Every month, find out all about the sustainable market bonds news in our newsletter

« MySustainableCorner ».

Topic of the month

Why COP 27 highlights the need for a FAIR Transition

Last month, COP27 was held in Egypt. Four main topics were on the agenda: The budgetary commitments of rich countries towards developing countries, the financing of losses and damages (a specific fund for irreversible climate damage could be created), increasing funding for climate change adaptation, and finally reducing greenhouse gas through strengthening Nationally Determined Contributions (NDC).

This COP 27 took place in a complex geopolitical context. The Ukrainian crisis has highlighted the strategic and social consequences of our reliance on fossil fuels. The situation is critical for the poorest countries, faced with a double incapacity: incapacity to bear rising prices, and incapacity to transition because of their debt burden. Hence the key aspect of the Bridgetown initiative to reform the global financial system to facilitate the financing of mitigation projects as well as climate change adaptation projects in developing countries.

As UN Secretary-General Antonio Guterres pointed out, the war has worsened a three-dimensional global crisis: an energy crisis, but also a food and financial crisis that affects the most vulnerable populations, countries and economies. In addition to COVID-19, global warming is the main cause due to the resulting natural disasters (drought, fires, floods, etc.) whose frequency and severity increase each year. Climate, social inequalities, loss of biodiversity, all these issues are global and interconnected. More than ever, COP 27 has put forward the imperative of a just transition, of decisive and solidarity action.

Figure of the month

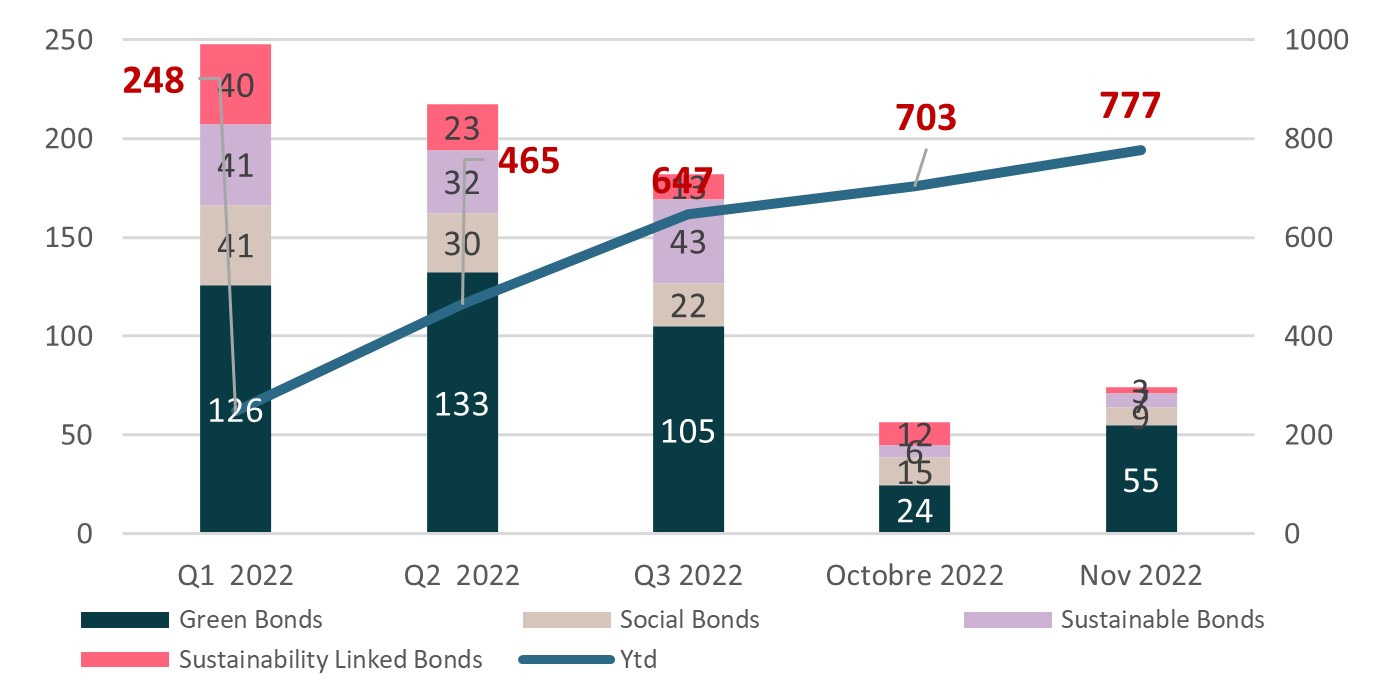

$55 billion of new Green Bond issuances in November 2022.

By comparison, it’s representing over twice as much as the previous month. Since the start of the year, the total volume of Green issuances has been $443 billion.

Dashboard

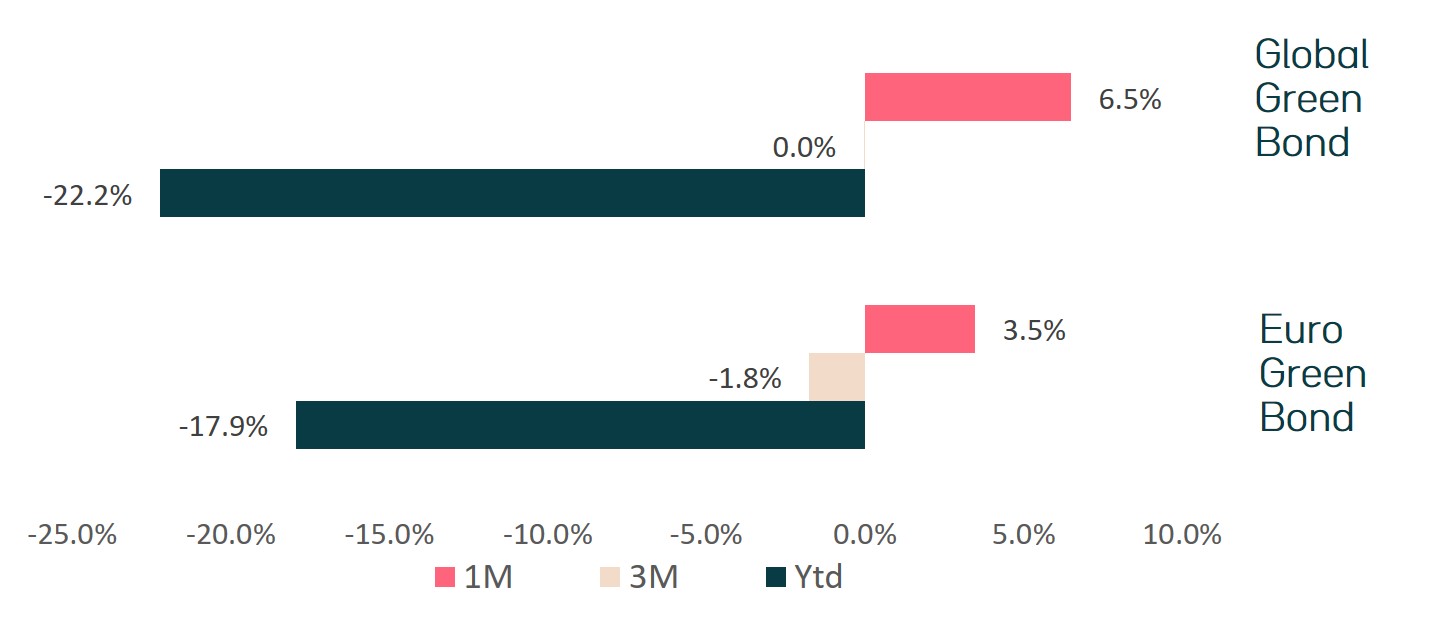

Market returns (%)

Data as of November 30th 2022 - Sources : Bloomberg MSCI Euro Green Bond Index et Bloomberg MSCI Global Green Bond Index

Émissions en obligations durables (en Mds $)

Sources : Bloomberg/Ostrum AM – Données au 30 novembre 2022