Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO Letter

Goldilocks?

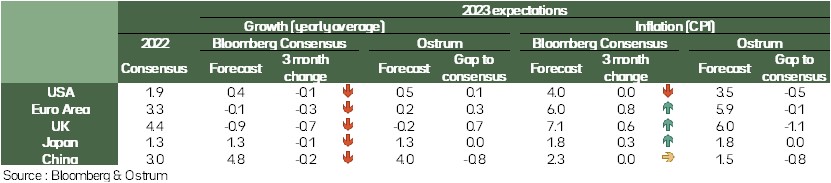

Comfort on the growth. On the economic front, the data remain mediocre and if the recession in Europe is not certain, growth will be close to zero. Paradoxically, this is good news for markets for two reasons. On the one hand, the data are better than expected by consensus and should therefore generate a wave of upward revisions, albeit a modest one. On the other hand, the alternative scenario, a strong recession, seems less and less likely and so the concern fades. The debate is also running out of steam as the consensus converges on our very limited recession scenario and therefore markets demand lower risk premiums.

Lower inflation. Another important change at the beginning of the year, inflation figures are finally turning around. This improvement is partly deceptive as underlying pressures remain far too high to calm central banks. But the market has decided to see the glass half full and welcomes the drop in the headline rather than focusing on the resilience of the core. This trend is expected to continue with potentially large declines in inflation in the coming months. We remain very doubtful, however, in the medium term, the resilience of inflation should lead central banks to maintain a restrictive policy throughout the year. And so the drop in rates seems very optimistic.

A little more visibility on central banks. Last point, the trajectory of central banks is less subject to uncertainty. The Fed should take a break when the Fed funds reach 5% and if in the case of the ECB the 3% target on the deposit rate is still under discussion, it is very likely that the overall upward cycle will slow down considerably at the beginning of the year and end in the second quarter.

Goldilocks? Not really so many uncertainties remain! But, everything is relative, after an annus horribilis in 2022, we enter a phase of greater serenity. Indices of market volatility have already declined significantly. The problem is that the markets have already anticipated this scenario a lot and we are fighting “against a reverse front”: a few months ago we were talking about excessively pessimistic markets and therefore investment opportunities, in the current relative calm we are more nervous about markets that are starting to show signs of complacency.

Economic Views

Three themes for the markets

-

Monetary policy

Central bank uncertainty is fading. The pace of increases is slowing. Visibility on the future trajectory improves and debates become less virulent. If the tightening cycle is not over yet, the issue of the terminal rate is not really a debate. The question is rather the duration of the restrictive policy.

-

Inflation

The signs of falling inflation are multiplying. We think inflation can go down very quickly in the first half of the year. That should support the markets. However, the underlying pressures remain very resilient, and the optimistic view of the market will be tested over time.

-

Growth

The data is poor and confirms that the recession will be very limited. However, the consensus is too low and will have to recover slowly. The catastrophic scenario of a severe recession seems less and less likely. This bears the risk premium.

Key macroeconomic signposts : activity

- Business surveys are more pessimistic than what actually happens.

- This can be seen when comparing the SP Global surveys for which activity has been contracting since the summer and the industrial production indices which are stable and show no break either in France or Germany, to consider the two major economies.

- This resistance reflects the strong support of economic policy. This is a major support for domestic demand and it compensates the consumer for the negative effects of tightening monetary policy.

- In the United States, signals deteriorate when we look at the pace of the ISM investigation. The US economy is paying the price of a moderate decline in purchasing power and tougher financial and monetary conditions. An improvement will only come with the slowdown in inflation.

- The Chinese economy is penalized in the short term by health issues. The lifting of Policy zero-Covid in mid-December is primarily reflected in a dramatic increase in contamination. This will weigh on the economic situation in the short term, but it is the necessary transition for a recovery of activity in the second part of the year.

Key macroeconomic signposts : inflation and budgetary policy

- Inflation in developed countries tends to decline.

- It was observed in the Eurozone with an inflation rate of 9.2% in December and 8.4% on average over the year as a whole. For the United States, the inflation rate was 6.5% in December and 8% on average for 2022.

- Rather, the energy indicators are trending downwards through lower oil prices in general and lower gas and electricity prices in Europe. Prices remain high, but the energy markets have benefited from a very favorable weather situation and from sober behavior on the part of households and businesses.

- In the US, survey indicators suggest a reduction in nominal stresses in production processes. The two points to keep in mind is the impact of housing prices which will maintain an upward bias on inflation but with a slowdown in wage growth. That will satisfy the Fed.

- Food prices are strong everywhere and largely reflect the impact of rising fertilizer prices, via gas prices. Fertilizer prices are stabilizing and their variation is fading. This should help to influence the contribution of food prices to inflation in large countries.

- Inflation will slow everywhere but central banks will wait before validating the end of the inflationary episode.

Strategic Views

Forget 2022

The main views: Markets breakout higher

Despite the Fed’s tight money stance, the deceleration in inflation has fanned expectations of monetary easing starting in the second half of the year in the United States. This assumption spurs the appetite for risky assets, especially as incoming economic data hint at resilience of activity in Europe. Yield curves remain inverted amid high demand for long-term bonds. The reopening of China already has an impact on commodity prices… which could, later on, postpone disinflation. The markets are thus taking advantage of a narrow window to break higher before the ECB’s monetary policy tightening via balance sheet reduction from March.

Risky assets: in a sweet spot for now

Monetary policy uncertainty has decreased compared to 2022, supporting lower volatility and risk premia. The deluge of sovereign, supranational and credit issuance in January is met with strong investor demand despite significant competition from money market funds. High yield spreads are well oriented, all the more so primary market issuance in speculative-grade has not yet picked up. The resilience of growth in Europe thanks to government handouts is amplified by the outlook for a recovery in China. Equity valuations are up thanks to falling long-term interest rates and still resilient margins.

Monetary Policy

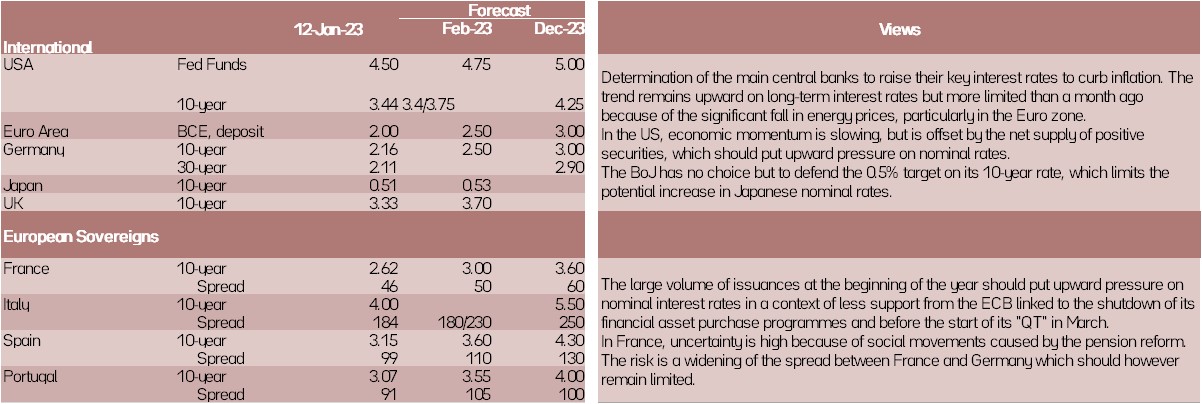

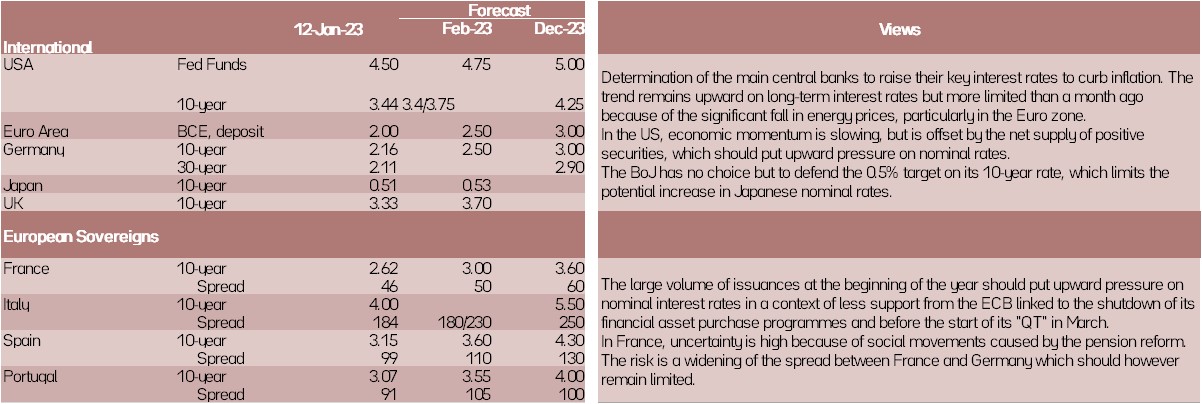

Central banks determined to fight inflation that is still far too higher

- Fed : More moderate rate hikes for a more restrictive monetary policy

Despite slowing growth and moderating inflation, the Fed has been very clear. It will continue its rate hikes, albeit at a more moderate pace given the magnitude already achieved (+425 basis points), to bring its monetary policy sufficiently into restrictive territory and maintain it for some time. In this context, the Fed rate cuts anticipated by the market in the second half of the year are not necessary. It should raise its rates by another 25bp in February and then in March and keep them within the range [4.75% -5%] throughout the year. - ECB: rate hikes of 50 basis points and QT from March

The ECB has clearly toughened its tone since the December meeting. Inflation and inflation expectations that are far too high (2.3% in 2025 according to the ECB) require continued rate hikes to quickly bring monetary policy back into restrictive territory. We anticipate a rate hike of 50 bps on February 2, followed by 2 hikes of 25 bps to bring the deposit rate to 3% and maintain it there throughout 2023. The risk is more monetary tightening, especially since financial conditions have eased markedly since the beginning of the year. The terms of the QT will be specified in February. It will begin in March via the non-reinvestment of 15 billion euros per month of redemption of bunds acquired under the APP. - The Bank of Japan suprises

The BoJ created a surprise on December 20 by modifying the yield curve control parameters. It widened the range framing the 0% target for the 10-year rate from +/- 0.25% to +/- 0.50%. The strong pressures that have taken place on rates have forced it to buy government bonds massively. This decision was taken to reinforce the zero interest rate policy, but the markets anticipate the start of monetary tightening.

Asset classes