Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte's and Zouhoure Bousbih's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Red Sea, Panama, and Inflation

- Tensions in the Red Sea and Panama Canal have brought back the specter of distortions in the global supply chain;

- The consequences are higher freight costs, especially for sea routes from China to Europe;

- An inflationary shock as in 2021 seems unlikely;

- However, this should not be long-term. Contagion to other critical bottlenecks could also impact inflation through higher oil prices.

Market review: An unsinkable market ?

- US inflation at 3.4% in December;

- T-note yields dip back below 4%;

- Strong demand at euro area sovereign bond syndications;

- Equities rebound as high yield spreads narrow.

Axel Botte's and Zouhoure Bousbih's podcast

- Topic of the week : Equity/high yield flows, T-note and euro credit;

- Theme : Red Sea, Panama and inflation.

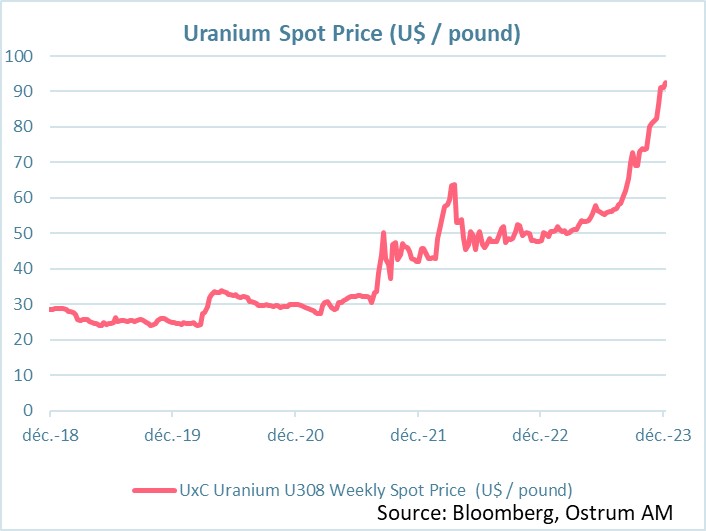

Chart of the week

Uranium prices are at their highest in 17 years. The benchmark contract is $90 a pound. The surge in prices is due to the revival of nuclear in the energy mix in Western countries.

Other factors also explain the surge in prices, such as fears of oil and gas supplies linked to geo-political tensions, particularly after the coup in Niger.

Global demand for uranium is expected to continue to grow. Kazakhstan is the world’s largest uranium producer, producing 45% of the market supply.

Figure of the week

U.S. debt reached a new all-time high of $34.002 trillion. It is also the age of the new French Prime Minister, the youngest of the Vth Republic.