Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO Letter

A strong dollar as a challenge to BRICS expansion

At the end of the summer, the US economy keeps posting solid growth whilst surveys point to a downturn in Europe and China continues to face the lasting consequences of the collapse of its real estate sector. This situation results in an ever-stronger US dollar. The strength of the greenback may seem paradoxical at a time when the enlargement of the BRICS to 11 countries aims for greater integration of this part of the world and less dependence on the US currency. In fact, capital outflows from China intensify and the Chinese yuan plummets.

The September-October period was often marked by financial turbulence. Central banks, with the exception of the PBoC, continue to face inflation much higher than their targets. The risks to price stability have increased with the rebound in oil to $90 a barrel of Brent and the climatic pressure on food prices. Social conflicts (automotive in the United States, LNG in Australia) remind us of the inertia of wage demands. Inflation is not yet under control. For this reason, central banks will keep interest rates high until mid-2024.

The rise in bond yields is stronger in the United States (4.20% on the 10-year bond). The Fed's posture and the state's refinancing needs are weighing on the Treasuries market. The Bund (around 2.60%) remains weighed down by a mediocre economy in the euro area. The bond market will, however, have to digest the contraction of the ECB's balance sheet. Credit spreads are likely to be affected by the economic situation and monetary tightening as European equities, flat since February, remain dependent on the ability of companies to maintain their profit margins.

Economic Views

Three themes for the markets

-

Monetary policy

At Jackson Hole, the Fed and the ECB confirmed their restrictive bias. The Fed is expected to make one final rate hike this year, despite divergent views within the FOMC. The ECB raised rates to 4% in September, and will maintain status quo on rates for as long as necessary to curb inflation. Against the trend, China has lowered several of its main interest rates and the reserve requirement ratio in order to support its real estate sector.

-

Inflation

This summer was marked by a surge in inflation, linked to the rebound in energy prices. In the United States, inflation increased to 3.2% in July, reversing its downward trend that had prevailed since June 2022. In the Eurozone, inflation remained above 5%. Wage inertia in the Eurozone should keep underlying inflation high. In China, inflation remains very low at 0.1% for the month of August. In Asia, the rise in rice prices is notable.

-

Growth

The growth differential remains in favor of the United States, which explains the strength of the dollar. US growth remains driven by consumption, supported by the resilience of the labor market. Whilst the euro area skirted recession in the first half, the deterioration in employment prospects makes the outlook more uncertain. In China, the latest economic indicators for the month of August indicate a stabilization of activity. However, the real estate sector remains a drag on the recovery.

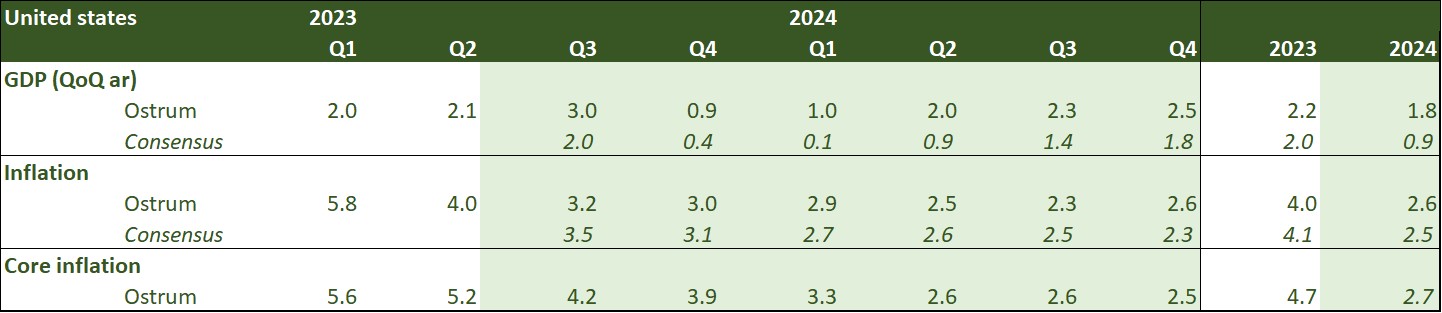

Key macroeconomic signposts : United States

- The US economy has been able to maintain surprisingly strong growth since the start of the year. The slowdown in employment is more gradual than expected and fiscal support is much stronger.

- GDP growth for 3Q 2023 should be solid after July retail sales. Disinflation supports demand especially as wage increases are more inert. A setback is likely in 4Q 2023 as student debt payments resume (worth 0.2/0.3 pp of disposable income affecting 43 million Americans). Default rates on consumer debt are also normalizing.

- Housing investment is gathering pace after a prolonged period of contraction. The upswing may drive consumption in equipment goods and furniture.

- The federal deficit rose due to individual income taxes (notably lower capital gains realized in 2022). The implementation of the CHIPS Act also leads to an increase in federal spending. Business equipment spending is stagnating with the exception of technology. Accelerating investment in AI should translate into more investment in R&D.

- Foreign trade is expected to suffer amid consumer strength, but exports of energy products constitute a source of growth.

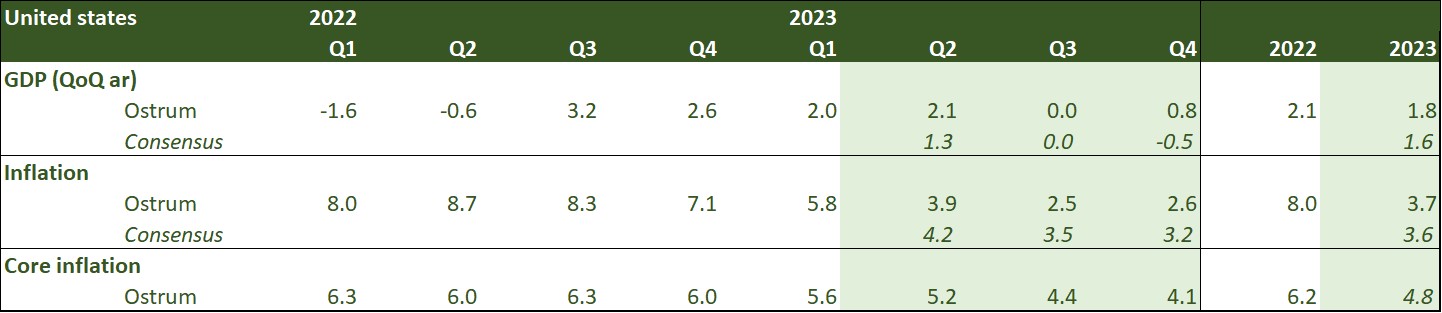

Key macroeconomic signposts : Euro area

- The Eurozone has proven resilient in the face of the energy shock. It did not experience a recession, but growth remained sluggish at the turn of the year. This is the result of measures taken by governments and the rebound in post-covid demand in services. Growth remained weak in Q2 (0.1%), with households remaining affected by continued high inflation.

- The performances are mixed. German growth was sluggish in Q2 after experiencing a recession. It suffers from its greater dependence on Russian energy before the war in Ukraine, the greater weight of the manufacturing sector in its economy and its greater dependence on foreign trade, more specifically with China, whose growth is disappointing.

- Domestic demand remains affected by the loss of purchasing power and the gradual impact of the strong monetary tightening by the ECB. Among the largest Eurozone economies, only Spain saw its internal demand rebound in Q2.

- All the surveys deteriorated this summer and revealed a spread of weakness from the manufacturing sector to the services sector. Production and new orders are contracting. In this context, business leaders are becoming more cautious and stop increasing their workforce according to surveys. The labor market, which remained robust, should therefore lose momentum.

- Business investment should continue to benefit from NextGeneration EU funds and the need to invest in renewable energy.

- In this context, we are revising our forecasts for Q3 and Q4 downwards. Growth should contract again in Germany and slow in the other countries.

Key macroeconomic signposts : China

- Chinese economic activity slowed this summer. The housing crisis and the lack of visibility on the labor market outlook have negatively affected the morale and spending of Chinese households.

- The housing crisis has spread across the economy and financial markets, worsening investor sentiment.

- Thus, China has decided to lower the interest rate on about CNY 38.6 trillion worth of real estate loans. This measure should cover 90% of loans. The bank deposit rate should also be lowered to preserve commercial bank margins.

- This measure allows for a transfer to households and is equivalent to -10 bps reduction in the 1-year rate of the medium-term loan facility.

- Adding the previous rate cuts, the effect on Chinese growth is expected to materialize in the coming quarters.

- We have revised our Q3 growth forecast downwards and expect a gradual rebound in growth.

- However, to significantly raise our growth forecasts, China must restructure the debt of local government financing vehicles. Their role goes far beyond infrastructure funding. LGFV have stakes in Chinese non-financial companies generating additional financial vulnerabilities.

- The cyclical and structural slowdown calls for reform of local governments and state-owned enterprises.

- The PBoC lowered its weighted reserve requirement ratio to 7.4% in September.

Monetary Policy

Last rate hike before a prolonged status quo

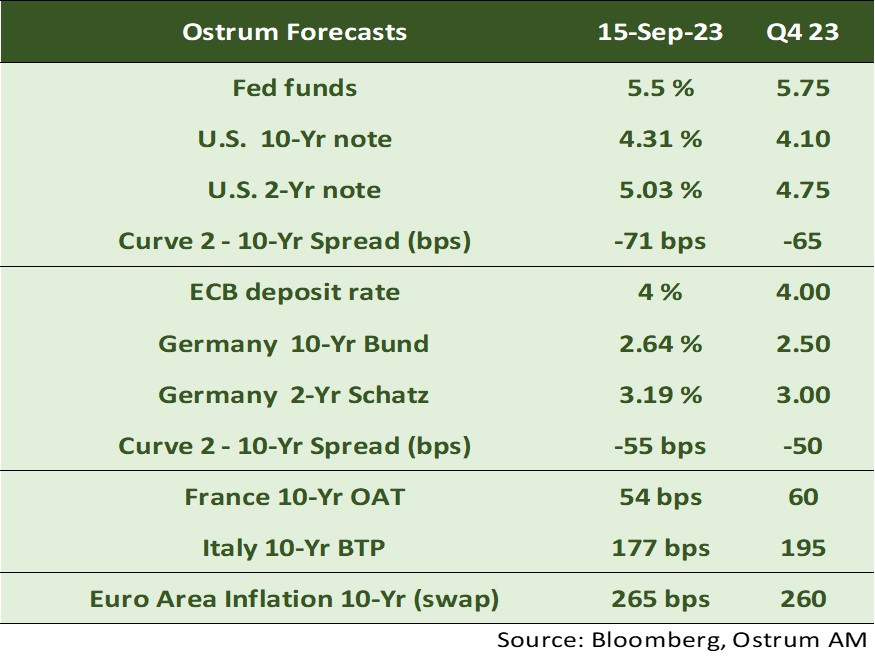

- Fed: +25 bp in September and status quo until Q2 2024

Stronger-than-expected growth, a job market that is only gradually slowing and inflation that is still higher than the target should lead the Fed to raise its rates one last time at the September 20 meeting. Subsequently, it should maintain them at this restrictive level long enough to allow inflation to return to around 2% in the medium term. We do not anticipate rate cuts from the Fed before the 3rd quarter of 2024. - ECB: A final rate hike to curb inflation

Despite the unprecedented monetary tightening carried out by the ECB (+425 bp rate increases in 1 year), inflation in the Eurozone remains well above the target of 2% (5.3% in August) and the moderation in core inflation is too slow (5.3%). This is mainly linked to tensions in the service sector due to wage increases. This is the reason why the ECB raised rates on September 14. We anticipate that it will be the last rate hike. - Monetary policy divergence

The Bank of England is expected to raise its rates by another 50 bp by the end of the year due to inflation still being too high, the Bank of Japan may maintain its negative interest rate policy until it is assured of a durable rise in wages and inflation and China is easing its monetary policy due to slowing growth and almost zero inflation.

Market views

Asset classes

- US rates: The Fed is likely to raise rates to 5.75% and leave rates unchanged through mid-2024. T-note note yields are forecasted to drift lower to 4.10% by year-end.

- European rates: the ECB will maintain status quo at 4% on the deposit rate until the second half od 2024. The Bund yields should trade sideways amid slower economic growth.

- Sovereign spreads: valuations are rich considering the challenging backdrop for public finances in both France and Italy. Ratings could be under pressure.

- Eurozone inflation: ECB monetary tightening and lower medium-term inflation forecasts should weigh on breakeven inflation over the months to come.

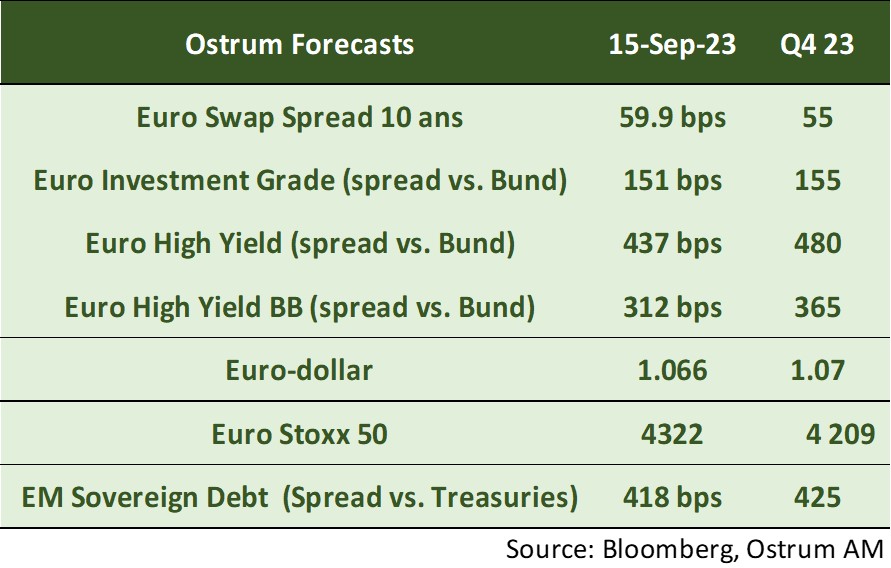

- Euro credit: IG credit spreads should rise modestly due to heavy bond issuance and signs of economic slowdown. High yield spreads are forecasted to widen and decompress given the richness of the single-B segment.

- Foreign exchange: the euro should trade sideways around 1.07 as ECB tightening is offset by slower growth and declining terms of trade.

- Equities: sideways drift this summer then decline at the end of the year reflecting slightly lower margins.

- Emerging debt: spreads are near our year-end target.