Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: A review of the ECB operational framework

- The ECB unveiled a review of its operational framework on March 13;

- The central bank will continue to play a key role in the functioning of money markets for years to come;

- The rate corridor has narrowed with the refi rate just 15 bp above the deposit rate from September;

- Full-allotment refinancing operations against a broad set of collateral should reach all corners of the euro area banking system;

- New structural LTRO and asset purchases will help banks comply with net stable funding ratios and liquidity coverage ratios;

- In all, the changes should mitigate short-term volatility and contribute to lower spreads in supranational and green bonds in particular.

Market review: Getting closer to rate cuts

- The Fed confirms three cuts in 2024;

- T-note yields dip to 4.20%;

- Sovereign spreads widen, some tensions in high yield space;

- Equities remain upbeat.

Axel Botte's podcast

- Topic of the week: The latest significant developments, back to central banks, the economic situation in the euro area;

- Theme: The ECB’s operational framework reviewed.

Chart of the week

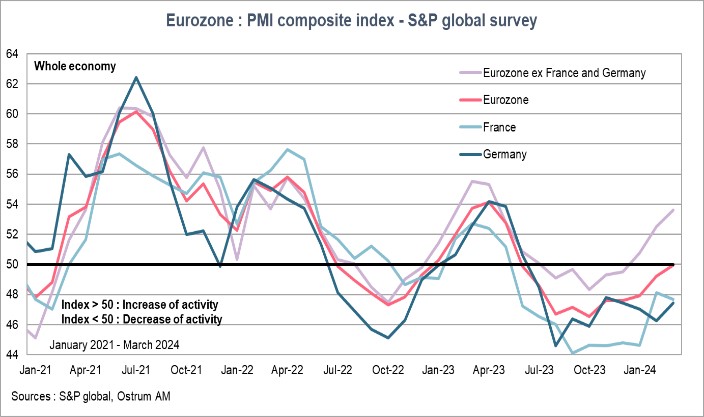

Preliminary PMI surveys for March demonstrate a two-speed recovery within the economic and monetary union. Germany remains lagging behind below the threshold of 48 and the rebound of the French economy seen in February already seems to be weakening.

Conversely, the economies of southern Europe are reporting a clear improvement in the economic situation. This better growth is one of the reasons for the clear tightening of the spreads of these countries against German and French debts. strategies to work is the absence of volatility.

Figure of the week

The size of the surprise rate hike in basis points in Turkey announced on 21 March. The increase to 50% aims at steadying the Turkish Lira ahead of the elections at the end of the month.