Every month, find out all about the sustainable market bonds news in our newsletter

« MySustainableCorner ».

Topic of the month

Green syndication of the Italian Treasury in a context of legislative elections

In a turbulent political context, the Italian Treasury announced the placement of a new green bond transaction, ahead of the early parliament elections scheduled on the 25th of September. With this new issue, the total outstanding green debt of the Italian State is close to 19.5 billion euros.

Green proceeds

This new transaction will allow the Italian government to allocate expenses for the fight against climate change through the financing of sustainable mobility, energy efficiency and environmental protection projects. This spending will contribute to the achievement of more than one of the European Taxonomy’s environmental goals and help Italy to support the 2030 Sustainable Development Goals (SDGs) such as the Affordable and Clean Energy, Sustainable Cities and Communities, Life on Land …

A solicited issue

The strong demand reaching nearly 40 billion euros, from a large panel of 290 investors, allowed the Italian Treasury to serve 6 billion euros at a coupon of 4%. Diversification was at the rendez vous for this new issue, in terms of investor typology or geographical origin with issuers from more than 30 countries.

Figure of the month

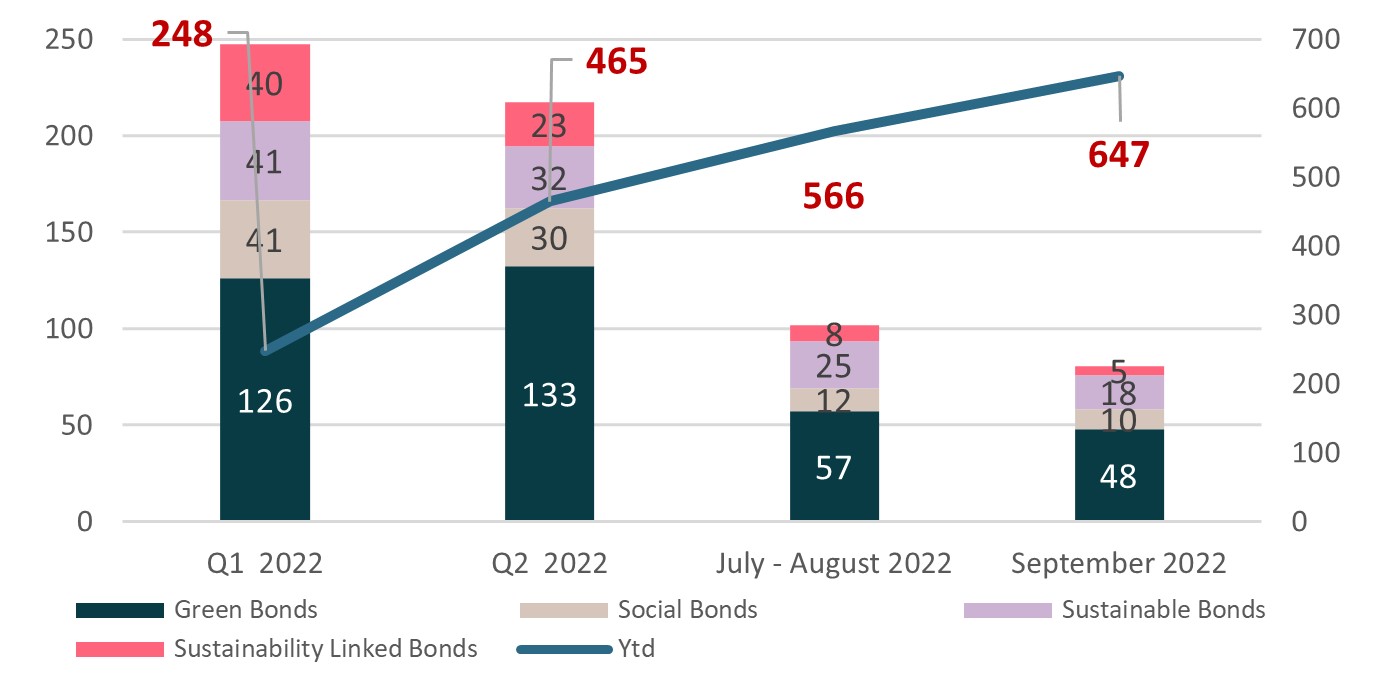

$81 billion of new sustainable issuances in September 2022.

By comparison, this figure was $125 bn in 2021, a 35% decrease in volume. Since the start of the year, the total volume of sustainable emissions has been $647 billion.

Dashboard

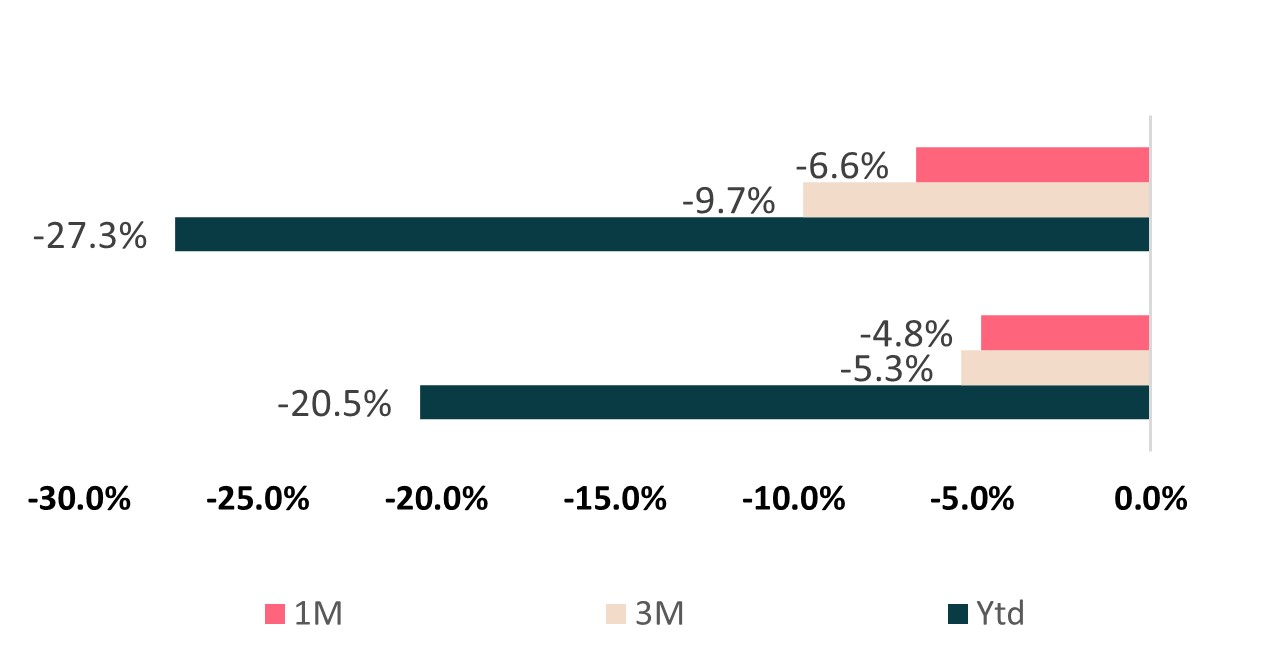

Market returns (%)

Data as of September 3Oth 2022 - Sources : Bloomberg MSCI Euro Green Bond Index et Bloomberg MSCI Global Green Bond Index

Sustainable issuances evolution ($ Bn)

Source : Bloomberg/Ostrum AM – Data as of September 30th 2022