Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO Letter

Do promises commit only those who listen to them?

Most business surveys indicate a pickup in activity since the beginning of the year. US growth is in line with its potential. Congress in-fighting has been resolved, thus averting the risk of a shutdown until the end of the fiscal year in September. However, the upcoming US election campaign, which is expected to be contentious, creates uncertainty for the end of the year. Growth in the Eurozone remains highly heterogenous. Germany is contracting, while France and Italy must implement fiscal tightening due to last year’s public deficit slippage. In contrast, Spain and Portugal are accelerating. Chinese growth is showing signs of improvement. The refocusing on industrial policy is driving a rebound in exports, also fueled by the weakness of the yuan. This mercantilist strategy will expose China to US and potentially European protectionism.

The end of the quarter is often conducive to portfolio rebalancing. Long-term bond yields have risen due to less favorable inflation data, undermining expectations of significant monetary easing. The yield on T-notes has surpassed 4.30%, sparking buying interest. The Bund yield is hovering around 2.40%. The increase in sovereign spreads, led by French OATs and Italian BTPs, reflects profit-taking and the risk of credit rating downgrades over the coming months.

The performance of risky assets has been stellar in the first quarter. Equities have delivered returns close to 10% with reduced volatility. However, profit margins have likely peaked. Meanwhile, credit spreads have less potential for further narrowing after a strong start to 2024. Specific risk is resurfacing in the high yield universe, although the default rate remains low.

Economic Views

Three themes for the markets

-

Monetary policy

Interest rate expectations continue to fluctuate but remain broadly in line with the central bankers' statements. The Fed is expected to proceed with a reduction in the fed funds rate after a review of the pace of QT in May. The ECB remains attentive to the evolution of wages, which remains inconsistent with a sustained return to the 2% target. China continues its monetary easing policy, while the BoJ ended negative rates in March.

-

Inflation

Inflation is gradually converging towards central bank targets. In the United States, inflation stood at 3.5% in March. Core inflation has remained below 4% since October, despite the inertia of rents. However, the deflator is close to the target at 2.5%. In the euro area, inflation slowed to 2.4%, according to the flash estimate for March. The underlying index dropped below 3%. Conversely, in China, inflation is still below 1%, due to the decline in food prices persisting.

-

Growth

The global manufacturing sector is showing encouraging signs at the beginning of this year. The US economy is operating at its potential in Q1. The Euro area is finally emerging from an extended period of stagnation. Surveys indicate improvement, particularly in the southern economies. In China, activity is stabilizing, supported by the service sector and a rebound in exports facilitated by a weaker yuan. Japan and the United Kingdom are experiencing moderate growth.

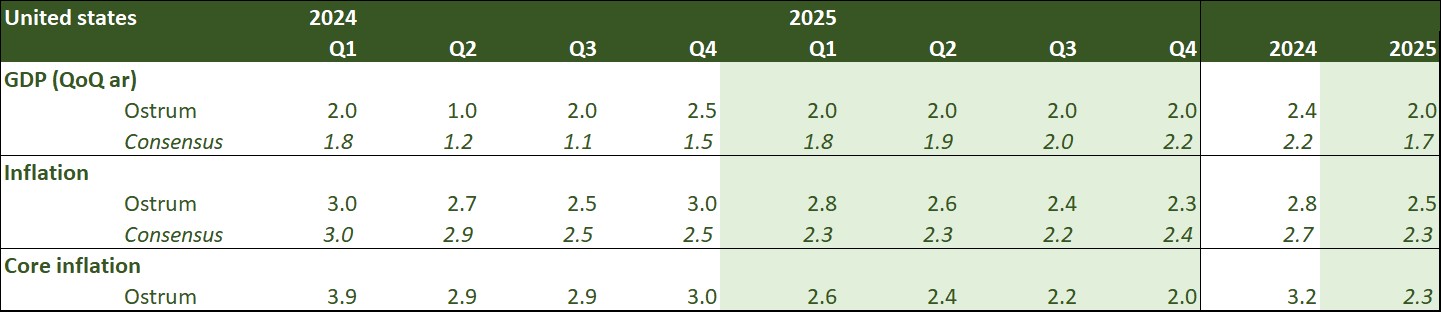

Key macroeconomic signposts : United States

- The U.S. economy remained strong at the end of the year, with a 3.4% growth in the fourth quarter. Domestic demand is being driven by consumption and public spending, while investment (equipment, R&D) has been revised upwards. The first quarter is expected to be close to 2%. As of the end of March, the Atlanta Fed estimates Q1 2024 at 2.3%.

- The federal deficit is expected to reach around $1.6 trillion in 2024. The risk of government shutdown has been avoided until the end of the fiscal year. Military aid to Ukraine, Israel, and Taiwan has not been voted on.

- Financial crisis risks appear to be contained. The NYCB episode is a replication of Signature Bank and not a precursor to a banking crisis. Household balance sheets remain healthy. However, attention should be paid to the increase in credit card defaults. The interest burden is above one trillion dollars annually.

- The unemployment rate remains below its equilibrium level (4-4.5%). The Fed does not anticipate a significant increase. Immigration has amplified growth. A halt to immigration would lead to new wage tensions.

- Disinflation continues. Core inflation is expected to decrease to around 3% by the end of 2024. Housing and energy pose risks for inflation, but the Fed favors the less weighted housing deflator (2.5% in February). The Fed will also facilitate Treasury refinancing.

Key macroeconomic signposts : Euro area

- The growth is expected to remain almost stagnant in the first quarter of 2023, before gradually strengthening.

- The beginning of a recovery is noticeable through the improvement in surveys conducted with business leaders. This is linked to peripheral countries, Spain and Italy in particular, which are benefiting from an increase in their order books.

- France, on the other hand, has not found a source of impetus and Germany remains penalized by the consequences of the energy shock and its strong past dependence on Russian energy, as well as by the disappointing growth of China which is weighing on its exports.

- Households will benefit from an increase in their real income given the fact that wages are expected to continue to grow at a sustained pace in a context of more moderate inflation. Combined with the maintenance of a robust labor market, this will support consumption.

- Internal demand should also benefit from a monetary policy that will become less restrictive and exports from a strengthening of world trade.

- On the other hand, fiscal policy will not support growth. After being suspended since 2020, the budgetary rules were reinstated at the start of the year and a reform was adopted. The budgetary slippage of France and Italy requires corrective measures.

- Inflation has significantly slowed down since October 2022, mainly due to the negative contribution of oil prices, followed by moderation in food and goods prices. However, inflation in services has stabilized at 4% for the past 5 months, reflecting wage pressures. Inflation will no longer benefit from the strong negative impact of energy prices, governments are gradually ending measures to contain the rise in energy prices and wages are expected to continue to increase at a sustained pace.

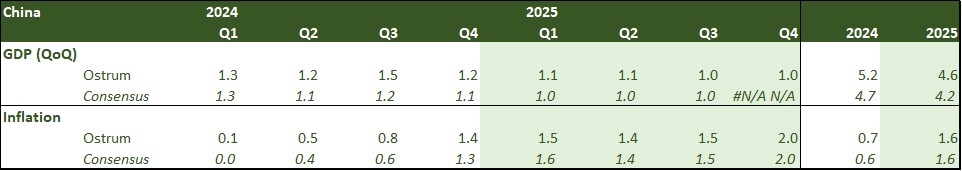

Key macroeconomic signposts : China

- Economic activity is picking up in Q1 driven by the service and manufacturing sectors (recovery of global exports).

- Is the PBoC preparing a QE?

- Comments made by Xi Jinping last October, but only recently published, suggest the possibility of the PBoC negotiating Chinese sovereign bonds. These comments have sparked speculation about a potential monetary easing.

- We believe it is more a willingness to expand the PBoC's toolbox to provide liquidity to the economy rather than a QE resembling those of the Fed and the ECB. PBoC loans to commercial banks have become the main instrument for providing liquidity to the economy. Government bonds account for only 3% of the central bank's balance sheet.

- The PBoC already has several instruments to inject liquidity: the medium-term lending facility and required reserve ratios.

- Given the accommodating turn taken earlier this year, such as the surprise 50 basis point cut in required reserve ratios, we believe that further reductions in required reserve ratios are likely, and negotiations on sovereign bonds will be conducted within the PBoC's daily operations (OMO).

- Fiscal policy should manage the risk of local government debt in coordination with monetary policy, as well as finance infrastructure projects, especially in rural areas, as part of the country's modernization.

- Inflation (-0.8% in January) has likely reached a low point, posing no short-term problem. The inflation target for 2024 has been set at 3% to anchor inflation expectations.

Monetary Policy

Towards a rate cut by the summer from the Fed and the ECB

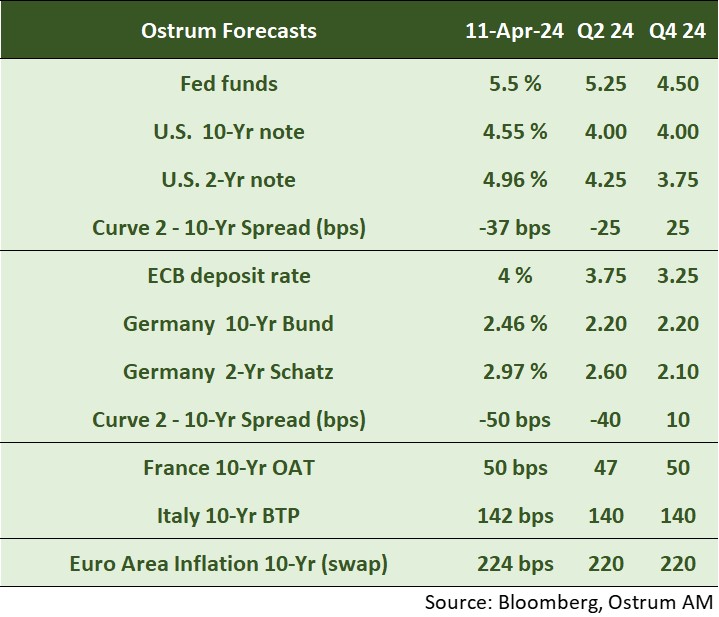

- The Fed should reduce the pace of its QT in May and then cut its rates

During the March 20 meeting, the Fed significantly raised its growth projections for 2024 (2.1% compared to the previously anticipated 1.4% in December) and its projections for core inflation (2.6% compared to 2.4%), while slightly lowering its unemployment expectations (4% compared to 4.1%). Despite these revisions indicating continued robust growth and stronger than expected inflation, FOMC members still anticipate in average three interest rate cuts for this year, putting the Fed in an uncomfortable position. Considering Jerome Powell's indication that the moderation of the pace of QT would be announced very soon, we anticipate a change in QT in May and a first rate cut that could occur in June. - The ECB is preparing to lower its interest rates in June

The ECB left its rates unchanged for the 5th consecutive time in April. In its statement released after the meeting, a passage was added opening the way to a rate cut in June if the data published by then further strengthens its confidence in the return of inflation towards the 2% target. The ECB emphasized that its decisions were data-dependent and that it did not pre-commit to a trajectory concerning interest rates. The central bank is expected to lower its rates in June, once the results of the spring wage negotiations are known, and for better understanding to what extent companies continue to absorb a portion of the increase in wage costs in their margins. We anticipate 3 rate cuts over the year. At the same time, the contraction of the balance sheet will accelerate from July, with the ECB reinvesting only half of the maturing PEPP (at an average monthly pace of 7.5 billion euros), to end it in late 2024.

Market views

Asset classes

- US rates: The Fed appears determined to lower its rates despite inflation, creating uncertainty about the start of the monetary cycle. Nevertheless, the T-note yield is expected to return to around 4%.

- European rates: The Bund (2.45%) tightened in the wake of US rates despite an expected rate cut by the ECB in June. Our year-end forecast is at 2.20%. The yield curve is expected to steepen.

- Sovereign spreads: Sovereign spreads have widened with the return of the theme of public finance consolidation.

- Eurozone inflation: Breakeven rates have slightly increased due to tensions in the oil market.

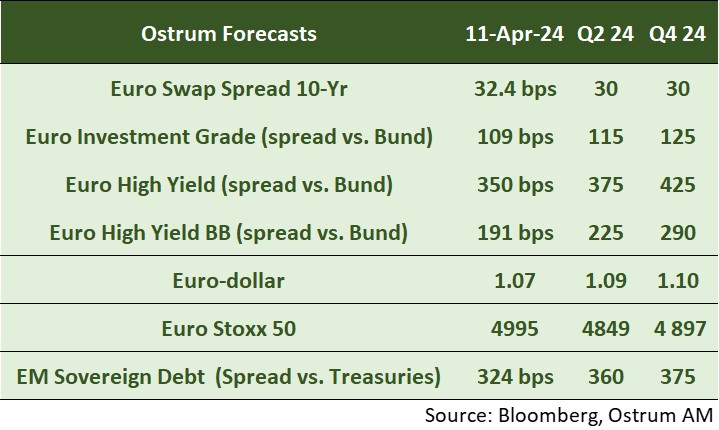

- Euro credit: Swap spreads have rebounded to 30 bps, collateral shortages have been alleviated through quantitative tightening. Investment grade credit valuations are now less attractive.

- Exchange rate: The euro has dropped to $1.07 but remains within a narrow range below $1.10.

- Equities: The impressive performance at the beginning of the year is expected to wane as margins moderate. Multiples are expected to stabilize around 13.5x.

- Emerging debt: Spreads have decreased beyond our targets.