Every month, find out all about the sustainable market bonds news in our newsletter

« MySustainableCorner ».

This month in a nutshell

- COP28 closed on Wednesday December 13th, 2023, in Dubai. For the first time in the COP history, countries around the world have approved a decision calling for a “transition” away from fossil fuels.

- Brazil issued its first Green bond for $2 billion. During the COP28, President Lula marks a break with his predecessor and calls on world leaders to "take concrete action and respect climate agreements“.

- Société Générale issued its first digital green bond for €10 million on a public blockchain. The two investors paid the transaction in CoinVertibles.

- France is the first member state of the European Union to transpose the European CSRD directive on corporate ESG reporting (French Official Journal of December 7th, 2023). Sustainability information will be subject to audit, like the audit of accounts.

- Climate Bond Initiative published a study demonstrating that global debt mark-ets could be a vital source to finance a Just Transition – fair and equitable, especially green, social, sustainable and sustainability-linked bonds*.

- The Global Reporting Initiative (GRI), an organization promoting standardized ESG reporting, published draft versions of two Climate Change and Energy Standards**.

Source : * https://www.lse.ac.uk/granthaminstitute/wp-content/uploads/2023/12/Mobilising-global-debt-markets-for-a-just-transition-policy-insight.pdf

** https://www.globalreporting.org/news/news-center/setting-the-standard-for-transparency-on-climate-change-impacts/

Figure of the month

Amount of sustainable bond issuances in November 2023 – mainly Green Bonds, euro issuances, in Europe, Middle East and Africa

Source: Bloomberg, November 2023

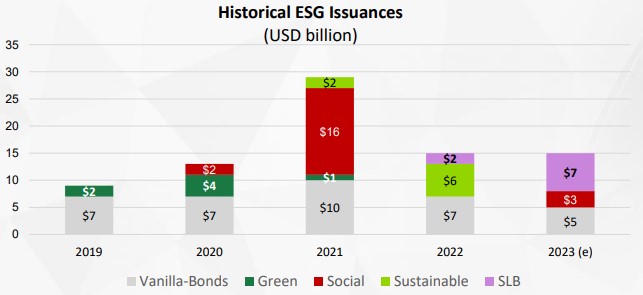

Chart of the month

Chile, an issuer of sustainable bonds of all types

At COP28, the country confirmed to be in favor of the 1.5°C target (not 2°C).

Source: SLB Framework (June, 2023) https://hacienda.cl/index.php/english/work-areas/international-finance/public-debt-office/presentations

Vanilla bonds: classic bonds. SLB : Sustainable-Linked Bonds