Investors, whether institutional, banks or retail, are all looking for investments in line with their convictions, especially in terms of environment. Beyond the climate concern, they seek to participate in changes according to a Just Transition, which is socially responsible. These ambitions support the sustainable bond market, with the search for impact solutions, both from issuers – including governments – and from investors.

In a turbulent 2022 bond market, sustainable bonds continued to appeal. This is excellent news, because if this growth continues, it is a sign of a better alignment between financial and sustainable investment objectives. They showed some resilience, and accounted for 26% of new issues in the euro bond market in 2022.

In 2023, we expect the attractiveness of this asset class to continue due to improved bond markets, and investors’ investment and CSR policies always more oriented towards sustainable solutions.

Sustainable bond market: key facts

The EIB’s Climate Awareness Bonds (2007) and the World Bank Green Bonds (2008) are seen as the first sustainable bond issues, launching a bond market that has since grown at a spectacular pace, embedding an ambition to align ESG goals and climate action.

Starting in 2014, ICMA (International Capital Market Association) issued a series of Principals (voluntary standards1), providing guidelines and standardization for issuers by bond type.

2022 was complicated for bond markets, but growth in Green bonds stands out. Highlights include the EU Commission’s NextGenerationEU program, targeting to raise 30% of issuance through Green bonds (equiv. to €250 bn between 2022–2026) and inaugural issues from Canada, Singapore and private sector Suez (waste & water). France also issued the 1st ever inflation-linked Green. Finally, the auto industry was especially active, financing green mobility.

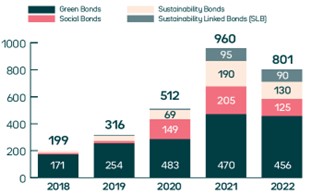

Sustainable bond issuances, 2018 to 2022 ($ billion)

Source : Bloomberg, Ostrum AM, 12/31/2022

Impact Investing: the shift is on

Aggregate bond strategies invest across the major fixed income asset classes, seeking to consistently have investment grade credit quality. Like equities, most aggregate bond indexes are market-cap weighted, implying that the countries, agencies, or private sector companies with the most debt are most represented in the index.

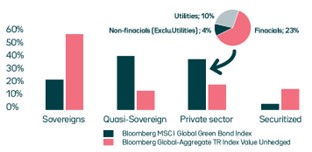

According to Olivier Vietti, Senior Aggregate portfolio manager, specialized in sustainable bonds, one of today’s best proxies for an Aggregate Impact sustainable bond portfolio is the Bloomberg MSCI Global Green Bond index, 100% comprised of green bonds. Consequently, a strategy invested in the full sustainable bond opportunity set will likely have a higher tracking error.

The issuer profile of the BBG MSCI Global Green bond index also differs significantly (image right), with higher weights in quasi-sovereigns and the private sector, implying that an allocation to a sustainable bond strategy in an investor’s portfolio will bring diversification attributes.

Structure of Global Aggregate Indices – by segment (%)

Source : Bloomberg, Ostrum AM, 12/31/2022

In our opinion, themes to watch in 2023 to invest in sustainable bonds are the following:

- initiative at the ECB to decarbonize their balance sheet, replacing conventional with green;

- European Use of Proceeds Taxonomy now covers the manufacture of Electric Vehicles & batteries, pointing to the auto sector as prime candidates for greener bond issuance;

- Sovereign greens from India, Brazil, Greece…

“Must have’s” for investors to consider an Aggregate Impact sustainable bond strategy

In our opinion, the prerequisites for an Aggregate Impact sustainable bond strategy to stand out amongst peers are multi-dimensional:

Multi-expert fixed income houses have a natural size advantage considering the wide scope of the fixed income assets eligible for an aggregate portfolio. Skilled managers with in-depth research resources can position to capture all available opportunities: active management across asset classes, duration management, security selection, rating & spread arbitrage.

A robust fixed income investment process is key to manage global interest rate markets and to optimize the asset allocation mix. A multi-factor approach with risk budgeting tolerance for each strategy is supportive for consistent returns over time. The asset manager should have coverage across the full fixed income opportunity set, allowing them to identify market drivers and valuation attributes. Portfolio construction and front office tools are essential for simulating and monitoring financial and extra-financial characteristics of aggregate portfolios.

Evidence-based security selection is key as sustainable bonds are issued to finance green and social projects and sustainability targets. Asset managers must be able to evaluate the viability of both the issuer and the issue in terms of use of proceeds and/or key performance indicators that will drive the performance of the sustainable bond over time.

Comprehensive, granular & timely DATA matters. The sustainable bond market is vulnerable to quality concerns (risk of missed targets). Asset managers with dedicated analysts are well positioned to collect and understand relevant data. Data is used to analyze and display impact results, aggregated at a portfolio level, and provides proof of sustainability.

Proprietary research methodology is essential for asset managers to take a forward-looking approach when evaluating public and private sector credit risk. Idem for sustainable bond research with proprietary methodology focused on in-depth issuer and issue analysis.

Sustainable bond strategies in insurers’ multi-asset allocations

“We are currently allocating more and more to sustainable bonds for most of the mandates we manage”, says Xavier Audoli, Head of Multi-asset Insurance management at Ostrum AM. In part, clients are keen for more sustainable bond exposure as part of their core allocation and in other part, clients are keen to fulfill their Corporate Social Responsibility (CSR) ambitions. Investments are largely made direct in sustainable bonds. When UCITS funds are used for diversification, the “currency” cost of capital can be expensive, as a result strategies fully hedged are preferred.

Starting January 1st 2023, insurance companies face a new paradigm: those under IFRS 9 norms have to measure their fund investments at fair value. At the end of each fiscal year, insurers will need to reset their profit & loss (P&L) accounts to zero (versus, for example in France, owning assets based on historical cost over time under French GAAP). We believe this change will imply that the fund component of insurer portfolios will likely be managed more actively (vs buy and maintain). Insurer investors considering allocation to funds, are likely to focus on the following attributes:

- Volatility: IFRS 9 introduces a need to better understand the drivers of volatility in a portfolio. Considering the mark to market effect, insurers will likely prefer solutions with lower volatility;

- Drawdowns: the introduction of mark to market implies insurers will be looking to identify strategies with strict risk control procedures;

- Duration: for certain types of insurance clients with longer term liability structures, funds with longer duration may be sought out;

- ESG: SFDR Article 8, 9 or SRI labels have become a “must have” positive attribute for insurers as they have objectives to maintain high thresholds.

Which partner to choose to invest in sustainable bonds?

The sustainable bond market is framed by Principles and Guidelines elaborated by the ICMA (excl. Transition Bonds), adapted to each kind of bonds. However, it is a “self-labeled” market, where each investor qualifies the sustainability of its issues. It is thus crucial to be able to conduct an in-depth analysis of each issuer and issue.

Consequently, as for some other specialized asset classes, investors in sustainable bonds must partner with asset managers offering large human and technological resources. Dedicated methodologies are and edge to appropriately qualify each bond in an enlarged market made of investment grade and high yield issuers.

Ostrum AM invests in the sustainable bond market since its creation. We currently manage over € 25 billion.

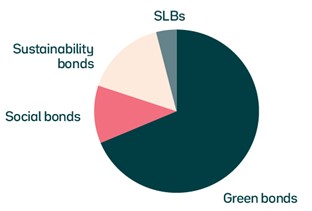

Breakdown of Ostrum AM sustainable bond investments: € 25 bn

Source : Ostrum AM, 12/31/2022

To best support investors in their sustainable bond approach, we have a dedicated team of two sustainable bond analysts with an average of 17 years of experience.

The proprietary “Sustainable Bond Ratings” methodology they have developed goes beyond the ICMA principles, and is tailored to each type of bonds. To date, they have rated more than 600 sustainable bond issues which they permanently monitor, applying a dual approach:

- Axis 1 – Issuer analysis - evaluation of the issuer’s climate/environment and/or social policy, and decision on whether the bond issue is aligned with this policy;

- Axis 2 – Instrument analysis to assess transparency and impact of the Use of Proceeds (green, social & sustainability bonds); assessment of KPIs (key performance indicators) and SPT2 ambitions (Sustainability Linked Bonds).

Conclusion

All stakeholders are focused on sustainable investments and climate impact, at all levels, an environment favorable to the sustainable bond market which current framework may improve over time.

As an example, the European Central Bank recently stressed the need to go further in its contribution to the achievement of European objectives related to the Paris Agreements. This will require an adaptation of its policy and additional actions to ensure a trajectory of decarbonization of its operations in line with carbon neutrality by 2050. It may redirect its corporate bond portfolio towards issuers with good climate scores at the expense of carbon-intensive issuers.

Additionally, the European Union sets standards to avoid greenwashing: provisional agreement for the creation of a EU Green Bond Standard.

On its side, the AMF proposes to introduce into European law minimum environmental requirements that financial products should meet to be categorized as Article 8 or Article 9 according to the SFDR regulation which would usefully complement the current regulatory structure.

Finally, the European Commission presented its Industrial Green Deal to improve the competitiveness of European industry to achieve its carbon neutrality goal.

1 Standards defined by ICMA: The Green Bond Principles, The Social Bond Principles, The Sustainability Bond Guidelines, The Sustainability-linked Bond Principles

2 Sustainability Performance Targets (SPT): measurable improvements in key performance indicators on to which issuers commit to a predefined timeline. SPTs should be ambitious, material and where possible benchmarked and consistent with an issuer's overall sustainability/ESG strategy

Sustainable bonds definition – financing targets

Sustainable bonds are instruments that provide positive responses in terms of transparency and use of proceeds towards projects with environmental or social added value. There are five categories, each being by Principles and Guidelines elaborated by the ICMA (excl. Transition Bonds). However, it is a “self-labeled” market, where each investor qualifies the sustainability of its issues. It is thus crucial to be able to conduct an in-depth analysis of each issuer and issue.

GREEN BONDS

Green Bonds are sustainable bonds that finance or re finance projects aimed at the energy and ecological transition: Renewable energy, energy efficiency, pollution prevention and control, sustainable environmental management of living natural resources and land use... Green bonds were the first sustainable bonds issued in the financial markets. Today, both private issuers and sovereign and assimilated issuers use this type of issue to finance their green projects. Green bonds dominate the market and account for about 2/3 of sustainable bonds.

SOCIAL BONDS

Social Bonds are sustainable bonds that finance or re-finance projects to solve or mitigate key social problems: basic affordable infrastructure (drinking water, sanitation, etc.), access to basic services (health, housing, education, training), job creation, food security, access to digital technology, etc. Social Bonds have grown particularly strongly in 2020 in the context of the Covid-related health crisis. Since then, they have continued to grow but at a slower pace and represent about 15% of the market. The interest of issuers is partly linked to the need for a Just Transition, which integrates social criteria into environmental projects.

SUSTAINABILITY BONDS

Sustainability bonds are sustainable bonds that finance or re-finance a combination of both environmental and social projects. These instruments help diversify the market, an important element for both issuers and investors. Sustainability bonds allow issuers to clearly identify environmental projects that have social benefits or social projects that have positive environmental impacts. It is the issuer that chooses to classify its issue as Green Bonds, Social Bonds or Sustainability Bonds.

SUSTAINABILITY-LINKED BONDS

Sustainability-linked bonds are sustainable bonds that finance or re-finance the general needs of a company while promoting its CSR ambitions through a commitment to specific and costed medium- and long-term sustainable development goals. The issue is accompanied by KPIs (Key Performance Indicators) to measure and monitor commitments made. Since their creation in 2020, Sustainability-Linked Bonds have continued to grow: in 2021, the number of issues has multiplied by more than ten, to nearly 100 billion dollars, or about 12% of the market. New issuers, mainly from the high yield category, have seized the opportunity to refinance through this instrument, which represents in 2022 about 4% of the market.

TRANSITION BONDS

Transition bonds are sustainable bonds whose purpose is to bridge the gap between “already low carbon” projects, eligible for financing by Green Bonds, and those that are not. However, they do make significant progress in reducing greenhouse gas (GHG) emissions. Transition bonds are mainly aimed at the industrial sector, to finance the transition of companies to a low-carbon world. Emitters commit to measurable reductions in their greenhouse gas (GHG) emissions. The Transitions bond market does not currently have a standard definition or framework.