Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Topic of the week: China’s Real Estate Crisis: “an air of déjà vu”?…

- The Chinese real estate crisis bears similarities with the Asian crisis of 1997, particularly on the over-investment in sectors that are unsustainable over the long term;

- Nevertheless, financial risk remains focused on real estate through local governments and their financing vehicles (LGFV);

- LGFV collossal debt is a risk for the Chinese banking sector;

- Recent government measures, including LGFV debt restructuring, should best stabilize the sector;

- China needs new growth drivers, which is challenging in this hostile international environment.

Market review: Powell’s guilty hesitations

- Fed: a pause is likely in November despite sustained growth;

- Strong tensions on T-note yields which skirts 5%;

- Risky assets under pressure from high yields;

- Gold is back as a safe haven.

Zouhoure Bousbih's podcast

- Topic of the Week: Sovereign rates, at the crossroads: geopolitics, central banks and economic conditions;

- Theme: China’s housing crisis: an air of déjà vu?

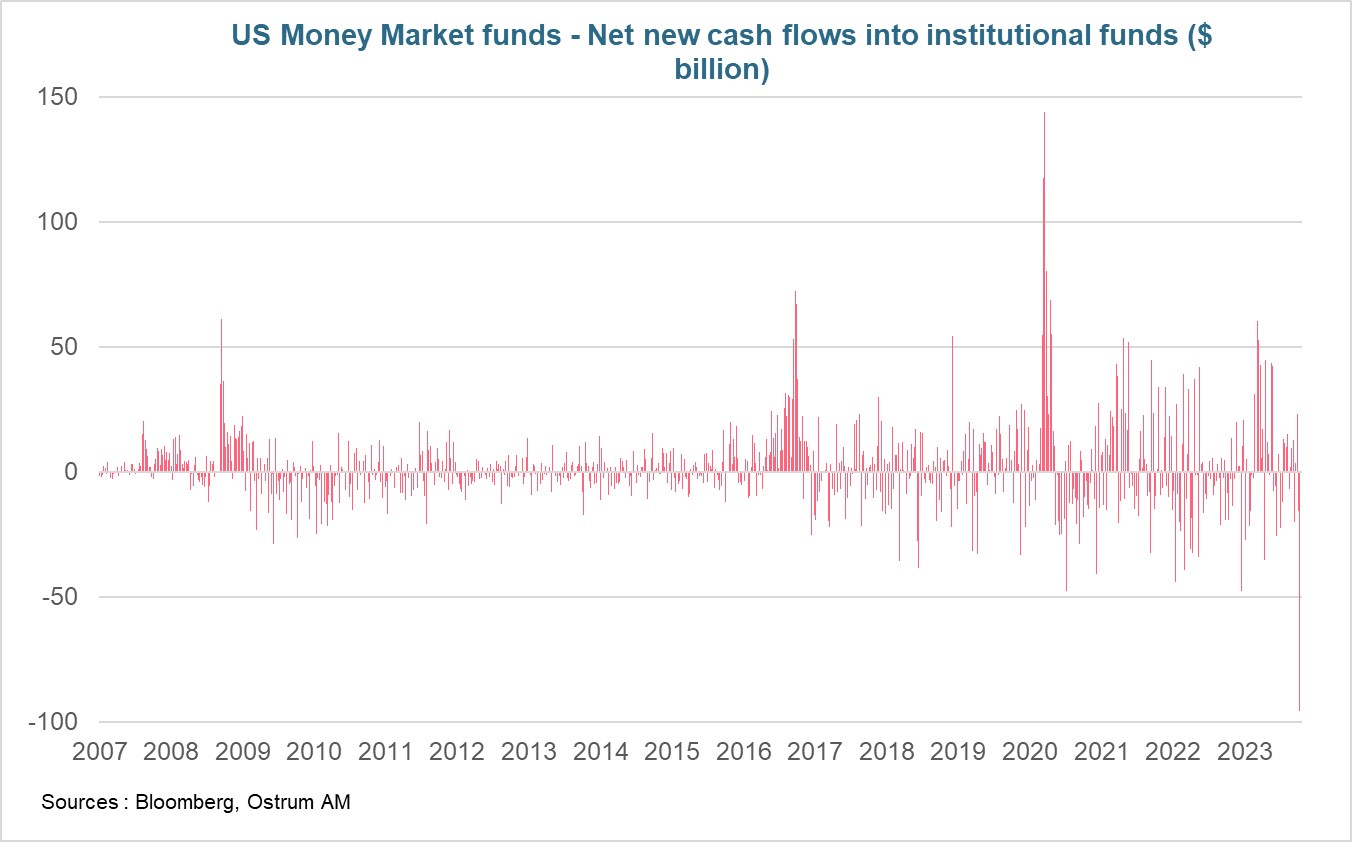

Chart of the week

US money market funds have seen unprecedented redemptions over the past seven days. According to ICI data, outflows reached $95 billion between Thursday October 12 and Wednesday October 18.

In addition to arbitrage towards bonds as yields rise, the main reason for these movements seems to be corporate tax payments (usually mid-September) postponed by a few weeks due to climatic disasters recorded at the start of year.

Figure of the week

China sold $21.2 billion worth of American assets in August (including $15 billion in bonds), the biggest drop in 4 years. This comes as the PBoC attempts to stem the depreciation of the yuan against the dollar.