Every month, find out all about the sustainable market bonds news in our newsletter

« MySustainableCorner ».

This month in a nutshell

- Saint-Gobain, a French company active in building materials, has identified its «green» activities aligned with the European Taxonomy in order to meet the new regulations in force. In particular, this exercise enabled the group to switch from a sustainable financing method such as “Sustainability-linked bonds” to green bond issues. This approach could be a positive signal for the growth of the green bond market if other European groups follow the same dynamic.

- On March 13th, Stellantis issued a 12-year green bond that had a resounding success. Investor demand was huge (x10 oversubscribed), which allowed the company to set the bond price below its existing issuance curve. The funds raised will solely be used to finance projects related to the electrification of vehicles.

- The majority of professional investors worldwide have implemented ESG investment policies. More than 1,000 investors were surveyed by Deloitte and the Fletcher School at Tutfs University (US). The study revealed a significant growth in the proportion of investors implementing sustainable investment policies: 79% of investors reported having developed a policy, compared to only 20% 5 years ago.

- The French Institute of Sustainable Finance has published its overview of the practices of Place de Paris to fight against deforestation. This panorama offers a relay to the National Strategy to fight against imported deforestation (SNDI) with the mobilization of financial actors of the Place de Paris.

Figure of the month

Performance of the MSCI Green Bond Index in 2023. It is possible to combine performance and positive impact.

Source: Bloomberg, March 2024

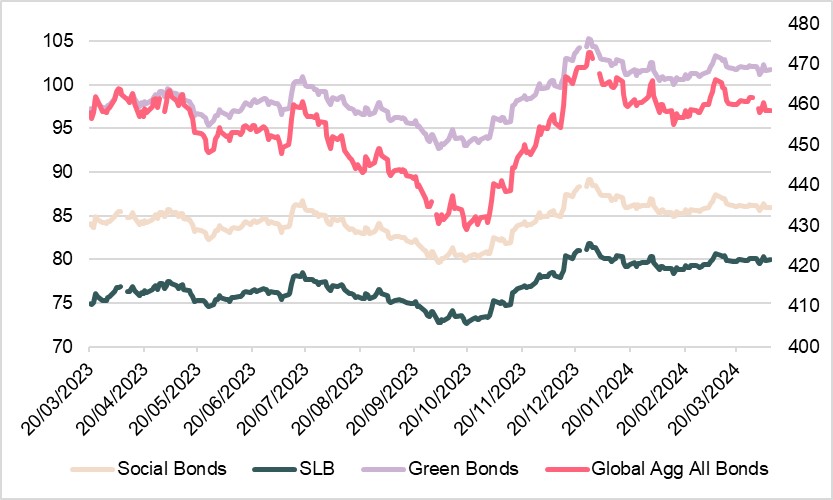

Chart of the month

Sustainable bond performance compared to the rest of the bond market

Investing in sustainable bonds: performance comparable to traditional bonds (rolling one-year period), with a positive impact on the planet and its inhabitants!

Sources: Bloomberg, Ostrum AM, March 2024

SLB: Sustainability-Linked Bonds. Ice SLB Index.

Green bonds: MSCI Green Bond Index. Social Bonds: ICE Social Index. Global Agg All Bonds: Bloomberg Global Agg Index.