Processed food companies are highly dependent on the agribusiness sector. They therefore have a key role to play in protecting biodiversity. They also have a major interest in doing so, as the destruction of ecosystems has a direct impact on their business model and the long-term sustainability of their businesses. Adapting practices and changing behaviour is a vital response to consumer and shareholder expectations, whose awareness regarding the environmental impact of production methods and supply chains is increasing constantly. As an investor, Ostrum Asset Management (Ostrum AM) uses stewardship, dialogue and voting policy to curb the most harmful practices and encourage sustainable innovation.

In this context, industrial groups mass-producing consumer foods have set targets for each of the environmental, social and governance (ESG) pillars.

Environment: in the short term, preserving their brand image, reducing greenhouse gas (GHG) emissions, reducing water usage and recycling waste. In the medium term, preserving resources.

Social: in the short term, preserving consumer health, reducing product recall frequency. In the medium term, improving nutritional quality and increasing the proportion of organic products.

Governance: raising supply chain awareness issues (audit, internal control) and demanding greater transparency (ESG reporting, lobbying, taxation).

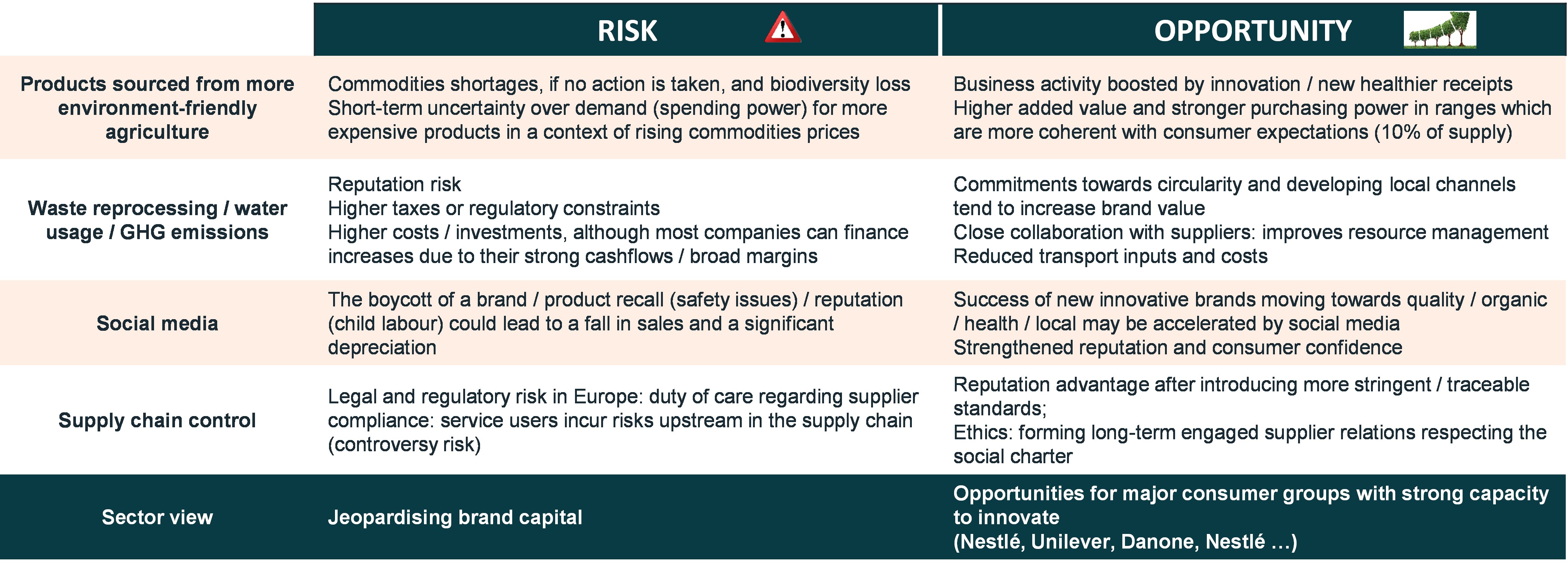

Changing practices can provide numerous opportunities for companies in the food industry. If no action is taken however, the risks are extremely great. Awareness is increasing.

1. Biodiversity loss: a major issue for companies in the food industry

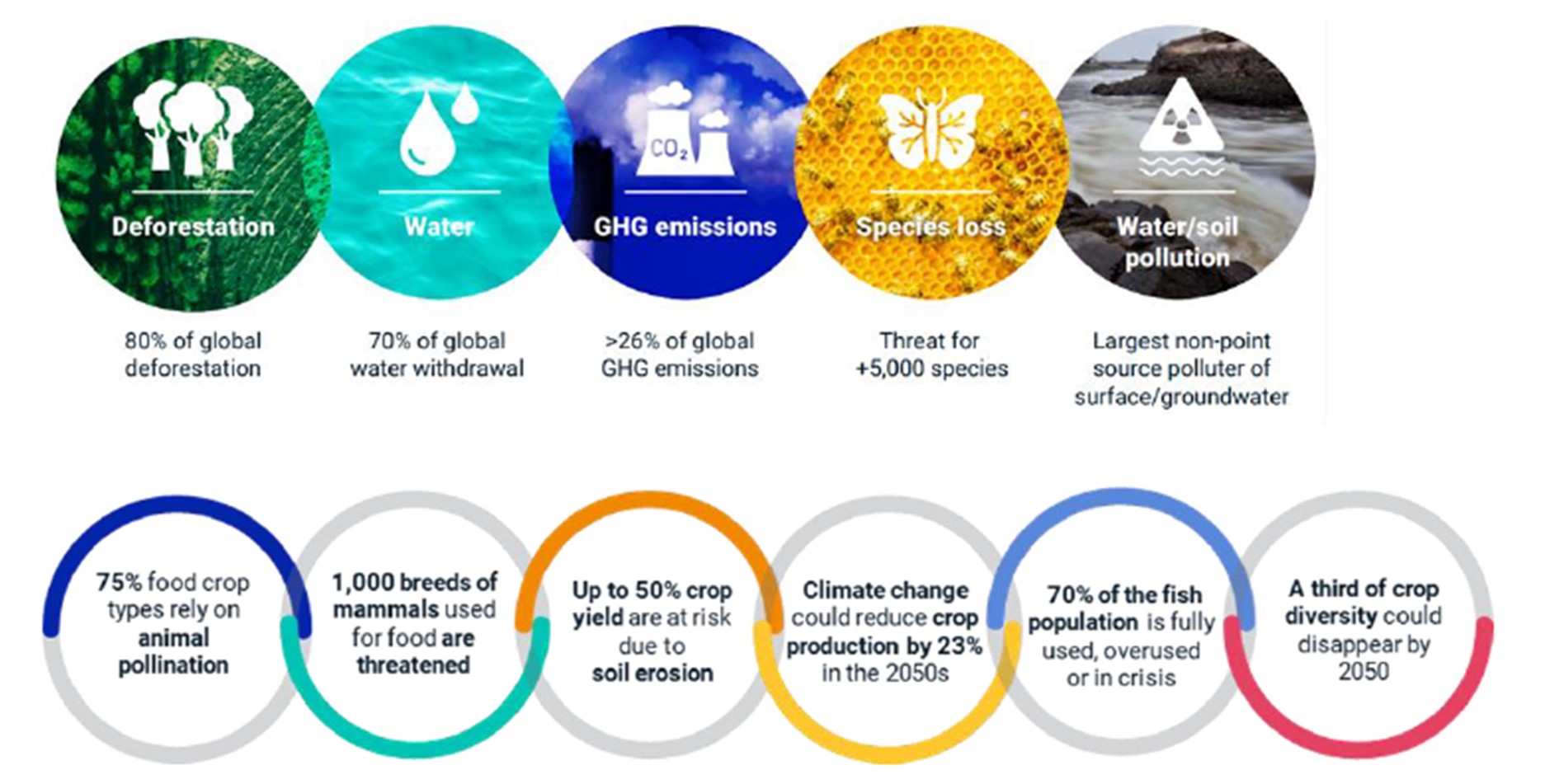

Soil erosion, water scarcity and the carbon impact of livestock farming are major challenges facing the agribusiness sector. According to Novethic, agriculture represents almost one quarter of global carbon emissions. However, agriculture is an indispensable source required to sustainably ensure sufficient quality food resources to feed a world population of over 9 billion by 2050.

Agriculture, a major impact on biodiversity loss

Source: The Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES)

Thirty percent of biodiversity loss is caused by changes in land and ocean usage. A further 23% is due to overexploitation, while climate change and pollution both account for 14%, with 11% resulting from rain forest destruction.

Food production has a major impact on climate, particularly agriculture, which, represents one quarter of all greenhouse gas emissions (Source: OurWorldIine Data, BNP). The impact on the environment is therefore a major issue, particularly as only one third of companies composing the MSCI Investable Market Indexes have implemented programmes to reduce greenhouse gases and the use of pesticides (Source: MSCI ESG Research).

Processed food companies are at the heart of the equation

Multinational food companies such as Danone, Unilever, Nestlé, Pepsico and Kellogg’s, dominate the food industry sector. These processing companies transform agricultural resources into everyday consumer products, which are retailed through dominant brands. These companies are therefore key intermediaries which can act to protect biodiversity.

A change of model is required to reduce the impact on biodiversity. Most major groups have already set this process in motion, although there is still much progress to be made.

Risks

Inaction would expose these groups to operational risks, including the medium-term risk of resources scarcity. In the shorter term, they are also facing legal risks, such as non-compliance with new regulations, including the current European directive regarding greater traceability, introduced as a means to curb deforestation. Risk associated with this directive can be as high as 4% of turnover. Other risks include controversies risk and higher taxation resulting from pollutive activities and water pollution. Reputation risk is also at stake, as a company’s image can be damaged. Further potential risks include market risk, due to pressure from shareholders, and financial risks resulting from funding difficulties, as investors take the biodiversity theme increasingly into account.

Opportunities

Major consumer goods groups are responding to the growing expectations among consumers regarding preserving the environment, which constitutes an opportunity through marketing used to strengthen brand image. This is the case with Lu, one of the Mondelez group brands in France, which is highlighting its partnership with farmers targeting sustainable wheat production (source: reportage France 5 on 16/11).

There are clear financial opportunities for companies and investors. Brand image is improved, market share increases and new value-added products can be developed with wider margins.

2. What measures can be implemented to adapt?

In order to adapt to climate change, regulatory requirements and investor and consumer expectations, companies have to implement adaptation measures. Biodiversity and the food industry are unilaterally linked, as their business models depend on ecosystem sustainability and restoration.

What are the range of measures that can be implemented to adapt?

• Contributing towards improving working conditions for livestock breeders / farming partners and promoting best practices, such as independently certified farms;

• Supply chain diversification among sites and global regions, with food multinationals already implementing this process, in order to avoid supply disruptions;

• Product traceability to avoid health risks (swine fever and contaminated products) including certification, such as the labels used by Fromageries Bel stating that milk products are sourced from cattle fed with no genetically modified (GM) products;

• Third-party supplier certification ensuring that supplies respect company charter engagements;

• Commitment to a percentage of energy / commodities from renewable sources / sustainable farming, particularly concerning base products causing deforestation, such as soya and palm oil;

• Selecting products sourced from sustainable farming, e.g. major groups including Nestlé, Unilever, Procter and Henkel have adopted a palm oil engagement charter;

• Using low-carbon supply transport fleets;

• Sustainable water resource use in product processing. Major groups have committed to specific 3 to 5-year water footprint targets;

• Reducing carbon emissions from production plants;

• Encouraging consumer trends. Habits and food production have begun to change over the past few years, taking animal health and wellbeing into account and also growing consumer climate change awareness. For example, meat product purchases have declined by 12% in France over the past ten years. Plant protein production used in human foods has risen by 7% per year, according to the Protéines France consortium composed of plant protein and new resources sector leaders.

Many groups, such as Danone, Nestlé and Upfield, have broadened their range of products using plant protein sources, in order to capture this growth market.

3. Several themes can be analysed to assess the extent to which biodiversity preservation is taken into consideration

The food industry must therefore change its practices in order to limit the economic and financial impact of biodiversity loss. A variety of themes can be analysed to assess the extent to which industrial groups have adapted, including water, soil and plastic waste management, commodities supply and deforestation commitments.

3.1 Water management

The processed food industry is a high-water consumer. Water management remains a key issue in this sector, despite the efforts already made.

Transition risks include potentially higher costs for industrial groups’ compliance with new national and European regulations, which are becoming increasingly stringent.

All major agribusiness players issue statements regarding their steady reduction of water usage required for production and are progressively adopting increasingly efficient water management technologies.

To avoid accidental environmental spillage, these companies protect water sources and rivers close to their industrial sites through dedicated systems. These groups must also ensure that production site outflow organic waste levels and temperatures comply with the regulations in force.

Waste water from industrial sites is mainly managed internally. These groups pre-manage waste water handled by third-parties.

In many cases, silt from water treatment plants can be re-used in other industries. Silts can be used as farmland fertilisers.

Given the number of production plants and countries involved in manufacturing processes, incidents cannot be ruled out. As a result, all of these groups are implementing increasingly sophisticated controls to avoid exposure to reputational risk for their brands, which represents a real major risk.

The brand image of the most advanced or virtuous companies is also strengthened by highlighting environmental efforts in their marketing campaigns.

Breweries case study

As an example, breweries have undertaken major efforts to reduce water consumption in their production processes. The brewing process requires vast quantities of water usage, including cooling and cleaning containers and materials, as well as soaking and washing spent grains, rinsing-out canalisations and filling machines, along with washing floors. Over the past 20 years, brewers have halved their water consumption by improving water management processes and practices, notably through more efficient hot water rinsing methods, recycling in the cooling and rinsing processes, along with new equipment and technologies.

Margin trends over the same period do not appear to have been impacted by these efforts. Other factors have influence margins, such as developing innovative products, particularly craft beers, local brands, alcohol-free brands and soda waters. Bolt-on growth has also been instrumental, due to consolidation in the sector.

3.2 Land management

Industrial food groups are indirectly responsible for land degradation and have also been impacted by this factor. Land degradation can lead to lower volumes, higher prices, shortages and reputation risk. Legislative measures obliging companies to review their practices is a source of opportunities, as these constraints will lead to the development of healthier and more ethical products, which strengthens brand image and provides a source of growth and improves brands.

Examples of the consequences of land depletion:

• Greater resource scarcity caused by higher natural risks, including drought and flooding;

• Commodities and partially processed goods purchase prices trending higher recently;

• Risks of supply difficulties in the event of a market shortage;

• Damaged company reputation due to unscrupulous practices among suppliers highlighted by NGOs or the media.

Soil preservation is a key theme that we take into consideration in analysing food multinationals’ environmental pillar, including Danone, Nestlé, Unilever and Barry Callebaut. These groups have committed to transforming their supply chain by promoting regenerative agriculture, in order to improve soil quality and human health and also ensure higher revenues for farmers. They are also progressively diversifying food production, in order to strengthen and restore soil biodiversity and protect high ecological value ecosystems.

This has involved establishing clear specification schedules with their suppliers, in order to guarantee products which are free of pesticide residues, through biodiversity-friendly practices, such as organic and mineral soil fertilisation and protecting plants using alternative techniques.

Highly virtuous models are beginning to emerge due to pressure from governments, public opinion and as agro-industrial groups aim to respond to growing awareness among consumers on these issues, by accompanying their suppliers:

• Developing agroecology to reduce emissions from chemical pesticides and restore the health of agricultural ecosystems;

• Diversifying crops through the emergence of new strains which consume less water and with a high protein content, like chick peas;

• Developing less meat-based product ranges to reduce livestock emissions and extending plant protein product ranges;

• More efficient land management by combating soil erosion and protection through reforesting.

3.3 Plastic waste management

Consumers are increasingly sensitive to plastic pollution from food and household product packaging. NGO reports in the past have highlighted that certain major groups contribute to global plastic pollution, which could harm their reputation and encourage consumers to switch towards products with less packaging, and also accelerate regulatory changes, including new taxes, which may differ by country.

Danone, Nestlé, Unilever, P&G and Colgate are among the majors which have signed the Ellen MacArthur Foundation Global Commitment targeting 100% reusable, recyclable or biodegradable plastic packaging by 2025. This move represents investments which are manageable for major groups which generate strong cashflow. They are also encouraged to switch to sustainable practices, as this engagement also improves company brand image.

Danone has announced 900 million euros of further investments in packaging during 2020/23. This sum represents a 20% capex increase, which can be easily integrated, as the group generates annual cashflow of around 3 billion euros.

Meanwhile, Nestlé will invest almost 2 billion Swiss francs, over the period spanning 2020/23, to switch from new plastic to recycled food-quality plastic and to develop new technologies. This investment will have little impact on the group’s annual free operating cashflow of between 6 and 7 billion.

This will not represent a standout factor for consumers however, as most companies are adopting similar plans, and these efforts will not weigh significantly on margins either. Nevertheless, these companies cannot afford to choose not to make these investments, as growing public awareness of plastic pollution could cause consumers to reject brands which fail to respect the environment.

Examples of virtuous practices and engagement exist in the domain of plastic waste management.

New plastic

Nestlé has committed to reducing its use of new plastics by one third between 2018 and 2025. Nestlé used 1.3 million tonnes of plastic packaging in 2020, including various stratified hybrid materials. This represents one third of total packaging used by the company. In 2020, recycled materials accounted for 35% of packaging. Recycled plastic accounted for 4.2% of plastic packaging.

Unilever has committed to halving the quantity of new plastic used in its packaging, by reducing plastic use by over 100,000 tonnes. The group currently uses 690,000 tonnes of plastic packaging.

Procter has committed to reducing its global new plastic use by 50% in its packaging by 2030.

Eliminating problematic plastic

Henkel has reduced its use of undetectable carbon-black packaging by 500 tonnes, by switching to carbon-free packaging in its toilet cleaner bottles. The group plans to scrap all undetectable carbon-black packaging use by 2025.

Increasing recycled content

Danone has increased its recycled content targets for 2025 from 25% to 50%, which it plans to achieve using 100% recycled PET* throughout Europe, chiefly in its water division. In 2019, Danone launched several 100% recycled PET bottles for its brands in France, Spain and Indonesia.

Nestlé has committed to investing around 2.2 billion dollars by 2025 to set up a market in recycled soft food-quality packaging, by paying a premium for recycled food-quality plastics.

Unilever has stated its aim to use solely reusable / recyclable / biodegradable plastic packaging by 2025. The group has committed to increasing the use of recycled plastic materials in its packaging to at least 25% by 2025, compared to 11% currently.

Packaging circularity is a priority for Danone. Half of the 2-billion-euro 2020/22 investment plan will be earmarked for this purpose. Danone has already committed to achieving 50% recycled PET* in its water division packaging by 2025. Its target in Europe is 100% for the same deadline.

Danone plans to stop using polystyrene in its yogurt pots from 2024 onwards in Europe and by 2025 worldwide. The Alpro brand inaugurated this move in 2021. Potential substitute products include glass, paper and recycled and organically-sourced PET.

* PET (polyethylene terephthalate) is an inert plastic material (i.e. it does not migrate in water), which is inalterable and totally neutral, authorised by all health & safety bodies.

PET is 100% recyclable. Recycled PET (rPET) comes from PET already used to produce packaging, such as plastic bottles. It is collected, sorted, cleaned and recycled to produce new packaging or products.

Increased collection, sorting and recycling rates

Companies also consider that they are responsible for encouraging recycling. As well as providing information regarding sorting advice to consumers, some groups, including Nestlé, Danone, Henkel and Unilever also support the development of dedicated recycling channels.

Most contribute to The Ocean Fund, managed by Circulate Capital. In collaboration with other major consumer goods and beverages groups, these companies invest together in waste collection, management and recycling infrastructures, initially in India and Indonesia.

At this stage, Nestlé is playing an active role in developing successful collection, sorting and recycling programmes in its operational countries. The group has identified 20 countries considered as “pioneer” states, in which it has focused its efforts to increase recycling rates, along with 12 other countries concentrating on plastic neutrality, involving collecting and co-managing an equivalent quantity to the amount of plastic contained in products sold. This scheme prevents further plastic waste flow into landfill sites and the oceans.

Plastic-free and biodegradablbrand innovation

At Unilever, plastic-free packaging innovation includes Signal brand bamboo toothbrushes, Knorr brand recyclable glass soup bottles and Carte D'Or brand paper ice cream tubs. Seventh Generation also offers a plastic-free range in its electronic commercial channels in the US, using steel packaging. Dove brand soap bars are now sold without plastic wrappers. We do not know the proportion of total products represented by these innovations. Although they remain marginal, they represent a source of innovation for development on a larger scale in the future.

Other solutions are being introduced such as refill-reuse schemes

An increasing number of brands are available through refill units, with pilot projects working on the logistics of making product refilling easy and user-friendly. In collaboration with major supermarkets, agro-industrial groups are testing models enabling shoppers to buy a container and refill it when required. Refills can be bought on-line or in-store, or from automatic distributors in shops.

3.4 Commodities supply and deforestation

According to experts, agriculture is the cause of 80% of global deforestation and the system currently in place is no longer tenable.

The main agricultural commodities processors such as Unilever, Danone and Nestlé, have taken decisive measures to restore biodiversity within their agricultural supply chains. These groups have put in place “tangible actions and innovative solutions to protect biodiversity and agricultural systems”, regarding soya, coffee and palm oil production.

Some of their products integrate plant-based ingredients (fats, proteins). We assess the extent of engagement adopted by groups, both in terms of nutritional quality and sustainable supply, notably to combat deforestation.

In 2020, 94.5% of palm oil came from RSPO certified and segregated channels for the major groups, including Nestlé, P&G and Kraft (RSPO: Roundtable on sustainable palm oil international organisation).

Danone has committed to sourcing 100% of its agricultural commodities produced in France from regenerative agriculture by 2025.

Regenerative agriculture involves farming practices aiming to protect soils and animal wellbeing and support farmers. It also includes conventional and organic farming.

An analysis of Unilever highlights the key efforts undertaken by major groups in the food industry which have provided a model for the broader sector. The company is continuing to progress in terms of sustainable supply, which now represents 65% of its agricultural commodities. This compares to 15% ten years ago. Twelve key commodities, representing 60% of purchases, are monitored for their sustainability.

The group now has 99% sustainable palm oil supply. This is a major step forwards which shelters the company from potential controversy and reputation risk, particularly given accusations in the past concerning tropical deforestation by third-party suppliers.

The company has committed to sourcing 100% of its supplies from sustainable farming and deforestation-free supply chains by 2023.

Unilever has set a target of 1 billion euros of sales in plant protein-based products between 2025 and 2027. Although this target appears high in absolute terms, further progress is still required given that it represents only around 3% of total food sales. Other major groups have set comparable levels, with targets of around 5%.

Bel, in its efforts to combat deforestation, uses paper and cardboard materials made from recycled fibres sourced from sustainably-managed forests. 96% of paper and cardboard packaging now includes recycled fibres or fibres certified as being sourced from responsibly-managed forests.

Soya

The question arises regarding major companies’ soyabean supplies, for their processed food products, and whether sourcing products from Brazil implies an indirect participation in deforestation. Certain companies, like the cheese producer Bel, are attempting to adjust their supply sources towards soyabean meal from more responsible countries and publish engagements on this topic in their report.

60% of deforestation due to agricultural commodities imports to Europe is caused by soya. In this context, we assess companies supporting more sustainable production models positively, prioritising soya alternatives and access to dairy cattle pastures. These themes are included in the Global Charter developed by groups including Bel.

We analyse actions implemented by the major groups to support responsible soyabean meal channels, by ensuring that they adopt sustainable solutions, with RSPO certification in order to define sustainable production standards. This involves supporting measures introduced to help local producers adopt more responsible production methods.

Danone secures 56,000 tonnes of soya supplies directly, for use in its plant-based products in Europe (Alpro) and America, sourced from deforestation-free regions.

60% of the soya used by Alpro is cultivated in Europe (France, Austria, Italy, the Netherlands and Belgium) and 40% in Canada. 100% of Alpro soya grains are certified ProTerra.

Regarding indirect soya sources used primarily for cattle feed, Danone has put in place projects to help farmers, by reducing their dependence on imported soya.

Almost 20% of soya used for dairy cattle feed is not traced at this stage however. Danone nonetheless mitigates this statistic, indicating that soya represents less than 5% of cattle feed.

Palm oil

Palm oil is an interesting example, as it demonstrates that poor supply chain management can incur major risk for the food industry. This factor particularly concerns food health & safety and also non-food products due to reputation risk, as consumer awareness is growing.

Most palm oil comes from Indonesia. Large areas of forests are burned in the region, in order to plant palm trees. As well as emitting large quantities of greenhouse gases into the atmosphere, which impact the climate, this practice also threatens biodiversity. These forests harbour many species such as orang-outans, Borneo pygmy elephants and Sumatra tigers. The whole ecosystem is perturbed. These types of plantations are therefore becoming increasingly controversial.

The use of palm oil in a broad range of food products and cosmetics is a key problem that major companies have been trying to resolve for several years, by sourcing sustainable palm oil in order to avoid future controversies concerning tropical deforestation. Companies are aware that reputation risk remains high. Information circulating rapidly through social media can undermine the legitimacy of a brand at any time.

4. The sector also faces social and governance issues

The food industry also faces social and governance risks, but to a lesser extent than environmental risks.

Limited social risks, low-key initiatives

The key risks incurred are the respect of social standards throughout the supply chain. Food companies must seek to avoid suppliers involved in child labour in emerging markets, particularly in Africa and India. They may also be concerned by controversies in coffee, cacao bean and tea plantations.

Other practices that we control in our analysis of companies include workforce reduction, the excessive use of subcontracting and temporary contracts. We also monitor restructuring plans following brand portfolio repositioning, after divestments and consolidation in higher value-added markets, and the delocalisation of production plants towards consumer markets.

Adaptation measures vary between players. Examples include best practices, such as independently certified farms respecting the engagements in company charters or improving working conditions among partner livestock breeders/farmers.

Governance : towards greater transparency?

In terms of governance, the food industry is subject to legal, regulatory and reputational risks. The practices we monitor closely include conflicts of interests, corruption, anti-competitive practices, insider information and tax optimisation.

Other controversies are also monitored carefully, such as price-fixing, particularly in Europe, or exposure to countries at war. These situations may lead to a boycott of products.

Companies also have responsibilities regarding their supplies, which may be exposed to regulatory and legal risk in Europe. They have a duty of care regarding their suppliers, as service users incur risks upstream in the supply chain. Companies therefore have to adapt their conduct and processes, through supply chain audits for example. They should support responsible supply channels, such as RSPO* certified sustainable palm oil, and ensure soya traceability, through RTRS* certification, and also back projects which reduce livestock breeders’ dependency on imported soya. Corporate social responsibility (CSR) measures can also ensure the quality of supply contracts, by establishing relations based on trust.

* RSPO: Roundtable on sustainable palm oil. RTRS: Round table on Responsible Soya, international organisations

Conclusion

Companies in the sector are not adapting their practices uniformly. The sector is dominated by giants however, which have made major progress and act as role models for smaller or less robust companies, which may not have the financial means required to adapt their value chains rapidly.

In the longer term, companies which fail to promote biodiversity may lose the trust of investors who will then switch to more sustainable investments. Reputation risk may weigh on product demand or lead to boycotts, exacerbated by the press and social media. Promoting biodiversity is also a requirement for these groups, as the viability and sustainability of their business models will depend on preserving ecosystems. We take this factor into consideration in our analysis of the strength of their business models.

Feeding the world in the future depends on the capacity to develop sustainable and regenerative agriculture, in harmony with producers. This will involve focusing closely on the issues of soil pollution, deforestation and waste management.

We believe that the impact of potentially revising supply circuits and incurring slightly higher costs is relatively absorbable, considering the billions returned to shareholders by agro-industrial companies, which generate strong cashflows, and also with regard to the two key issues at stake: brand franchise and preserving agricultural resources, which requires respect for the planet.

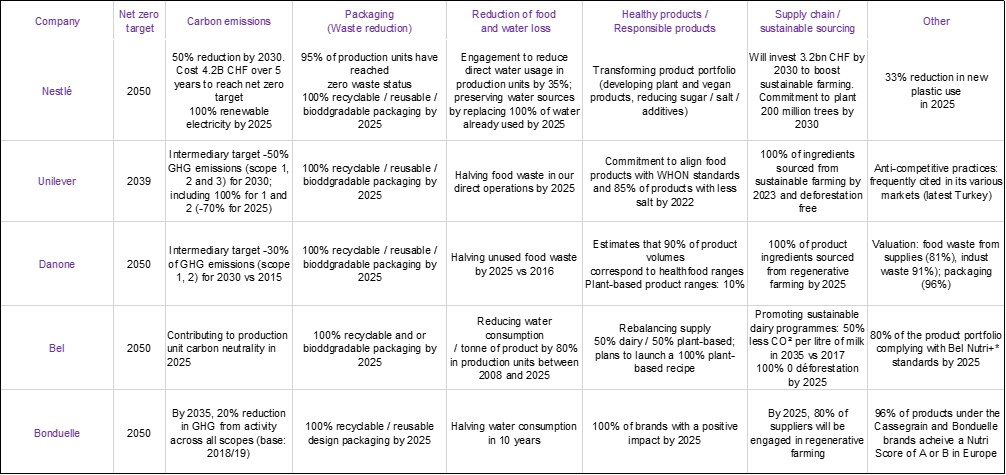

Summary of some of the major groups' commitments:

Source: Ostrum AM, and information available from the companies concerned, May 2022

Additional notes

Ostrum Asset Management

Asset management company regulated by AMF under n° GP-18000014 – Limited company with a share capital of 48 518 602 €. Trade register n°525 192 753 Paris – VAT: FR 93 525 192 753 – Registered Office: 43, avenue Pierre Mendès-France, 75013 Paris – www.ostrum.com

This document is intended for professional, in accordance with MIFID. It may not be used for any purpose other than that for which it was conceived and may not be copied, distributed or communicated to third parties, in part or in whole, without the prior written authorization of Ostrum Asset Management.

None of the information contained in this document should be interpreted as having any contractual value. This document is produced purely for the purposes of providing indicative information. This document consists of a presentation created and prepared by Ostrum Asset Management based on sources it considers to be reliable.

Ostrum Asset Management reserves the right to modify the information presented in this document at any time without notice, which under no circumstances constitutes a commitment from Ostrum Asset Management.

The analyses and opinions referenced herein represent the subjective views of the author(s) as referenced, are as of the date shown and are subject to change without prior notice. There can be no assurance that developments will transpire as may be forecasted in this material. This simulation was carried out for indicative purposes, on the basis of hypothetical investments, and does not constitute a contractual agreement from the part of Ostrum Asset Management.

Ostrum Asset Management will not be held responsible for any decision taken or not taken on the basis of the information contained in this document, nor in the use that a third party might make of the information. Figures mentioned refer to previous years. Past performance does not guarantee future results. Any reference to a ranking, a rating or an award provides no guarantee for future performance and is not constant over time. Reference to a ranking and/or an award does not indicate the future performance of the UCITS/AIF or the fund manager.

Under Ostrum Asset Management’s social responsibility policy, and in accordance with the treaties signed by the French government, the funds directly managed by Ostrum Asset Management do not invest in any company that manufactures, sells or stocks anti-personnel mines and cluster bombs.

Natixis Investment Managers

This material has been provided for information purposes only to investment service providers or other Professional Clients, Qualified or Institutional Investors and, when required by local regulation, only at their written request. This material must not be used with Retail Investors.

To obtain a summary of investor rights in the official language of your jurisdiction, please consult the legal documentation section of the website (im.natixis.com/intl/intl-fund-documents)

In the E.U.: Provided by Natixis Investment Managers International or one of its branch offices listed below. Natixis Investment Managers International is a portfolio management company authorized by the Autorité des Marchés Financiers (French Financial Markets Authority - AMF) under no. GP 90-009, and a public limited company (société anonyme) registered in the Paris Trade and Companies Register under no. 329 450 738. Registered office: 43 avenue Pierre Mendès France, 75013 Paris. Italy: Natixis Investment Managers International Succursale Italiana, Registered office: Via San Clemente 1, 20122 Milan, Italy. Netherlands: Natixis Investment Managers International, Nederlands (Registration number 000050438298). Registered office: Stadsplateau 7, 3521AZ Utrecht, the Netherlands. Sweden: Natixis Investment Managers International, Nordics Filial (Registration number 516412-8372- Swedish Companies Registration Office). Registered office: Kungsgatan 48 5tr, Stockholm 111 35, Sweden. Or,

Provided by Natixis Investment Managers S.A. or one of its branch offices listed below. Natixis Investment Managers S.A. is a Luxembourg management company that is authorized by the Commission de Surveillance du Secteur Financier and is incorporated under Luxembourg laws and registered under n. B 115843. Registered office of Natixis Investment Managers S.A.: 2, rue Jean Monnet, L-2180 Luxembourg, Grand Duchy of Luxembourg. Germany: Natixis Investment Managers S.A., Zweigniederlassung Deutschland (Registration number: HRB 88541). Registered office: Senckenberganlage 21, 60325 Frankfurt am Main. Belgium: Natixis Investment Managers S.A., Belgian Branch, Gare Maritime, Rue Picard 7, Bte 100, 1000 Bruxelles, Belgium. Spain: Natixis Investment Managers, Sucursal en España, Serrano n°90, 6th Floor, 28006 Madrid, Spain.

In Switzerland: Provided for information purposes only by Natixis Investment Managers, Switzerland Sàrl, Rue du Vieux Collège 10, 1204 Geneva, Switzerland or its representative office in Zurich, Schweizergasse 6, 8001 Zürich.

In the British Isles: Provided by Natixis Investment Managers UK Limited which is authorised and regulated by the UK Financial Conduct Authority (register no. 190258) - registered office: Natixis Investment Managers UK Limited, One Carter Lane, London, EC4V 5ER. When permitted, the distribution of this material is intended to be made to persons as described as follows: in the United Kingdom: this material is intended to be communicated to and/or directed at investment professionals and professional investors only; in Ireland: this material is intended to be communicated to and/or directed at professional investors only; in Guernsey: this material is intended to be communicated to and/or directed at only financial services providers which hold a license from the Guernsey Financial Services Commission; in Jersey: this material is intended to be communicated to and/or directed at professional investors only; in the Isle of Man: this material is intended to be communicated to and/or directed at only financial services providers which hold a license from the Isle of Man Financial Services Authority or insurers authorised under section 8 of the Insurance Act 2008.

In the DIFC: Provided in and from the DIFC financial district by Natixis Investment Managers Middle East (DIFC Branch) which is regulated by the DFSA. Related financial products or services are only available to persons who have sufficient financial experience and understanding to participate in financial markets within the DIFC, and qualify as Professional Clients or Market Counterparties as defined by the DFSA. No other Person should act upon this material. Registered office: Unit L10-02, Level 10 ,ICD Brookfield Place, DIFC, PO Box 506752, Dubai, United Arab Emirates

In Japan: Provided by Natixis Investment Managers Japan Co., Ltd. Registration No.: Director-General of the Kanto Local Financial Bureau (kinsho) No.425. Content of Business: The Company conducts investment management business, investment advisory and agency business and Type II Financial Instruments Business as a Financial Instruments Business Operator.

In Taiwan: Provided by Natixis Investment Managers Securities Investment Consulting (Taipei) Co., Ltd., a Securities Investment Consulting Enterprise regulated by the Financial Supervisory Commission of the R.O.C. Registered address: 34F., No. 68, Sec. 5, Zhongxiao East Road, Xinyi Dist., Taipei City 11065, Taiwan (R.O.C.), license number 2020 FSC SICE No. 025, Tel. +886 2 8789 2788.

In Singapore: Provided by Natixis Investment Managers Singapore Limited (company registration no. 199801044D) to distributors and qualified investors for information purpose only.

In Hong Kong: Provided by Natixis Investment Managers Hong Kong Limited to professional investors for information purpose only.

In Australia: Provided by Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) and is intended for the general information of financial advisers and wholesale clients only .

In New Zealand: This document is intended for the general information of New Zealand wholesale investors only and does not constitute financial advice. This is not a regulated offer for the purposes of the Financial Markets Conduct Act 2013 (FMCA) and is only available to New Zealand investors who have certified that they meet the requirements in the FMCA for wholesale investors. Natixis Investment Managers Australia Pty Limited is not a registered financial service provider in New Zealand.

In Colombia: Provided by Natixis Investment Managers International Oficina de Representación (Colombia) to professional clients for informational purposes only as permitted under Decree 2555 of 2010. Any products, services or investments referred to herein are rendered exclusively outside of Colombia. This material does not constitute a public offering in Colombia and is addressed to less than 100 specifically identified investors.

In Latin America: Provided by Natixis Investment Managers International.

In Uruguay: Provided by Natixis Investment Managers Uruguay S.A., a duly registered investment advisor, authorised and supervised by the Central Bank of Uruguay. Office: San Lucar 1491, Montevideo, Uruguay, CP 11500. The sale or offer of any units of a fund qualifies as a private placement pursuant to section 2 of Uruguayan law 18,627.

In Mexico: Provided by Natixis IM Mexico, S. de R.L. de C.V., which is not a regulated financial entity, securities intermediary, or an investment manager in terms of the Mexican Securities Market Law (Ley del Mercado de Valores) and is not registered with the Comisión Nacional Bancaria y de Valores (CNBV) or any other Mexican authority. Any products, services or investments referred to herein that require authorization or license are rendered exclusively outside of Mexico. While shares of certain ETFs may be listed in the Sistema Internacional de Cotizaciones (SIC), such listing does not represent a public offering of securities in Mexico, and therefore the accuracy of this information has not been confirmed by the CNBV. Natixis Investment Managers is an entity organized under the laws of France and is not authorized by or registered with the CNBV or any other Mexican authority. Any reference contained herein to “Investment Managers” is made to Natixis Investment Managers and/or any of its investment management subsidiaries, which are also not authorized by or registered with the CNBV or any other Mexican authority.

In Brazil: Provided to a specific identified investment professional for information purposes only by Natixis Investment Managers International. This communication cannot be distributed other than to the identified addressee. Further, this communication should not be construed as a public offer of any securities or any related financial instruments. Natixis Investment Managers International is a portfolio management company authorized by the Autorité des Marchés Financiers (French Financial Markets Authority - AMF) under no. GP 90-009, and a public limited company (société anonyme) registered in the Paris Trade and Companies Register under no. 329 450 738. Registered office: 43 avenue Pierre Mendès France, 75013 Paris.

The above referenced entities are business development units of Natixis Investment Managers, the holding company of a diverse line-up of specialised investment management and distribution entities worldwide. The investment management subsidiaries of Natixis Investment Managers conduct any regulated activities only in and from the jurisdictions in which they are licensed or authorized. Their services and the products they manage are not available to all investors in all jurisdictions. It is the responsibility of each investment service provider to ensure that the offering or sale of fund shares or third party investment services to its clients complies with the relevant national law.

The provision of this material and/or reference to specific securities, sectors, or markets within this material does not constitute investment advice, or a recommendation or an offer to buy or to sell any security, or an offer of any regulated financial activity. Investors should consider the investment objectives, risks and expenses of any investment carefully before investing. The analyses, opinions, and certain of the investment themes and processes referenced herein represent the views of the portfolio manager(s) as of the date indicated. These, as well as the portfolio holdings and characteristics shown, are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material. The analyses and opinions expressed by external third parties are independent and does not necessarily reflect those of Natixis Investment Managers. Past performance information presented is not indicative of future performance.

Although Natixis Investment Managers believes the information provided in this material to be reliable, including that from third party sources, it does not guarantee the accuracy, adequacy, or completeness of such information. This material may not be distributed, published, or reproduced, in whole or in part.

All amounts shown are expressed in USD unless otherwise indicated.

Natixis Investment Managers may decide to terminate its marketing arrangements for this product in accordance with the relevant legislation