Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

Economic Views

Three themes for the markets

-

Monetary policy

The major central banks are expected to raise rates in July in line with their June statements. The Fed will raise Fed funds rates to 5.50% and the ECB will set the deposit rate at 3.75%. A final hike in September appears likely. In the euro area, the contraction in the balance sheet is accelerating with the repayment of TLTRO (€477 billion in June) and the end of APP reinvestments from July 1 (€148 billion in the second half). Other central banks have toughened up their stances on the persistence of inflation, notably the BoE and the BoC, while waiting for the BoJ.

-

Inflation

Inflation (under 3% in June) continues to decline in the United States, thanks to energy and imported goods. Core inflation stood at 5.0% in June. Tensions in the labor market are fueling inflation in services. In the euro area, inflation stands at 5.3% with a temporary dip in the underlying index (5.4%). Dynamic wages delay disinflation. Inflation is nil in China, or even negative on producer prices. The rebound in consumption is insufficient to recreate price pressures.

-

Growth

In the United States, monetary tightening should lead to a slowdown in the second half. The recession risk is receding, however. The Eurozone recorded a technical recession between Q4 and Q1. Growth should improve in Q2. Disinflation and rising wages will support a rebound in consumption. In China, the disappointing economic recovery requires monetary and fiscal support.

Key macroeconomic signposts : euro area

- According to preliminary figures, the Eurozone experienced a slight technical recession in Q4 2022 and Q1 2023.

- Household consumption was affected by the loss of purchasing power linked to high inflation. Temporary factors played a role: sharp drop in public spending (Germany) and fall in GDP in Ireland (very volatile). They will not reproduce.

- Available activity and retail sales data improved in April and May, as did the activity index published in real time by the Bundesbank. The Q2 figure should be positive.

- Surveys of business leaders give mixed signals. The PMI index of the global S&P survey deteriorated in June, contrasting with the virtual stability of the national INSEE and Istat surveys and the limited decline in the current situation component of the IFO.

- Persistence of the divergence between the service sector and manufacturing. The latter, along with that of construction, is more affected by the tightening of monetary policy.

- In the second half of the year, growth should firm up, supported by consumption, thanks to the fall in energy prices, wage increases and employment growth.

- Growth will nevertheless remain weak over the year (0.6%). The impetus on domestic demand will be dampened by the strong monetary tightening carried out by the ECB.

- Inflation will continue to slow due to a more negative contribution from energy prices. Core inflation will take longer to moderate, with wages adjusting with some lag to the sharp slowdown in inflation.

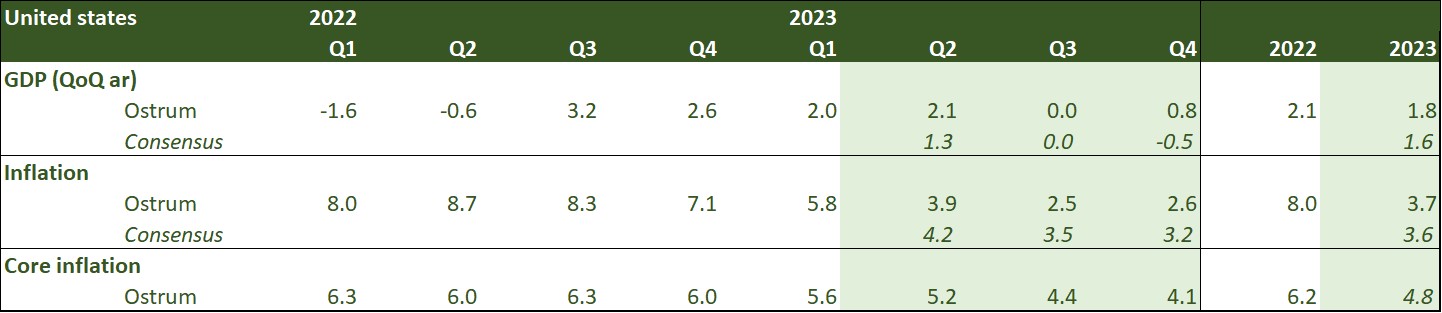

Key macroeconomic signposts : United States and China

- Growth is revised upwards to 1.8% in 2023 (1.4% in 2024). The Fed communicates on 1% YoY in Q4. Our equivalent projection would be 1.2%.

- The second half will be more difficult with slightly positive growth. The consensus no longer predicts a recession but only one quarter of contraction between July and September.

- 2Q 2023 growth at 2.1% assumes weaker consumption (+1%), offset by a recovery in investment (structures, equipment, R&D) and a rebound in inventories.

- Productive investment is improving thanks to the deployment of the Inflation Reduction Act and the CHIPS Act, which has an impact on structural expenditure.

- Inflation falls below 3% with underlying inflation falling towards 4% thanks to the delayed impact of the deceleration in rents observed in 2022 (actual or imputed to owners).

- The trade deficit should deteriorate somewhat in the second half.

- "Bad news is good news" for China. The more disappointing the economic data, the greater the magnitude of the stimulus should be. In this perspective, we maintain our growth forecasts for the second half of the year unchanged. However, we have revised down our Q2 GDP forecast, taking into account the weakness of the recent economic indicators published for the months of May and June.

- S&P global PMI and official surveys indicate a moderation in the economic recovery, linked to the services sector. Youth unemployment remains high, undermining the sustainability of the consumption recovery. Several indicators on the real estate sector, both on the demand and supply side, fell in May and June, suggesting a strengthening of the authorities' support for the sector.

- Consumption support policies have also been strengthened. On June 29, the State Council approved several measures to promote city renovations (slums, care facilities for the elderly) and the consumption of durable goods, such as automobiles and household appliances. The investment is directed towards electric vehicles and the greening of the Chinese economy. These measures should strengthen consumption and investment in the second half of the year.

- Monetary policy has clearly become accommodative because of the real estate sector. The PBoC lowered its interest rates for the first time since August 2022, allowing banks to lower their borrowing rate. The absence of inflationary pressures gives the PBoC room to maneuver to support activity.

Monetary Policy

Central banks will continue to hike rates in the face of persistent inflation

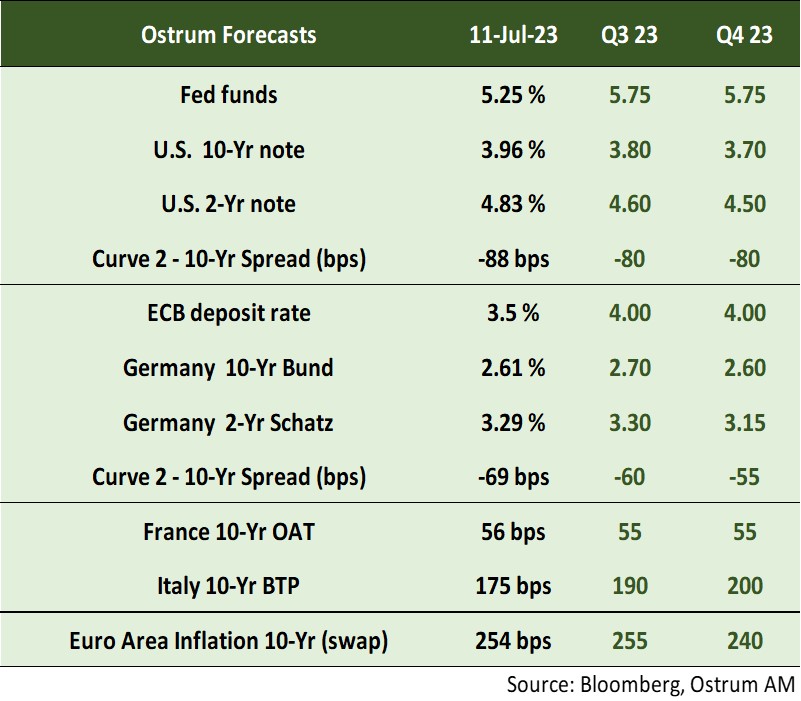

- Towards two Fed rate hikes in July and September

After taking a break in June, the Fed will continue its rate hikes, starting in July, to fight against inflation that is still too high. During his intervention in Sintra, Jerome Powell indicated that there was a strong consensus within the FOMC to raise rates two more times, which was confirmed by the Minutes of the June 14 Fed meeting. Growth is proving more robust than expected and the job market remains too tight. The Fed is expected to raise rates by 25 basis points on July 26 and then on September 20. - The ECB preannounces a rate hike in July and leaves the door open for another

The ECB is worried about the second phase of the inflation process, namely that linked to the rise in wages. Its impact on inflation is amplified by weak productivity growth, which translates into high unit labor costs. In this context, Christine Lagarde pre-announced a new rate hike in July and left the door open for another hike that we are expecting in September. It will then opt for a prolonged status quo to keep its monetary policy in restrictive territory as long as necessary to weigh on domestic demand and inflation. - +50bp from the BOE and la BoJ is still behind

The Bank of England surprised the markets on June 21 by raising its rates by 50 basis points due to the acceleration of underlying inflation (7.1% in May against 6.8% in April). The very tight labor market and strong wage growth call for further rate hikes. The Bank of Japan, on the other hand, is maintaining its ultra-accommodating monetary policy.

Strategic Views

A volatile summer?

The main views: the steady hand of central banks

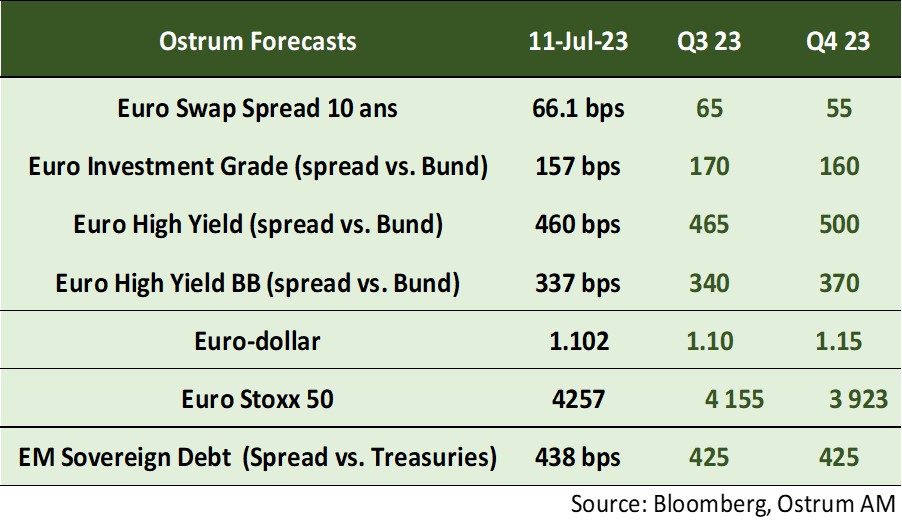

The maintenance of growth at potential in the United States seems to prove the Federal Reserve right, which is preparing to raise its rates by an additional 50 bp this summer. The rise in rates will eventually weigh on activity by the end of the year and will accelerate disinflation. Like the Fed and other central banks in developed countries, the ECB is maintaining the restrictive course by gradually withdrawing from the government bond and credit markets. This withdrawal could be a vector of volatility and tension during the summer. The euro should benefit from the reduction in the balance sheet of the ECB.

Markets: probable increase in volatility

The reduction in the positioning on the flattening of the curves caused a sharp rise in long rates at the beginning of the summer towards 4% on the T-note. This rebound in 10-year yields reduces the attractiveness of equity markets, which should move in a wide range during the summer. Volatility should increase but most institutional accounts being underexposed, the downside potential seems limited. Credit still offers attractive valuations. High yield, on the other hand, has more stretched valuations.

Market views

Asset classes

- US rates: we are projecting a fall in 10-year bonds to around 3.80% at the end of the year, despite the recent tensions and the ongoing monetary tightening. Inflation is expected to slow as growth falls below potential in H2. The 2-year includes monetary relief in 2024.

- European rates: the ECB raised its main interest rates in June. An increase in July is acquired. The ECB's restrictive bias justifies the current 2-year level. Beyond that, German yields should consolidate somewhat.

- Sovereign spreads: valuations seem excessive given the fiscal outlook in Italy.

- Eurozone inflation: the fall in energy prices and monetary tightening should reduce the breakeven points by the end of the year.

- Euro credit: the IG segment remains solid. By contrast, HY risk premia are likely to widen given tighter valuations.

- Foreign exchange: the euro should benefit from the monetary tightening of the ECB and the improvement in the terms of trade.

- Equities: sideways drift this summer, then decline at the end of the year reflecting a more uncertain second half of the year on margins.

- Emerging debt: in the absence of a global recession, spreads should continue to tighten.