measures to limit the impact of prohibitive US tariffs on its growth.

ECONOMY: UNITED STATES

US growth will remain tepid in Q2, impacted by a reduced contribution from inventories, before recovering due to diminished uncertainty.

- Demand: Consumption will be hampered by tariffs and a less dynamic labour market. Investment (equipment, structures, software) will adjust given profit pressures and a lack of visibility. However, the de-escalation of the trade war reduces uncertainty.

- Labor Market: The labour market adjustment continues, but layoffs are scarce due to persistent recruitment difficulties. An increase in unemployment above 4.5% is likely by year-end.

- Fiscal Policy: The budget is still under discussion. Tax cuts appear difficult to finance without drastic reductions in transfer payments (Medicaid, SNAP).

- Inflation: Inflation remains slightly above target. Rents will decelerate in 2025, and falling oil prices are keeping headline inflation below the core index. Tariffs on imported goods have an immediate impact on inflation, with a stronger effect on the CPI than on the deflator.

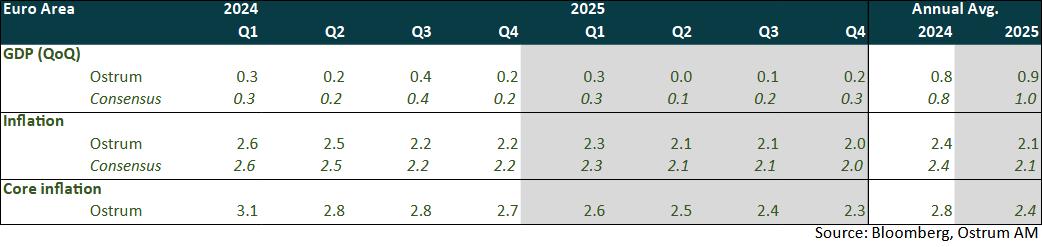

ECONOMY: EURO AREA

Stronger-than-expected Q1 growth offers a temporary reprieve, but a slowdown looms due to the impact of the trade war.

- Activity : Maritime transport demand has declined sharply following the significant increase in US tariffs, foreshadowing a contraction in global trade that will weigh on overall activity and the Eurozone in particular. Some surveys of business leaders, notably the European Commission's, have begun to deteriorate.

- Domestic Demand: Consumer confidence has weakened due to increased uncertainty, and business leaders are becoming more cautious. This is expected to weigh on investment, employment, and consumption, offsetting the anticipated impact of purchasing power gains and the ECB's monetary easing.

- Fiscal Policy: Germany's €500 billion infrastructure fund and debt brake reform will only impact German and Eurozone growth from 2026. In 2025, there is limited fiscal room for maneuver.

- Inflation: Inflation will depend on potential retaliatory measures from the EU against the US. These are suspended until mid-July, which, in the short term, argues for lower inflation due to falling oil prices, the appreciating euro, and weaker demand. Added to this is the risk of a massive influx of highly competitive Asian products due to higher US tariffs on these goods. The EU has stated its readiness to take measures to limit this.

- Downside risks to growth in the event of an escalation in trade tensions.

ECONOMY: CHINA

The Geneva Agreement reduces the risk to short-term Chinese growth.

- After a robust GDP growth of 5.4% year-on-year in Q1, the impact of tariffs became evident in maritime freight data, indicating a paralysis of trade between the United States and China by the end of April. Container exports between the two countries have dropped by 40% since April 18.

- The PMI surveys published for April indicate, however, that the impact is limited, reflecting exemptions on certain products and the diversion of Chinese exports to other countries.

- During the Geneva meeting on May 10-11, the two countries finally agreed on a 90-day pause during which tariffs were reduced by 115 basis points. As a result, U.S. tariffs on Chinese products were lowered from 145% to 30% (10% for the base tariff + 20% related to fentanyl, which remain in place). China reduced its customs duties on American products from 125% to 10%.

- This truce reduces the risk to short-term Chinese growth, increasing the chances for authorities to achieve their growth target of 5%. It is also a victory for China as it asserts its position as a superpower equal to that of the United States.

- This decision is expected to please businesses in both countries, which were already beginning to feel the effects of high tariffs. Chinese exports to the United States fell by 21% year-on-year in April, while overall exports performed better than expected, particularly to Asia (+20% year-on-year) and Europe (+8%).

- Before the Geneva meeting on May 10-11 between U.S. and Chinese trade representatives, the PBOC lowered its main interest rate by 10 basis points to 1.4% and its reserve requirement ratio for large banks by 50 basis points to 9.5% to support economic activity.

Monetary Policy

Central banks are plunged into the uncertainty of Trump’s policies.

- THE FED AWAITS THE IMPACT OF TRUMP'S POLICIES

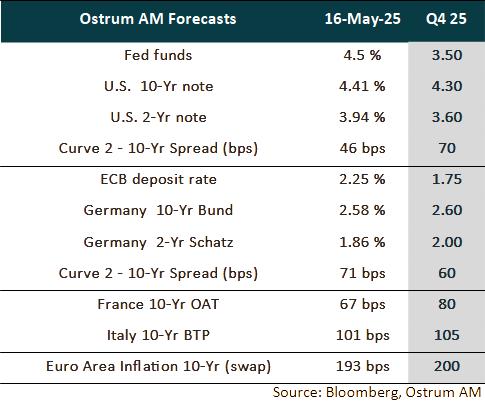

The Federal Reserve finds itself in an uncomfortable position. The rising uncertainty surrounding Donald Trump's policies increases the risk of higher unemployment and stronger inflation, according to Jerome Powell. In this context, FOMC members continue to believe that the central bank is well-positioned to await greater visibility on the impact of White House policies before making any decisions. This is why it kept rates unchanged for the third consecutive time on May 7. To prevent the U.S. economy from slipping into recession, we anticipate 100 basis points of Fed rate cuts by year-end. Furthermore, the Fed may slow the pace of balance sheet contraction or even suspend it until the debt ceiling issue is resolved. - FURTHER RATE CUTS EXPECTED FROM THE ECB

During the April 17 meeting, which marked the ECB's seventh rate cut, Christine Lagarde emphasized the numerous downside risks to growth due to the significant increase in U.S. tariffs, while noting that the impact on inflation remains highly uncertain. She stressed that future monetary policy decisions will be more data-dependent than ever. In light of deteriorating growth prospects and the risk of more moderate inflation in the coming months, we foresee two additional 25 basis point cuts by year-end, bringing the deposit rate down to 1.75%. According to Philip Lane, the threshold for the ECB to further slow the pace of balance sheet contraction is quite high. - RATE CUTS IN CHINA AND THE UK; INCREASES IN BRAZIL

The People's Bank of China (PBoC) has lowered its main policy rate by 10 basis points to 1.4% and cut the reserve requirement ratio for large banks by 50 basis points to 9.5%, aiming to reduce real rates as inflation fell to -0.1% in April.

The Bank of England (BoE) has, as expected, reduced its main interest rate by 25 basis points to 4.25%, following a 5-4 vote. Two members advocated a 50 basis point cut, while two others favored maintaining the status quo. Future rate reductions will remain "gradual," despite the shock from U.S. tariffs.

Conversely, the Central Bank of Brazil raised its benchmark rate by 50 a points to 14.75%, following a 100 basis point increase last month, but indicated that its monetary tightening cycle is nearing its end.

Market views

Asset classes

- U.S. Rates: Tensions surrounding the U.S. fiscal trajectory imply a steeper curve as the Fed takes easing measures.

- European Rates: The ECB is expected to lower its deposit rate to 1.75%. The 10-year Bund reflects the more ambitious fiscal policy in Germany while benefiting from reallocations from the U.S. dollar to the euro.

- Sovereign Spreads: Sovereign spreads are expected to remain generally stable by the end of the year. OAT spreads may widen to some extent. Fiscal consolidation in Italy has been praised by S&P (BBB+).

- Eurozone Inflation: The decline in oil prices has weighed on inflation expectations. However, a moderate increase in breakeven rates is likely.

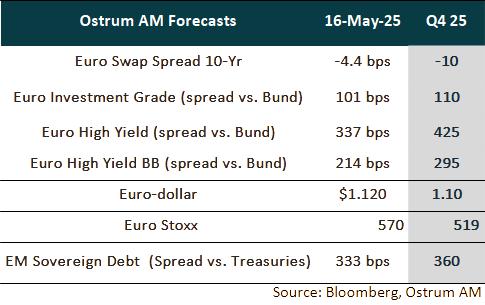

- Euro Credit: Investment-grade credit spreads have tightened significantly. In the absence of a recession, stability is likely to prevail.

- Euro high yield: Valuations in the high yield sector are expected to normalize over the year. The default rate remains below the historical average.

- Exchange Rates: Distrust of the dollar has led to an appreciation of the euro. However, the single currency is expected to return to around $1.10 by the end of 2025.

- European equities: Tariffs will weigh on margins, and increasing volatility is likely to compress multiples, leading to an anticipated decline in the market.

- Emerging Market Debt: Emerging market spreads have recovered from the tensions seen in early April and appear relatively expensive compared to our year-end targets.