Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte's and Aline Goupil-Raguénès' podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Risk of downgrade of the French debt rating

- The budget deficit turned out to be much higher than expected by the government in 2023: 5.5% of GDP compared to 4.9%;

- This is due to lower-than-anticipated revenues related to faster-than-expected disinflation in a context of sluggish growth;

- Despite additional savings of 10 billion euros and more to come, the target of a 4.4% deficit of GDP in 2024 appears ambitious;

- The objective to bring it below the 3% threshold by 2027 seems difficult to achieve;

- This budget overrun limits the government's ability to make the necessary investments in energy transition, digitalization, and defense, as well as to cope with a potential new shock;

- The risk of a downgrade of France's debt rating by S&P has increased. The impact is expected to be limited on the markets.

Market review: Oil prices drifting higher

- US job gains top 300k in March amid improving activity surveys;

- Higher oil prices sent equities lower;

- Euro credit spreads tighten ignoring equity weakness;

- Dollar stays firm, as Yellen criticizes China’s industrial policy.

Axel Botte's and Aline Goupil-Raguénès' podcast

- Topic of the week: Rate hike before the ECB;

- Theme: Risk of downgrade of the French debt rating.

Chart of the week

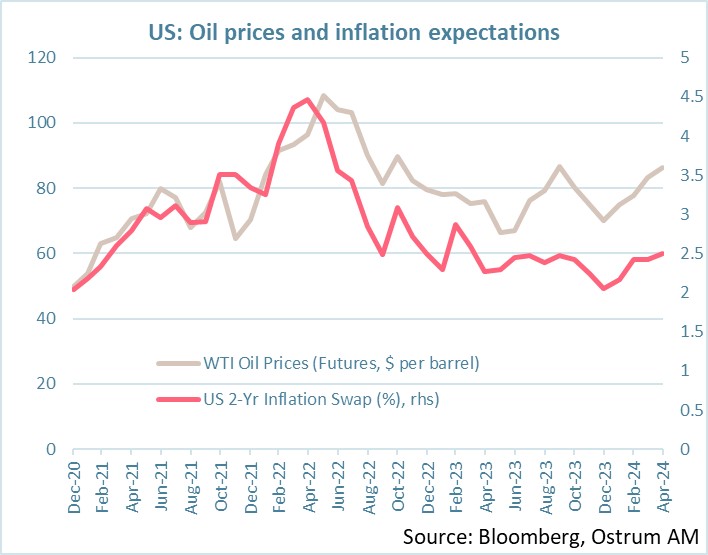

The price of Brent crude oil has been gradually rising over the past few weeks. Oil prices continue to rise steadily due to tensions in the Middle East. OPEC's supply remains limited.

Furthermore, the cyclical improvement seen in global manufacturing surveys foreshadows an increase in demand. The beginning of the driving season in the United States also represents a significant source of demand.

In this context, the modest increase in 2-year inflation breakeven rates may present investment opportunities.

Figure of the week

188 billion dollars: This is the unprecedented amount of green bond issuance globally, up by 16% year-on-year in the first quarter of 2024.