Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO Letter

What landing?

Monetary tightenings never have linear effects. There’s always a point where rate hikes break economic momentum. Is Silicon Valley Bank this inflection point? We do not think so, on the one hand because SVB was mostly a specific case, with management errors also characteristic. But also, and especially, because the reactions of the authorities have considerably reduced the liquidity risks for the American banking system. The ECB’s anti-fragmentation instrument allows the ECB to raise rates without fear of risk on the peripheries. Similarly, the reaction of the Fed puts the banking system under control and allows to continue the rate hikes made necessary by an inflation that settles more and more at an elevated level. Paradoxically, SVB rather confirms the trend: the Fed’s desire to avoid a systemic risk, “whatever it takes”, in order to have degrees of freedom on monetary policy and finally reduce inflation to a more tolerable level.

In this scenario part of the monetary tightening in the United States will be the consequence of stress on the banking system. This, in part, delivers what the Fed wants, a tightening, but it does not challenge the trend.

In this case, the central scenario is soft landing on both sides of the Atlantic, a severe crisis or recession is not the central scenario. Which landing for the economy? A soft landing. With growth that remains very soft and probably below potential. Short rates should therefore continue to rise, with long rates as well. As inflation eases, with a more moderate outlook in 2024, markets could anticipate rate cuts in 2024. Central banks are expected to keep their key interest rates at their peak until 2024, but long-term rates could begin to ease at the end of the year. The highest would be reached by mid-year. This is a weak environment for risky assets, which were already highly valued and seem to offer little upside potential. We remain cautious.

The alternative scenario, of course, is where SVB, Signature, and Credit Suisse are indeed a tipping point and we’re heading right into a systemic crisis. Plausible scenario, but it is too early to make it the central scenario.

Economic Views

Three themes for the markets

-

Monetary policy

The task of central banks (Fed, ECB) is becoming more complicated. Added to the risk linked to inflation that is still too high is that weighing on the stability of the financial system following the bankruptcy of 2 American banks and the tensions on Credit Suisse in Europe. The Fed has taken major measures to avoid the risk of contagion and the ECB has reassured about the resilience of the European banking system and says it is ready to do what is necessary if needed. This allows them to continue their rate hikes to bring their monetary policy back into more restrictive territory and fight inflation.

-

Inflation

Inflation continues to moderate due to lower energy prices. The problem remains underlying inflation, which crystallizes domestic tensions. It accelerated to a historic high in the Eurozone (5.6%) and remains high in the United States (4.7% for the PCE). This reflects the continued diffusion of higher energy prices within the economy as well as wage pressures. The strong inertia means underlying inflation will remain high at the end of the year. The reopening of China will weigh on the price of raw materials.

-

Growth

Growth remains resilient. The Eurozone escaped recession thanks to government support measures and the sharp drop in gas prices. Growth is expected to firm up slightly over the course of the year, supported by domestic demand. In the United States, growth is robust at the start of the year, driven in particular by household consumption. The real estate market tends to stabilize. Growth should tend towards 0 in the 2nd half of the year due to the impact of the strong monetary tightening carried out by the Fed.

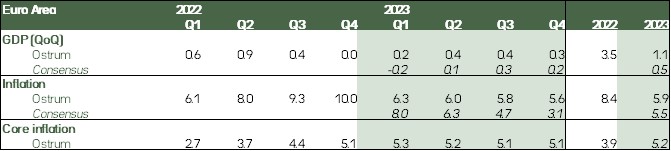

Key macroeconomic signposts : euro area

- We expected a very moderate recession in Q4 2022 and Q1 2023. The figures published for Q4 actually show a stabilization of the economy. On the other hand, the evidence for this year’s Q1 shows growth, albeit low, but in all probability positive.

- As a result, the growth carry-over at the end of 2022 was already 0.4%. With moderate growth, average growth over the rest of the year should therefore be in the 0.5/1.0% range.

- The relative decline in inflation and the rise in wages, but also in government subsidies, should keep the purchasing power of wages at a very slightly positive level. Consumption would then be slightly upward over the year. Similarly, the accumulated investment lag should allow capex to progress, again moderately.

- As a result, we have a GDP trajectory that is still mediocre but displays a little acceleration at mid-year. This puts us on the high side of the consensus.

- A fundamental point in our forecast is the inflation trajectory. It’s declining rapidly until this summer, largely because of the basic effects on the energy component. But the underlying part remains very stable, and should not fall below 5% by the end of the year. This leads to a high year-end landing, above 5% over the last quarter. This is fundamental to monetary policy.

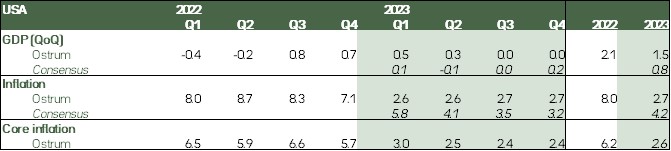

Key macroeconomic signposts : USA et al.

- Rising rates are a drag on growth, with the most directly exposed sectors, including real estate, showing very strong signs of slowing. While the figures available for the first quarter show, once again, a very resilient economy, on the other hand we think that the economy will approach recession at the end of the year.

- The U.S. economy has shown an unusual ability to absorb rate hikes. We believe that structural changes explain this resistance. As a result, we think the “soft landing” scenario is more likely than the “hard landing” scenario.

- The bankruptcies of SVB and Signature are a warning shot: we do not think this constitutes the beginning of a systemic crisis, the much more pessimistic alternative scenario can however be ruled out even if its probability is limited.

- Finally, continued inflation above the Fed target remains the most likely scenario. Wage pressures in particular remain high. Again, this is a structuring element for the Fed.

- It should also be noted that China is rapidly reopening. This implies more sustained global growth, an improvement in the latest production problems related to supply chains, but also new potential inflationary pressures on raw materials. The reopening of China therefore bears out the idea of growth that surprises upward, as well as inflation.

Monetary Policy

Need to continue rate hikes to fight high inflation

- The Fed acts urgently to maintain financial stability

During the Humphrey Hawkins speech, Jerome Powell signaled that the Fed was ready to step up the pace of its rate hikes due to stronger than expected core inflation and an extremely tight labor market, leaving the door open for a 50 bp rise in March. A few days later, the bankruptcies of the SVB and Signature System banks led the Fed to take emergency measures via the establishment of a new bank loan facility. This avoids contagion to the entire banking system and thus allows the continuation of Fed rate hikes to combat high inflation. The pace should be 50 bps, on March 22, then 25 bps in May, followed by an extended status quo. - ECB: "Inflation should remain too high, for too long"

As it reported in February, the ECB raised rates by 50 bps on March 16 to bring the deposit rate to 3%. This time, it was careful not to indicate what it intended to do next time, insisting that it would depend on the data. It is closely monitoring the current tensions in the markets and says it is ready to act if necessary to guarantee price stability and financial stability. Continued high core inflation (4.6% expected in 2023, 2.5% in 2024 and 2.2% in 2025, according to ECB staff) argues for further rate hikes and prolonged maintenance in restrictive territory. We anticipate two more rate hikes of 50 bp in May and June, then 25 bp in July. - Kazuo UEDA will have to normalize the monetary policy of the BoJ

During his hearing before Parliament for his confirmation, Kazuo Ueda subscribed to the continuity of the current monetary policy. High inflation is not sustainable since it is linked to temporary factors such as the rise in the prices of imported goods. The BoJ is therefore not ready to abandon its negative interest rate policy. On the other hand, the yield curve control parameters should probably be modified by the summer.

Strategic Views

Central banks between inflation and banking risks

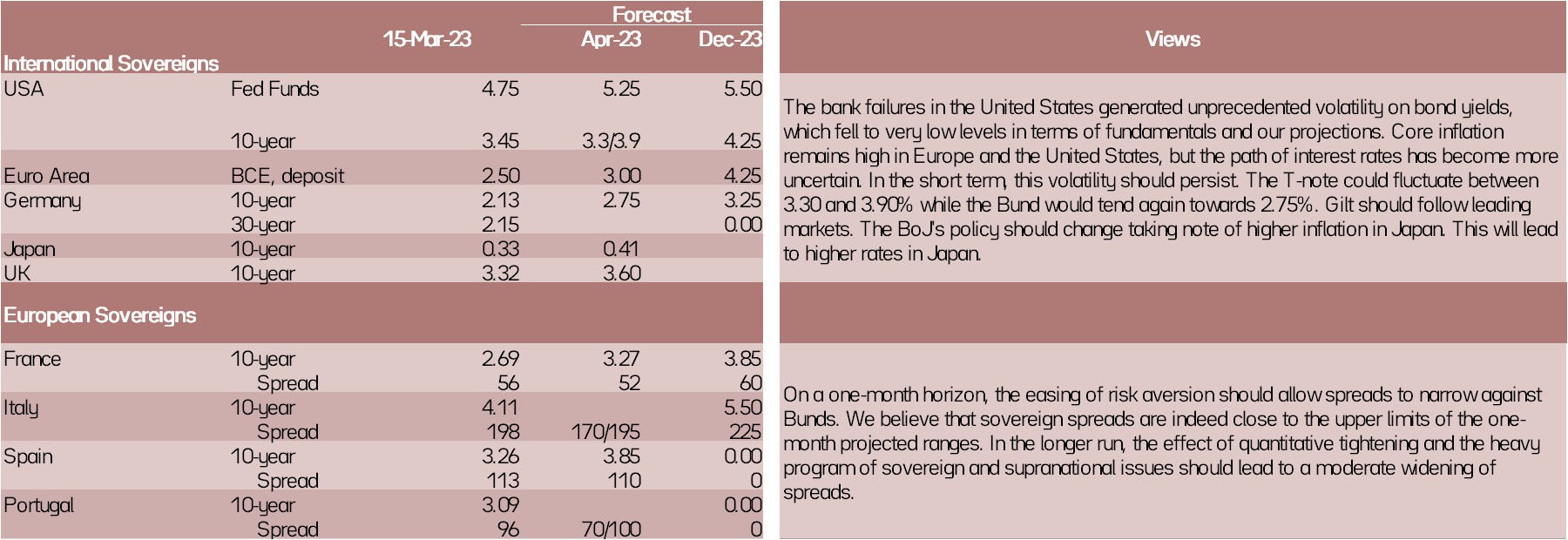

Synthetic market views: the specter of financial stress

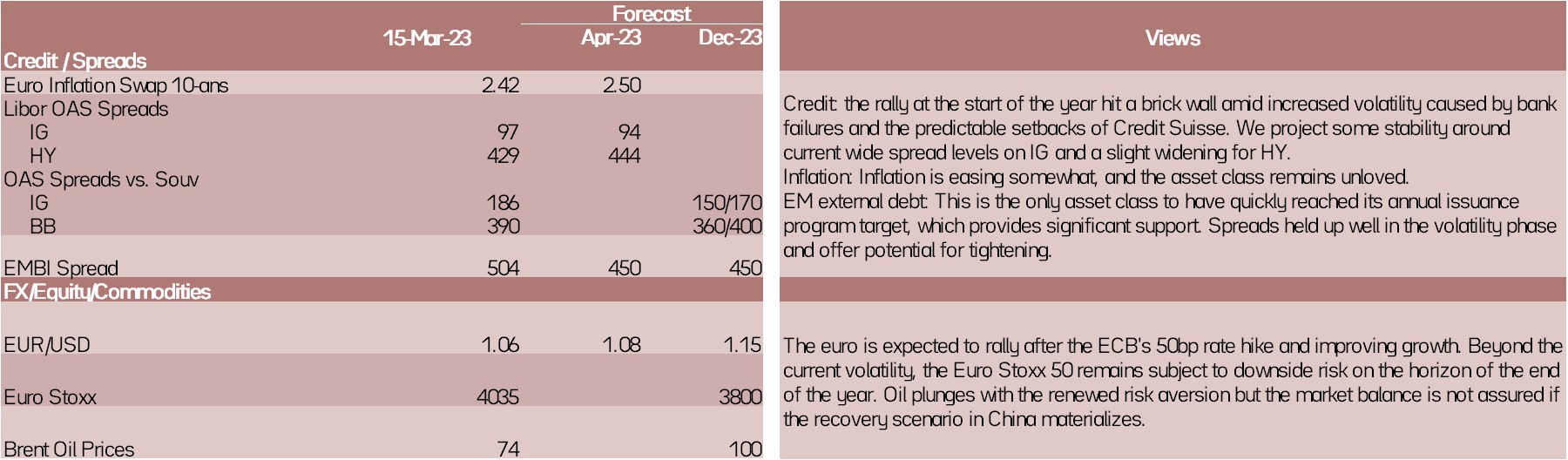

The outlook of an economy that seemed resilient, even overheated, has darkened with bank failures in the United States and the resurgence of financial stress on some European institutions. The knee-jerk reaction of the financial markets is always to consider rapid monetary relief, but nothing is less certain in the present context of high inflation. Volatility however sets in. Swap spreads, on short-term maturities, are widening and call for some caution on credit. Sovereign debt, on the other hand, is well bid.

Allocation recommendations: warning shots

Volatility increased everywhere including on the "risk-free" asset. The ECB is now refusing to comment on its next moves, which should help reduce uncertainty and volatility in the short term. Equity markets should stabilize, despite the likely gradual rise in long-term rates from current crisis levels (around 2.75% on Bunds). Credit spreads seem able to stabilize thanks to attractive valuations, while high yield should tighten further. Emerging sovereign debt seems spared and offers tightening potential.

Asset classes