After 3 years of absence due to the Covid-19 pandemic, China is making a strong comeback on the international scene, notably in the G-20’s common framework for renegotiating the debt of poor countries created in 2021. What are the stakes and implications in terms of investment strategy?

The Strategy’s Perspective

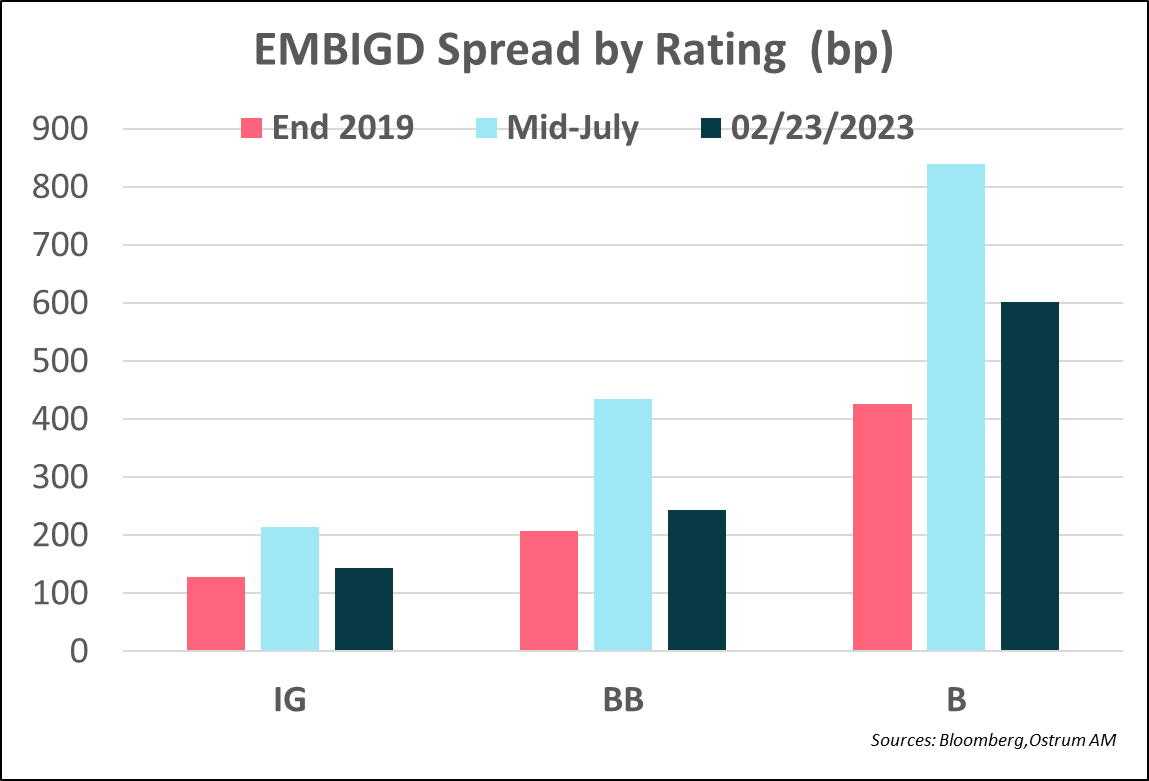

Zambia, Ethiopia, Ghana, Sri Lanka and Pakistan have been waiting for several months for the disbursement of IMF financial assistance. The reason: the choices made by China. Under the G-20 common framework for renegotiating the debt of poor countries created in 2021, the China guarantee is a prerequisite for the disbursement of IMF financial support. Since the start of the pandemic, the number of emerging countries with “distressed”* debt has increased significantly, as shown in the chart below.

Sources JP Morgan, Bloomberg – March 10 2023

17 countries are involved in the JPM EMBIGD index. These countries have the characteristic of being highly indebted. The large expenditure linked to the pandemic and the sharp rise in their borrowing costs in dollars have accentuated the deterioration of their public finances by excluding them from the capital markets. It is to help them that the common G20 debt renegotiation framework was created in 2021, also including China. Indeed, China has become the first creditor in the world, within the framework of the “Belt and Road Initiative”. Ethiopia is indebted to 17% of its GDP, 23% for Zambia, 11.6% for Pakistan and nearly 10% for Sri Lanka.

At the last G20 summit, China followed in the footsteps of other creditors by drastically reducing the debt burden of several countries. Thus, the Chinese authorities recently announced a moratorium on Sri Lanka's debt, prior to the release of the IMF rescue plan of 2.9 billion dollars. For Pakistan, the Chinese banks granted 2 billion dollars, also paving the way for a rescue plan of 1.2 billion dollars. These are positive elements that should give budgetary leeway to these countries in order to return to economic growth. This should result in a compression of risk premia. These countries must also accelerate structural reforms in order to achieve long-term sustainable growth. Improving governance is a key element. Thus, Sri Lanka is currently passing a law to fight against corruption, one cause of social tensions in the country

* « distress » : a country with a spread higher than 1.000 bps

The Manager’s perspective

China's return to the negotiating table is indeed excellent news: this confirms one of the points of our confidence in emerging debt, namely the support for the countries most in financial difficulty, from multilateral lenders, the IMF, the World Bank, etc. and China. The market was quite confident although it took a while.

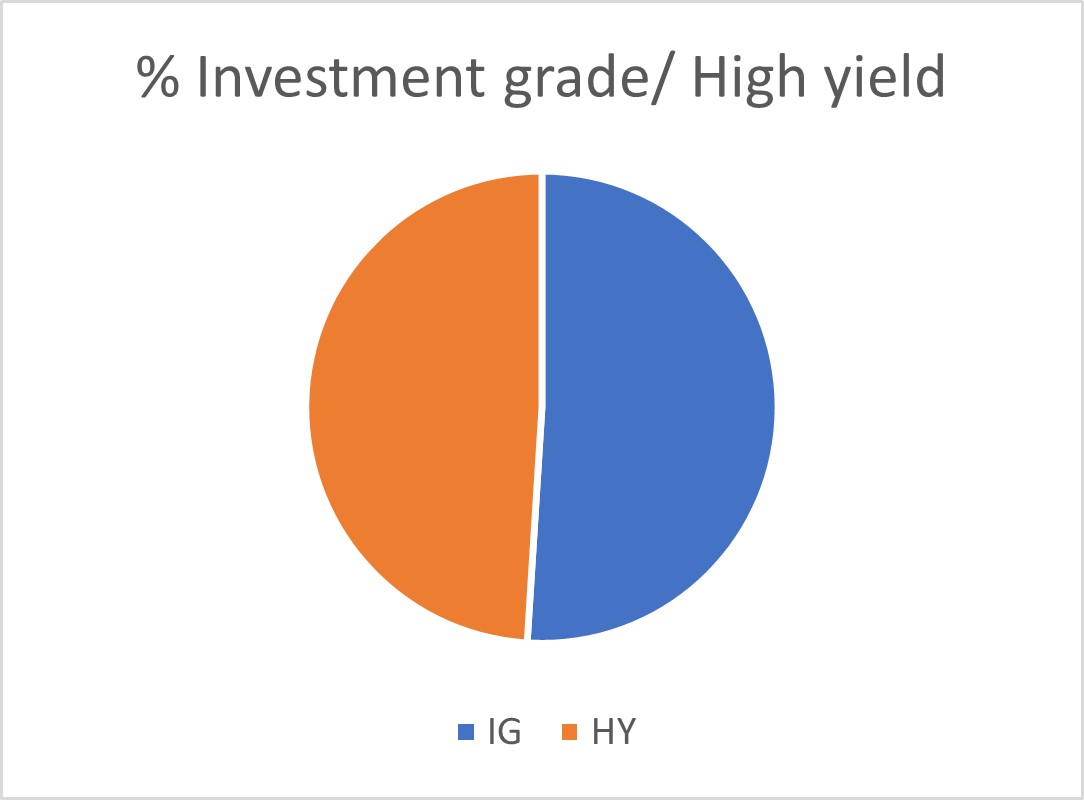

But this news should not suggest that all emerging countries need help. It is important to keep in mind that 50% of the Emerging Debt universe is Investment Grade.

The number of Distress countries in our management universe may have increased since the pandemic, but it has also started to decrease and above all it is essential to put this number into perspective with the weight importance of these countries in our universe!

Indeed the five countries mentioned (Zambia, Ethiopia, Sri Lanka and Pakistan) represent barely 2% of our universe!

In total, the CCC countries (i.e. close to payment default) and in default represent a little less than 4% of our index. With a high rate of return sometimes close to 20%, they remain attractive provided of course that you choose them correctly in order to avoid payment accidents; Our dual approach integrating both fundamental and technical elements as well as ESG criteria should precisely help us do this.

In the end, this news is important, but we must not be mistaken: it concerns the poorest countries, which are dimly represented in the Emerging Debt management universe, even if these countries represent investment opportunities that should not be underestimated.

Sources JP Morgan, Bloomberg – February 28 2023

Financial aid to developing countries: China is the magic word

Download Financial aid to developing countries: China is the magic wordOstrum Asset Management

Asset management company regulated by AMF under n° GP-18000014 – Limited company with a share capital of 50 938 997 €. Trade register n°525 192 753 Paris – VAT: FR 93 525 192 753 – Registered Office: 43, avenue Pierre Mendès-France, 75013 Paris – www.ostrum.com

This document is intended for professional, in accordance with MIFID. It may not be used for any purpose other than that for which it was conceived and may not be copied, distributed or communicated to third parties, in part or in whole, without the prior written authorization of Ostrum Asset Management.

None of the information contained in this document should be interpreted as having any contractual value. This document is produced purely for the purposes of providing indicative information. This document consists of a presentation created and prepared by Ostrum Asset Management based on sources it considers to be reliable.

Ostrum Asset Management reserves the right to modify the information presented in this document at any time without notice, which under no circumstances constitutes a commitment from Ostrum Asset Management.

The analyses and opinions referenced herein represent the subjective views of the author(s) as referenced, are as of the date shown and are subject to change without prior notice. There can be no assurance that developments will transpire as may be forecasted in this material. This simulation was carried out for indicative purposes, on the basis of hypothetical investments, and does not constitute a contractual agreement from the part of Ostrum Asset Management.

Ostrum Asset Management will not be held responsible for any decision taken or not taken on the basis of the information contained in this document, nor in the use that a third party might make of the information. Figures mentioned refer to previous years. Past performance does not guarantee future results. Any reference to a ranking, a rating, a label or an award provides no guarantee for future performance and is not constant over time. Reference to a ranking and/or an award does not indicate the future performance of the UCITS/AIF or the fund manager.

Under Ostrum Asset Management’s social responsibility policy, and in accordance with the treaties signed by the French government, the funds directly managed by Ostrum Asset Management do not invest in any company that manufactures, sells or stocks anti-personnel mines and cluster bombs.

Natixis Investment Managers

This material has been provided for information purposes only to investment service providers or other Professional Clients, Qualified or Institutional Investors and, when required by local regulation, only at their written request. This material must not be used with Retail Investors.

To obtain a summary of investor rights in the official language of your jurisdiction, please consult the legal documentation section of the website (im.natixis.com/intl/intl-fund-documents)

In the E.U.: Provided by Natixis Investment Managers International or one of its branch offices listed below. Natixis Investment Managers International is a portfolio management company authorized by the Autorité des Marchés Financiers (French Financial Markets Authority - AMF) under no. GP 90-009, and a public limited company (société anonyme) registered in the Paris Trade and Companies Register under no. 329 450 738. Registered office: 43 avenue Pierre Mendès France, 75013 Paris. Italy: Natixis Investment Managers International Succursale Italiana, Registered office: Via San Clemente 1, 20122 Milan, Italy. Netherlands: Natixis Investment Managers International, Nederlands (Registration number 000050438298). Registered office: Stadsplateau 7, 3521AZ Utrecht, the Netherlands. Spain: Natixis Investment Managers International S.A., Sucursal en España, Serrano n°90, 6th Floor, 28006 Madrid, Spain. Sweden: Natixis Investment Managers International, Nordics Filial (Registration number 516412- 8372- Swedish Companies Registration Office). Registered office: Kungsgatan 48 5tr, Stockholm 111 35, Sweden. Or, Provided by Natixis Investment Managers S.A. or one of its branch offices listed below. Natixis Investment Managers S.A. is a Luxembourg management company that is authorized by the Commission de Surveillance du Secteur Financier and is incorporated under Luxembourg laws and registered under n. B 115843. Registered office of Natixis Investment Managers S.A.: 2, rue Jean Monnet, L-2180 Luxembourg, Grand Duchy of Luxembourg. Germany: Natixis Investment Managers S.A., Zweigniederlassung Deutschland (Registration number: HRB 88541). Registered office: Senckenberganlage 21, 60325 Frankfurt am Main. Belgium: Natixis Investment Managers S.A., Belgian Branch, Gare Maritime, Rue Picard 7, Bte 100, 1000 Bruxelles, Belgium.

In Switzerland: Provided for information purposes only by Natixis Investment Managers, Switzerland Sàrl, Rue du Vieux Collège 10, 1204 Geneva, Switzerland or its representative office in Zurich, Schweizergasse 6, 8001 Zürich.

In the British Isles: Provided by Natixis Investment Managers UK Limited which is authorised and regulated by the UK Financial Conduct Authority (register no. 190258) - registered office: Natixis Investment Managers UK Limited, One Carter Lane, London, EC4V 5ER. When permitted, the distribution of this material is intended to be made to persons as described as follows: in the United Kingdom: this material is intended to be communicated to and/or directed at investment professionals and professional investors only; in Ireland: this material is intended to be communicated to and/or directed at professional investors only; in Guernsey: this material is intended to be communicated to and/or directed at only financial services providers which hold a license from the Guernsey Financial Services Commission; in Jersey: this material is intended to be communicated to and/or directed at professional investors only; in the Isle of Man: this material is intended to be communicated to and/or directed at only financial services providers which hold a license from the Isle of Man Financial Services Authority or insurers authorised under section 8 of the Insurance Act 2008.

In the DIFC: Provided in and from the DIFC financial district by Natixis Investment Managers Middle East (DIFC Branch) which is regulated by the DFSA. Related financial products or services are only available to persons who have sufficient financial experience and understanding to participate in financial markets within the DIFC, and qualify as Professional Clients or Market Counterparties as defined by the DFSA. No other Person should act upon this material. Registered office: Unit L10-02, Level 10 ,ICD Brookfield Place, DIFC, PO Box 506752, Dubai, United Arab Emirates In Taiwan: Provided by Natixis Investment Managers Securities Investment Consulting (Taipei) Co., Ltd., a Securities Investment Consulting Enterprise regulated by the Financial Supervisory Commission of the R.O.C. Registered address: 34F., No. 68, Sec. 5, Zhongxiao East Road, Xinyi Dist., Taipei City 11065, Taiwan (R.O.C.), license number 2020 FSC SICE No. 025, Tel. +886 2 8789 2788.

In Singapore: Provided by Natixis Investment Managers Singapore Limited (NIM Singapore) having office at 5 Shenton Way, #22-05/06, UIC Building, Singapore 068808 (Company Registration No. 199801044D) to distributors and qualified investors for information purpose only. NIM Singapore is regulated by the Monetary Authority of Singapore under a Capital Markets Services Licence to conduct fund management activities and is an exempt financial adviser. Mirova Division is part of NIM Singapore and is not a separate legal entity. Business Name Registration No. of Mirova: 53431077W. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong: Provided by Natixis Investment Managers Hong Kong Limited to professional investors for information purpose only.

In Australia: Provided by Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) and is intended for the general information of financial advisers and wholesale clients only.

In New Zealand: This document is intended for the general information of New Zealand wholesale investors only and does not constitute financial advice. This is not a regulated offer for the purposes of the Financial Markets Conduct Act 2013 (FMCA) and is only available to New Zealand investors who have certified that they meet the requirements in the FMCA for wholesale investors. Natixis Investment Managers Australia Pty Limited is not a registered financial service provider in New Zealand.

The above referenced entities are business development units of Natixis Investment Managers, the holding company of a diverse line-up of specialised investment management and distribution entities worldwide. The investment management subsidiaries of Natixis Investment Managers conduct any regulated activities only in and from the jurisdictions in which they are licensed or authorized. Their services and the products they manage are not available to all investors in all jurisdictions. It is the responsibility of each investment service provider to ensure that the offering or sale of fund shares or third-party investment services to its clients complies with the relevant national law.

The provision of this material and/or reference to specific securities, sectors, or markets within this material does not constitute investment advice, or a recommendation or an offer to buy or to sell any security, or an offer of any regulated financial activity. Investors should consider the investment objectives, risks and expenses of any investment carefully before investing. The analyses, opinions, and certain of the investment themes and processes referenced herein represent the views of the portfolio manager(s) as of the date indicated. These, as well as the portfolio holdings and characteristics shown, are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material. The analyses and opinions expressed by external third parties are independent and does not necessarily reflect those of Natixis Investment Managers. Past performance information presented is not indicative of future performance.

Although Natixis Investment Managers believes the information provided in this material to be reliable, including that from third party sources, it does not guarantee the accuracy, adequacy, or completeness of such information. This material may not be distributed, published, or reproduced, in whole or in part.

All amounts shown are expressed in USD unless otherwise indicated.

Natixis Investment Managers may decide to terminate its marketing arrangements for this product in accordance with the relevant legislation