The current macroeconomic context is surrounded by some big questions: are we facing a recession? If so, how deep will it be? and how resilient is inflation? For Ostrum AM, it is inflation that will continue to remain the number one “sticky” topic on everyone’s mind.

In this environment, what strategies could be considered by investors?

Rates, inflation, spreads, curves…

- Inflation: 2 more hikes are anticipated for the ECB and the FED

- Curves: to remain inverted

- Bond market volatility: down versus 2022 but still high historically

- Periphery bond markets: after significant tightening, valuation is expensive

- Issuance: supply has been well absorbed, the challenge into year end is for France and Germany

- Emerging Market debt: inflation and supply are less worrisome. Many EM central banks are in a good position. We expect spreads to narrow further

- Sustainable bonds: decarbonisation strategies will keep the market well bid

Credit

- Spreads: 2023 should be a decent year for carry. The end of the upward rate cycle is close.

- IG vs HY: Investment Grade is attractive at more than 4%, but High Yield even more so at more than 7%. HY spreads have already onboarded a rise in default rates.

- Credit curve: no maturity premium. The short end of the credit curve is the best place to be.

- Financials vs Corporates: financials are cheap versus corporates.

- Senior vs Subordinated debt & hybrids: yields on AT1 and hybrid credit are more than correct. Bank AT1 “stress” has been integrated by the market.

- Sectors: REITS are cheap (on a selective basis) along with Banking. Energy & Telecoms trade expensive.

- Euro credit vs USD credit: for a euro-based investor, preference for € IG as $ IG (hedged in €) implies a yield loss of ~ 0.8% (vs its current yield.

- Go Green: sustainable bonds now represent 20% of IG primary market (corporate & banks). A “greenium” at 5 bp is no longer a hurdle, considering attractive IG yield levels.

INTRODUCTION

MACROECONOMIC FOCUS

The current macroeconomic context is surrounded by some big questions: are we facing a recession? If so, how deep will it be? and how resilient is inflation? For Ostrum AM, it is inflation that will continue to remain the number one “sticky” topic on everyone’s mind.

If we look at the economic situation in the Eurozone, we note that PMIs have been weaker than expected, pointing the manufacturing sector to recession territory. The Services sector does stand out, but at the same time, is also showing some signs of a slowdown. Beyond soft data, the labour market is still tight. Demand is more resilient than supply. In Europe, firms are struggling to fill positions, people are leaving the workforce and they are also working less. The shortage in labour is a positive for consumer sentiment as it gives people a feeling of increased job security.

At Ostrum AM, we believe that Eurozone inflation will not come down as quickly as the market expects. We estimate wage growth at around 5% in 2023 and it should not be much lower in 2024. Even if headline inflation does come down thanks to base effects and lower gas prices, when consumers go shopping, they are still paying more for goods than the 5% wage increase they may have received.

Regarding growth in the Eurozone, we do not predict a recession, however, growth could remain sluggish. As stated already, our main concern is inflation. We see higher core inflation for a longer period than expected by the market and the consensus.

As for growth in the US, the economy is slowing down, but we don’t forecast a recession. Our view is also contrary to the market consensus.

Supporting our case is US durable goods orders that are very strong, the housing market that is bouncing back and the fact that real wages are improving. These factors provide some compensation against negative effects that have resulted from the Federal Reserve’s (Fed, US central bank) restrictive monetary policy and also the credit tightening that is highlighted on the Fed Senior Loan Officer Opinion Survey regarding bank lending practices.

Regarding US headline inflation, we are not far from the consensus, but we continue to believe that core inflation will remain sticky.

Monetary policies

For central banks, inflation is still a big challenge and as there are many longer-term factors like deglobalisation and the climate transition that are inflationary. As we move to the end of 2023, the resilience of core inflation is a key element, especially for the ECB. The question that will become more important is: How to reduce demand so that we can create a real change in the trajectory of inflation?

In June, ECB’s C. Lagarde said a hike in July was very likely. So that is what the market is expecting. Beyond July, we see a last hike of 25bp in September. Why should it be the last hike? Because in September, we believe the ECB will likely revise down growth and inflation projections considering the amount of aggressive tightening (they have already tightened by 400bp!). Beyond September, we expect to see a long pause of about a year before the ECB starts to cut rates. Considering the inflation concern has been so big, we can’t see the ECB cutting rates any sooner, unless we were to face a severe recession which is not our main scenario.

By the end of this summer, market focus is likely to move away from rates to instead focus on the ECB’s balance sheet. In June, we had the TLTRO reimbursement and there will be no more reinvestment in the APP starting July 1st. That said, the ECB could accelerate the pace of the balance sheet wind down by bringing the PEPP reinvestment down sooner than the expected end of 2024.

In the US, the market is saying that the Fed is almost done with its interest rate hiking cycle (to be finalised in July). At Ostrum AM, we hold a different view and think another hike could occur in September. Again, we do not foresee a recession and we see core inflation remaining at a high level until the end of 2023. As a result, we think the Fed will pause until the end of Q1 2024, to then ease very gradually its monetary policy.

RATES, INFLATION, CURVES…

1. Eurozone and US inflation

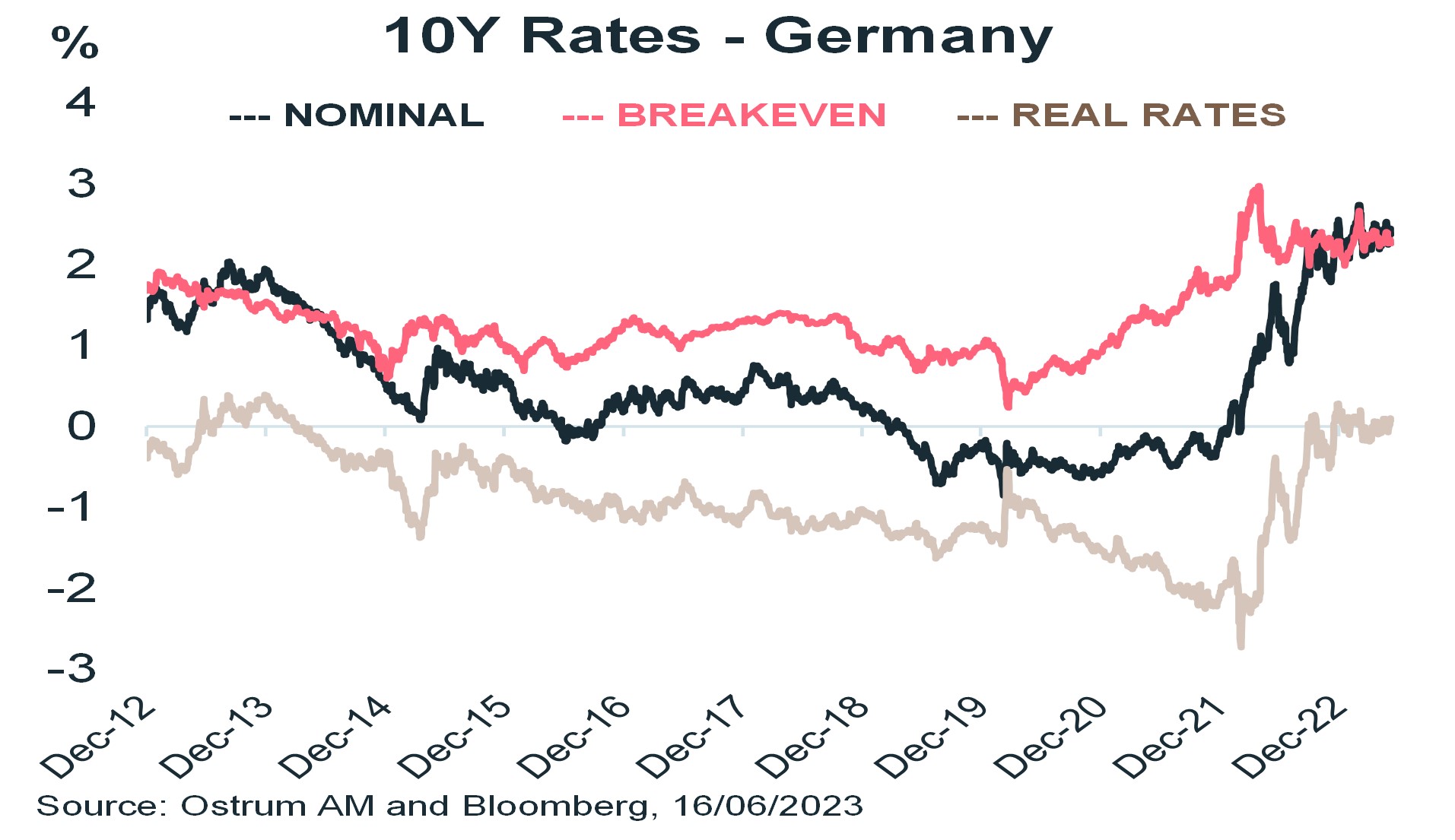

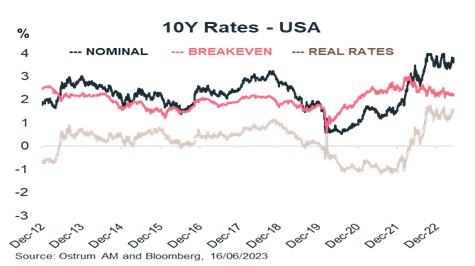

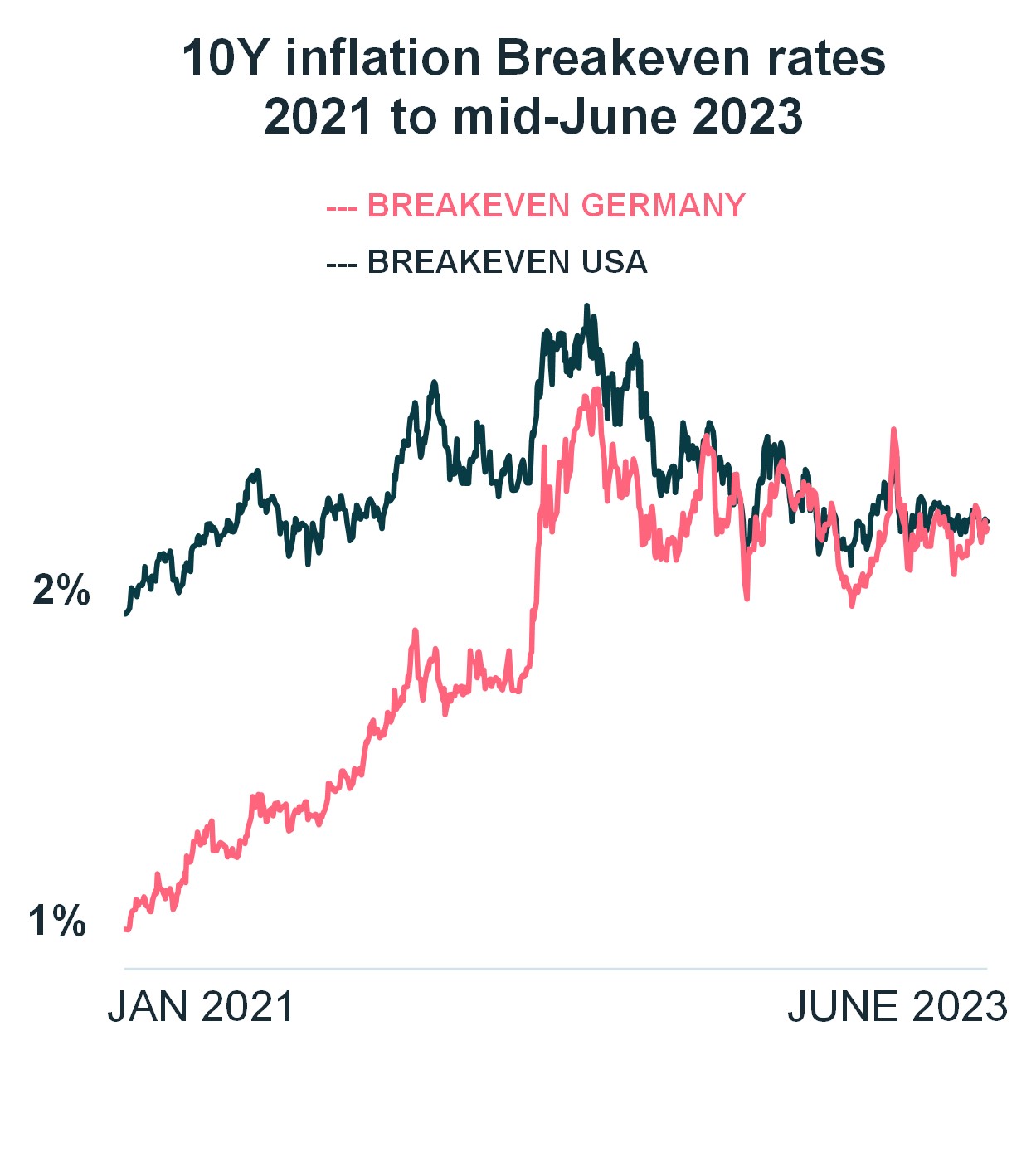

Where do we stand on Eurozone and US rates? (nominal rates, real rates and breakeven rates - June 2021 until today).

If we focus on breakevens, what is noticeable is how they have stabilised in Q2 between 2,20% and 2,40% in the Eurozone and in the US. The market is therefore stating that it believes that central banks are credible in their fight against inflation. This stabilisation is also true for nominal and real rates. 10-year rates will likely continue to move in trading ranges for the next few months.

2. Eurozone and US interest rates

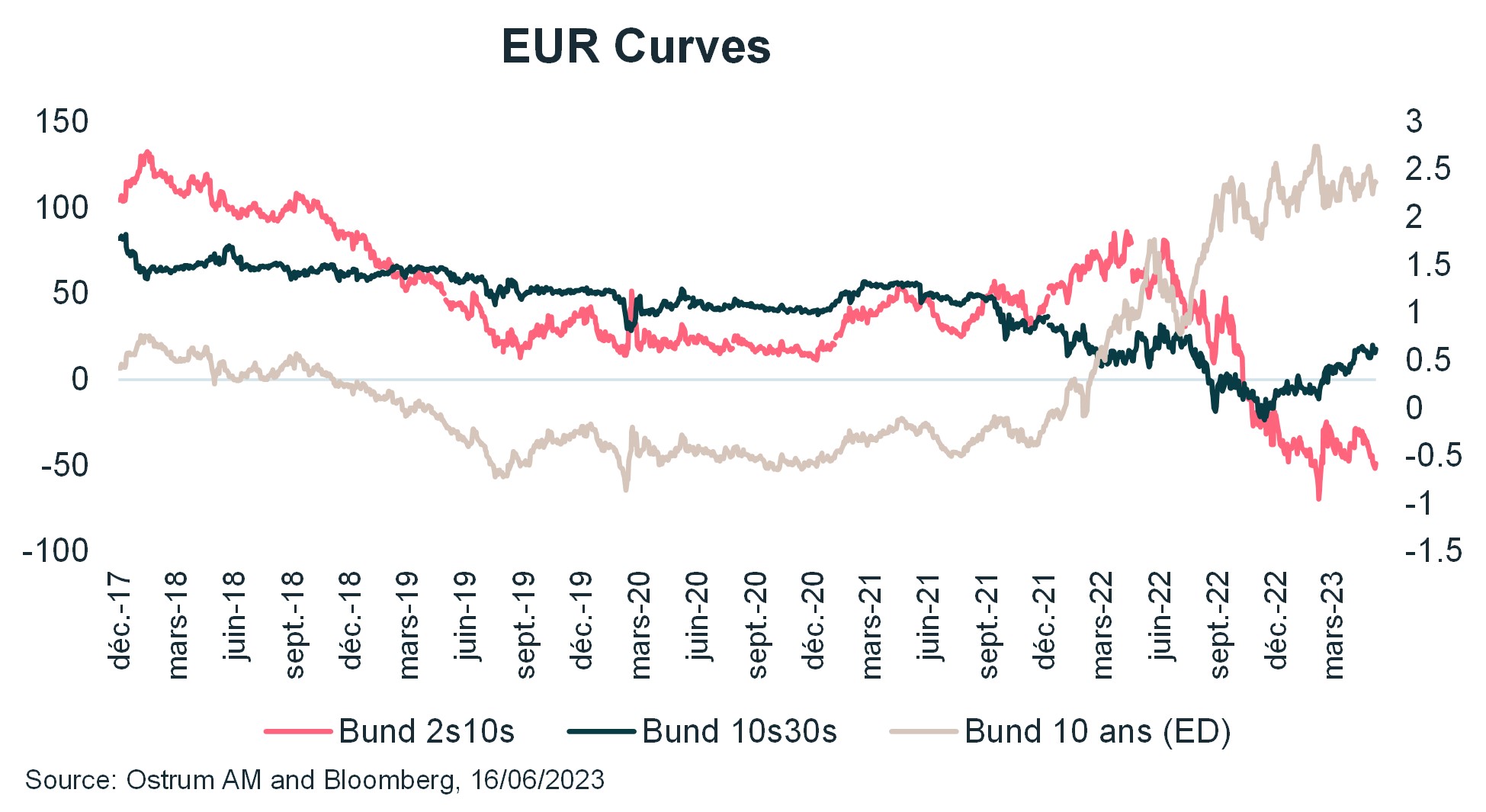

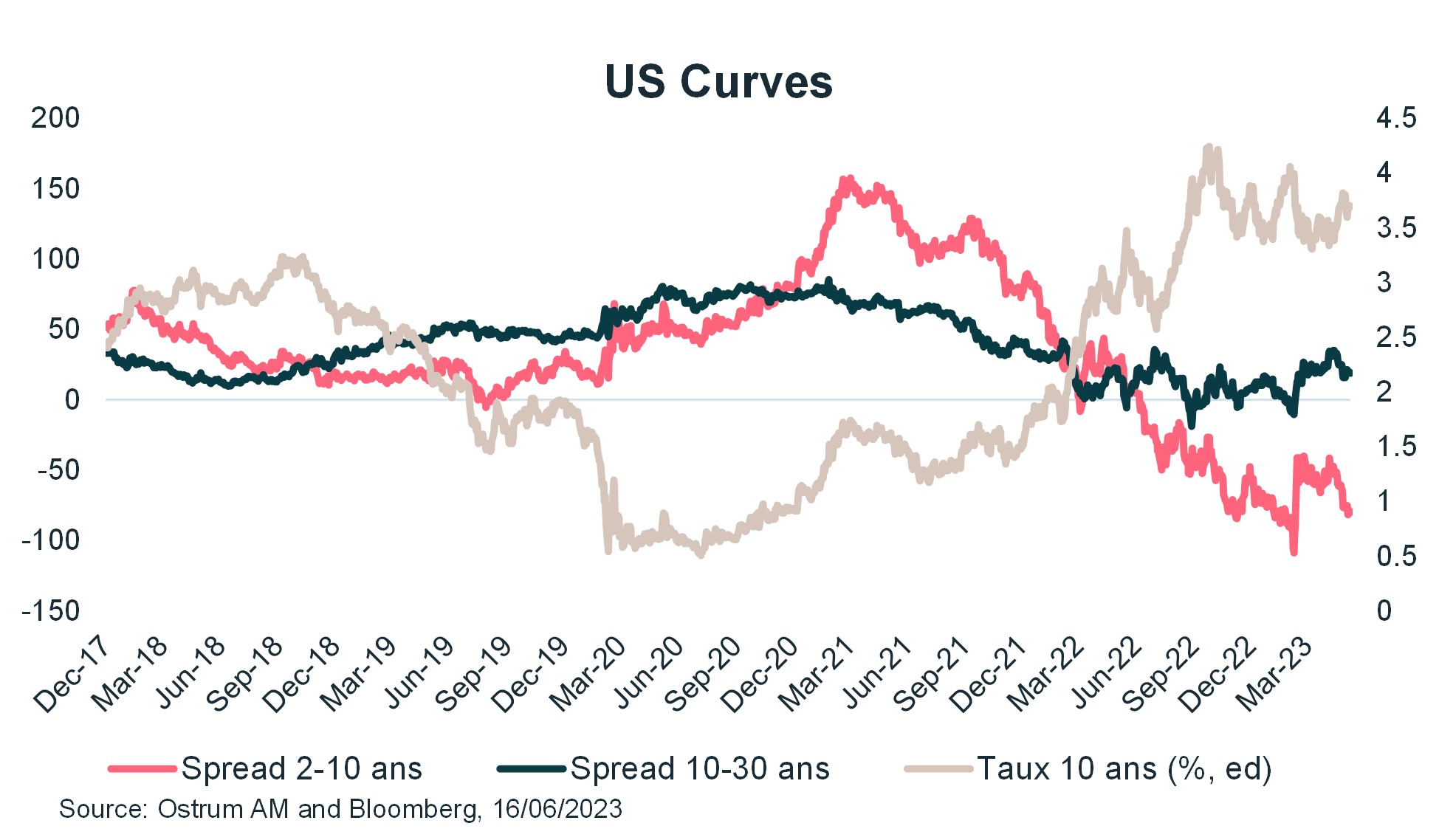

Euro and US yield curves have massively flattened and are deeply inverted. The [2-10] year curve has reached -82bp in the Eurozone and -110bp in the US. These extreme levels have not been seen for 30 years!

Central banks policies are driving the front-end of the curve which has been the most volatile. Generally, curves tend to flatten until the final rate hike which we don’t see until September. In addition, Central banks may continue to communicate in an unclear mode about the last hike, saying for example that they will remain vigilant and data dependent… This explains why we find it difficult to see the curve re-steepening significantly with an outperformance of the front-end of the curve in the upcoming months.

The steepening trade, which is a “carry negative” trade, has proved to be extremely painful for a lot of market participants over the past few months. We think we will need more evidence to motivate participants to play significant steeping.

What about the risk of bear steepening? (steepening led by the back end of the curve) – for now, we believe this risk is limited despite the acceleration of the Quantitative Tightening and the reimbursement of the TLTRO at the end of June.

Rates volatility

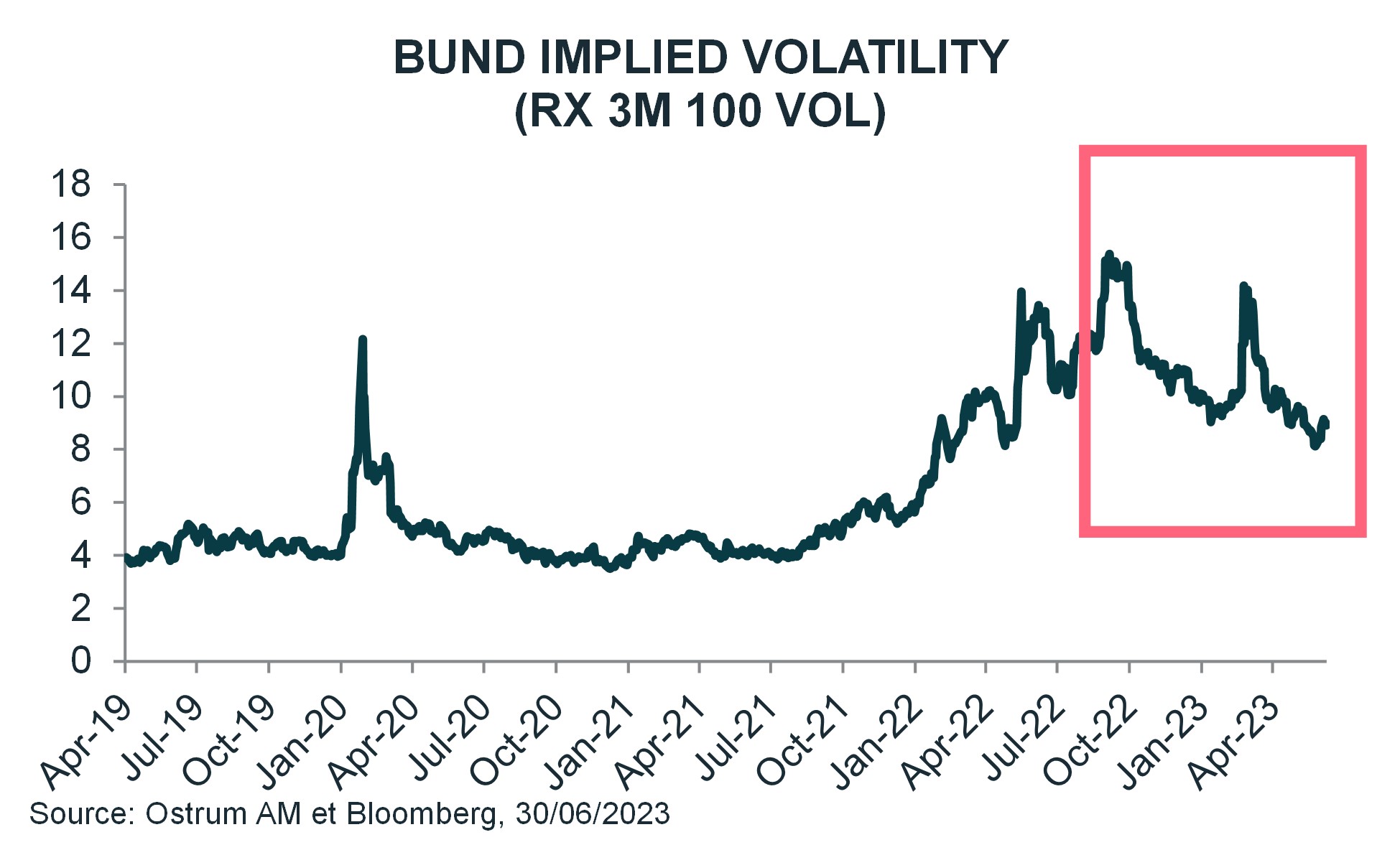

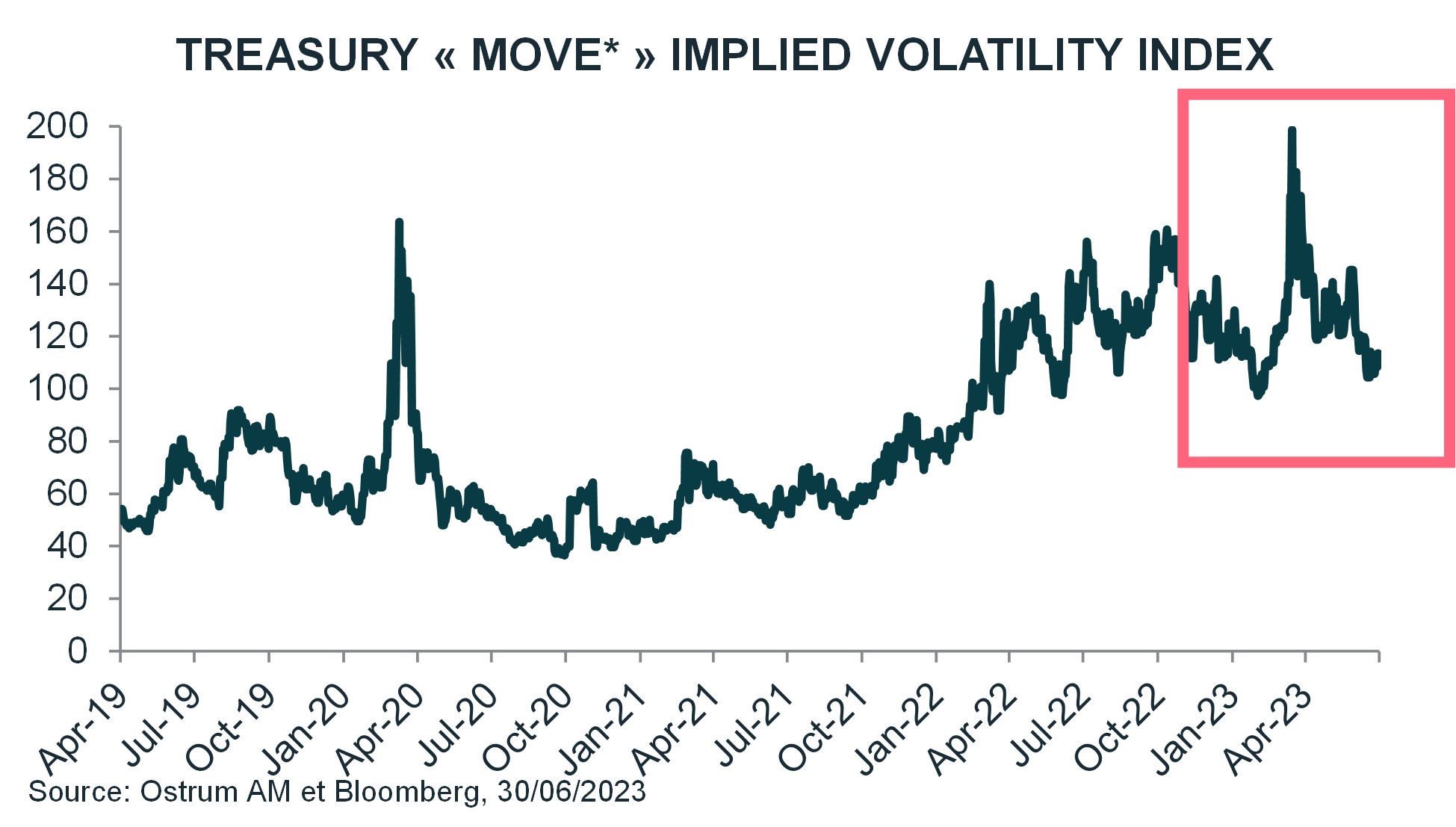

Rates volatility was a key topic last year, and again in March with the SVB credit event (US Silicon Valley Bank collapse). Since then, volatility has come down significantly but remains high if you compare it to the period before the beginning of the hiking cycle.

This easing in rates volatility has had a positive contribution by tightening of all types of spreads: European peripheral countries, agencies, supranational and credit.

If our macroeconomic scenario proves to be correct, we believe that the volatility will continue to come down steadily.

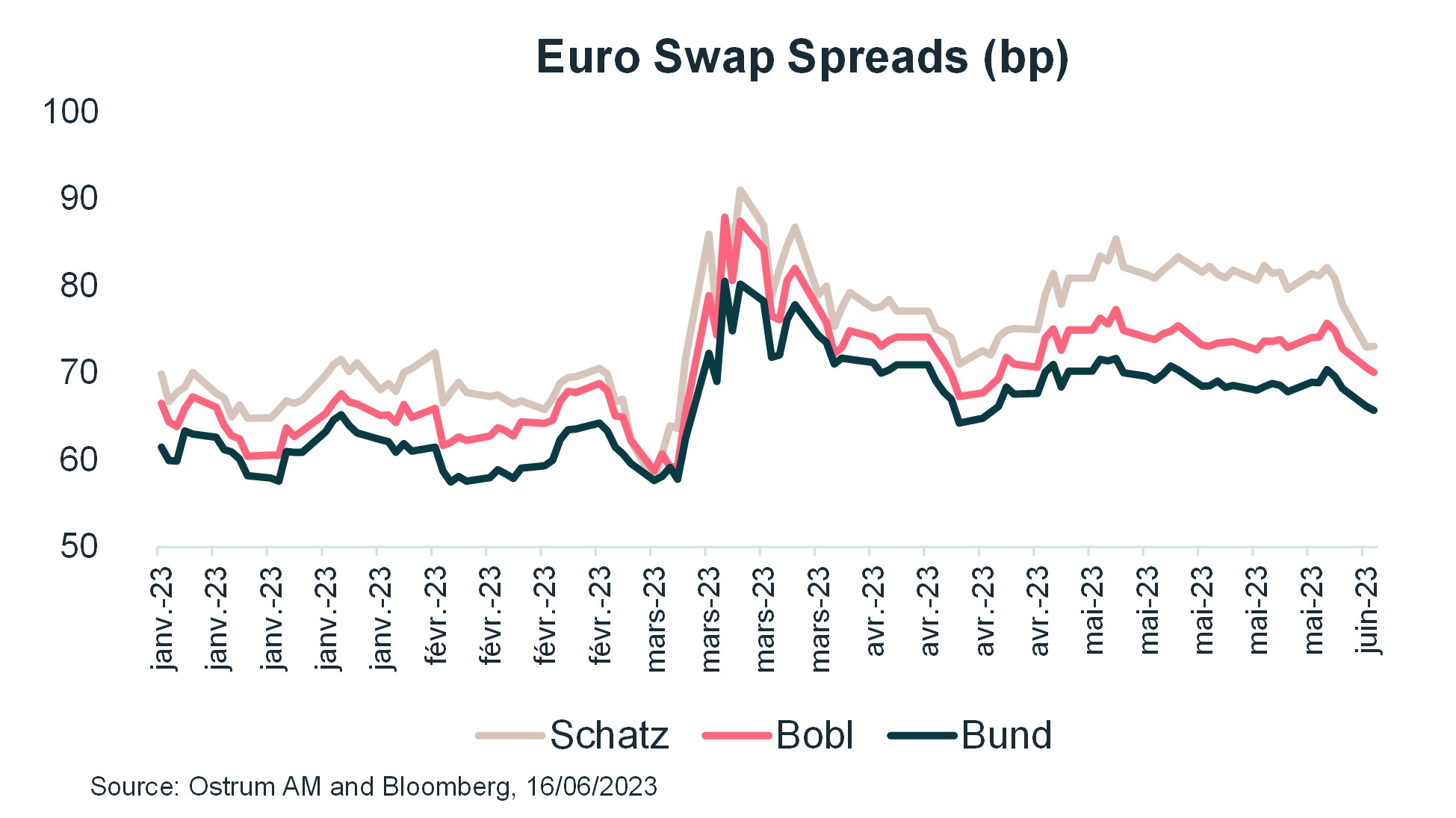

3. Euro swap spreads to normalise gradually

Bund scarcity which was one of the major factors explaining the widening of swap spreads in 2022. This factor is less an issue this year. Also in 2022, another key driver was the inflation hedging activity from banks using swaps. This factor is also less now less relevant. Thus, we expect a gradual normalisation of swap spread valuations with an objective of 55bp.

A constructive view on swap spreads should bring increased demand from investors for asset classes like supranational organisations, agencies and covered bonds.

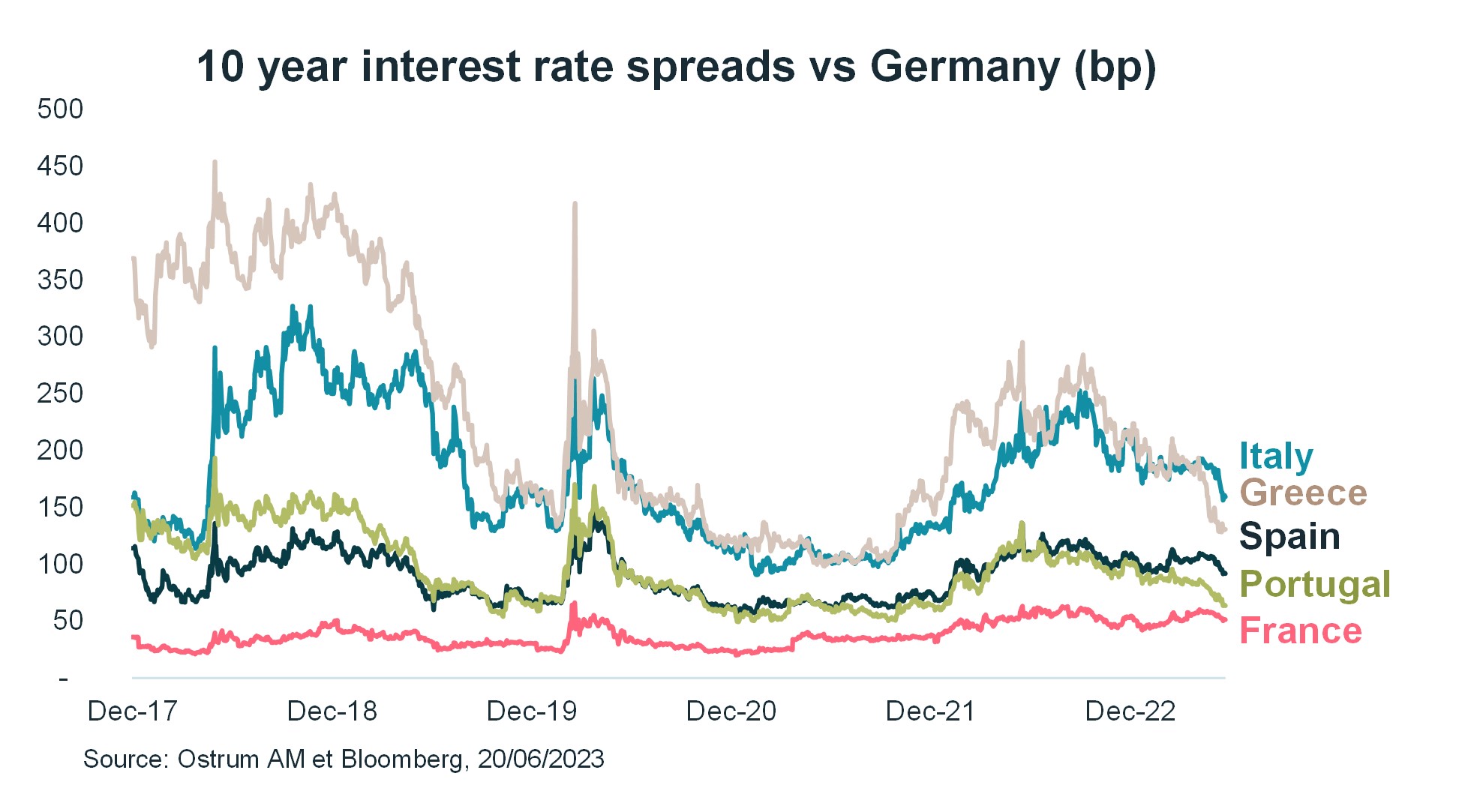

4. European peripheral countries: significant peripheral spread narrowing

Performance of peripheral spreads has been very impressive this year.

Several factors can explain this tightening.

First, the massive supply expected this year has been remarkably digested by the market. Retail demand, especially in Italy, has been underestimated.

Second, the positioning of investors has moved from an underweight to a neutral position which has been supportive for the narrowing trend.

And third, ECB Italian bond purchase has been active through the reinvestment of the PEPP in April and May.

And third, ECB Italian bond purchase has been active through the reinvestment of the PEPP in April and May.

Nevertheless, we now think that valuations, at their current levels, especially for Italy, are less attractive and especially in a context of accelerating Quantitative Tightening. Italian banks who previously purchased regularly BTPS and for large amounts will likely not be as active as they have been in H1 2023 and in 2022.

To conclude, we have a cautious view on peripheral spreads and we will remain at best Neutral for the coming months.

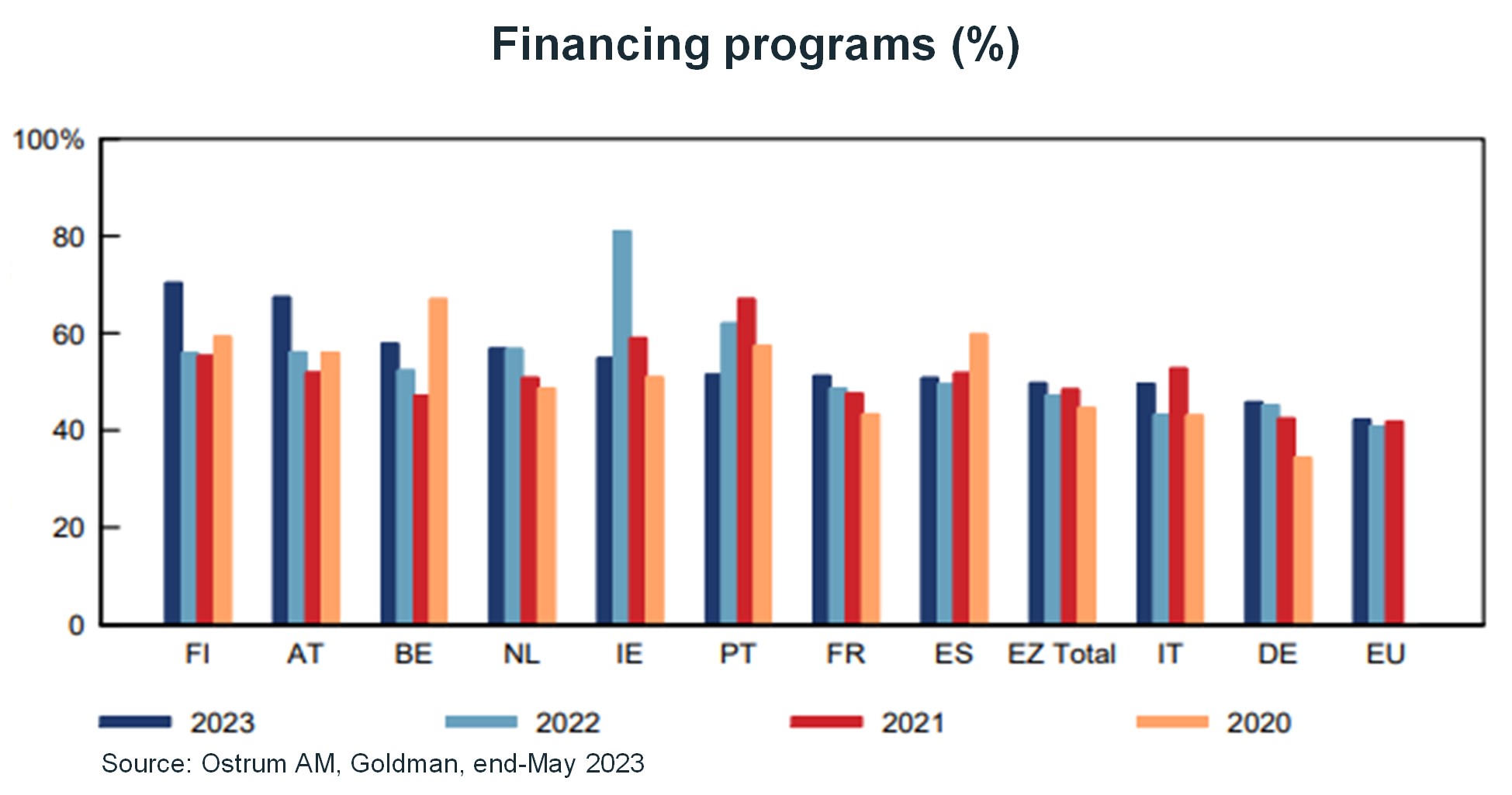

5. Government financing programs

The record supply this year, identified at the end of 2022, has been absorbed by the market without any major issues. Several countries like Finland and Austria are well advanced in their programs. The only 2 countries which could be challenged in terms of net financing for the second part of the year are Germany and France. But we don’t think this will have a material impact on spreads.

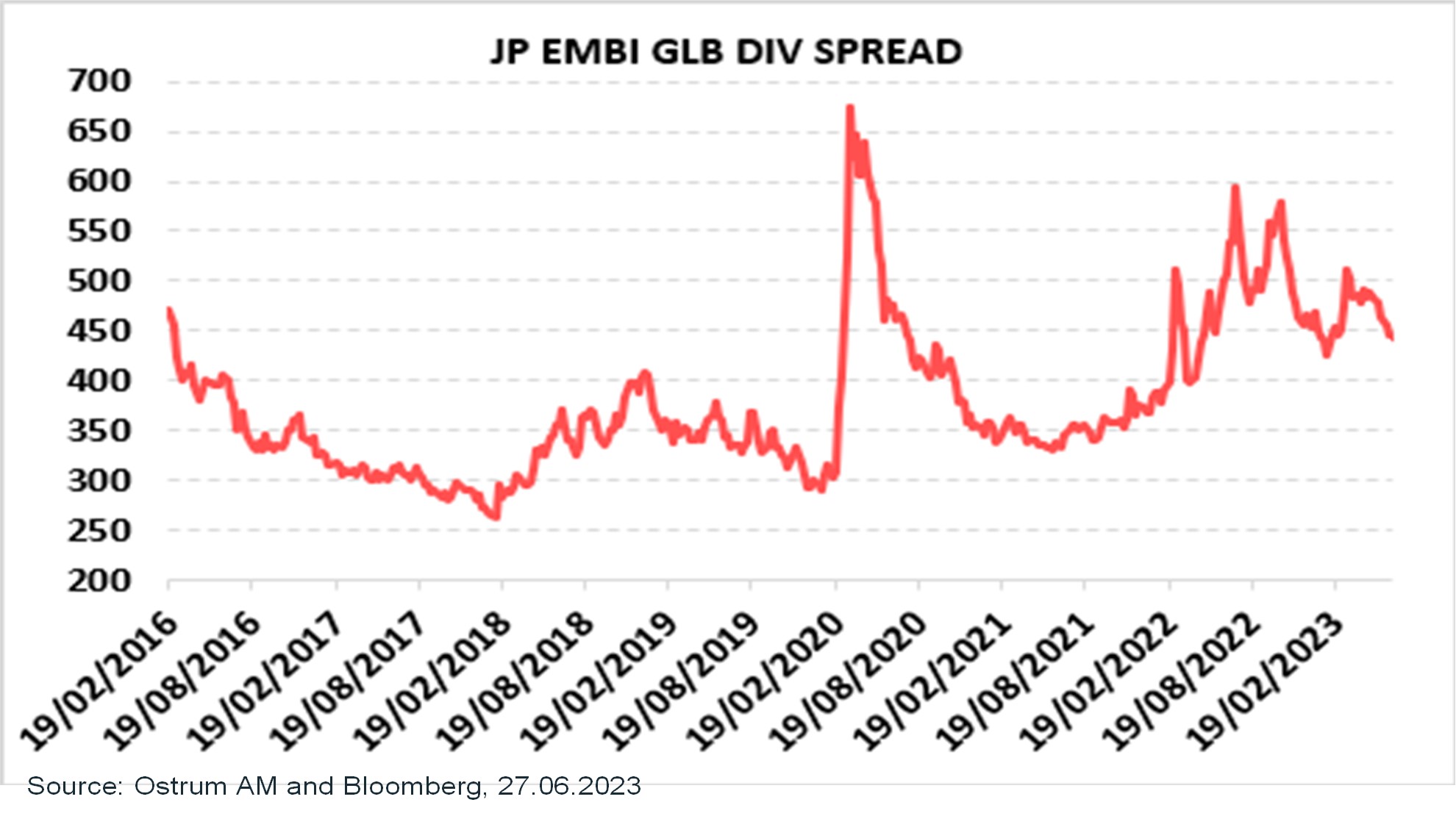

6. Emerging market debt: the stars are aligned

At Ostrum AM, we identify a solid investment case for the Emerging Market Debt asset class.

First, Inflation has plummeted in many countries (Brazil, Indonesia, Malaysia for example). Second, central banks are now in a position to ease their monetary policies and support their local markets. Third, the tightening cycle of the Fed is close to its end. Fourth, the USD currency stability (range trading) is supportive for the asset class. Fifth, many countries are on schedule or ahead on their financing needs. Year-end supply is now expected to be low. And last but not least, valuation at about 8,25% with a spread of 450bp versus US Treasuries is attractive.

THE CREDIT MARKET

The credit market is appealing

So far, 2023 has been an excellent year for fixed income overall and in particular for credit and risky assets to some extent.

The volatility spike in March softened the context a bit but we are now benefiting from all-time high yields in European Investment Grade and High Yield credit. We recognise that for some market participants, current valuations may seem a bit tight, however, we see credit assets as fairly valued with regards to an slight economic slowdown, which is Ostrum AM’s scenario – versus a hard landing. For sure, we are late in the credit cycle. Fundamentals are deteriorating a bit, but they remain resilient. And the default rate is currently very low, nearly zero. It thus can only go upwards but we believe it will stay below its long-term historical average.

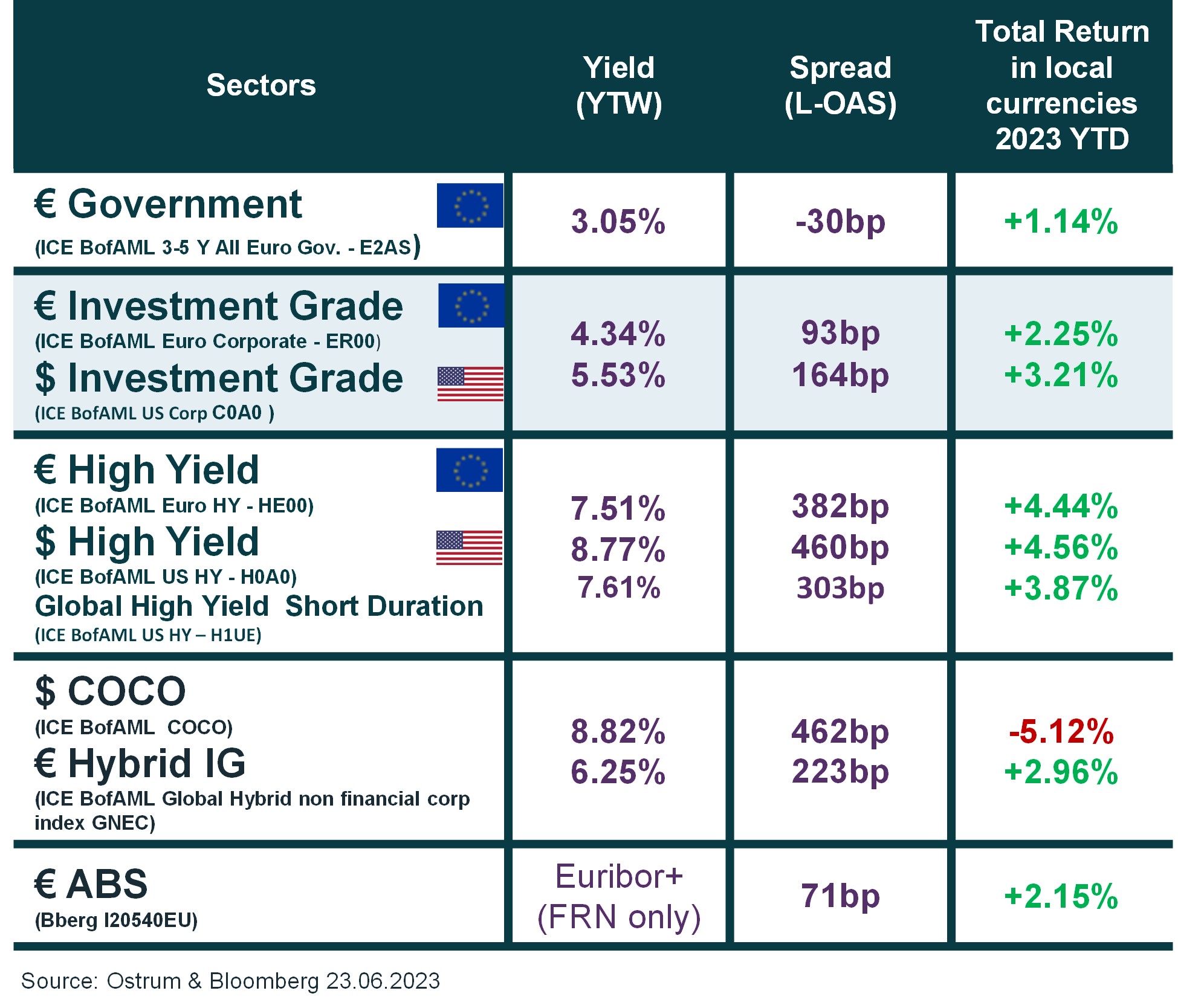

1. Credit indicators in green territory

We identify credit indicators as “green” with returns in a positive territory, as shown in the right hand side column of table 1. Fixed income investments have seen good for performance since last year, for the bulk of underlying fixed income asset classes.

Table 1

Contingent convertibles (“cocos”), a subordinated debt market segment, are an exception, due to the AT1 crisis earlier this year (Credit Suisse wipe-out). Despite this event, subordinated bonds have recovered to some extent. Indeed, late March, the index posted double-digit negative performance. Since then, it has recovered, still staying in negative territory and thus offering an investment opportunity.

Comparing yields to equity dividends: equity dividends are now lower than a typical Investment Grade yield in Europe. This is historical. It is the first time in more than 12 years that the Euro Investment Grade yields are higher than the dividend yield which explains why some asset allocators have shifted from equities to fixed income. Fixed income is now back on track in portfolios, allowing clients to grasp attractive returns.

The “yield” column of table 1 focuses on the typical yield we now have in the fixed income markets. Euro High Yield is yielding above 7.5%, US High Yield almost 9%. The subordinated debt segment is also attractive with Contingent convertibles (“cocos”) yielding at 8.8% and Investment Grade hybrids at 6.25%. Investment Grade hybrids are subordinated debt issued by corporates.

The bulk of the asset class is issued by Investment Grade issuers but issuers featured from time to time with High Yield ratings.

The higher yield is due to the subordination. We have a positive view on this asset class.

2. Resilient fundamentals but a slowdown in flows

Fundamentals are resilient. We expect markets to do well even if we get more downgrades than upgrades on the European High Yield segment (default risk is less relevant for the European Investment Grade segment).

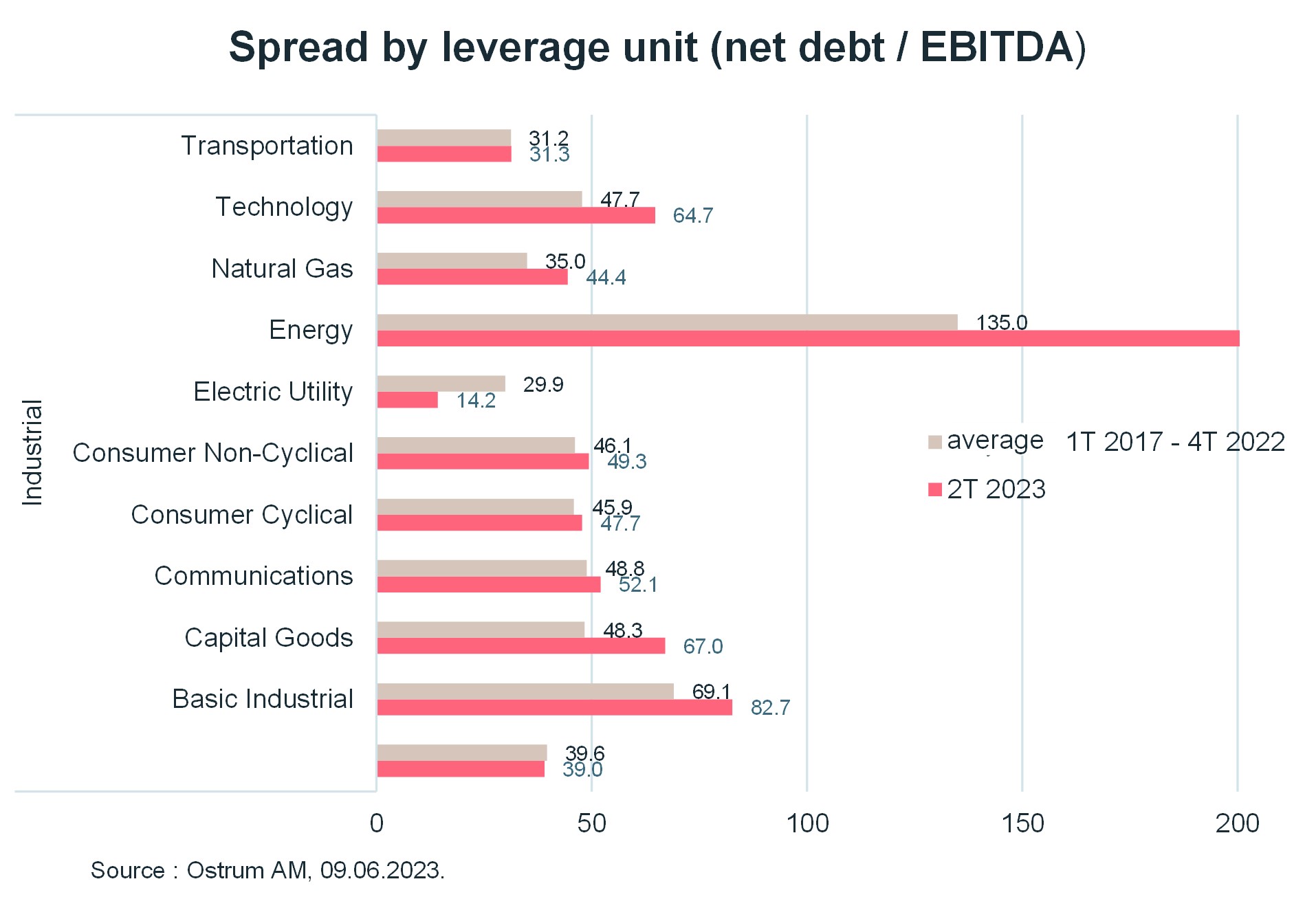

Illustration of the evolution of the spread per unit of leverage (defined as net debt / EBITDA) over the last 6 years (2017-2022).

When reading this bar chart, we can see that the majority of sectors are at their long-term value levels, according to historical standards, with few exceptions such as basic industries.

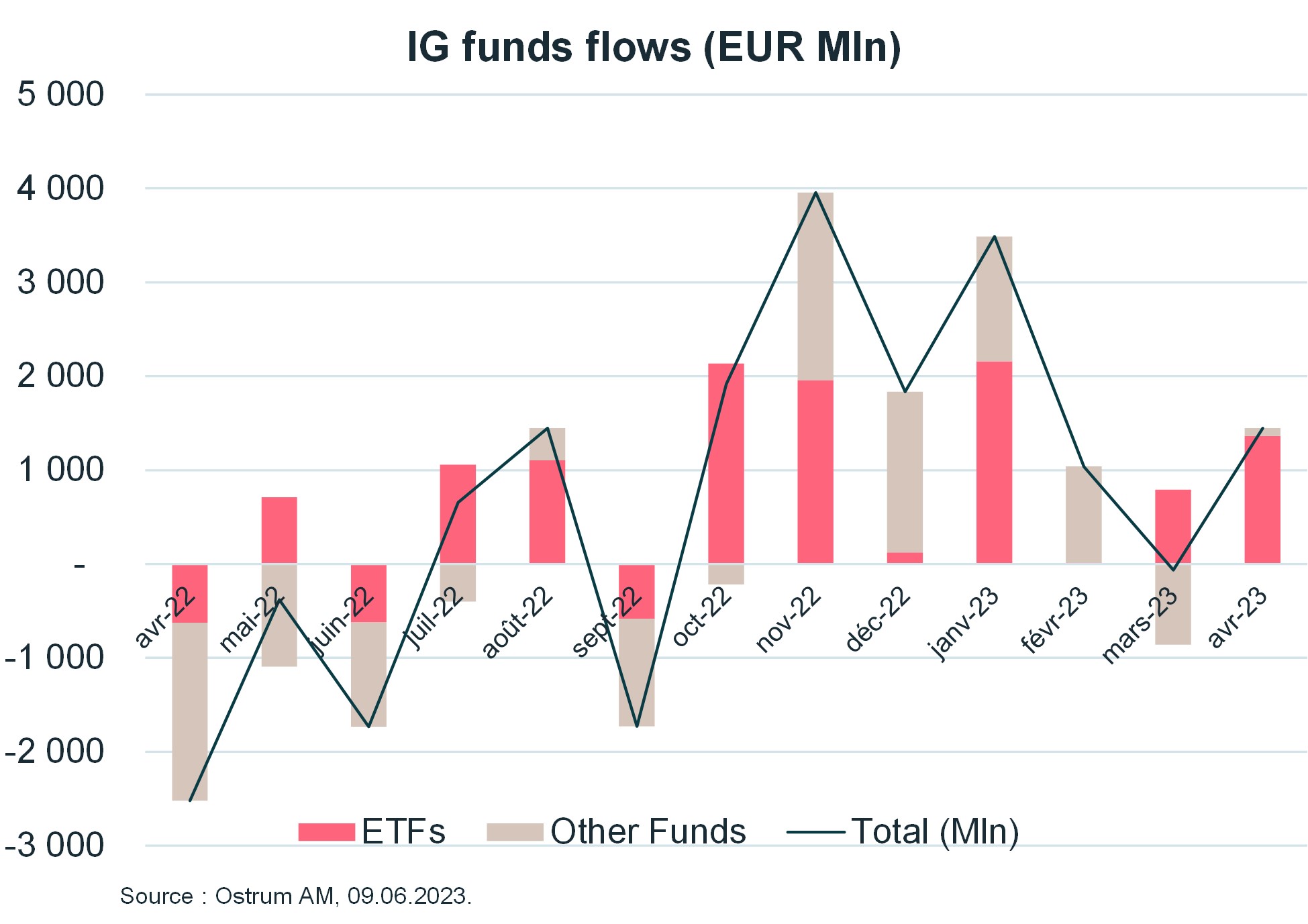

If we deep dive into technical factors, we can raise that there are more and more inflows in credit asset classes, yet polarised on ETFs and HTM (hold-to-maturity) strategies. We believe the current environment is clearly one where active asset managers can make the difference. Therefore, we think that the flow trend may stitch to benefit active managers in a near future.

3. Increased default rate but should stay below historical average

As mentioned, we believe the credit market is still appealing as we think default rates will stay under control. We identify two main factors driving spreads over the long run: first, a top-down factor such as the PMI (“Purchasing Manager's Index”, which reveals the economic situation of a sector or a country) and second, a microeconomic or Bottom-up factor is our key factor - the default rate.

At Ostrum AM, we take a dual approach when analysing default rates.

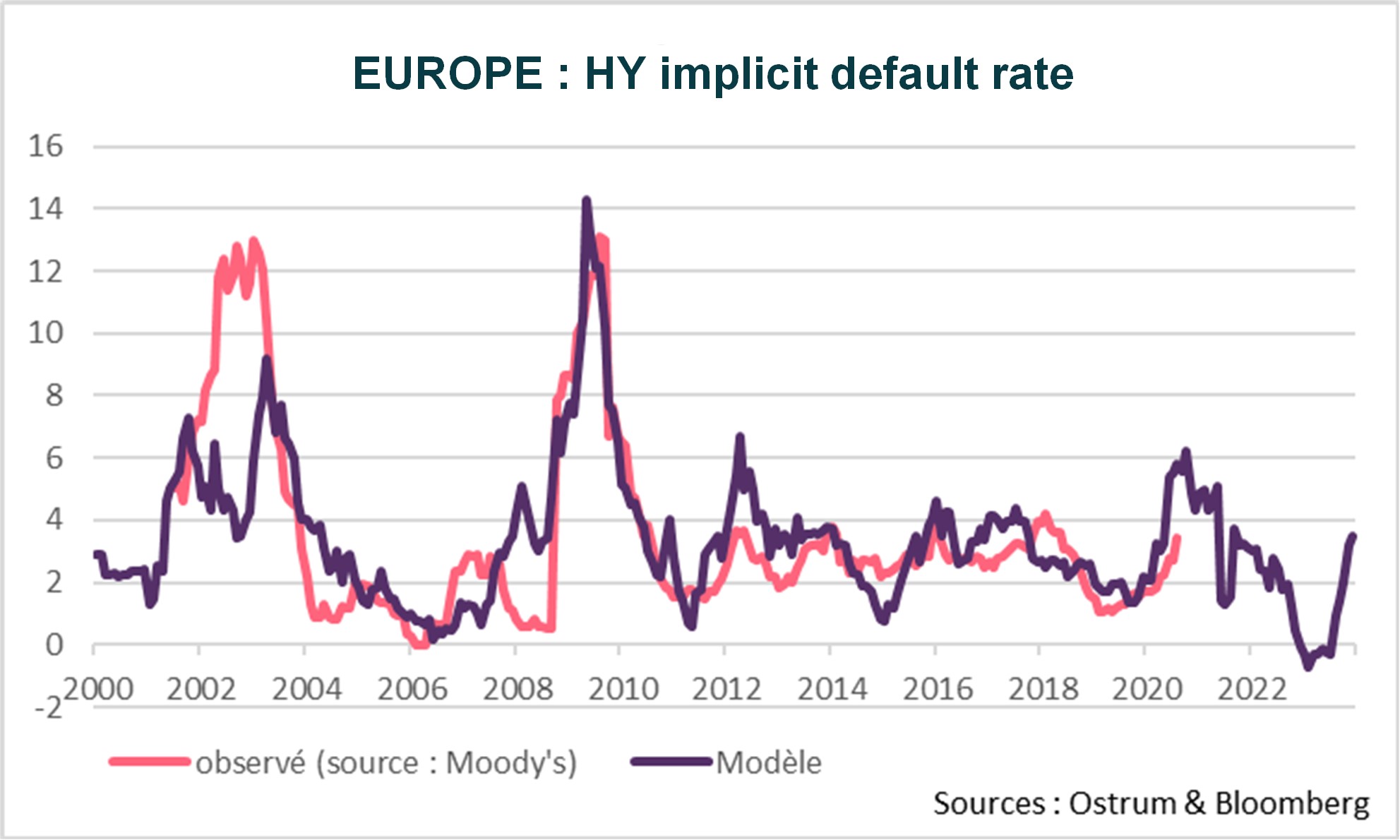

- Top-down default rate analysis, relying on a proprietary model developed by our team of market strategists which is based on specific variables: inflation, interest rates, equity volatility. This model is currently projecting a 3.5% default rate which is below the 20-year historical average (4% - 5%).

- Bottom-up default rate analysis stems from our team of 23 credit analysts which identifies each quarter the “weaker” candidates: issuers which are likely to default over the next 12 months. Currently, there are 13 identified candidates out of 400 issuers which corresponds to a 3.8% expected default rate. Hence, despite an expected slowdown, the current assumption at Ostrum AM is that default rate will definitely go a bit higher but will stay below the long-term historical average.

However, these figures can be compared with the current spreads on High Yield at ~400 bp (ITRAX Xover CDS 5Y), which implies a default rate of almost 6%. At this level, we can say that a lot of bad news is already priced into current valuations. Therefore, we consider this level as exaggerated which explains why we are still bullish High Yield (we have a contrarian view versus other market participants).

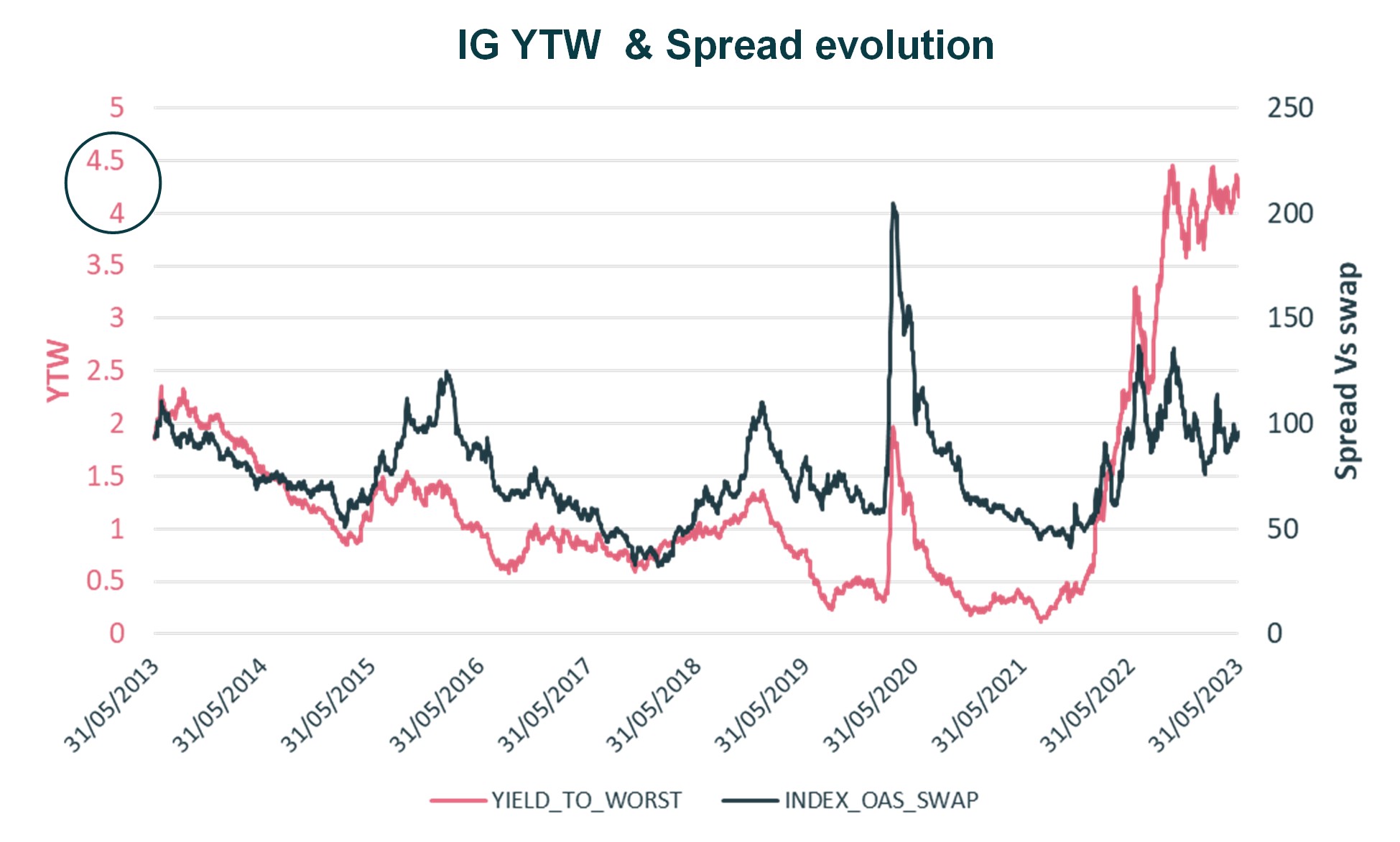

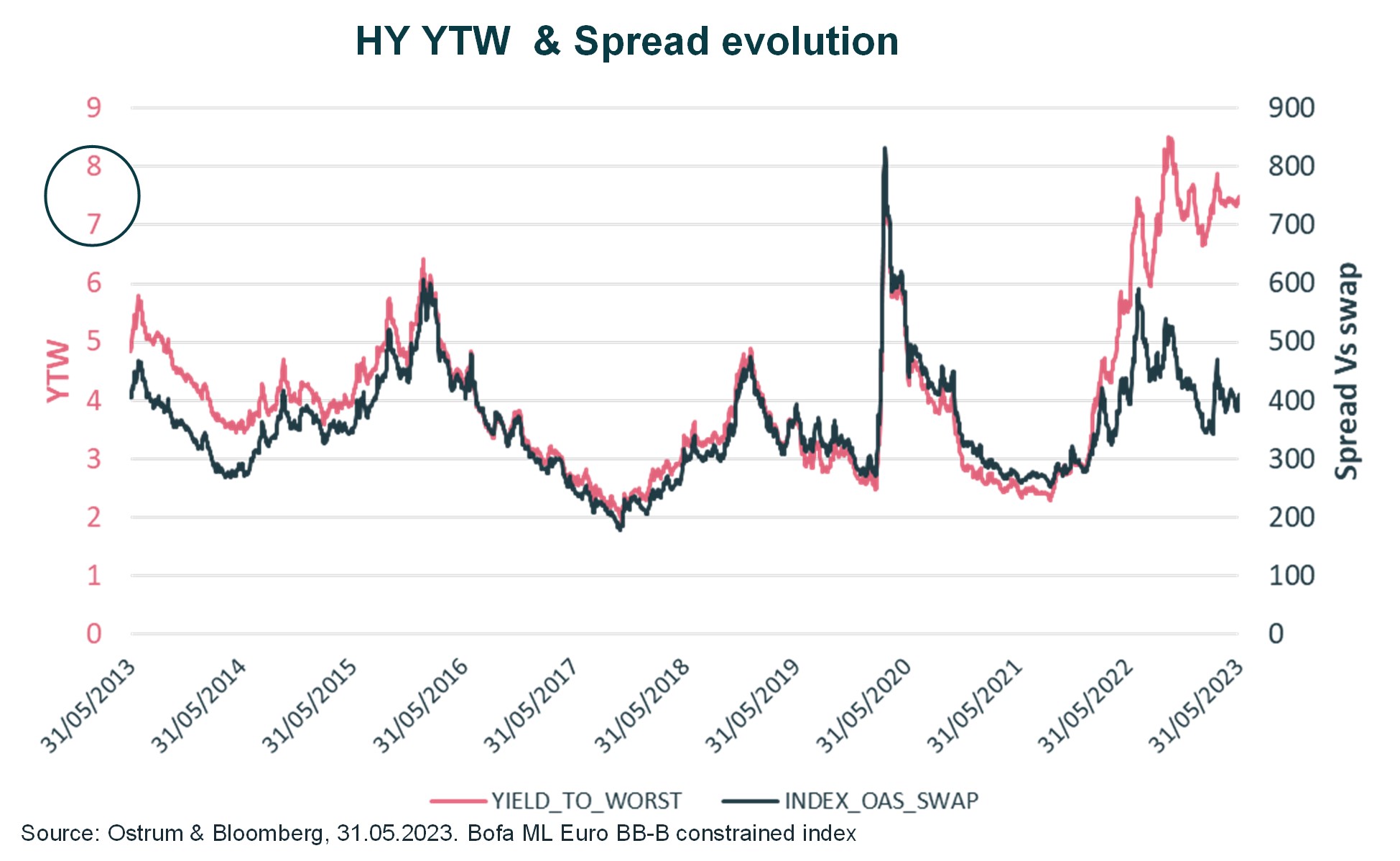

4. Yields at their 10-year highs

The Yield-to-Maturity (YTM) on European Investment Grade has never been so high. Previous peak levels, over the past 12 years, have been limited to 4%.

The same is true for European High Yield, with a Yield-to-Maturity (YTM) now above 7%.

If we look at other spreads, for example the OAS spread vs the swap curve index which provides a photo of pure specific credit risk, we note that its level is lower than during the pandemic crisis in 2020. As we are in an environment characterised by higher inflation and higher rates, yields are higher on the credit asset classes, be it Investment Grade or High Yield.

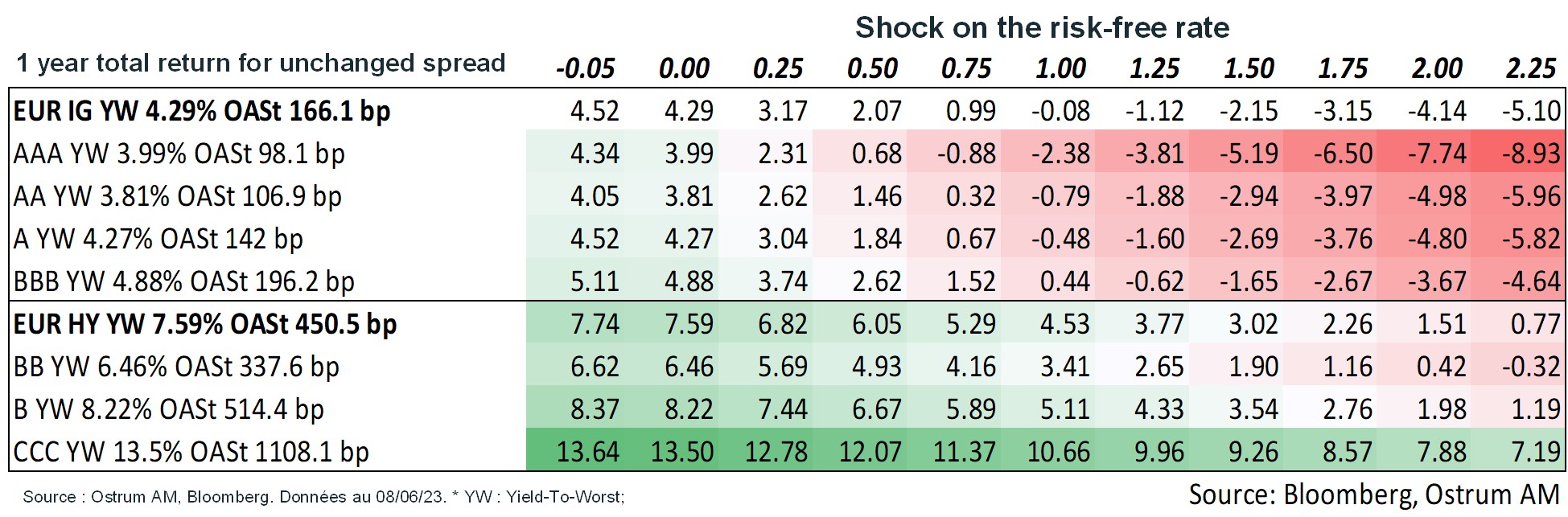

Current carry allows to withstand substantial shocks

Carry is attractive at almost 4.5% on European Investment Grade and more than 7% on European High Yield. We believe this high carry provides protection for the credit markets to withstand potential - substantial shocks.

Table 2

In our opinion, the Investment Grade segment (table 2, higher part) can absorb a 75 to 100 bp rate shock before going into negative total return territory. As a reminder, a 75 to 100 bps rate shock is not compliant with our main scenario.

As for The High Yield segment (table 2, lower part), we estimate that it can absorb a 225 bp rate shock.

This shock analysis is evidence that the context (higher rate environment) 2023 is totally different from 2022 when we began the year with yields close to zero.

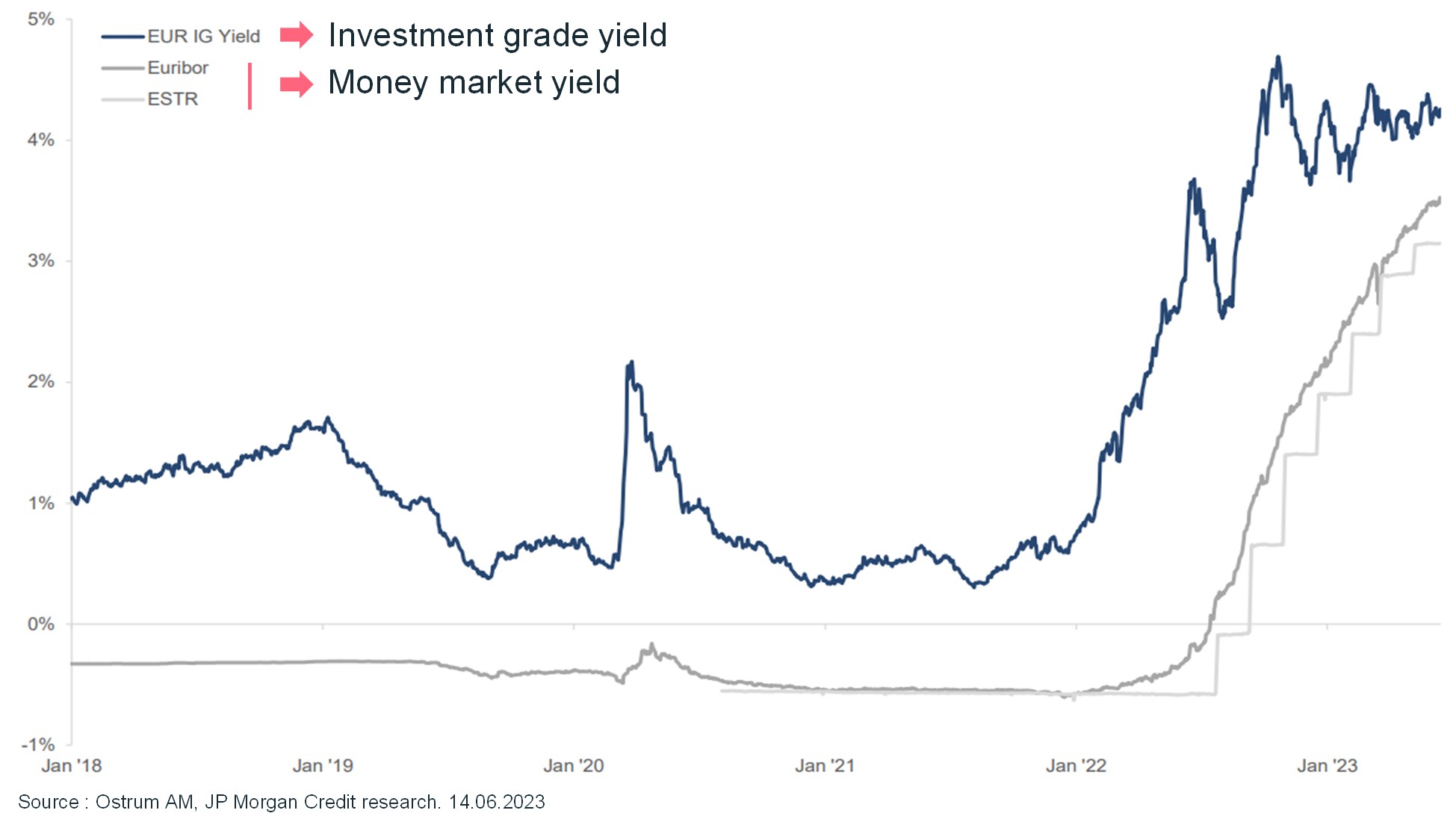

5. Incredible appealing yield on money market

The rise in rates has transformed the money market into a very appealing asset class.

As mentioned already, if our prospective views for rates are correct, we expect 2 additional hikes (July and Sept). Therefore, yields on risky assets will have to adjust. Afterwards, the period 2024 - 2025 will be a question of time value to market. Money markets are appealing for now but a change in appetite can be expected when we start expecting central banks to decrease rates. At this point, it will be beneficial to add duration.

As appetite is currently for money market, this explains why, for the time being, that yields on other fixed income asset classes are still so appealing. It is likely that money market products will remain a fierce competitor for a lot of risky assets into year-end.

6. What are the credit market opportunities for H2 2023?

2023 is turning into a year of “carry”. We are nearing the end of the hiking cycles. Investment Grade is a screaming buy above 4% and the High Yield asset class is one of the few ways to get more than 7%.

Considering the credit yield curve is quite flat between short [1-2Y] maturities and 10Y+ maturities, investors are not obliged to add longer duration to seek out additional substantial yield. As a result, focusing on the short end of the curve is very appealing.

Sector wise, we find Financials attractive versus corporates. In addition, yields on AT1 and hybrid credit bonds are more than correct. Therefore, Financials in the form of covered bonds, senior non preferred, Tier2 and AT1 are now appealing “credit wise” according to our team of 23 credit analysts and also appealing in terms of “relative value” according to our team of credit portfolio managers.

We also have a position opinion on the REITS sector that we consider “cheap” (on a selective basis). REITS have suffered from the rate hike cycle(s). On the other hand, we find Energy & Telecoms very expensive. This explains why we favour banks and other financials to a lesser extent.

Euro credit vs dollar credit? We consider € Investment Grade as more relevant in the current context. If at first glance there is 1% yield pickup on dollar Investment Grade credit, it should be noted that the cost of hedging underpins the potential additional yield. Investing in $ Investment Grade (hedged in €) actually implies a loss of yield of ~ 0.8%.

Go Green! Sustainable bonds now represent 20% of the Investment Grade primary market (corporate & banks). We even now see High Yield issuers on this market. The “greenium” on Investment Grade, which used to be detrimental to yields when yields were nearing zero, is no longer a hurdle, considering current Investment Grade yield levels.

In this environment, what strategies could be considered by investors?

In the rates, sovereign bonds, inflation scope, we can highlight four strategies.

Just Transition sustainable bonds: this market segment is interesting from a financial point of view and is also a solution for investors and issuers to meet their CSR goals in terms of environment and climate. Taking a “Just Transition” focus allows investors to combine social and territorial impacts with their climate-focused investment. The sustainable bond market continues to grow in issuance and investor flows are supportive for the development of the market.

Emerging market bonds: in 2023, we believe the stars are aligned for this asset class, marked by improving credit and ESG quality. We identify the following attributes: ⭐️ An asset class that benefits when risk appetite increases which is likely as the US Fed’s tightening cycle moves into final phase. ⭐️ In EMs, many Central Banks have already ended their tightening cycles. ⭐️ The new year has started with inflows (USD2.7bn). ⭐️ EM currencies can benefit as the US dollar stabilises. ⭐️ China’s reopening & the accelerating ‘Green Transition’ is supportive for commodity producers. ⭐️ This year’s very active primary market has been well received by investors.

Subordinated debt: this segment of the credit market is generally issued by IG issuers. Current yields above 8% can be considered as extremely attractive. The subordinated debt market is a Euro biased investment that is backed by regulation. We believe this is a strong argument in favour of the asset class. The market has recovered following the period of volatility in March. The primary market has reopened, helping the market to gain its positive convexity. It is a timely proposition.

Inflation strategies: inflation expectations are currently well priced by the market. That said, the asset class can be considered as a structural allocation for portfolios. “Real rates” trading in positive territory is an zone where we believe investors will start repositioning in the asset class. In sum, inflation linked bond strategies can be considered as diversification for inflation hedging and the big plus is that the asset class also offers potential long-term outperformance vs nominal rates.

On the credit market, we favour four strategies.

“Ultra” short-term credit strategies: these strategies are designed to boost the yield-to-maturity and performance compared to money market funds. They invest in Investment Grade and High Yield credit segment, with a very short duration profile. Investing in short-end bonds positions investors to benefit from the “pull to par effect” of bonds, which limits the risk of volatility and drawdowns.

Hold to Maturity (HTM) strategies: investors select these credit strategies to benefit from the carry, and 2023 is the year for the carry. Opportunities can be found by selecting relatively short-dated strategies which offer a clear view on the maturity date, excluding perpetual bonds.

High Yield strategies: the European high yield segment is where yields are above 7%. This is an interesting proposition to boost a credit allocation, on a selective basis. Supporting our argument is that we believe default rates could deteriorate maybe slightly but we expect them to remain below their historical average, based on sound fundamentals. Short-duration HY strategies focused on BB-B can be favoured, alongside global strategies, allowing investors to benefit from attractive yields in all markets.

Longer-duration credit strategies: for the second part of the year, when interest rate hikes will come to an end, it will be interesting to add duration to benefit from higher yields.

CONCLUSION

At Ostrum AM, we believe that the markets are still trading within the final phase of monetary tightening, both in the US and in Europe. Rate hikes are still expected on the basis of “sticky” and persistent core inflation. The result of the aggressive monetary policy has been yield curve inversion, which should remain in place for the coming months. Stability in long rates is beneficial for Investment Grade credit and, to a lesser extent, also High Yield where valuations have tightened. The continued adjustment of the dollar gives rise to optimism on emerging market debt.

In this context, selective investment approaches should remain central for investors. And well-resourced, active fixed income asset managers are well positioned to assess and measure duration risk, credit risk and volatility risk. As we move into H2 2023, we believe that short-duration credit strategies can be favoured with diversification on appealing markets such as emerging market debt and high yield, or niche solutions like subordinated debt. Finally, the sustainable bond market continues to grow and is supported by CSR and decarbonisation strategies.