Every month, find out all about the sustainable market bonds news in our newsletter

« MySustainableCorner ».

This month in a nutshell

- The AMF (Autorité des Marchés Financiers) recently published in its position paper, the essential principles that it believes should guide the revision of the SFDR regulation (Sustainable Finance Disclosure Regulation). It emphasizes the categorisation of products and proposes products to be categorised more accurately and objectively (beyond the Articles 8 and 9).

- 36 major climate risks have been identified by the European Environment Agency, calling for more ambitious European public policies. These risks fall into five broad areas: ecosystems, food, health, infrastructure, economics and finance.

- A study mentioned by Bloomberg suggests that diversity on boards could lead to a reduction in volatility in the financial markets for the companies concerned. It is important to have a Board diversity of genders, ethnies, cultures and experiences.

- SBTI (Science Based Target Initiative) rejects the commitments of more than 200 companies on net greenhouse gas emissions, because they are ambitious enough. It is thinking of extending its sectoral standards while promoting regional differentiation to encourage more southern participants to adopt its framework.

- A step back on the climate in the US! The Securities and Exchange Commission (SEC) adopted new climate-related risk disclosure rules for public companies. It will finally not require disclosure by public companies of their so-called “Scope 3” GHG emissions, and the requirement to disclose Scope 1 and 2 GHG emissions is limited by a materiality standard.

Figure of the month

European Union investments needed between 2031 et 2050 to achieve carbon neutrality.

Source: European Commission, January 2024

Chart of the month

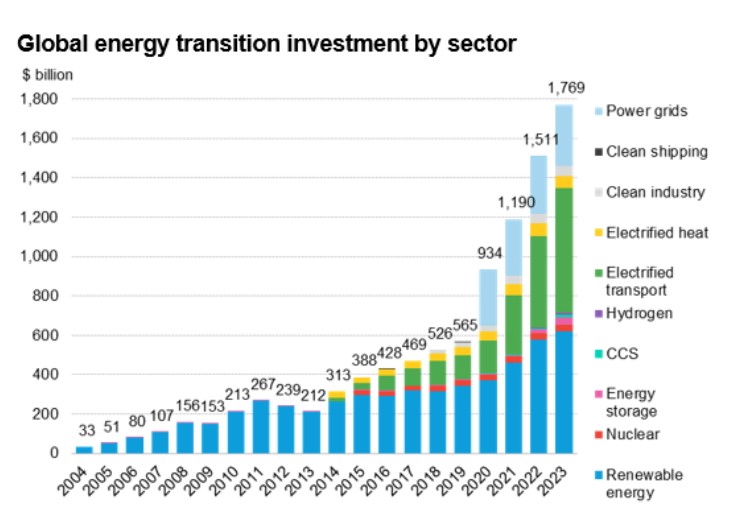

Global energy transition investments by sector

Investments in low carbon energy hit new records in 2023. However, it is not nearly sufficient to set the world on track for net zero by mid-century (average $ 4.8 Tr/year from 2024 to 2030).

Source: BloombergNEF, 30 January 2024

https://about.bnef.com/blog/global-clean-energy-investment-jumps-17-hits-1-8-trillion-in-2023-according-to-bloombergnef-report/