Every month, find out all about the sustainable market bonds news in our newsletter

« MySustainableCorner ».

Topic of the month

The ECB wants to go further to green its investments

Speaking at the Central Bank Symposium in Stockholm, Isabel Schnabel, member of the ECB's Executive Board stressed the need for the central bank to go further in its contribution to the achievement of European objectives related to the Paris Agreements. This will require an adaptation of its policy and additional actions to ensure a trajectory of decarbonization of its operations in line with carbon neutrality by 2050.

A change of approach to achieve its objective

With the upcoming reduction of its reinvestments of around €15 billion per month starting in March, the ECB wants to change the composition of its credit debt portfolio by modifying the implemented flow-based approach (adjusting private bond reinvestments based on a climate score that reflects the carbon intensity of issuers and incorporates their decarbonization plan). Considered limited in order to achieve the decarbonization objectives, this approach should be replaced by an inventory-based approach that allows for more flexibility.

Green bonds favoured

Within the corporate bond sector, the ECB will be able to redirect its portfolio towards issuers with good climate scores at the expense of carbon-intensive issuers. While its presence will be through the secondary market, it will make an exception in order to intervene on the primary market for green bonds and issuers of non-bank companies performing from a climate perspective. As for the public sector, it could prefer green bonds issued by supranationals and agencies and favour green issues by sovereign issuers as soon as it can, while respecting the ECB’s capital allocation keys. Overall, this new approach is expected to support the decarbonization of bond investments and provide significant support to the sustainable bond market in 2023.

Figure of the month

The share of social bonds issued in January represented 23% of the total sustainable bond issues. In comparison, this percentage was 15% in 2022, showing a very good start to the year for this market segment.

Dashboard

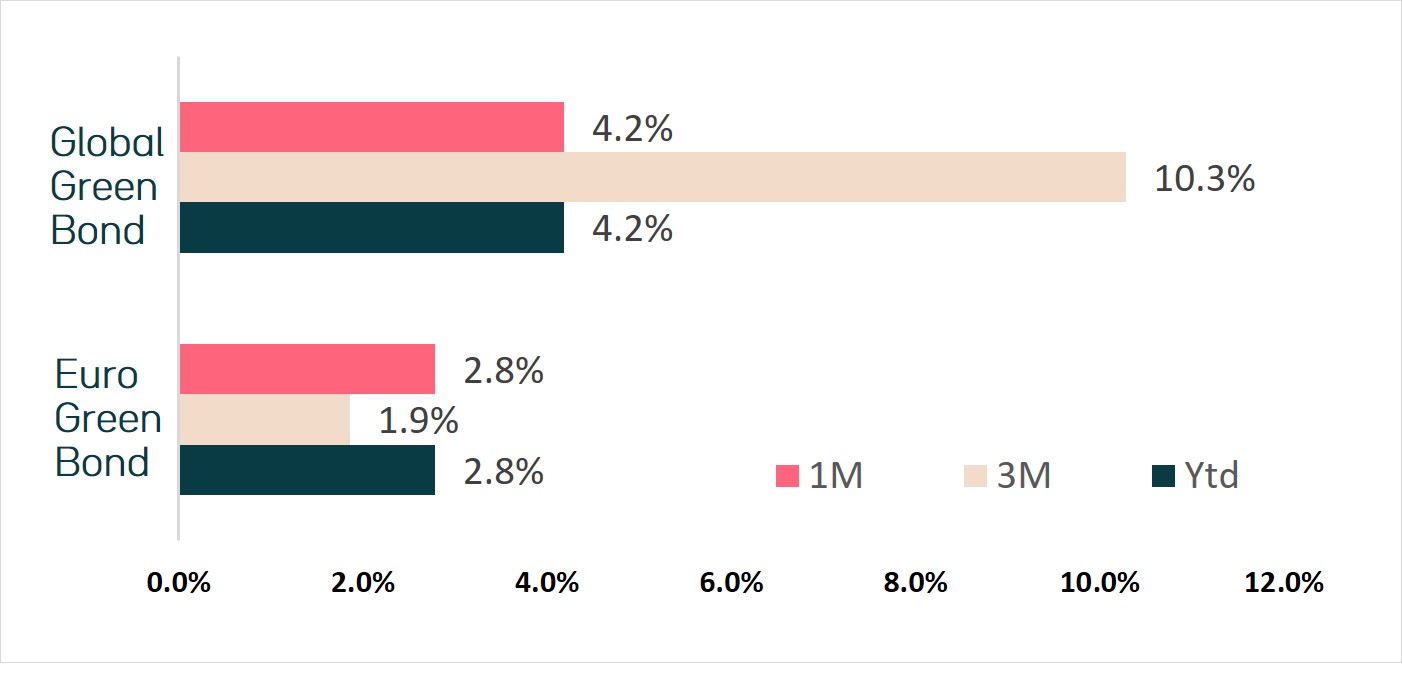

Market returns (%)

Data as of January 01/31/2023 – Sources : Bloomberg MSCI Euro Green Bond Index et Bloomberg MSCI Global Green Bond Index

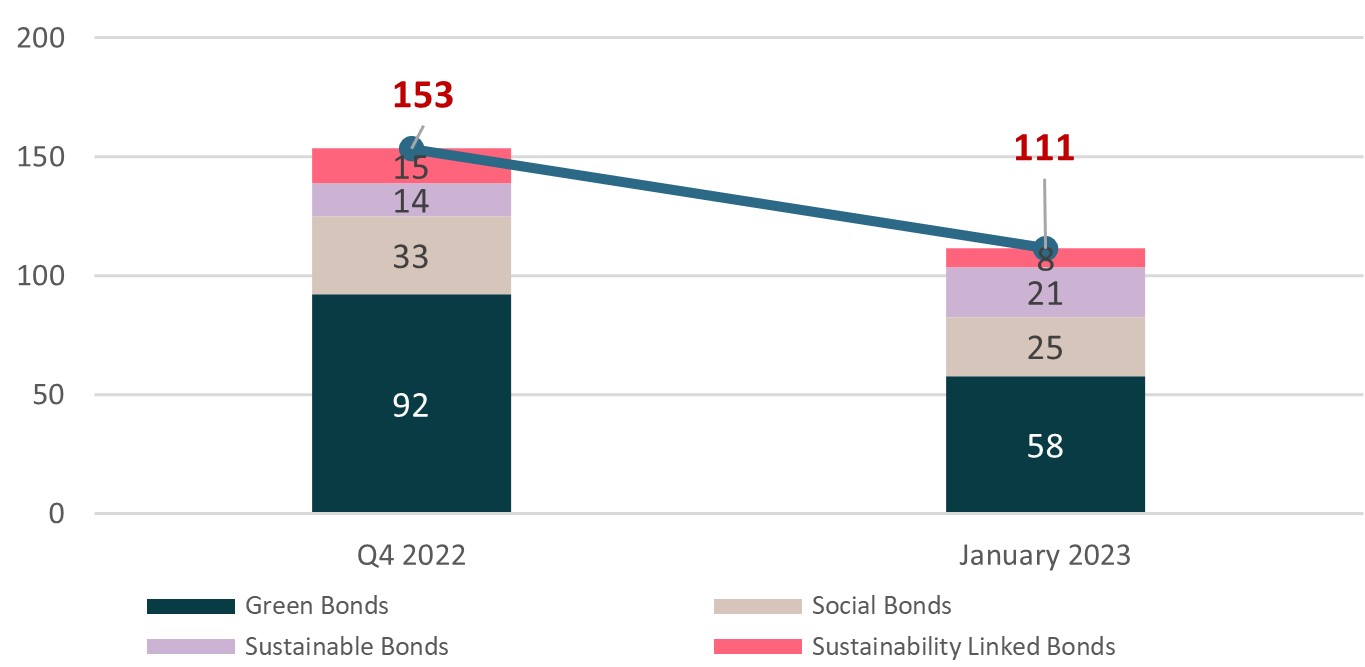

Sustainable issuances evolution ($ Bn)

Sources : Bloomberg/Ostrum AM – Data as of 01/31/2023